- with readers working within the Media & Information industries

- within Cannabis & Hemp topic(s)

The Digital Markets, Competition and Consumers (DMCC) Act 2004 introduces significant changes to consumer law and the way it is enforced. One of the changes is to clarify the law on drip pricing. The new provisions came into effect in April 2025.

What is drip pricing and why is it a problem?

Drip pricing is when consumers are shown an initial price for a product1 but as the consumer proceeds through the purchasing journey additional mandatory charges are added. The result is that the price paid by the consumer is higher than the price originally presented to the consumer.

Research has estimated that dripped fees (other than delivery fees) cause UK consumers to spend between an additional £595 million- £3.5 billion each year2.

The DMCC Act tightens the old law on drip pricing and removes the need to show that the practice has affected the transactional decision-making of the average consumer when bringing enforcement action. This makes the new provisions an attractive enforcement option for cases under the new Act.

When do I need to think about drip pricing?

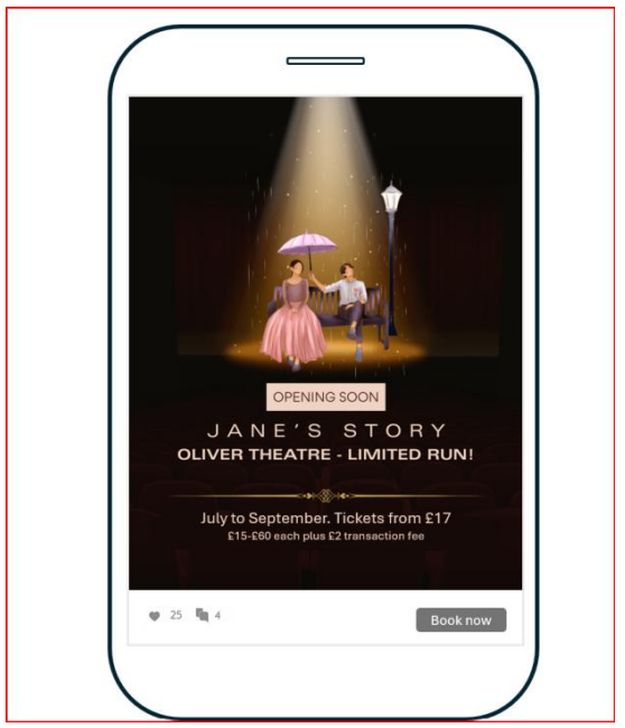

When a trader gives information to consumers about a product and its price, this would normally be an "invitation to purchase". Invitations to purchase can be made in many ways including by listing products on a website, by promoting a product in an email or text message or in an advertisement. A consumer may be presented with an invitation to purchase at multiple points during their purchasing journey.

The trader making an invitation to purchase is responsible for ensuring that it complies with the updated law set out in the DMCC Act. As well as the general requirement that prices must not be misleading, the DMCC Act makes certain pricing information "material information" which must be included in the invitation to purchase3 . This includes telling consumers the "total price" of the product.

Advertisements which promote a trader's brand will not be invitations to purchase as they will not be promoting specific products. Ads that do not include a price also will not be invitations to purchase.

What is the total price?

In an invitation to purchase traders must tell consumers the total price of the product which includes any fees, taxes, charges or other payments that the consumer will necessarily incur if they purchase the product. This means that any mandatory charges should be included in the total price for the product. Examples of mandatory charges are:

- Purchase taxes (e.g. VAT)

- Booking fees

- Fees relating to additional charges that cannot be avoided such as cleaning fees of accommodation or service charges at a restaurant

- Delivery charges where consumers cannot arrange for their own collection or delivery of the product being advertised

- Joining fees that are payable in addition to a first regular payment of a subscription or membership

- Local taxes and resort fees that become payable on arrival or departure at, for example, hotels or airports.

If the trader is offering an optional service in addition to the product, then the price of this does not have to be included in the total price.

If owing to the nature of the product, the whole or any part of the total price cannot reasonably be calculated in advance the invitation to purchase must set out how the price (or that part of it) will be calculated. This information must be set out with as much prominence as the part of the total price that is calculable in advance. This exception is likely to be interpreted narrowly and will commonly apply when the nature of the product means the total price will depend on the consumer's requirements and the trader has not yet been provided with this information, for example where products are sold by weight or length.

How should I present delivery charges?

The total price of the product must include any mandatory delivery charges.

Delivery charges are mandatory if the consumer cannot purchase the product without paying an additional charge for delivery. So, if for example, a consumer can collect the product instore then delivery would be optional. Optional delivery charges must also be provided in an invitation to purchase but are not required to form part of the total price.

Where mandatory delivery charges are fixed for all deliveries then they should be included in the total price. For example, if an advertisement promotes a dress at £20.99 and delivery is mandatory and costs £4 then the total price of £24.99 should be given. The "base" price of £20.99 can be given too. If there are various delivery options, then the cheapest should be included in the total price and the other options explained in the invitation to purchase.

