- within Environment topic(s)

- with readers working within the Securities & Investment industries

- within Insolvency/Bankruptcy/Re-Structuring topic(s)

Welcome to Edition 39 of P2N0 covering the drive to avoid, reduce and remove greenhouse gas (GHG) emissions to progress to net-zero GHG emissions (NZE).

P2N0 covers significant news items globally, reporting on them in short form, focusing on policy settings and legal and regulatory, and project developments and trends. P2N0 does not cover news items about M&A activity or that are negative.

This Edition 39 covers significant news items from November 22, 2025, to December 15, 2025. Edition 40 will provide a summary of 2025 will be published in the first full week of January 2026. Edition 41 will cover the period from January 1, 2026, to January 16, 2026.

Access all previous editions of P2N0 at bakerbotts.com.

KEY ITEMS ARISING FROM NOVEMBER 22, 2025, TO DECEMBER 15, 2025

- End of calendar year 2025 approaching ... some reflections ...

- GHG emissions: The rate of avoidance, reduction, and removal (ARR) of GHG emissions is not fast enough to achieve the objectives of the Paris Agreement1 The rate of ARR needs to increase if there is any prospect of staying within reach of those objectives, and the best way to achieve this is through the increased development and deployment of renewable electrical energy (of which more shortly).

- Age of electricity: For some time now, the age of electricity has been upon Demand for electrical energy is increasing as countries continue to electrify activities, as populations increase and urbanise, and demand for electrical energy increases because of the deployment of artificial intelligence (AI) and the resulting need for computer capacity and data storage2

- Age of AI: A recurring theme of 2025 has been the development of data centres globally in response to the ever-increasing rate and scale of AI. Data centres require electrical energy and

contributions of parties to the Paris Agreement and their progress to developing and deploying renewable electrical energy in its Climate Action Support 2025.

AUSTIN BRUSSELS DALLAS DUBAI HOUSTON LONDON NEW YORK PALO ALTO RIYADH SAN FRANCISCO WASHINGTON, D.C. SINGAPORE

water for power and for cooling. The supply of both electrical energy and water is the only thing placing a break on the development of data centres and the accompanying deployment of AI.

- Critical metals and minerals: Folk have long been aware of the importance of critical materials, metals, and minerals (CM3)3 and rare earth elements (REEs)4 During 2025 we were snowed with news reports of export controls, CM3 and REE security and supply chain strategies, and government funding (in all forms) and partnerships, and most recently the inclusion of CM3 and REE in discussions at COP 30. The IEA has taken something of a lead to explain who has what and who needs As with all elements of decarbonisation, there is a central role for governments to play.

On November 25, 2025, the good folk at the Visual Capitalist published a pie chart (albeit with some intriguingly shaped pieces of pie) answering the question Where Are the World's Rare Earth Minerals? The pie chart is well-worth a view, and for these purposes, a link is attached.

- Government Funding Support - a needed constant: The role of government in decarbonization is core to the development and deployment of technologies to achieve ARR in GHG emissions. This includes continued funding for renewable electrical energy, carbon capture and storage, and

During 2025, the role of Government has expanded to include the development of new mines to extract and to produce CM3 and REEs. With the IEA Table-Top Exercise and Diversification Workshop on rare elements (held under the IEA Critical Minerals Security Programme) held on November 21, 2025, it is likely that Governments will continue to align to address the need for reliable CM3 and REE supply chains.

- Hydrocarbons: The global economy continues to rely on hydrocarbons. However strong the desire and determination to "transition away from fossil fuels" (i.e., the use of hydrocarbons), now called "the UAE consensus", it is going to take time. This is not a question of fault! It is what it is! As the author has noted on more than one occasion, the challenge of addressing climate change is an "ever-changing 8.3-billion-piece three-dimensional jigsaw puzzle", all of whom use hydrocarbons in one form or another.

It is not possible to ignore the body politic: the backbone of decarbonisation is affordability, with the new term imperative of energy security, with the medium-term objective of sustainability.

- Dust still settling after COP 30: As folk reflected on the implications of the outcomes from COP 30, it seems to the author that there is a general acceptance that while the structure and process have served reasonably well since the Paris Agreement, the structure and process need to be more responsive to the increased temperatures and their impact.

At a high level, the combined impact of all nationally determined contributions (NDCs), together, if implemented in full, would reduce GHG emissions by 19% by 2035, compared to 2019 GHG emission levels. According to the UNFCCC, this is not enough: to hold the increase by average global temperatures to 2OC above pre-industrial times, the reduction needs to be 35% compared to 2019 GHG emission levels, and to hold the increase to 1.5OC, the reduction needs to be 55%.

