- in North America

- with Finance and Tax Executives

- with readers working within the Accounting & Consultancy, Automotive and Construction & Engineering industries

INTRODUCTION

For Italian enterprises contemplating expansion into the United States, it is essential to appreciate the country's multifaceted legal landscape. Although the regulatory and commercial environment may appear complex, the United States offers access to capital, a large and diverse consumer base, and a robust framework for commercial growth.

However, achieving success in the U.S. market requires thorough preparation and an understanding of several key legal areas, including but not limited to corporate structuring, immigration, employment law, taxation, and trade regulations. This GT Advisory provides considerations for Italian businesses navigating both the opportunities and challenges of the U.S. market, with an emphasis on the dynamic regulatory environment and current legal trends.

CORPORATE STRUCTURING

Selecting the Appropriate Entity and Jurisdiction

Selecting the right legal entity and jurisdiction is a critical early step for Italian companies entering the U.S. market. This decision may affect liability, tax treatment, financing prospects, and long-term flexibility of the business itself.

Regardless of the state of incorporation (e.g., Delaware), companies generally must register (foreign qualify) in each U.S. state where they do business.

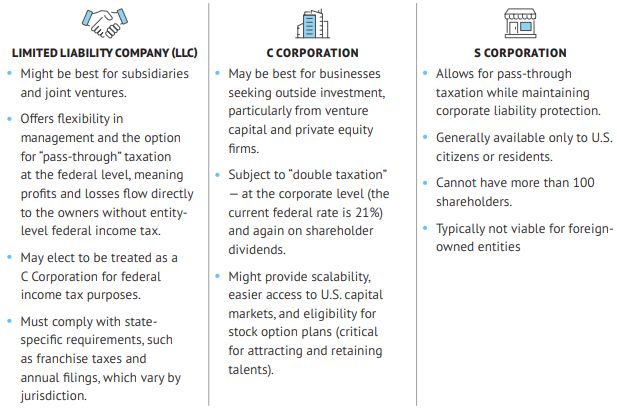

AVAILABLE STRUCTURES

LIMITED LIABILITY COMPANY (LLC)

Important Note on B Corporation Certification:

"B Corp" certification is a private designation B Lab awards to companies meeting high standards of social and environmental performance. It is not a separate legal entity.

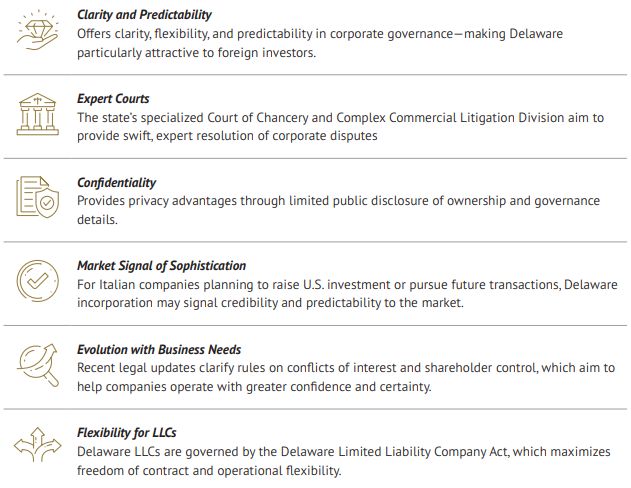

WHY DELAWARE? THE "GOLD STANDARD" FOR U.S. INCORPORATION

Delaware is widely regarded as the premier jurisdiction for incorporation in the United States, as the corporate domicile for a majority of public and private companies, including Fortune 500 and S&P 500 companies. The state seeks to offer companies:

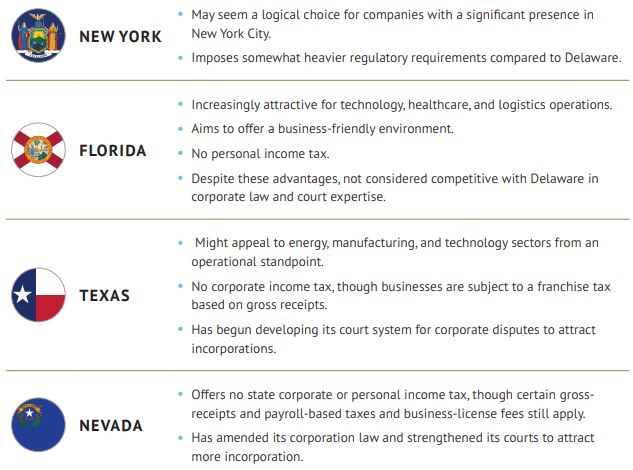

ALTERNATIVES TO DELAWARE

Sometimes foreign companies may consider incorporation in other states, though it is important to avoid confusion between operational matters and matters of corporate internal affairs.

When selecting the right jurisdiction, companies may wish to align with their long-term strategy, particularly regarding corporate internal affairs and the context of its business strategy, tax planning objectives, and operational realities.

To view the full article click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]