- within Corporate/Commercial Law topic(s)

- with Finance and Tax Executives and Inhouse Counsel

- in Canada

- with readers working within the Banking & Credit, Environment & Waste Management and Pharmaceuticals & BioTech industries

Introduction

"Climate disclosure on the rise" was the title of our inaugural climate-related disclosure study published last year. Would that trend persist in 2025 following federal elections on both sides of the border, and potentially competing legislative priorities? We set out to answer that question by conducting a year-over-year analysis of the disclosure filings of the S&P/TSX Composite Index constituents, representing Canada's largest public companies, and approximately 70% of the total market capitalization of the TSX. In general, while major policy changes have undoubtedly impacted reporting practices, the companies we surveyed overwhelmingly continue to publish sustainability reports, including disclosure of greenhouse gas (GHG) emissions and climate-related risks and opportunities. While we did not see an overall rise in climate-related disclosure, we also did not see a groundswell of companies abandoning or significantly watering down their climate disclosures. Instead, we observed incremental changes, including a notable decrease in companies using the highly politicized term "ESG" to describe their disclosure reports and a drop in disclosure of net-zero targets.

Regulatory fragmentation and the absence of mandatory standards for climate-related reporting continue. In early 2025, the Canadian Securities Administrators (CSA) announced that it would pause efforts to finalize mandatory climate-related disclosure rules. This decision followed the U.S. Securities and Exchange Commission's (SEC) voluntary stay of its climate disclosure rules in the face of pending U.S. federal policy changes and litigation. The pause by Canadian securities regulators similarly reflects a notable shift in regulatory priorities. In its Statement of Priorities for 2026-2027, the Ontario Securities Commission no longer identifies the development of mandatory climate-related disclosure rules as a key priority and instead indicates that it will assess compliance with existing disclosure rules that require disclosure of material climate-related risks. This shift in Canadian regulatory priorities is unsurprising, given broader geopolitical headwinds and mounting pressure to advance policies to bolster the competitiveness of Canadian companies and the Canadian capital markets. While securities regulators may be hitting pause, the Office of the Superintendent of Financial Institutions (OSFI) has not moved away from its climate-related reporting regime—Guideline B-15—under which Canadian federally regulated financial institutions are expected to make prescribed climate-related disclosures. In fact, OSFI updated its guidelines in 2025 to reflect the finalization of the Canadian Sustainability Standards Board (CSSB) standards on climate related disclosures (i.e., CSDS 2).

Meanwhile, anti-greenwashing amendments to Canada's Competition Act, enacted in 2024 and met with widespread concern from companies across the country, received attention in the 2025 Federal Budget. The Government of Canada acknowledged that the amendments were creating investor uncertainty and having the opposite of their desired effect, leading some companies to slow or reverse their environmental protection efforts. Addressing market feedback in the Budget Implementation Act, the federal government proposed to amend aspects of these provisions, namely by removing the requirement that environmental claims about business activities be substantiated (in accordance with an internationally recognized methodology) and by removing the ability of private parties to seek enforcement of one branch of the anti-greenwashing provisions. At the time of writing, the proposed amendments are undergoing second reading. While many companies would welcome these amendments, they would not completely repeal the new provisions and, more generally, the risk of regulatory enforcement or litigation alleging greenwashing continues to be a significant factor for companies in their climate-related reporting.

Despite the marked shift in the political and regulatory landscape during 2025, investor appetite for climate related reporting remains strong. A recent study found that nearly 90% of Canadian institutional investors surveyed, representing $13.3T in assets under management, advised issuers to continue voluntary reporting of material climate information, citing reputational risks, stakeholder expectations and long-term value creation1. The move towards the rollout of a baseline of standards in voluntary reporting to meet investor demand was given a boost when the CSSB published its final standards—CSDS 1 and CSDS 2—on December 18, 2024, aligning closely with the International Sustainability Standards Board (ISSB) framework. We caught up with the Chair of the CSSB, Wendy Berman, to find out how the CSSB is continuing to advance its mandate in the current political environment and almost one year following the finalization of the Canadian standards. Ms. Berman notes that success for the CSSB will be achieved when "Canadian companies [are] trusted, competitive and able to access global capital on equal footing with their peers". While climate-related reporting may not have been on the rise in 2025 compared to 2024, it certainly appears that many Canadian companies continue to see the benefit to stay the course.

December 2025

Report highlights

Using the same methodology as last year, we surveyed the disclosures of 217 companies included on the S&P/TSXi Composite Index as of May 31, 2025, representing approximately 70% of total market capitalization of the TSX. For more details regarding the surveyed companies and our approach, see "Scope and methodology".

The results were interesting, with several key takeaways

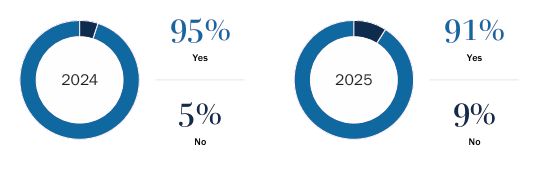

- 91% of companies published a sustainability, ESG, climate action/transition or similar report, a downtick from 95% of companies in last year's study, and materially fewer companies used the term "ESG" to describe their report.