While there is no silver bullet, we know what hits the spot! That is the development and deployment of renewable energy (primarily, photovoltaic solar and wind as scale) to provide renewable electrical energy. The author considers that for the next decade, this should be the focus of efforts globally.

In the context of scarce capital, capital available for investment in decarbonisation should be applied to accelerate the development and deployment of renewable energy, including cross-border, using HVDC5

While developed countries are making considerable progress in the development and deployment of renewable electrical energy, the challenge for less developed countries is the scaling of finance to ensure that the development and deployment of renewable electrical energy capacity is global and inclusive.

From the macro to the micro, GlobalData is projecting that by 2035, Indonesia will have installed 38.1 GW of renewable energy capacity, because of the application of policy settings and investment frameworks under the National Energy Policy.

In a similar vein, the author entreats all countries to aggregate CO2.

For what the International Renewable Energy Agency (IRENA) regarded as five key takeaways from COP 30, see Five Takeaways from COP 30 in Belém.

Africa

During the time period covered by this edition of P2N0, the author has identified no news items that may be regarded as significant.

Middle East, Central Asia, and South Asia

- Nuclear Power Bill tabled in the Indian Parliament: On December 15, 2025, the Minister of State tabled the Sustainable Harnessing and Advancement of Nuclear Energy for Transforming India Bill, 2025 (SHANTI). SHANTI provides a new framework to allow the development of nuclear reactors to generate electrical energy under one piece of legislation.

- Saudi Arabia positions as carbon trading hub: On December 13, 2025, Arab News (at https://arab.news, under Saudi Arabia looks to become carbon trading hub for Global South) reported that Saudi Arabia's Voluntary Carbon Market signed a memorandum of understanding with Marubeni "for collaboration on carbon markets".

- Oman plans three carbon capture ecosystems: On December 4, 2025, OQ Gas Networks announced, in an Information Memorandum (inviting interest from international corporations and other organization), plans to develop a CO2 pipeline network to carry CO2 captured at major industrial areas in Oman, with the CO2 pipeline network to carry CO2 from those areas for injection and storage.

- Bahrain and Saudi Arabia work jointly: In early December 2025, ACWA Power and Bapco Energies entered into a joint development agreement (JDA) for the development of photovoltaic solar capacity and large-scale BESS in the Eastern Province of the Kingdom of Saudi As announced, the JDA provides a framework of the development, in stages, of up to 2.8 GW of photovoltaic solar capacity. The renewable electrical energy generated will be transmitted to the load centre of Bapco Energies in Bahrain.

Americas

- NextEra to supply 2.5 GW of renewable energy to Meta: On December 10, 2025, it was widely reported that NextEra had signed 11 renewable energy purchase agreements and two renewable energy storage agreements with Meta to supply 2.5 GW of renewable electrical energy to Meta across the United States. As reported, the renewable energy and renewable energy storage capacity is to be developed in phases, going live from 2026 to 2028.

- ExxonMobil and NextEra to develop GW data center: On December 8, 2025, CNBC (at cnbc.com, under NextEra working with Exxon to develop gigawatt data center for hyperscaler) reported that NextEra and ExxonMobil are working together to develop a data center to be powered by 1.2 GW gas-

fired power plant, with the power plant to capture CO2 arising from the combustion of the natural gas, with the natural gas and the carbon capture technology to be provided by ExxonMobil. As reported, NextEra and ExxonMobil have secured 2,500 acres of land on which the data center and power plant are to be located, close to ExxonMobil CO2 pipeline infrastructure.

By way of reminder: Edition 37 of P2N0 reported that: "ExxonMobil talking to AI data centers about the supply of electrical energy gas fired power plants using CO2 capture technology: On October 31, 2025, it was reported widely that the Chair and CEO of ExxonMobil, Mr. Darren Woods, has stated that ExxonMobil was in advanced talks with power providers and tech corporations to supply electrical energy from gas fired power plants at which carbon capture technology is used".

- NextEra Energy and Google Cloud to develop multiple data centers: On December 8, 2025, NextEra Energy announced that it is to partner with Google, among other things, to develop "multiple gigawatts

... of data center capacity and energy infrastructure".

- PJM awards interconnection agreements: On December 4, 2025, the good folk at energystorage (at https://www.energy-stornews, under PJM awards interconnection agreements to 23 BESS resources) reported that PJM 6, under its first transition cycle (TCI), had awarded interconnection agreements in respect of 23 BESS resources. The TCI may be regarded as a direct response to the need for near-term affordable capacity as loads increase across the PJM transmission network through 2023 and beyond.

