- within Real Estate and Construction topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- in Canada

- with readers working within the Accounting & Consultancy, Banking & Credit and Business & Consumer Services industries

In 2024, I wrote a paper titled Distressed developers: Soaring costs, fixed returns and public policy create perfect storm, which was published by Lexpert. It described how development costs had escalated rapidly for a number of reasons, including high demand arising from historically elevated levels of immigration, cost increases in labour and construction materials, steep interest rates and significant costs associated with government in the form of rapidly increasing development charges, land transfer taxes and the burden of municipal oversight.

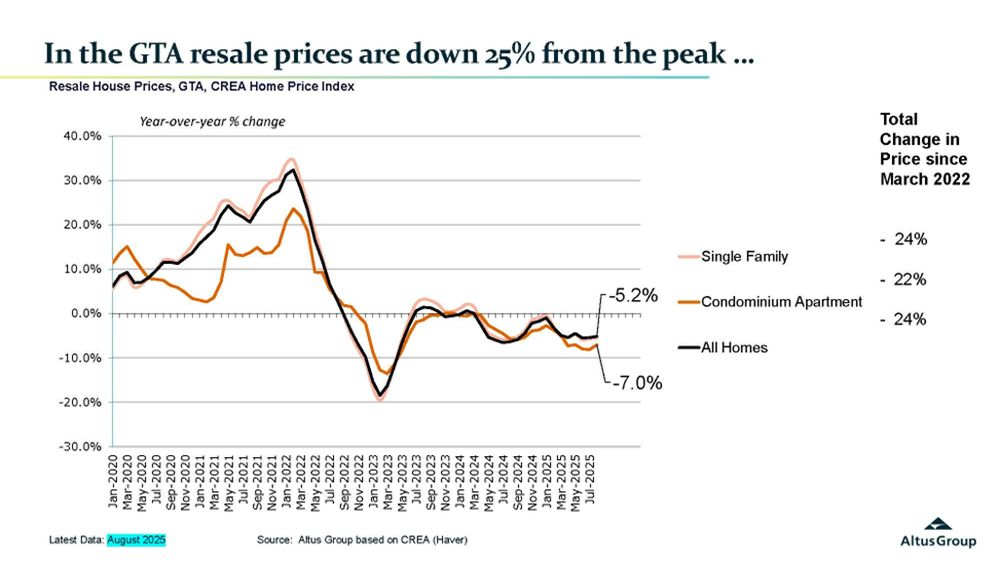

Since then, the federal government has materially lowered its immigration targets and that, along with GTA residents moving to areas where housing is less expensive, has led to a decline in the population of the Greater Toronto Area ("GTA"). This, together with elevated interest rates, has contributed to a steep decline in the resale value of homes of all sorts in the GTA. A decrease in interest rates has not materially altered that trend. The inflection point that started people reflecting on real estate investments was the dramatic rise in interest rates in 2021. That led to a decrease in resale prices, but the number of sales remained relatively stable through 2021 and early 2022. By the end of 2022, however, sales declined significantly.

