- in United States

- within Criminal Law, Immigration and Cannabis & Hemp topic(s)

Private equity sponsors are using flexible financing and streamlined deal structures to beat strategic buyers in competitive auctions.

This is the second article in our "Strategies for Winning Deals" series, which highlights ways that private equity sponsors can gain a competitive edge in buyouts without overpaying.

While valuation remains paramount in M&A transactions, savvy buyers increasingly recognize that deal certainty can be just as powerful a competitive weapon. For sellers evaluating multiple bids, the confidence that a transaction will actually close often trumps marginal price differences.

The Time Factor

Time remains the enemy of deals — perhaps more today than ever. Transactions are taking increasingly longer to complete, and each passing day reduces the likelihood of closing. Buyers often demand exclusivity during due diligence and financing arrangements, effectively removing companies from the market. In competitive processes, sellers may refuse exclusivity entirely or grant only narrow windows or a preferred path, forcing buyers to sign definitive agreements quickly or risk losing the asset to competitors. This dynamic particularly pressures buyers in auction processes, in which sellers maintain leverage by keeping multiple bidders engaged simultaneously. Read "Deal Timelines: Turning Delays Into Competitive Advantages" for more detail.

Financing: The First Test of Certainty

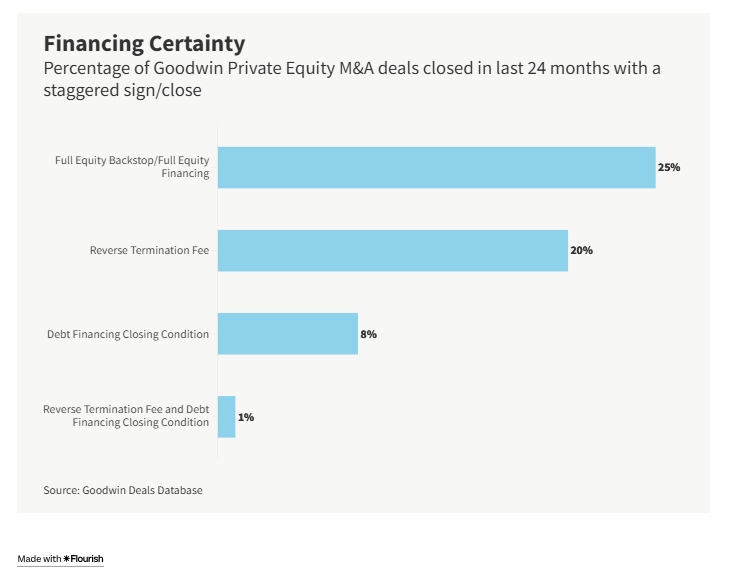

Beyond valuation, a buyer's financing proposal often provides the clearest signal of deal certainty. Buyers have several tools to differentiate themselves:

- Full equity backstop: The strongest position involves signing definitive agreements with no financing contingency and minimal closing conditions, with the private equity (PE) sponsor committing to fund the full purchase price with equity. This signals high conviction and ready access to capital.

- Financing contingencies: These fairly rare provisions shift financing risk to sellers by conditioning the buyers' obligations to close on obtaining debt or equity financing. Sellers naturally prefer buyers willing to bear this risk themselves.

