- within Real Estate and Construction, Law Practice Management and Law Department Performance topic(s)

- with Finance and Tax Executives

- with readers working within the Accounting & Consultancy and Insurance industries

Key Takeaways:

- Energy tax credits like §45W and §30C face 2025/2026 phaseouts, placing urgency on electric vehicle (EV) and charging station timelines for businesses planning capital expenditures.

- Many mid-market companies haven't aligned project timelines with placed-in-service deadlines, risking partial or lost clean energy credits.

- Wage rules, documentation, and foreign-sourcing bans can disqualify credits — early compliance checks help preserve full tax benefit.

For many businesses, the Inflation Reduction Act (IRA) was a green light to pursue electric vehicles, charging infrastructure, and other sustainable projects — backed by strong federal tax incentives. But in 2025, the rules have changed. And companies that haven't adapted to new deadlines and eligibility requirements may leave valuable credits behind.

Tax provisions like §45W and §30C — which offer up to $7,500/$40,000 per EV and $100,000 per charging port — remain available. But with stricter placed-in-service timelines, prevailing wage requirements, and supply chain sourcing restrictions now in effect, the process has grown more complex.

At MGO, we've seen a growing sense of urgency among tax leaders and CFOs looking to retain the full value of these incentives. The common thread? It's not enough to start building — you need to verify that your timeline, documentation, and sourcing all meet current standards.

What's Changing — and Why It Matters

Businesses investing in clean energy may qualify for:

- §45W Commercial Clean Vehicle Credit: Up to $7,500 per eligible EV under 14,000 pounds (cars, vans, trucks, etc.) and up to $40,000 per eligible EV over 14,000 pounds (school buses, semi-trucks, etc.)

- §30C Alternative Fuel Infrastructure Credit: Up to $100,000 per qualified charging port

- § 48 (Pre-2025) Investment Tax Credit for Energy Property/§ 48E Clean Electricity Investment Tax Credit: 6% of qualified investment increased to 30% if a taxpayer meets prevailing wage and apprenticeship requirements or exceptions. Eligible to be transferred to an unrelated taxpayer.

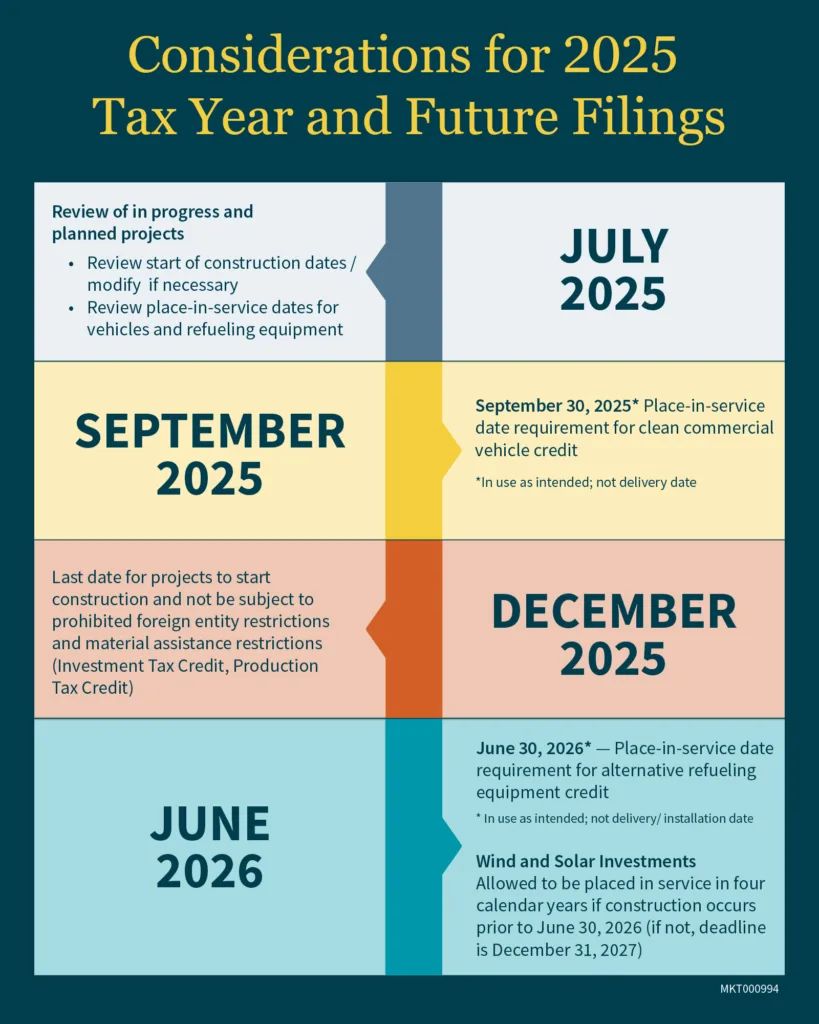

But, beginning in 2025, these credits are affected by key IRS updates. Most notably:

- Credits are tied more strictly to placed-in-service deadlines

- For EVs, the deadline to place in service is September 30, 2025

- For charging ports, the deadline to place in service is June 30, 2026

- For wind and solar, allowed to be placed in service in four calendar years if construction occurs prior to June 30, 2026; if not, then deadline is December 31, 2027

- Bonus credits now require detailed compliance with wage and apprenticeship standards

- The foreign entity of concern rule may limit credit access based on component sourcing, particularly for EV batteries

In short, technical compliance now carries real financial consequences. Projects that would have qualified two years ago may fall short today — even if the investment itself hasn't changed.

Where CFOs Stand on Readiness

During a recent MGO webinar, we asked mid-market tax leaders how ready they felt for the upcoming shift. Their responses reflected a common trend:

- 40% said they were not prepared

- 30% were somewhat prepared

- Only 5% were fully prepared

- 25% said it was not applicable to their business

This signals a significant planning gap. Despite rising investment in electric fleets and infrastructure, many companies haven't realigned their tax strategy to fit the changing requirements. Without that alignment, even well-intentioned efforts can lose value.

Key Areas Where Companies Face Risk

Several issues have emerged as common barriers to full credit access:

- Project delays that affect placed-in-service eligibility

- Inconsistent wage documentation that disrupts bonus credit calculations

- Foreign-sourced components that invalidate certain credits

- Disconnection between tax and operations, leading to missed planning windows

As these rules evolve, companies that aren't regularly reviewing their compliance posture may struggle to capture the full benefits — or may face clawbacks if later audited.

Planning Priorities for 2025

To prepare for the upcoming changes and protect your tax position, MGO recommends focusing on four core actions:

1. Check Placed-in-Service Schedules

Review your project timelines to confirm that EVs, chargers, or facilities will be operational before IRS deadlines. Delays — even short ones — can affect eligibility.

2. Coordinate with Tax Early

Bring your tax team into capital expenditure planning discussions to evaluate credit exposure and prioritize projects with the most favorable timelines and tax treatment.

3. Review Wage and Sourcing Documentation

Work closely with contractors and procurement teams to track wage compliance and verify sourcing for battery or component parts.

4. Run Credit Risk Scenarios

Model potential loss of credits based on current projections, and adjust project sequencing or vendors accordingly to maintain incentive value.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.