- During November 2025, the good folk at the International

Renewable Energy Agency (IRENA) published:

- The Energy Transition in Brazil – providing an overview of the progress that Brazil has made in the development and deployment of renewable electrical energy capacity; and

- The Regional Energy Transition Outlook for South America – providing a roadmap for the energy transition across South America.

- By way of reminder and to emphasize clear themes, Edition 37 of

P2N0 reported as follows:

- "NextEra to reopen nuclear power station to provide electrical energy to Google: On October 28, 2025, it was reported widely that NextEra had signed a 25-year power purchase agreement with Google under which it will supply electrical energy from the Duane Arnold Energy Center in the US State of Iowa. As reported, reopening the power station will cost in the region of USD 1.6 billion.

- Google contracts for power supply from gas-fired power plant with carbon capture: On October 23, 2025, it was widely reported that Google had contracted in respect of electrical energy to be supplied from the Broadwing Energy project. As reported, the 400 MW Broadwing Energy project will be located at an existing industrial facility owned and operated by Archer Daniels Midland, Decatur, in the US State of Illinois, and will use carbon capture technology from Mitsubishi Heavy Industries, which is understood to be designed to capture up to 90% of the CO2 arising from combustion of natural gas. This is a first for North America.

- Amazon modular nuclear reactor program: On October 20, 2025, the good folk at New Atlas (at com, under Amazon goes nuclear with new modular reactor plant) reported that Amazon Web Services (AWS) is to invest in restarting or developing nuclear power plants to provide reliable "around-the-clock" electrical energy to power its data centers. As reported, AWS is to use the X-Energy Xe-100 Small Modular Reactor (SMR) to be installed near the Energy Northwest Columbia Generating Station in the US State of Washington. The Xe-100 SMR is a high- temperature gas-cooled reactor (HTGR)."

APAC

- China installs more than 200,000 metric tonnes of GH2

production capacity: In early December 2025 it was widely reported

that China:

- had installed 200,000 metric tonnes of green hydrogen production capacity; and

- has over 10 million metric tonnes of green hydrogen production capacity under

- IFC, Permodalan Darul Ta'zim (PDT) and Ditrolic Energy aligned: On November 25, 2025, the good folk at the businesstimes (at https://www.businesstimes.com, under Johor, Ditrolic Energy partner World Bank's IFC to develop US$ billion solar-and-storage hub to power JS-SEZ) reported on plans to develop a USD 6 billion solar-and-storage corridor to power the next phase of its industrial expansion. As reported, IFC, PDT, and Ditrolic Energy have signed a collaboration letter to provide a framework for the development of their project within the Southern Johor Renewable Energy Corridor (SJREC). The project will comprise 4 GW of photovoltaic solar capacity and 5.12 GWh of BESS capacity.

- Ethiopia and Singapore sign carbon credit MoU: On November 24, 2025, Ethiopia and Singapore signed a Memorandum of Understanding (MoU) to provide a framework where "both countries will explore in carbon markets, including the exchange of best practices and knowledge on carbon market mechanisms, as well as future collaboration on initiatives to support the development of high-integrity carbon markets, including the cooperative approaches referred to in Article 6 of the Paris Agreement".

By way of reminder: On November 20, 2025, Singapore and Malawi signed an MoU to collaborate on carbon credits aligned with Article 6 of the Paris Agreement today, on the sidelines of COP 30. Under the MoU, both countries will work towards a legally binding Implementation Agreement on carbon credits aligned with Article 6.2 of the Paris Agreement. The MoU will facilitate the exchange of best practices and knowledge on carbon credit mechanisms, as well as the identification of mutually beneficial carbon credit projects that will support both countries in achieving their climate targets.

As of November 2025, Singapore has signed similar MOUs with other countries such as Cambodia, Colombia, Costa Rica, Dominican Republic, Fiji, Kenya, Laos, Malaysia, Mongolia, Morocco, the Philippines, Senegal, Sri Lanka, and Zambia. Singapore has also progressed to sign legally binding

Implementation Agreements with 10 countries: Bhutan, Chile, Ghana, Mongolia, Papua New Guinea, Paraguay, Peru, Rwanda, Thailand, and Vietnam.

- IEA publishes South Korea review: On November 25, 2025, the International Energy Agency (IEA) published Energy Policy Review Korea 2025. The publication is well worth a read for those familiar with the Republic of Korea (South Korea).