- 39% of companies have publicly set a target to achieve net-zero GHG emissions, a notable decrease from 45% last year.

- 38% of companies mention that disclosure or climate-related political and regulatory changes have influenced their strategy, targets and related disclosure.

- 24% of companies referenced Bill C-59 or recent amendments to the Competition Act in their disclosure.

- Notwithstanding these shifts, GHG emissions disclosure remained consistent year-over year, with 86% of companies disclosing Scope 1 and 2 GHG emissions, compared to 88% last year.

- Board expertise in climate, environmental, ESG or sustainability matters continues to be in high demand, with 83% of companies identifying this in their board skills matrix (up from the previous high of 78%), and a significant majority of board members being identified as having these skills.

While we did not see an overall rise in climate-related disclosure, notwithstanding significant changes in the political and regulatory landscape over the past year, we also did not see a groundswell of companies abandoning or significantly watering down their climate disclosures.

General disclosure practices

Although the Task Force on Climate-related Financial Disclosures (TCFD) has disbanded, having fulfilled its remit, its recommendations for climate-related financial disclosures remain influential, having been memorialized by the ISSB in the International Financial Reporting Standard on Climate-related Disclosures (IFRS S2) and localized versions of IFRS S2, such as the Canadian Sustainability Disclosure Standard on Climate-related Disclosures (CSDS 2) by the CSSB. Consistent with last year's report, this report is structured to align with the four pillars of the TCFD framework: governance, strategy, risk management, and metrics and targets.

Does the company prepare an annual sustainability, ESG, climate action/ transition or similar report?

Over 90% of companies continue to publish annual sustainability or similar reports. The year over-year decline, from 95% to 91%, may reflect some movement in market practice in response to the shift in the political and regulatory landscape. Of the companies we surveyed, 67% have operations (and some are incorporated) in the U.S., and as a result, were more likely to consider trends and risks in both the U.S. and Canada when preparing their disclosure. An additional factor influencing disclosure practices was the introduction of Bill C-59 in Canada, which specifically targets "greenwashing". Several companies in our study explicitly stated in their public disclosure that they had elected to forego the publication of an ESG or similar report in light of concerns associated with the new legislation. Nearly half of the companies that chose not to prepare an annual sustainability or similar report are companies within the energy sector. However, in light of the government's proposed amendments to repeal certain aspects of the Bill C-59 provisions, this may be a temporary dip.

The use of the term ESG when describing a company's report on sustainability and climate matters has decreased significantly: a 12% drop from last year's study. Given the number of companies that published such a report was roughly comparable year-over-year, this change illustrates a marked shift away from the increasingly politicized terminology, with companies electing to instead use terms such as "sustainability" or "climate action".

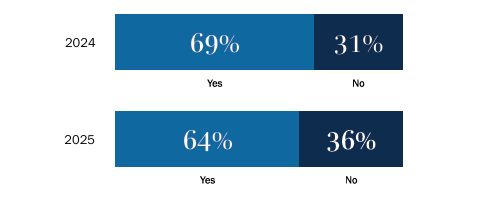

Does the company disclose that it is reporting in accordance with the TCFD?

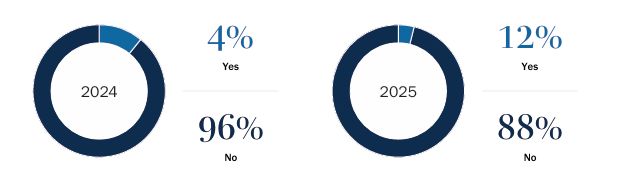

Does the company disclose that it is reporting in accordance with IFRS S2 and/or CSDS 2?

Following the disbanding of the TCFD in 2023, it was unclear whether its principles for climate related disclosure would remain the leading framework for companies around the world. However, reflecting the foundational nature of the TCFD framework and its fundamental integration into the ISSB disclosure standards (and, in turn, the CSSB disclosure standards), there was only a slight year over-year decline in the number of companies disclosing that they are reporting in accordance with the TCFD, decreasing from 69% to 64%. There was also an increase in the number of companies disclosing reporting in accordance with IFRS S2 and/or CSDS S2, with 12% of companies disclosing reporting in accordance with those standards, an 8% increase from last year's study. Of the companies we surveyed, 11% indicate that they report in accordance with IFRS S2, whereas only three companies (1%) report in accordance with CSDS S2. This may reflect the fact that CSDS S2 has not yet been mandated by any regulatory body and was only published in final form in December 2024, whereas IFRS S2 is the foundation for several foreign regulatory requirements that may be applicable to Canadian companies with operations in those jurisdictions.

To view the full article click here.

Footnote

1. Millani, "A climate of change: Canadian investor perspectives" (September 8, 2025).

We would like to thank Adam Ibrahim, Max Ledger and Caroline Marful, as well as the Torys summer student class of 2025, for their significant contributions to this report.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.