Examining the statistical evidence

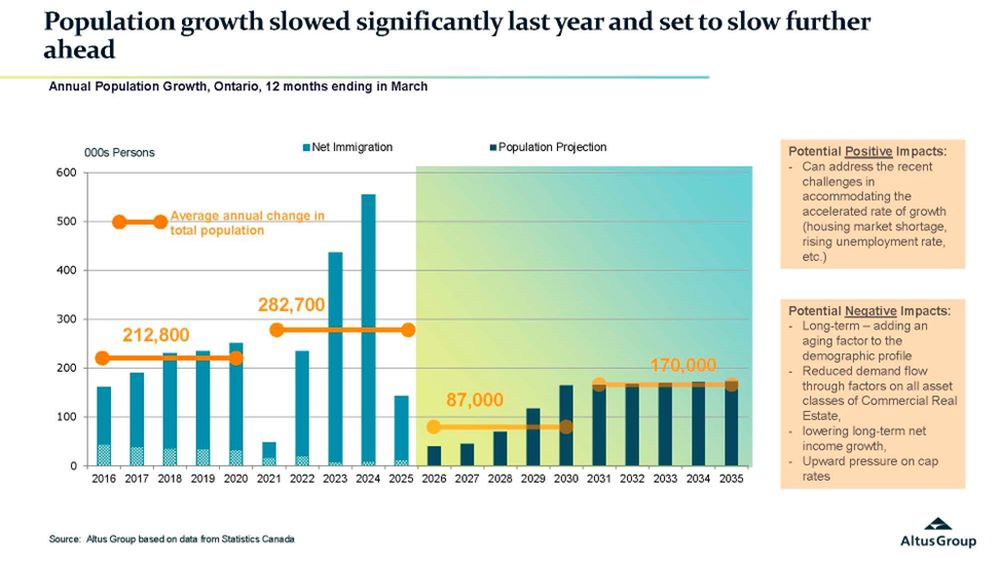

Nationally, total immigration has gone from 1.3-million newcomers in 2024 to 480,000 in 2025 and is projected to be very low for the next three years. (The charts and graphs below were generously provided by Altus Group Limited.)

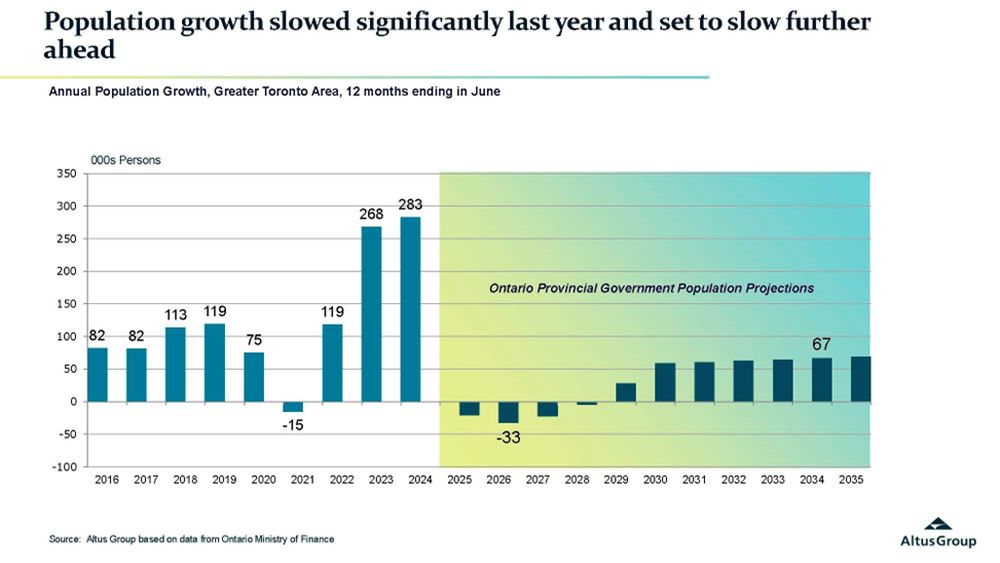

In the GTA, total population grew by 283,000 in 2024 and then declined in 2025. Net decline is expected to continue through 2028.

Housing resale prices in the GTA are down by 25% from the peak for all types of housing.

However, construction costs have not declined in tandem with sale prices. Development charges and fees levied by Toronto and other municipalities, land transfer tax and compliance costs also remain stubbornly high.