The publication affirms that which is understood: 1. South Korea has concentrated on energy security and progress to carbon neutrality, after COVID-19 and the Ukraine conflict; 2. The progress to carbon neutrality is informed by the Framework Act on Carbon Neutrality and Green Growth for Coping Climate Crisis (the Carbon Neutrality Act), and is now guided by the Ministry of Climate, Energy and Environment (MCEE) established in October 2025; 3. It is hoped that the MCEE and the Ministry of Trade, Industry and Resources (MOTIR, previously MOTIE), will work together to realise the policy objectives of South Korea; 4. The policy objectives of South Korea include strong emphasis on the electrification of activities; 5. With the establishment of MCEE, the activities of the electricity regulator (KOREC) are now overseen by MCEE; 6. South Korea continues to rely on non-renewable electrical energy, and the development and deployment of renewable energy sources remains a matter with which South Korea continues to grapple; 7. The Korean Emissions Trading System (K-TES) applies to nearly 80% of GHG emissions arising across South Korea, and with higher price points and increased liquidity, the K-TES may be used to incentivise greater development and deployment of renewable electrical energy; 8. Nuclear power generation remains key to the generation of electrical energy across South Korea, with the current target for nuclear power being a minimum of 30%; 9. Low-emission hydrogen is seen as a solution to decarbonise difficult to decarbonise industries; and 10. The achievement of decarbonization of the power sector is a challenge, and will continue to be so.

Whether active in the market in South Korea or not, the publication is well worth a read.

On November 16, 2025, Hyundai announced that it is to develop a 1 GW a year electrolyser manufacturing plant in the southwest of South Korea.

- No 2 Unit of Zhangzhou connects to State Grid: On November 22, 2025, the good folk at Global Times (at globaltimes.cn, under World's largest Hualong One nuclear power base successfully of State Grid) reported that No 2 Unit of Zhangzhou nuclear had connected to the State Grid. The connection of No 2 Unit is located within Hualong-I and marks the first step in the deployment of the Hualong-I reactor series in Shandong Province, China. Six reactor units are planned, how long this will take is not known yet.

Europe and the UK

- Omnibus and EU Deforestation Regulation (EUDR): On December 16, 2025, the European Parliament voted in favour of scaling back sustainability reporting and due diligence requirements (428 votes in favour, 218 against, with 17 abstentions).

Under the Omnibus:

- Corporate Sustainability Reporting Directive (CSRD) applies to corporations and other organizations with 1,000 employees and above, having an annual net turnover of € 450 million and The rules will also apply to non-EU companies with a net turnover in the EU of over €450 million and to their subsidiaries and branches generating turnover higher than €200 million in the EU;

- Corporate Sustainability Due Diligence Directive (CSDDD or CSD3) applies to corporations and other organizations with 5,000 employees and above, having an annual net turnover of € 5 billion, and Climate Transition Plans are not required; and

- Harmonized EU-wide liability regime not implemented, rather, a review will be required, with maximum liability set at 3% of net turnover globally.

The EUDR is aimed at stopping the EU from contributing to global deforestation and forest degradation by ensuring products imported for sale in the EU (for example, like coffee, cocoa, soy, palm oil, cattle, rubber, wood) are not linked to deforestation and are produced legally, avoiding adverse GHG emissions outcomes, protecting biodiversity, and requiring corporations and other organizations to prove their supply chains do not involve adverse biodiversity outcomes through the application of due diligence and traceability requirements.

On December 17, 2025, the European Parliament voted to postpone the application of the EUDR for one year for all businesses. Large operators and traders will have to apply the regulation from December 30, 2026, while small operators (private individuals and enterprises with less than 50 employees and an annual turnover below €10 million) will have to apply the regulation from June 30, 2027.

- European Climate Law to be amended: On December 10, 2025, the Council and European Parliament agreed to the GHG emissions reduction target for the EU: the European Climate Law will be amended to provide for a 90% reduction in GHG emissions by 2040 compared to 1990 While this has been agreed in principle the amendment to the European Climate Law will give effect to the target.

By way of reminder: Edition 37 of P2N0 reported that: "On November 5, 2025, EU Climate Ministers agreed a 2040 GHG emissions reduction target, which provides for a reduction of 90% of GHG emissions by 2040 compared to 1990. In a move away from the position outlined in proposed legislation on July 2, 20257 the EU Climate Ministers agreed to allow EU Member States to purchase carbon credits from countries outside the EU to match up to 5% of the 2040 GHG emission target of a 90% reduction. The effect of this is that EU Member States may be regarded as having domestic obligations to reduce GHG emissions by 85% in fact, with 5% to be achieved through offsetting."

