- within Employment and HR topic(s)

- in United States

- with readers working within the Insurance industries

- in United States

- within Real Estate and Construction and Transport topic(s)

Executive Summary

With critical regulatory deadlines looming in Europe and U.S. policy shifts sowing widespread confusion, European employers are in something of a holding pattern when it comes to managing key workplace issues—from artificial intelligence (AI) usage and inclusion, equity and diversity (IE&D) programmes to pay transparency and in-office work policies.

That's the topline takeaway from Littler's 2025 European Employer Survey Report, which draws on responses from more than 400 in-house lawyers, human resources (HR) professionals and business executives, 64% of whom hold C-suite or leadership positions. Respondents are based across Europe and represent a range of company sizes and industries.

Taken together, the results provide an in-depth look at how business leaders are navigating ongoing regulatory and workforce management challenges, as well as the steps they can take to prepare for the transformative changes ahead.

REGULATORY UNCERTAINTY PERSISTS AS COMPLIANCE DEADLINES LOOM

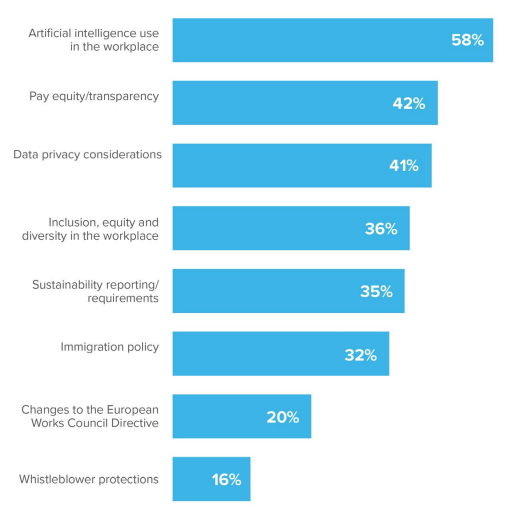

2026 is shaping up to be a watershed year for European regulations impacting the workplace. The provisions of the European Union (EU) AI Act relating to most uses of AI in employment processes go into effect in August 2026, while the EU's Pay Transparency Directive (PTD) has a local implementation deadline in June 2026. Given those milestones, it follows that AI use in the workplace (58%) and pay equity/transparency (42%) are the top two areas where respondents expect regulatory changes to impact their organisations' workforce management in the next 12 months.

But are employers ready to meet the moment? Our survey suggests more work may need to be done. For instance, just 18% of respondents say they are very prepared to comply with the EU AI Act, while 20% indicate they are not at all prepared—the latter matching the proportion who said the same in 2024. Employers also showed little movement when it comes to preparing for the PTD: less than a quarter (24%) say they are very prepared to comply with the law.

In which of the following areas do you expect regulatory changes in Europe and/or abroad to impact on your organisation with regard to workplace/workforce management over the next 12 months? (Select all that apply)

To be fair, slow progress on the part of national governments, which share regulatory responsibilities for these laws, could be hampering employers' ability to prepare. Only eight of the 27 EU countries had announced their AI regulators as of August 2025. Similarly, many jurisdictions have issued little-to-no draft PTD guidance and at least one country, the Netherlands, has delayed implementation. Still, our survey shows that the majority of organisations have yet to take some core steps to prepare for compliance with either law, from conducting audits of pay practices and AI use cases to assigning task forces dedicated to these issues.

