- within Criminal Law, Immigration and Cannabis & Hemp topic(s)

As M&A deal timelines stretch, some private equity sponsors are finding opportunities when others see only delays.

This is the first article in our "Strategies for Winning Deals" series, which highlights ways that private equity sponsors can gain a competitive edge in buyouts without overpaying.

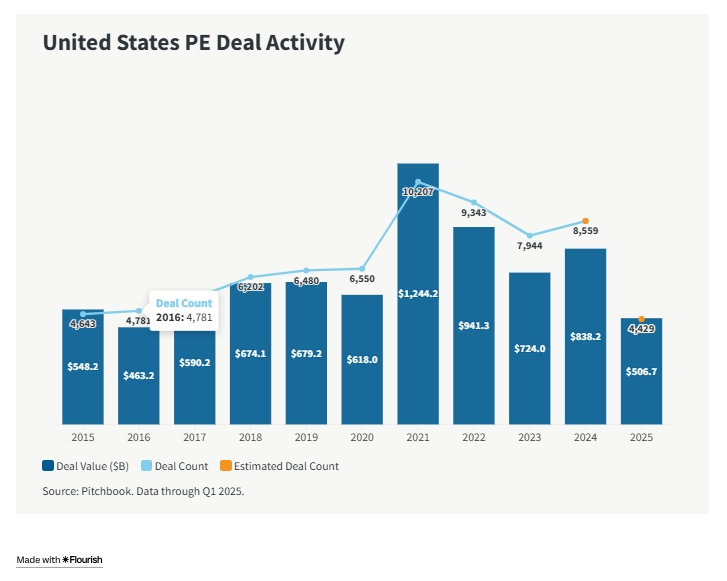

Private equity (PE) dealmaking is showing clear signs of recovery. After a difficult 2023 that saw US deal value fall 24% and deal count drop 15%, the market rebounded in 2024, with deal value rising by 16% and deal count rising by 8%. That momentum has carried into 2025, with estimated H1 deal value reaching $506.7 billion, up 29% from a year earlier.

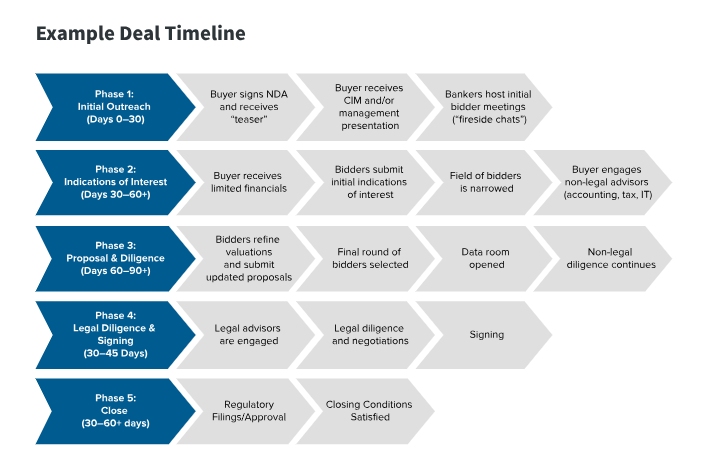

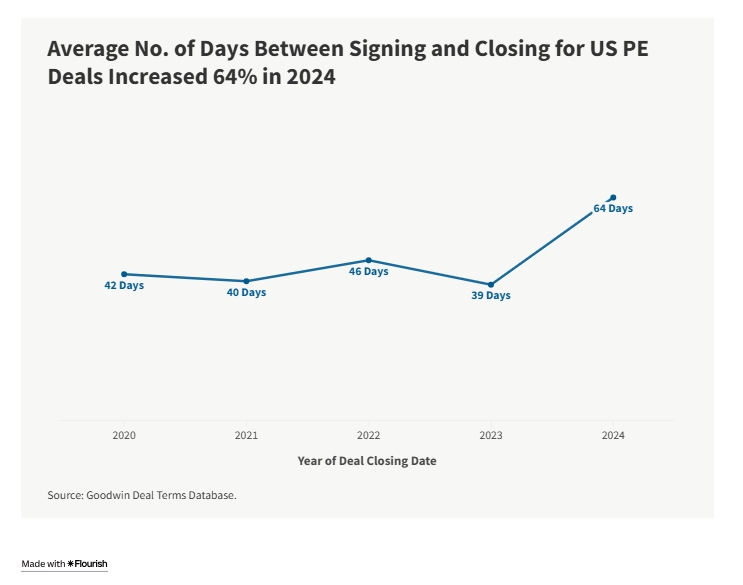

However, the deals getting done are taking much longer to complete. Extended due diligence, complex financing arrangements, and heightened regulatory scrutiny have stretched deal processes well beyond traditional time frames. Our Goodwin Deal Terms Database shows that the time between signing and closing private equity M&A deals increased 64% from 2023 to 2024, and this represents only the final phase of an overall lengthening process that begins much earlier, from initial target identification through due diligence and negotiation.