- EC approves State Aid:

- of € 5 billion to promote cleantech manufacturing in Italy; and

- for the first nuclear power plant in Poland: On December 9, 2025, the EC approved the provision of funding support from the Polish Government to allow the development of a 3.750 GW nuclear power plant. For more details, click on the following link [https://ec.europa.eu, under Commission approves State aid for the construction and operation of Poland's first nuclear power plant]

- CBAM ... see you soon: In early to mid-December 2025, there was considerable coverage of the introduction of the carbon border adjustment mechanism (CBAM) on January 1,

As noted previously, CBAM is intended to avoid carbon leakage, i.e., the manufacture and production of carbon intensive products (aluminum, cement, fertilizers, iron and steel, and hydrogen) and the provision of services (i.e., electrical energy) in jurisdictions with no price on carbon or a lower price on carbon than the EU, and the import of those products and services into the EU.

Stated another way, the purpose of a price on carbon in the EU, through the EU ETS is to incentivize the adoption of lower, low and no GHG emission technologies. This policy setting is side-stepped if the price on carbon in the EU can be avoided by importing carbon intensive products and services from outside the EU.

It is clear that CBAM will affect the import of iron and steel and aluminum products to the greatest extent, and hydrogen and electrical energy to the least extent. As a result, countries exporting iron and steel, and aluminum products have expressed concerns about CBAM as unilateral trade measures.

By way of reminder, recent editions of P2N0 have noted:

- CBAM, and any other border carbon adjustment (BCA) mechanisms are regarded as controversial by countries whose exports will be impacted by the introduction of a price on carbon.

- At COP 30 one of the most contentious matters was the use of "Trade Measures", including the CBAM and EUDR: other than the transition from fossil fuels, this was the most contentious matter at COP 30, with current geopolitical dynamics more obviously on display than COPs in recent times.

- During the third week of October 2025, the Council in Energy, Environment and Water (CEEW) in India published a working paper entitled EU Carbon Border Adjustment Mechanism – Dominant Perspectives in India.

The publication explains CBAM and provides a summary of some of the complaints levelled at CBAM, which always tend to miss the point – CBAM is intended to prevent carbon leakage, nothing more, nothing less: if you want to import into the EU, you must do so on an equivalent carbon price basis to prevent carbon leakage. The publication is worth a read.

- CBAM good to go:

On October 8, 2025, the Official Journal of the European Union published Regulation 2025/2083 of the European Parliament and of the Council, amending Regulation 2023/956 as regards simplifying and strengthening the carbon border adjustment mechanism. The original policy setting purpose of CBAM has not changed and remains as robust as ever, rather the amendments simplify.

- EUIF open for proposals: On December 3, 2025, the EU Innovation Fund (EUIF) called for proposals as part of the continued policy settings to accelerate the decarbonization of the industrial sector comprising up to € 5.2 billion in funding support (using receipts from the EU ETS).

- Innovation Fund 25 Net-Zero Technologies, under which up to € 2.9 billion of funding is available to support innovation in mature decarbonization projects, including EV batteries, Heat Pumps, Hydrogen production and Renewable Electrical Energy and energy storage. The closing date for responses is April 23, 2026.

- The third European Hydrogen Bank (EHB) auction, under which up to € 3 billion of funding is available to projects that increase the production of renewable fuel of non-biological origin (RFNBO) hydrogen and electrolytic low-carbon hydrogen, including for transport sectors that cannot electrify to decarbonize, i.e., aviation and maritime.

The third EHB auction will provide funding support as follows:

- € 600 million for RFNBO hydrogen;

- € 400 million for RFNBO and low-carbon hydrogen; and

- € 300 million for projects contracting with off-takers in the aviation and maritime sectors. The closing date for responses is February 19, 2026.

On the sidelines of the third EHB auction:

- Germany has stated that it intends to encourage green hydrogen projects in Denmark though the provision of up to € 3 billion in funding support, with the green hydrogen to be transported through a new dedicated cross-border pipeline. The Danish section of the project is known as the "Syvtallet" (The Seven-Route) pipeline, which will run approximately 133 km from Esbjerg, in western Denmark, to Frøslev at the German border; and

- Spain has announced that any project in Spain that is not successful in the third EHB auction will be eligible for funding support of up to € 415 million.

- The first Innovation Fund Fixed Premium Auction 2025 under which up to €1 billion8 in funding support is available from the Innovation Fund to allow the development and deployment of solutions to decarbonize industrial heat processes. It will be interesting to follow the heat auction, and the ability of those bidding in each EU member state to supply lower and low-cost heat. The closing date for submissions is February 19, 2026.

