The Federal Trade Commission ("FTC") has announced updated size-of-transaction thresholds for premerger notification (Hart-Scott-Rodino or "HSR") filings, as well as updates to the HSR filing fees and transaction value categories. Separately, the FTC has also updated the de minimis thresholds for interlocking officer and director prohibitions under Section 8 of the Clayton Act.

The HSR filing thresholds, which are revised annually based on the change in gross national product, trigger a premerger notification filing requirement with both the FTC and the Department of Justice's ("DOJ") Antitrust Division. For proposed mergers and acquisitions, the 2024 threshold will increase from $111.4 million to $119.5 million.

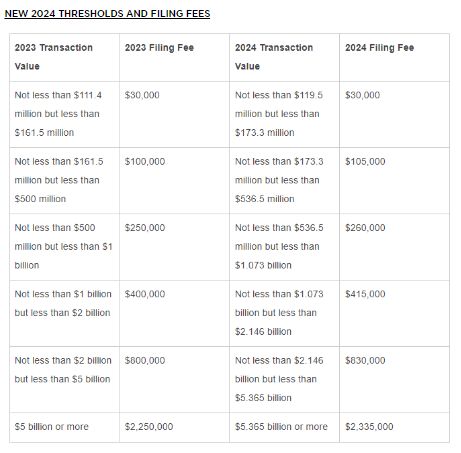

The Updated Filing Fees and Transaction Value Categories Are:

The new de minimis thresholds for triggering Section 8's bar on interlocking officers and directors are $48,559,000 for the minimum size of capital, surplus, and undivided profits for purposes of Section 8(a)(1) and $4,855,900 for the minimum amount of competitive sales for purposes of Section 8(a)(2)(A). The triggers for application of Section 8 of the Clayton Act are particularly important in light of the DOJ's recent focus and enforcement actions on this issue, as discussed previously.

The size-of-transaction threshold for transactions under Section 7A and the filing fees will take effect 30 days after publication in the Federal Register. The thresholds for Section 8 became effective on January 22, 2024.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.