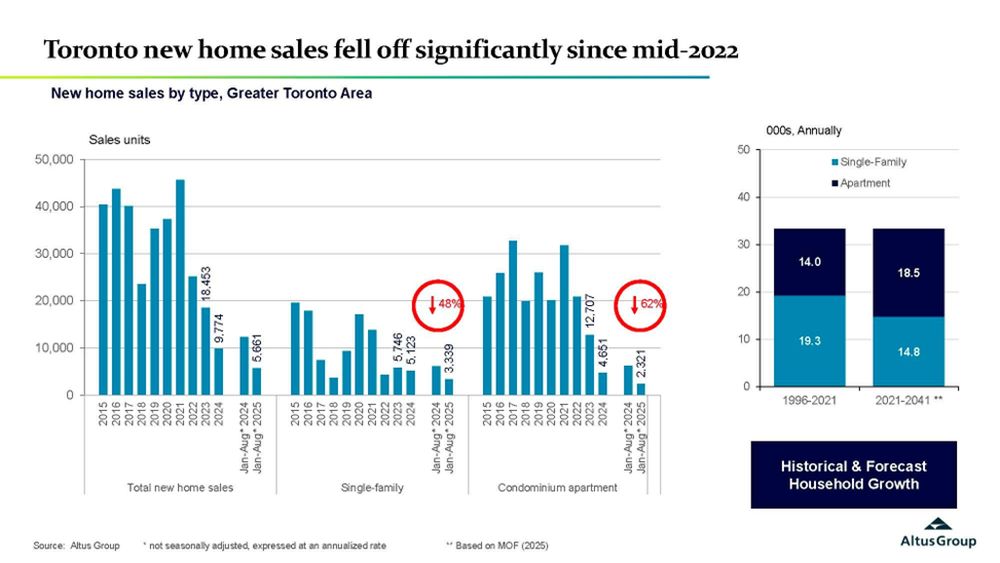

The number of construction projects has dropped significantly in the GTA, as would be expected under the circumstances, particularly for high-rise buildings.

Projects launched but unbuilt are facing great difficulty in selling units. Developers are reluctant to drop their prices, likely because they represent the price that will allow them to make a profit on the project. However, resales of even newer condos are occurring at significant discounts, making this pricing strategy difficult to maintain.

Simply put, developers are unable to build housing at a price that purchasers are willing to pay. The cost of construction has reduced slightly, but government-controlled costs are constant. So, developers are not building and existing new condo units remain unsold at current prices.

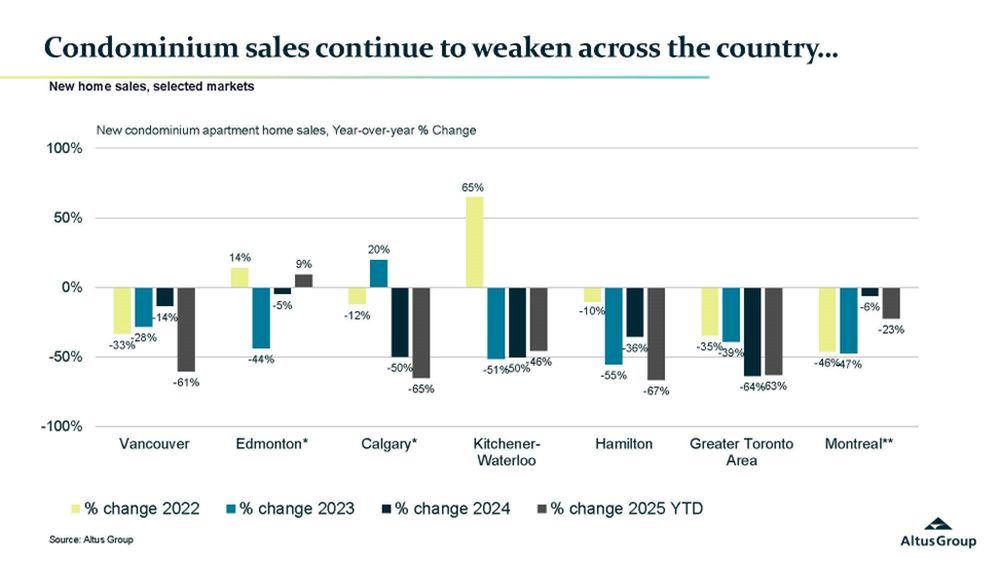

This is also reflected in the decline in condo sales in the GTA – down by more than 60% on a year-over-year basis for both 2024 and 2025.

How can there be a housing crisis in the GTA if homes are available for sale at reducing prices? Those that could not afford to live in the GTA have left and there is no one coming to replace them. There is plenty of housing to meet demand. There is no shortage.

The Ontario government set a goal for itself of building 1.5-million new homes during the period from 2021 to 2031. The closest the province has come to building sufficient homes to meet that goal in any year was just under 90,000. Now, with population stable and perhaps declining, it seems that the entire program was unrealistic. One wonders where the 1.5 million number came from.