- EC presents RESourceEU: On December 3, 2025, the European Commission published RESourceEU, the initiative of the EU to secure CM3 across the EU: Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions, RESourceEU Action Plan Accelerating our critical raw materials strategy to adapt to a new

The RESourceEU Action Plan builds on the structure provided by the Critical Raw Materials Act (CRMA). Under the Action Plan, during the first few months of 2026, the EC will establish the European Critical Raw Materials Centre and the Raw Materials Platform. These initiatives will facilitate assessment of demand, coordinate the purchase of raw materials and the arrangement of off-take agreements. For more detailed coverage of the Action Plan and CRMA, see Commission adopts RESourceEU to secure raw materials, reduce dependencies and boost competitiveness at https://ec.europa.eu.

The EU has made considerable progress. Now for implementation!

- Yara International CCS project: In early December 2025, it was widely reported that Yara is to capture up to 800,000 metric tonnes of CO2 annually from its Sluiskil plant, in the As reported, the plant produces ammonia and fertilizer, with CO2 arising from production to be captured, processed and treated, and liquified and transported for injection and storge in the Northern Lights Project.

- EU publishes new list of Projects of Common Interest (PCI) and Projects of Mutual Interest (PMI): In early December 2025, it was reported widely that the EU had developed a list of hydrogen projects, including cross-border projects. The link details the projects. As reported, the list of hydrogen projects requires approval of the European Parliament and the Council of the EU.

- BECCS expression of interest process opens: On November 26, 2025, the good folk at carbonherald (at https://carbonherald.com, under Carbonfuture Opens Tender For Government – Backed BECCS Supply in Denmark) reported that expressions of interest were sought for a BECCS project, with the project to come within the Negative Emissions for Carbon Capture and Storage (NECCS).

- Uniper and thyssenkrupp Unde get cracking: On November 26, 2025, Uniper announced that it had signed a framework agreement with thyssenkrupp Unde to allow Uniper to develop ammonia cracking plants using thyssenkrupp Unde The development of the cracking plants will allow the dehydrogenation of ammonia imported by ammonia carriers delivering ammonia to Uniper's import terminal at Wilhelmshaven.

- UK alert to critical metals and minerals: On November 22, 2025, the UK Government (Department for Business and Trade and Department for Energy Security and New Zero) published The UK's Modern Industrial Strategy, Critical Minerals Strategy.

The publication sets out:

"the UK's long-term ambition for securing critical minerals and harnessing [the UK's] competitive advantage in recycling and innovative midstream processing – the transformation of mined or recycled materials into refined or upgraded forms suitable for manufacturing".

The 'what' is clear, the 'how' more amorphous: 1. Work with international partners that have limited critical mineral resources (the EU) and that have critical mineral resources (Australia and Canada) to build more resilient and diverse supply chains; 2. Having secured those supply chains, the UK will cultivate its "midstream processing and recycling capacity ... to enable a circular economy and [to] reduce the impact of external shocks".

For these purposes, the UK Government anticipates that it will provide funding support. The publication is worth a read, and, having read it, it will be apparent that the UK, like many other countries, needs to partner with countries that have metal and mineral resources sooner rather than later.

- Finland aims to contribute 10% of the EU's renewable hydrogen by 2030: On November 27, 2025, the good folk at driving hydrogen (at https://drivinghydrogen.com, under Finland's bold plan: 10% of EU hydrogen by 2030) reported that Finland aims to be a key supplier of green hydrogen across the EU. There is nothing new in this news, because it has long been recognized that Finland has vast potential to produce green hydrogen. This is one to follow, although not as closely as the role of Denmark.

- EU Delegated Act on non-renewable hydrogen passes into EU law: On November 21, 2025, after publication in the Official Journal, Delegated Act on low-carbon hydrogen became law. The Delegated Act details the basis upon which hydrogen produced using non-renewable electrical energy (including grid electricity, and natural gas and nuclear-generated electricity) can be characterized as low carbon, and as such qualify for funding from the

- Czechia 2025 Energy Policy Review: On November 21, 2025, the IEA published Czechia 2025 Energy Policy Review. The author must confess to family connections to Czechia, and as such has taken a personal as well as a professional interest in this publication. The publication is worth a read, providing a clear sense of the policy settings in place, and that are needed.

