- within Real Estate and Construction topic(s)

- in United Kingdom

- within Real Estate and Construction topic(s)

- in United Kingdom

- within Real Estate and Construction, Law Department Performance and Insurance topic(s)

- with Finance and Tax Executives

- with readers working within the Accounting & Consultancy and Insurance industries

Key Takeaways:

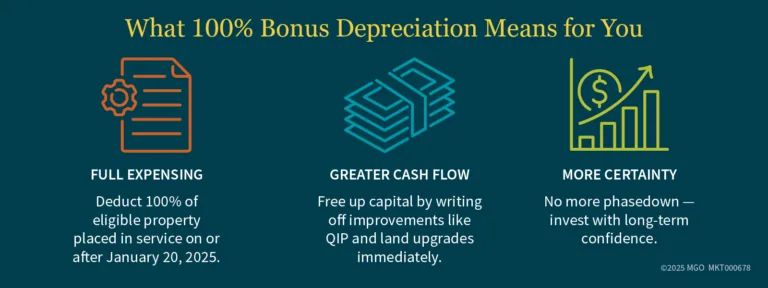

- The new tax law permanently restores 100% bonus depreciation for qualified property placed in service after January 19, 2025.

- This change allows you to fully deduct eligible improvement costs upfront — improving cash flow and long-term planning.

- Real estate investors should watch for state-level differences and consider cost segregation studies to maximize the benefit.

—

On July 4, President Donald Trump signed the One Big Beautiful Bill Act into law. Among the sweeping tax and spending provisions, one key change stands out for real estate investors: the return of 100% bonus depreciation.

Bonus depreciation is a powerful way to front-load deductions on qualifying property. Although it was first introduced in 2002 following the events of Sept. 11, the percentage deduction has varied over the years. Most recently, the 2017 Tax Cuts and Jobs Act (TCJA) increased bonus depreciation to a full 100% deduction. However, the TCJA also included a phasedown schedule — dropping the deduction to 40% in 2025 and eliminating it entirely by 2027.

Now, that phasedown has been reversed. The new law permanently restores 100% bonus depreciation for qualified property placed in service on or after January 20, 2025.

5 Ways the Return of 100% Bonus Depreciation Could Impact Your Strategy

If you're investing in real estate, the return of 100% bonus depreciation creates new opportunities. Here are five ways it could affect your planning and cash flow moving forward:

1. You Can Plan Ahead With Certainty

For years, bonus depreciation rates have been a moving target. With this new law, you get consistency. Knowing that 100% bonus depreciation is now permanent gives you the ability to map out property improvements or acquisitions with a clear understanding of the tax impact. No more rushing projects to get ahead of a phase-down deadline. This is especially useful if you're managing multiple properties or planning major capital expenditures.

2. Bigger Deductions Mean Better Cash Flow

Land improvements and qualified improvement property (QIP) — such as parking lots, landscaping, and interior upgrades to commercial buildings — are major expenses for real estate investors. With 100% bonus depreciation, you can deduct these costs in full the year they're placed in service. That's a non-cash expense generating real tax savings, freeing up cash you can reinvest into more properties, upgrades, or operations.

3. Bonus Depreciation Is Automatic — But You Still Have Options

The new law keeps the same framework: bonus depreciation is automatic unless you elect out. This means you don't have to remember to file any special paperwork to claim the deduction. But if you're planning to sell a property soon and want to avoid a large depreciation recapture, you still have the option to elect out of bonus depreciation for specific asset classes. That flexibility gives you more control over your long-term tax strategy.

4. Don't Forget About State Taxes

While federal bonus depreciation is back at 100%, state treatment varies widely. Some states conform fully, others partially, and some not at all. Several states have flip-flopped in past years, some years complying with federal bonus depreciation rules and other years decoupling from the federal deduction, so it's important to monitor changes over time. Failing to account for federal-to-state differences in depreciation can lead to surprises when filing your state returns. Work with a professional to stay ahead of shifting state policies.

5. Cost Segregation Studies Just Got More Valuable

With 100% bonus depreciation locked in, cost segregation studies are more useful than ever. These studies help you identify components of your property — like lighting, flooring, plumbing, land improvements and specialty electrical systems — that can be depreciated over five, seven, or 15 years instead of the standard 39 years or 27.5 years for residential real estate. That makes more of your investment eligible for immediate expensing. If you're buying, renovating, or developing commercial or residential property, a cost segregation study could lead to substantial tax savings.

Increased Opportunity and Complexity for Real Estate Investors

The return of 100% bonus depreciation is big news for real estate investors. It gives you stronger cash flow, more predictable planning, and powerful incentives to invest in and improve your properties. But it also adds complexity — from deciding when to elect out to understanding how state rules diverge from federal law.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.