U.S. POLICY DEVELOPMENTS IMPACT VAST MAJORITY OF EUROPEAN EMPLOYERS

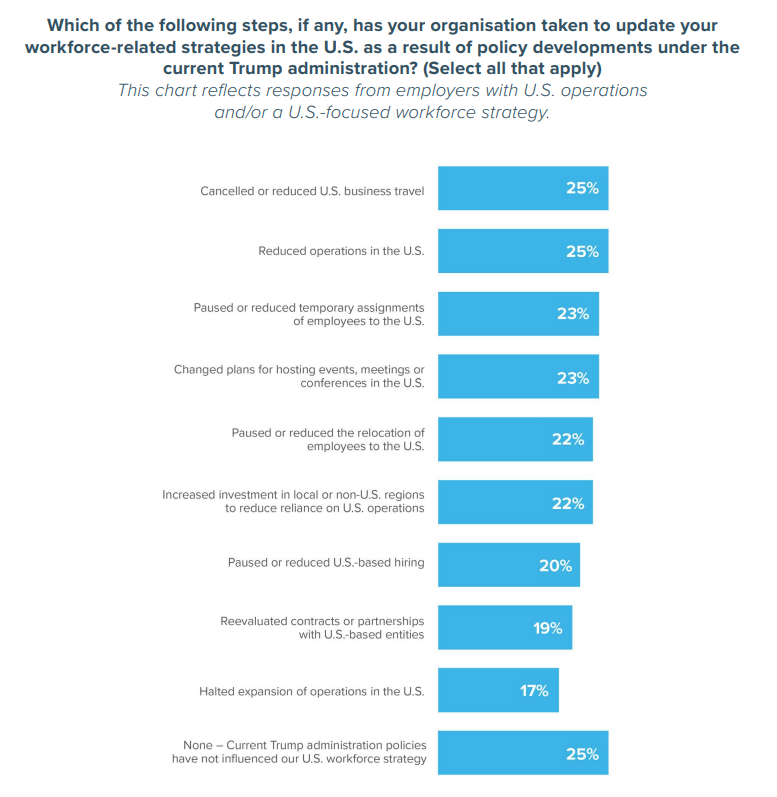

Across the pond, the Trump administration has initiated sweeping policy changes in areas like immigration and IE&D. European employers are not immune to the effects: Of the approximately two-thirds of respondents that have U.S. operations and/or a U.S.-focused workforce strategy, a striking 75% say they have taken at least one step to update that strategy as a result of these policy developments—including cancelling or reducing business travel to the country (25%) and reducing U.S. operations (25%). The impacts also extend beyond the United States. Roughly a third of all respondents selected immigration (32%) and IE&D (36%) when asked which regulatory changes, whether in Europe and/or abroad, they most expect to impact the workforce in the year to come— and those figures rise to 53% and 46%, respectively, for respondents based in the U.K.

On the IE&D front, more than two-thirds (69%) of those with existing policies say they are considering new or expanded rollbacks of these programmes as a result of heightened scrutiny from the Trump administration. Meanwhile, 79% of those with U.S. operations are facing challenges in managing the divergent approaches to IE&D in the U.S. and Europe.

After all, practices that may be deemed "illegal DEI" in the U.S. may be in conflict with certain European jurisdictions' workplace requirements that promote such practices—not to mention EUwide laws like the Leadership Positions Directive and the PTD, which create explicit IE&D-related obligations on employers. This complex patchwork could have important consequences. As one commentator toldThe Wall Street Journal earlier this year: "European companies choosing to pause or roll back DEI initiatives could face significant regulatory risk and reputational backlash in Europe."

PUSH FOR IN-OFFICE WORK PICKS UP

European employers continue to struggle with bringing employees back to the office, as they strive to balance their desire for more in-person work with the talent recruitment and retention benefits of remote options.

The push to get workers back to the office is on, though, according to our data. A clear majority of respondents (63%) whose organisations have positions that can be performed remotely say they have increased or are planning to increase the number of in-person workdays. Roughly a quarter of respondents have increased (11%) required in-person workdays to five days a week or are planning/ considering doing so (15%). Yet even as employers push to bring employees back to the office, 73% agree that remote or hybrid work schedules are important for attracting the right talent.

The report that follows delves into these and other hot-button issues facing European employers, while also spotlighting important differences among respondents from various countries and company sizes. Refer to page 16 for details on the survey methodology and a breakdown of respondent demographics.

U.S. POLICY IMPACTS

Restrictive U.S. immigration measures—including travel bans, enhanced vetting of visa applications and spikes in U.S. border agent activity—are impacting European employers with a U.S. footprint. Case in point: 75% of these respondents have taken at least one step to update their U.S. workforce strategies as a result of current Trump administration policies.

Roughly a quarter of respondents selected a range of actions, including cancelling or reducing U.S. business travel, reducing operations in the U.S., pausing or reducing temporary assignments of employees to the U.S., and revising plans for hosting events in the U.S.

Still others have increased investment in non-U.S. regions to reduce reliance on U.S. operations (22%), paused or reduced U.S.-based hiring (20%), or reevaluated contracts or partnerships with U.S.-based entities (19%).

That employers have already made a range of operational changes in response to U.S. policy shifts in just the first eight months of the new administration is notable. More change may be afoot given that this question only measures actions that have already been implemented, rather than those that may be under consideration or in process.

The data is also consistent with other recent reports. European business travel to the U.S. has dropped dramatically compared to 2024, according to April bookings data from a London-based business travel platform. Additionally, an April survey from the Global Business Travel Association found that nearly 30% of global travel buyers expected a decline in business travel at their companies in 2025 due to American policy shifts.

To view the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.