How did the pundits get this so wrong? I do not know but suspect that when public servants are estimating housing needs, they divide the number of people expected to be in an area by 2.5, which is the size of the average Canadian household. Perhaps if they were planning on there being 500,000 new immigrants in Ontario each year, the housing requirement makes sense. But that did not happen and will not happen in the foreseeable future.

Project analysis and market dynamics

What about the projects that have been built and are now being sold? In my previous article, I illustrated the dilemma faced by developers with reference to the Highlight of Mississauga project. Initiated in 2019, the developer of Highlight, Hazelton Development Corporation, filed for creditor protection under the Companies' Creditors Arrangement Act on April 20, 2022. At that time, the developer reported that the project was 80% complete. Now, 3.5 years and $100 million later, the project is 89% complete and requires substantial further investment to bring it to conclusion.

The monitor issued its 25th report on October 20, 2025. Astonishingly, the debtor-in-possession ("DIP") lender continues to pour money into this effort. The monitor reported that the DIP lender will not obtain full recovery, nor will any of the other creditors below the DIP lender in priority. The developer is reportedly thinking of finishing and then refinancing the project rather than trying to sell it in the current market. Who is going to finance an empty building?

I have spoken to banks that have financed condominium developments which have now been completed. They speak of deposits abandoned and owners simply unable to raise the money to complete the purchase. A bank in that position could likely realize, but what would it do with an asset that is devaluing at a significant rate? That requires maintenance and tax payments and security. It would be expensive. If the developer is paying those costs, it may be prudent to leave well enough alone for a while.

At some point, the lenders behind these developments will need to sell and, if they all do it at once, there will be a further deterioration in the market. If the housing market stabilizes at what represents a recovery cost for senior secured lenders, it would be reasonable to expect that there will be a controlled sell-off of lender interests. That will keep the market flat for quite a while. Investment in residential real estate for resale will not be terrifically attractive until after that bump has moved through the market.

Future outlook: Addressing supply and demand

How did we get here? In the condo market in particular, there developed a group of private investors keen on committing to buying condos in the presale market in the expectation that they would be able to either assign their rights to purchase for a profit or purchase the condo and hold it until the price was right. These were largely local, small investors who put their savings into condos.

This works very well while prices are rising and encourages both building and building units for people that never intended to live in them. Investor purchases made up 50% to 80% of presales toward the end of the boom. However, these investors are sensitive to interest rates and the rise in interest rates was devastating for them. Having been burned, they are unlikely to return to this market anytime soon. Any new condo project will require presales to people who actually want to live in the resulting housing or substantial investment from the developer or others. That would be a material change in the financing model that has been used in the GTA for a long time.

But what happened to demand and why are people still talking about a housing crisis? There is no housing crisis for people who can afford housing at 75% of its price in 2022. That is still a high price, but it is much better than it was, and it continues to trend down. If the purchase is optional, the canny investor will wait to see if what they want gets cheaper, especially in the economic circumstance in which Canada finds itself. This is a classic declining market, and the bottom is hard to predict.

In the GTA, there has been a significant overbuilding. If we continue trying to build at the rate promised by many political parties, we will have construction projects rotting empty on their plinths. But the market has spoken and there is very limited new construction.

There is a housing shortage for below-market and supported housing, perhaps. There is money in the federal budget for this type of housing. It would be interesting to see if the built but unsold projects could be converted to fill this need.

Finally, it is interesting to consider the importance of governments in this market. All three levels of government have a stake: the federal government because, up until recently, housing was among the top issues on voters' minds and they have a share in sales tax; the provincial government because they are also interested in voters and earn considerable revenue from the land transfer tax and sales tax; and municipalities because they also have voters to please and receive fantastic amounts from development charges and land transfer tax. Municipalities also have complex policy agendas which play out in building standards: green roofs provide a recent costly and controversial example.

Land transfer taxes and development charges are popular with governments because they are not visible to voters most of the time. Altus estimates that total governmental charges represent 30% of the cost of a condominium unit. The same percentage also applies to rental housing. Provincial and municipal governments obviously have a role to play in housing, but it may be time to consider the cost.

Originally published by Lexpert.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.