HELPFUL PUBLICATIONS AND DATA BASES

In addition to publications covered by this edition of P2N0, the most noteworthy publications read by the author during the period from November 21, 2025, to December 15, 2025, are:

- World Energy Employment 2025: On December 5, 2025, the IEA published World Energy Employment 2025. The publication outlines the rate of growth of employment across the global energy sector. The publication is worth a read, providing a sense of areas in which skill shortages may arise.

- Increase in Carbon! In early December 2025, the good folk at JCI published its Science for Policy Report, GHG Emissions For All World Countries, 2025. The publication makes for sobering The headline statistic is that in 2024, total global GHG emissions were a mass of 53.2 Gt CO2-e. The publication is well-worth a read.

- Impact on water distribution of planting trees: On December 3, 2025, Live Science (at livescience.com, under China has planted so many trees its changed the entire country's water distribution) reported on the impact of the regreening of China described in the journal Earth's Future. Both the report and the journal make fascinating reading, with the reactivation of the water cycle representing a heartening outcome.

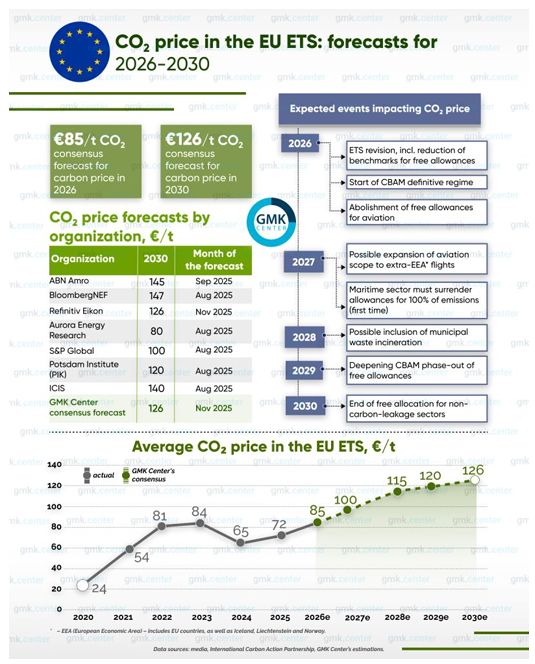

- Carbon Market Report: On December 3, 2025, the EC published the 2025 Carbon Market Report. The report makes fascinating reading and explains why the EU continues to make progress to decarbonize activities through the provision of funding support: receipts from the EU ETS now exceed € 250 billion since its inception, with receipts for 2024 at approximately € 38 billion. The impact of the price on carbon is clear in the EU, and the effectiveness of the EU ETS to raise money to fund decarbonization is established and is working.

The EU has provided forecasts for the price of carbon under the EU ETS as follows:

For consideration of carbon markets globally, the University of Oxford publication Roadmap to Net- zero Agreed Carbon Market Regulation. The publication provides an assessment of the range of prices on carbon regimes globally (now more than 80) and the carbon credit regimes globally (now more than 100).

- Enhancing Resilience – Climate Proofing Power Infrastructure: In early December 2025, IRENA published Enhancing Resilience – Climate Proofing Power Infrastructure. The publication provides a helpful overview of the impact of climate change on energy infrastructure. The publication is well- worth a read.

- Drop in Decarbonization: In early December 2025, the good folk at The Oxford Institute for Energy Studies published Drop in Decarbonization: Techno-Economic Benchmarks, Hydrogen Needs, and Policy Design of SAF and Renewable Diesel. The publication provides a helpful analysis of the uses for SAF and Renewable Diesel in those parts of the transport sector that are not able to be decarbonized using electrical energy. The publication considers four means of production and the costs of production across Brazil, the EU, and the USA. The publication is well-worth a read.

The Drop in Decarbonization is best considered in the context of the progress that China, the EU and India are making in the development and deployment of green hydrogen production capacity. During the first part of 2025, it is fair to say that progress in the development of green hydrogen production capacity appeared to be slowing, in particular in the UK and the US.

As noted above:

- China is understood to have achieved its target to install 200,000 metric tonnes of green hydrogen capacity and has continued to increase its capacity to manufacture electrolysers. With 10 million tonnes of green hydrogen production capacity under development, China could well be progressing to 20 million metric tonnes of production capacity by 2030;

- the EU continues to commit to the production and import of green hydrogen with continued funding support for green hydrogen production (including the EHB) and the development of infrastructure to allow the import of green ammonia and its cracking, and the carriage of hydrogen across the hydrogen network, and the funding of infrastructure to allow end use. It appears that it is still possible for the EU to achieve its 2030 import target of 10 million tonnes and production targets of 10 million tonnes under the REPowerEU Plan;

- India continues to roll out the implementation of its policy settings under the National Green- Hydrogen Mission, including its target to achieve 5 million metric tonnes of green hydrogen production capacity by 2030, with the development of 125 GW of renewable energy capacity to provide the electrical energy to power electrolysers to produce green hydrogen.

