- within Energy and Natural Resources topic(s)

- within Energy and Natural Resources topic(s)

- within Law Department Performance and Insolvency/Bankruptcy/Re-Structuring topic(s)

- in European Union

01THE MULTIPLE LAYERS OF OPERATIONAL CHALLENGES IN WIND FARMS

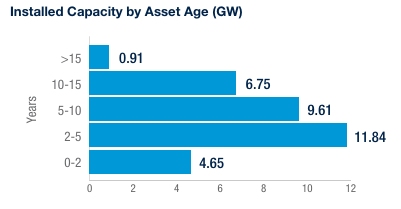

Brazil's wind power sector is entering a new phase, characterized by asset maturity, evolving operating models, and a reshaped supply chain. Following more than a decade of rapid expansion, early-generation wind farms are now reaching 10 to 15 years of operation. This shift demands a comprehensive reassessment of maintenance strategies, targeted reinvestment in asset life extension, and increased operational accountability from asset owners.

Asset Maturity and Expiry of O&M Agreements

Most Operation and Maintenance (O&M) contracts— particularly Full Service Agreements (FSAs) signed with turbine manufacturers—were originally structured with terms ranging from five to 10 years. As these agreements reach maturity, asset owners are confronted with strategic decisions: whether to renew with original equipment manufacturers (OEMs), often under less favorable conditions; transition to Operations Support Agreements (OSAs); engage independent service providers (ISPs); or fully internalize O&M activities through a dedicated in-house model.

This decision-making process demands a comprehensive technical, financial, and organizational assessment, factoring in total cost of ownership, performance guarantees, availability risk, and the internal capability to manage operations effectively.

Gap Between Operational Output and Expected Performance

Another critical challenge is the persistent underperformance of wind assets. Key contributing factors include unplanned outages, deviations from turbine power curves, degradation of critical components, and external constraints such as technical and regulatory curtailment.

This scenario underscores the need for active performance management of wind farms through the systematic application of Maintenance Planning and Control (PCM) tools, robust tracking of reliability, availability, and productivity KPIs, and the implementation of life extension strategies for wind turbine generators (WTGs).

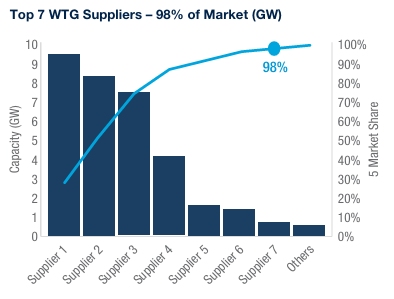

Supply Chain Reorganization

The exit of major OEMs from the Brazilian market has triggered a restructuring of the technical and logistical support ecosystem for operating wind farms. While some manufacturers opted to idle factories and scale back their local footprint, others began declining FSA renewals— effectively pushing asset owners toward direct operation models.

This transition has led to increased reliance on imported spare parts, a growing—but still nascent—role for independent service providers (ISPs) and heightened complexity in supply chain management. These shifts have direct implications for maintenance costs and response times, particularly for corrective and predictive interventions.

Enabling Asset Owners for Operational Transition

In this evolving landscape, asset owners must prepare to assume a more active and strategic role in operations.

This transition involves:

- Establishing in-house technical teams and Maintenance Planning and Control (PCM) capabilities

- Deploying remote monitoring and diagnostics systems

- Designing procurement and inventory strategies for critical spare parts

- Assessing existing contractual frameworks and challenges with OEMs

This paradigm shift requires not only technical know-how, but also robust managerial capabilities and a data-driven approach to asset performance and decision-making.

Maximizing Value in the Mid-to-Late Life Phase of Wind Assets

As wind farms progress into the second half of their operational life, it becomes increasingly critical to adopt lifecycle optimization strategies. These may include targeted retrofits of key components, renegotiation of grid connection agreements, technical and financial assessments for potential repowering.

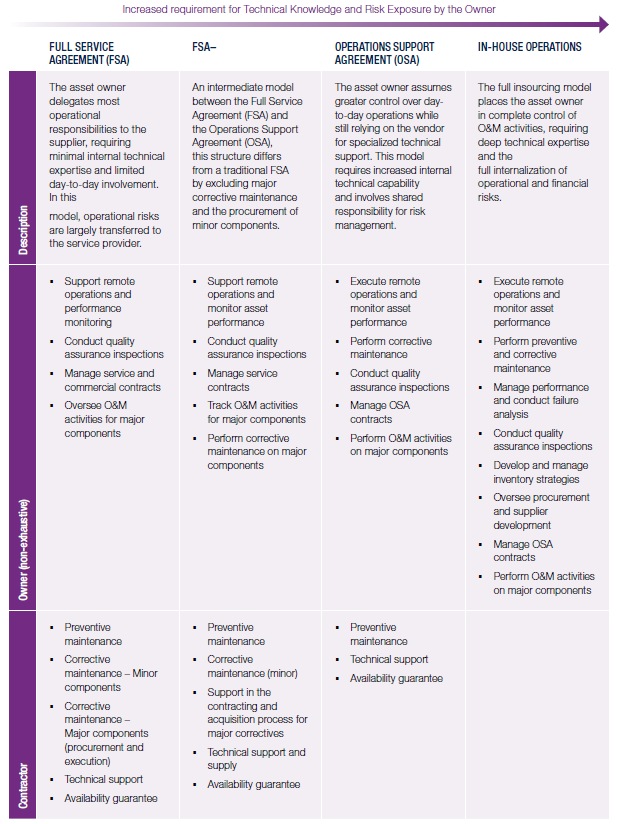

02 RESHAPING WIND FARMS OPERATING MODELS

In light of growing operational challenges faced by wind assets globally—driven by aging fleets, tighter margins, and reduced OEM support—there is a pressing need to reassess existing O&M models and contractual structures. Maximizing performance and ensuring long-term asset value will depend on selecting the right operational strategy, tailored to each portfolio's technical and financial context.

At one end of the spectrum is the Full Service Agreement (FSA), in which the supplier assumes most of the operational risk, offering the highest cost per turbine. Under this model, the OEM is responsible for preventive maintenance, corrective repairs (including major components), technical support, and availability guarantees. This structure is typically controlled by a small group of manufacturers, with inventory and maintenance services closely tied to proprietary supply chains—leaving little flexibility for alternative sourcing.

Key constraints of this model include:

- Long lead times due to part fabrication on a made-to-order basis, with no serial manufacturing in Brazil

- High dependency on OEM-specific logistics

- Availability losses triggered by a single turbine failure

- Crane mobilization requirements for large component replacements

At the opposite end of the spectrum is the fully internalized O&M model, where asset owners assume full operational responsibility for the wind farm. All risk management, maintenance planning, and execution are handled by in-house teams.

To read this article in full, please click here.

Originally published 19 August 2025.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.