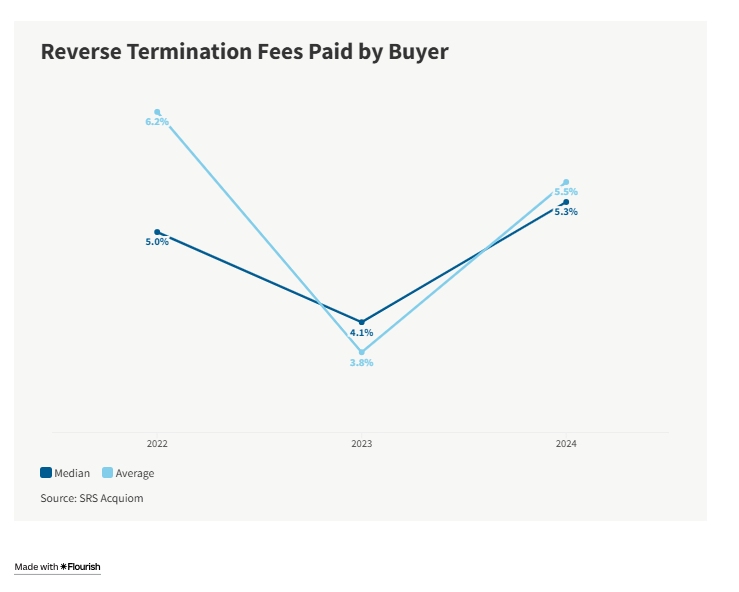

- Reverse termination fees (RTFs): When some financing risk is unavoidable, RTFs offer a middle ground. These fees — typically 4–7% of enterprise value — compensate sellers when buyers fail to close despite closing conditions being satisfied, such as inability to secure necessary debt financing.

Regulatory Risk Management

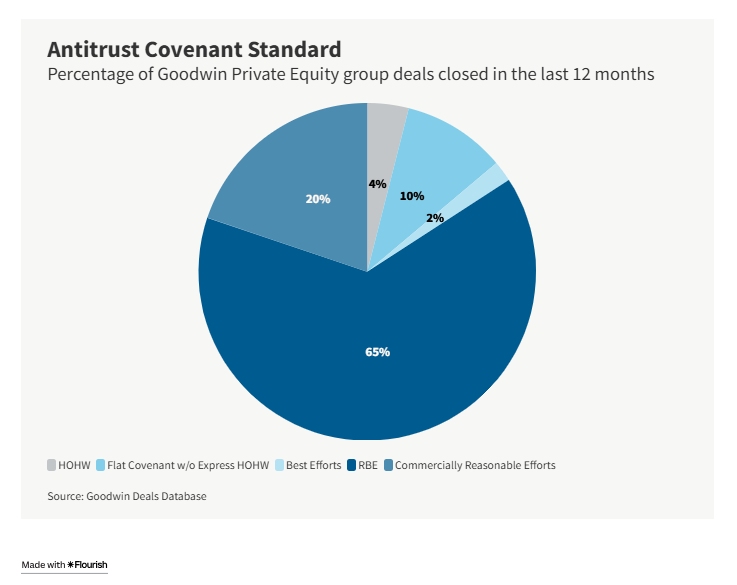

Deal certainty faces particular challenges in industries subject to heightened regulatory scrutiny. Buyers can position themselves favorably through "hell or high water"(HOHW) provisions, committing to clear regulatory review by any means necessary, including litigation and divestitures of assets or business lines.

Buyers and sellers can choose from a wide spectrum of antitrust provisions, ranging from buyer-protective anti-HOHW constructs to seller-favorable HOHW commitments. This approach often favors PE buyers over strategic acquirers, as financial sponsors face fewer antitrust complications and find HOHW commitments operationally less challenging than strategic buyers managing existing business integrations. The willingness to accept HOHW terms can sometimes overcome lower valuations.

Minimizing Closing Conditions

Buyers can enhance deal certainty by limiting closing conditions — the requirements that must be satisfied before either party has an obligation to close the transaction. Sellers typically view any conditions requiring third-party performance, such as material customer or vendor consents, unfavorably.

The "bringdown standard" for representations and warranties can also impact closing risk. Under the most seller-favorable "material adverse effect" (MAE) standard, sellers satisfy the bringdown closing condition so long as the failure of the representations and warranties made at signing being untrue would cause an MAE on the business.Buyers may demand stricter standards, requiring fundamental representations to be "true and correct in all respects" or "in all material respects" at closing, while general representations need only meet an MAE standard. More seller-favorable bringdown standards provide greater closing certainty but shift interim period risks to buyers.

The Strategic Advantage

In today's challenging regulatory environment, the deal certainty premium has never been more valuable. Buyers — particularly financial sponsors — who willingly assume risks to provide sellers with greater closing confidence consistently outperform competitors focused solely on price optimization.

The most successful acquirers understand that winning deals requires balancing valuation with execution and closing certainty, using financing structures, regulatory commitments, and streamlined closing conditions as competitive differentiators in an increasingly complex M&A landscape.

* * *

The next article in our "Strategies for Winning Deals" series, "Clean Exit: Minimizing Post-Closing Risk," examines tactics sponsors can use to facilitate a clean exit by structuring deals to ensure a smooth transition.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.