Understanding what's behind the slowdown — and how to respond — has become essential for deal success in today's market. In this article, we discuss the key factors driving longer deal timelines and highlight the strategies PE sponsors are taking to turn delays into competitive advantages.

The Financing Challenge

The elevated cost of debt has fundamentally altered PE-dealmaking dynamics. Prior to recent rate increases, reasonably priced debt was readily available to sponsors, which fueled M&A activity. With capital now more expensive and lenders exercising greater scrutiny before extending credit, private equity sponsors have been forced to adjust their approach.

Higher interest rates and tighter credit terms directly impact acquisition strategies and return models, leading fewer sponsors to meet aspirational valuations for assets. Sellers now face fewer potential buyers willing or able to meet their valuation expectations.

The result has been a significant decline in the number of "front-running" deals. In 2021's frothy market, sponsors routinely preempted banker-led sale processes by conducting extensive up-front work in hopes of submitting attractive bids with high valuations and commitments to close within days. In today's market, sellers are more inclined to conduct broader auction processes before granting exclusivity, extending M&A deal timelines as they seek to maximize competitive tension among bidders.

Process and Regulatory Complexity

The shift toward longer timelines extends beyond financing challenges. Sponsors are expanding their diligence processes in both scope and duration, adding weeks if not months to overall deal timelines. This heightened focus on diligence reflects the need for greater certainty in a more cautious market environment.

Buyer-side representations and warranties insurance (RWI) policies continue growing in popularity as sponsors seek to share or allocate risk. While the RWI market has become increasingly competitive — providing benefits in terms of cost, coverage quality, and payment of claims — these policies require thorough due diligence processes, further contributing to extended timelines and increased effort from both buyers and sellers.

More comprehensive diligence efforts inevitably uncover additional issues or areas of concern, leading to protracted negotiations and often reductions to previously proposed valuations. The intensified regulatory environment compounds these delays. A more active domestic antitrust regime (at both the federal and state levels), combined with increasingly complex foreign direct investment, Committee on Foreign Investment in the United States, and international regulatory guidelines, has necessitated more robust diligence exercises.

More transactions now require regulatory filings and approvals. These regulatory notices or consents can add significant time to deals and, depending on specific requirements, may prevent parties from signing definitive agreements or closing transactions until clearance is obtained.

The mix of expensive debt, expanded diligence requirements, and regulatory complexity has made it increasingly common for M&A transactions to be repriced or abandoned entirely as issues emerge during extended processes. This is not all bad news for buyers, however, as PE sponsors are positioned favorably relative to would-be sellers; similarly, owners of highly attractive assets can still drive competitive sale processes and, in limited circumstances, do so quickly.

Turning Longer Timelines Into Competitive Advantages

While extended deal timelines create challenges, savvy sponsors are learning to use these market dynamics strategically. The key is recognizing that longer processes create both opportunities and risks that can be managed with the right approaches.

- Leverage speed as a differentiator: In a market in which deals routinely stretch three to six months, sponsors who can commit to accelerated timelines gain significant competitive advantages. This means having preapproved financing, streamlined diligence processes, and dedicated deal teams ready for immediate deployment.

- Use time for competitive intelligence: Extended processes provide opportunities for deeper market analysis and competitive positioning. Smart sponsors use longer timelines to conduct thorough management assessments, identify operational improvement opportunities, and develop detailed value creation plans. This preparation enables more confident bidding and better post-acquisition execution.

- Conduct risk mitigation through expanded diligence:Longer timelines enable more comprehensive due diligence across legal, financial, operational, and environmental, social, and governance dimensions. Sponsors can identify and address potential issues before closing rather than discovering them post-acquisition. This thoroughness reduces execution risk and enables more accurate valuation.

- Manage deal fatigue and seller relationships: Extended processes create seller fatigue that smart buyers can address strategically. Communicating regularly about process progress, minimizing redundant requests, and demonstrating genuine partnership commitment help maintain seller engagement. Sponsors who manage relationships well during long processes often gain advantages in final negotiations.

- Time market entry strategically: Understanding that private equity deal processes now take longer allows sponsors to time their market entry more strategically, engaging with attractive targets earlier in their development cycles before formal sale processes begin.

The most successful private equity sponsors view longer deal timelines not as obstacles but as new market conditions requiring adapted strategies — and those who adapt effectively will gain sustainable competitive advantages.

* * *

The next article in our "Strategies for Winning Deals" series, "Deal Certainty: Building Closing Confidence," examines tactics sponsors can use to provide deal certainty — a critical differentiator when sellers face extended timelines and increased execution risk.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.