Online marketplaces, which display lists of items sold by different traders, should include mandatory delivery charges in the total price of each product.

Where mandatory delivery charges vary, then the trader must indicate in the invitation to purchase that there are delivery charges and how these will be calculated. When the delivery charges become calculable because the customer has given information to the trader enable this, then the invitations to purchase that occur after this must include the delivery charge in the total price.

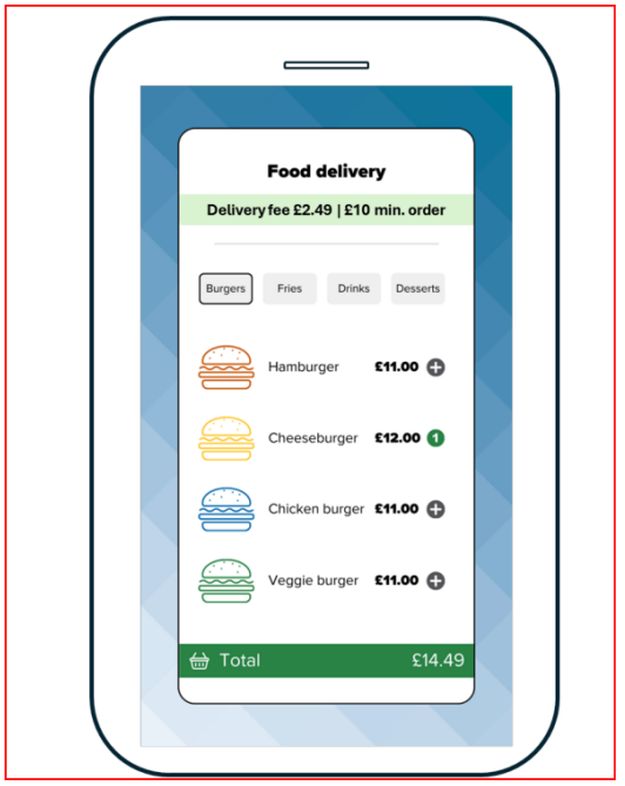

On websites and apps, traders should provide an explanation of the delivery fees and ensure the "total price" is provided to the consumer, for example, by a running total which includes the products selected by the customer and any mandatory delivery fees which will apply to the order.

What about booking, administrative or other per-transaction fees?

Mandatory per-transaction charges should be included in an invitation to purchase and, wherever possible, included in the total price. The use of per-transaction charges will not, in themselves, mean the total price cannot reasonably be calculated in advance owing to the nature of the product. This is the case even in early- stage advertising

Traders must use any information already supplied by the consumer to ensure they are presented with a total price inclusive of any per[1]transaction charge. If the consumer has the option of purchasing multiple products as part of the same transaction, then one way to comply with the total price requirements would be to present the consumer with a running total based on the products they have selected

Local charges and taxes

Mandatory charges can include local taxes, resort fees and other unavoidable charges that become payable on arrival or departure, for example, at hotels or airports. Before the trader has the consumer's specific requirements, mandatory local charges and taxes should be incorporated into the indicative pricing or the price given, for example, per person per night. Once the trader has the consumer's specific requirements, they should be incorporated into the total price.

The requirement to include the total price in each invitation to purchase is unaffected by when the payment is taken or to whom it is paid. If mandatory charges are to be paid locally in a foreign currency, then the total price must include them.

What about rolling and minimum term contracts?

Some contracts for products require consumers to make periodic payments, for example, gym memberships. These contracts can either be "rolling contracts" where the consumer can cancel at any time or "minimum term contracts" where the consumer is committed to receiving and paying for the product for the minimum term,

The "total price" for rolling contracts will be the price the consumer has to pay for each period of the contract (e.g. £15 per month) and must be inclusive of all mandatory charges the consumer will incur in that period.

The "total price" for minimum term contracts can be expressed either by providing the cumulative price the consumer will pay over the entire minimum length of the contract or4 the price for each period alongside a prominent statement explaining the length of time (e.g. number of months) the consumer is committed to pay that price.

Where a minimum term contract requires a one-off fee to be paid at the start of the contract, then the advertised price must set out the total price including the fee for the first month as well as setting out the subsequent monthly payments and length of commitment.

What happens if I don't comply?

The DMCC Act introduces wide -ranging enforcement powers for the CMA, which is now able to issue GDPR- style fines without going to court first, as well as ordering redress and compliance measures. More information is available here.

What should I do now?

B2C businesses should take into account guidance from the CMA and consider whether their own pricing practices require changes. The best way to do this will be to audit consumer journeys to check invitations to purchase for compliance with drip pricing rules.

Footnotes

1 The definition of "product" throughout this note includes goods, services and digital content

2 Estimating the prevalence and impact of online drip pricing

3 Section 230 DMCC Act

4 Providing the cumulative price doesn't prevent the trader from providing other pricing information too, such as the monthly payments

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]