- within Criminal Law, Immigration and Cannabis & Hemp topic(s)

Smart acquirers gain the competitive edge by offering price certainty and minimizing post-closing dispute exposure.

This is the third article in our "Strategies for Winning Deals" series, which highlights ways that private equity sponsors can gain a competitive edge in buyouts without overpaying.

Winning a competitive middle-market deal often requires more than simply offering the highest price. Sellers increasingly expect a "clean exit" — a transaction structure allowing them to sign, close, and "walk away" with little or no post-closing liability exposure. While once typical only of up-market deals, this approach is firmly entrenched for attractive assets in the middle market and is even reshaping dynamics in the lower middle market. For buyers, offering a clean exit has become a practical tool in the broader tool kit of strategies that can tip the balance in a competitive process.

The Structural Shift

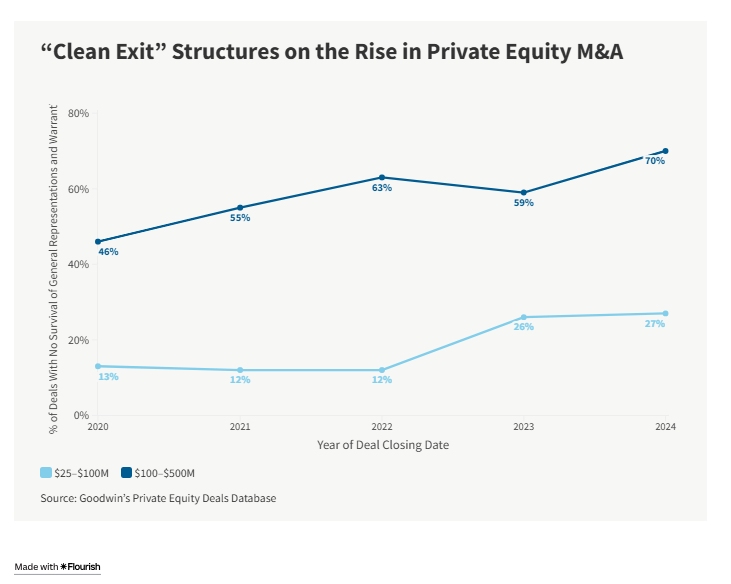

Historically, many up-market deals were completed "public company style," with representations and warranties not surviving closing except in the event of actual fraud. That approach has since become common in middle-market transactions ($100–$500 million) and is now extending into the lower middle market ($25–$100 million). Representation and warranty insurance is the central catalyst for this transformation.

Representation and Warranty Insurance: The Foundation

Representation and warranty insurance (RWI) has become a prevalent mechanism in middle-market transactions to mitigate seller risk and increase seller proceeds at closing. Improvements in pricing and retention (i.e., deductible) levels as well as minimum policy sizes have made clean exits more accessible across deal sizes.

Current Market Conditions for Middle-Market RWI

- Premium costs: Around 3% of the coverage amount. Rates were closer to 4% in 2022, dipped to about 2.5% in mid-2024, and have edged upward since. For deals closed over the last 18 months in Goodwin's Private Equity Deals Database, the buyer paid the premium in 70% of deals, the parties split the cost in 28%, and the seller paid in 2%.

- Coverage: Typically, 10% of the transaction value.

- Retention: .5% or lower (down from 1% in 2022), often with no retention for a subset of traditional fundamental representations.

Structural Approaches

- Split-retention deals: Sellers indemnify for a portion of the uninsured amount (i.e., retention amount) after closing to satisfy indemnification claims. In this structure, representations and warranties survive closing, with funds typically held in escrow or held back for the survival period (often 12 months for general representations and warranties). Split-retention deals are more common in lower middle-market transactions.

- RWI-only deals: Buyers' sole recourse for breaches of representations and warranties is the RWI policy except in the event of actual fraud. Representations and warranties do not survive closing, and buyers assume full risk for uninsured amounts (i.e., the retention amount or beyond coverage limits).

The market shows increasing adoption of RWI-only structures, with buyers relying solely on RWI in 63% of middle-market deals and 25% of lower middle-market deals in 2024.1

Both split-retention and RWI-only structures may include specific carve-outs for identified matters requiring traditional indemnification (e.g., known liabilities, which are typically exclusions from coverage under the RWI policy; breaches of fundamental representations; fraud.

Strategic Fraud Risk Management

Clean exits require buyers to propose thoughtful limitations on sellers' fraud exposure. Common approaches include restricting fraud claims to matters within the "four corners" of the purchase agreement and defining "fraud" narrowly. Parties sometimes end up limiting recourse to the actual perpetrator.

This approach demands that buyers carefully balance protection against material fraud and demonstrate a willingness to close through reasonable limitations.

Working Capital Adjustments: Reducing Friction Points

The development of generally accepted procedures for determining closing working capital and debt-like purchase price adjustments has reduced dispute frequency and friction. These procedures typically involve either post-closing true-up mechanisms (common in US deals) or lockbox mechanisms that indemnify buyers for value "leakage" (common in European deals).

Despite these improvements, working capital disputes persist, and in deals in which sellers can otherwise "walk away" from liability, they can become a focal point for recovery. Mastery of working capital determination and dispute resolution processes is essential for serial buyers seeking to avoid excessive costs or delays.

Friction-Reduction Strategies

- Working capital collars: Establish agreed ranges for target values that eliminate adjustments for normal or otherwise acceptable fluctuations. While not yet standard, 28% of middle-market and 17% of lower middle-market M&A deals in our Private Equity Deals Database used working capital collars in recent periods.

- Purchase price adjustment escrows: Set aside approximately 1% of deal proceeds (the size varies by deal size and industry) to resolve post-closing purchase price adjustments and often serve as an exclusive source of recovery. Recovery beyond escrow amounts may come from general indemnification escrows, future payment setoffs, or direct seller clawbacks — though the latter represents a step backward from clean exit principles.

- Simplified calculation methods: Add purchase agreement schedules with specific net working capital calculation methods, providing customized approaches that reduce complexity and potential disputes. Calculations should often exclude the impact of the transaction on agreed upon line items absent a specific intention to include.

- Professional arbitration: Pre-agree on dispute resolution mechanisms providing certainty and speed, including specific arbitrator identification (e.g., a Big Four accounting firm unaffiliated with the parties) and outcome-based arbitration fee allocation.

The Competitive Advantage

The clean exit trend shows no signs of reversing. While exceptions are sometimes carved out for specific matters, and fraud liability can't be eliminated entirely, the overall direction is toward structures that minimize post-closing exposure. For buyers, the advantage lies in recognizing that clean exits create genuine value for sellers: They deliver certainty and simplicity while still allowing buyers to protect their interests through careful drafting and RWI. In competitive situations in which valuations are close (or buyers are seeking to preempt what is expected to be a competitive auction process), a clean exit combined with other strategies in this series can provide the differentiation needed to win.

* * *

The next article in our "Strategies for Winning Deals" series,"Creative Structures: Leveraging Innovative Terms," examines tactics private equity sponsors can use to help ensure valuation certainty and/or increase value.

Footnote

1. Source: Goodwin Private Equity Deals Database. Note: The discrepancy between these figures and the 2024 figures in the "'Clean Exit' Structures on the Rise in Private Equity M&A" chart is the result of a small number of transactions in which representations and warranties did not survive but RWI was not obtained, either.↩

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]