While there has been mixed news for the green hydrogen sector globally, in China, the EU and India, the scaling of the sector continues.

- Integrated Sustainability – H2 and H2O management: The good folk at Integrated Sustainability have published Hydrogen Production Water Management: Understanding the Challenges. As the EU continues to provide funding support for the development of hydrogen and hydrogen derived fuel production capacity, the publication provides a useful reminder of the mass of water required for production, both as feedstock and for The publication is well-worth a read.

- IETA Handbook from printing press to hand: In early December 2025, the good folk at IETA published The New Carbon Order, An emerging system of markets, technology and scale. The publication pulls together analysis on a range of methodologies from a range of standards organisations to inform thinking in the voluntary carbon market, and, in some ways, to prepare the way for clearer thinking as the methodologies and standards for the purposes of Article 6.4 emissions units become defined.

- Nature-based Solution Studies in ASEAN Member States publications hit the shelves in time for the holiday season: The EU, via the Technical Assistance Facility, has published five publications relating to key aspects of N-b S across ASEAN: ASEAN Climate Risks and Hazards Analysis, ASEAN NbS Typology Characterisation, ASEAN Nbs Catalogue, ASEAN Nbs Policy Report, and ASEAN NbS Finance Report. While the author has yet to read each publication, from a quick scan of the publications, they look like they will be a good resource.

- Electricity Market Design – Building on Strengths, Addressing Gaps: On November 26, 2025, the IEA published Electricity Market Design, Building on Strengths, Addressing Gaps. The publication provides an overview of the challenges that arise in wholesale electrical energy markets and provides suggestions on policy settings that might address these challenges. The publication is worth a

- Pledges to Progress 2025: On November 24, 2025, the IEA published Pledges to Progress 2025. The publication provides an assessment of the progress that the natural gas and oil industry is making to avoid, reduce and remove GHG emissions arising from their activities. The publication is well-worth a

- World Energy Outlook 2025: On November 12, 2025, the IEA published its flagship publication World Energy Outlook 2025 (WETO 2025). As with previous editions of WETO from the IEA, WETO 2025 is compulsory reading.

Footnotes

1 By way of reminder, Article 2.1(a) of the Paris Agreement provides for "Holding the increase in the global average temperatures to well below 2OC above pre-industrial levels and pursuing efforts to limit the temperature increase to 1.5OC ..."

2 The good folk at International Renewable Energy Agency (IRENA) provide an up-to-date analysis of the national determined

3 CM3 are: 1. Bauxite, High Purity Alumina, and Aluminum; 2. Antimony; 3. Beryllium; 4. Bismuth; 5. Cobalt; 6. Copper; 7. Gallium; 8. Germanium; 9. Graphite; 10. Indium; 11. Lithium; 12. Magnesium; 13. Manganese; 14. Nickel; 15. Niobium; 16. Platinum metals; 17. Rare Earths Elements (REEs); 18. Silicon and Silicon metals; 19. Tantalum; 20. Titanium and Titanium metal; 21. Tungsten; 22. Uranium; and, 23 Vanadium.

4 Edition 29 of P2N0 defined 17 REEs as follows: Cerium (Ce), Dysprosium (Dy), Erbium (Er), Europium (Eu), Gadolinium (Gd), Holmium (Ho), Lanthanum (La), Lutetium (Lu), Neodymium (Nd), Praseodymium (Pr), Promethium (Pm), Samarium (Sm), Scandium (Sc), Terbium (Tb), Thulium (Tm), Ytterbium (Yb) and Yttrium (Y).

5 The Climate Policy initiative and International Renewable Energy Agency (IRENA) publication, Global Landscape of Energy Transition Finance 2025, provides timely, and detailed, analysis of the size and scope of the development and deployment necessary, and the capital cost. The publication is well-worth a read.

6 PJM is the Regional Transmission Organization (RTO), serving 13 US States and the District of Columbia.

7 On July 12, 2025, the EU decided not to allow offsets until 2036 at the earliest: the stated policy driver for this was that lower, low and no carbon technologies should be maximized, and only those activities that could not be decarbonized should be able to offset.

8 Up to € 500 million for high-temperature, up to € 150 million for small capacity, and up to € 350 million for large capacity.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.