- with readers working within the Law Firm industries

- within Transport, Media, Telecoms, IT, Entertainment and Employment and HR topic(s)

- with Inhouse Counsel

Capital requirements have long been relegated to the "someone else can think about it" category for the majority of the financial services industry. Until, that is, the Basel Endgame (as it has been dubbed in the US - elsewhere in the world the reforms are known as the Basel III Final Standards or Basel 3.1).

Since July 2023 there has been loud, public and visceral pushback on the implementation of the Basel Endgame in the US – with billboard advertisements opposing the rules popping up all over America. Concerns relate to increased capital requirements that, if applied, are expected to negatively impact everyday voters - particularly low-income and first-time house buyers.

But why does the US position matter to the rest of the world?

The Basel framework sets out international standards for bank regulation: the first was the Basel Concordat in 1975, but its landmark publications are the Basel I, Basel II and Basel III accords on capital adequacy (with Basel III being published in December 2010, reflecting lessons learned from the 2008 financial crisis). These accords aim to align international bank supervision and regulation - and ultimately have provided the bedrock for the international regulation of banks. International banks are (generally) only subject to capital requirements in their "home" country while conduct rules apply depending on "host" country rules. This international agreement means that banks are only subject to one set of capital rules and jurisdictions across the world can be comfortable that a familiar level of supervision and regulation applies.

This international agreement means that banks are only subject to one set of capital rules and jurisdictions across the world can be comfortable that a familiar level of supervision and regulation applies.

So, if a jurisdiction – particularly the US – starts to undermine or question the international standards it throws into question the entire international system.

What is Basel 3.1/Endgame?

The Basel 3.1 package is the final set of reforms designed to address the concerns identified following the 2008 financial crisis. It aims to close all potential loopholes to the rules. The package focuses on risk weighted assets (or RWAs) (for example, loans made to customers) that are used to calculate the ratio of capital instruments that must be held by a bank and ultimately ensure that the bank can withstand losses.

The existing Basel capital framework allows banks to use their own internal models to calculate risk weighted assets (so called internal rating based (IRB) models) rather than use the standardised approach set by regulators. In practice, this has resulted in significant differences in how banks are calculating their capital requirements (although some commentators consider that these divergent approaches could also be attributed to differences in the supervisory approach to capital requirements, even within the EU, where efforts in 2021 largely addressed concerns before Basel 3.1 implementation).

Basel 3.1 aims to restrict internal models and restore faith in the framework and calculation of risk weighted assets.

There are variations in the approach taken by different jurisdictions across the world to implementation of the Basel requirements (which are minimum standards), with many choosing to "gold-plate" them (impose higher standards). This means that the levels of bank regulatory capital required continue to vary jurisdiction by jurisdiction, particularly depending on the bank's size. So, for example, while the EU has applied the Basel framework to all banks, the UK is looking to take a more proportionate approach with small domestic deposit takers subject to a less onerous regime under the so-called "Strong and Simple" capital regime for smaller banks. The US' original 2023 approach to the Basel Endgame would have required significantly increased capital levels for banks holding US$100 billion or more in assets.

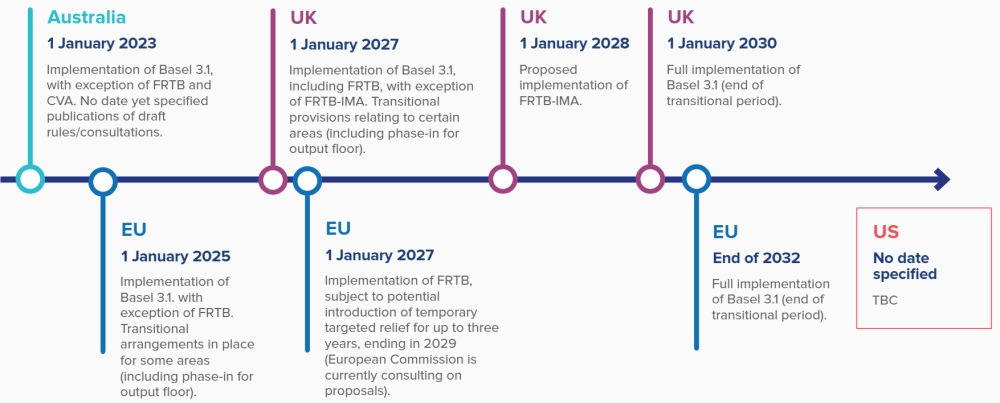

Basel 3.1 — The key dates

Where are we now? And what's to come?

A number of jurisdictions have progressed with implementation of Basel 3.1 (including Australia, Canada, China and Japan – although some jurisdictions have transitional arrangements), but the uncertainty around implementation timelines in jurisdictions with many internationally active banks (particularly the US) remains very high and further delays are expected or have been confirmed.

In this context, both the EU and UK have delayed implementation to see how the US approach settles.

EU

In the EU, with effect from 1 January 2025, revisions to the EU prudential framework completed the implementation of Basel 3.1, with the exception of the market risk prudential requirements (the Fundamental Review of the Trading Book or FRTB). The application of the FRTB was initially postponed by a year to 1 January 2026 and, recently, the EU has decided to further delay implementation until 1 January 2027, citing the need to prevent any distortions of the international level playing field. In implementing Basel 3.1, the EU has broadly followed the framework, subject to some specific calibrations and transitional adaptations to lessen the impact while the regime is phasing in. For example, in relation to the revised output floor, the EU has exercised its discretion and adopted a longer transition timeline that takes full application to 2032 (rather than 2028). The EU may also introduce temporary modifications to FRTB implementation: as of 6 November 2025, the European Commission is consulting on proposals for various types of targeted relief for a period of up to three years, ending in 2029, in areas where other jurisdictions have deviated (or indicated they plan to deviate) from the framework in their final FRTB implementation.

UK

The UK is committed to achieving full implementation by 1 January 2030. However, there was sufficient uncertainty in January 2025 about US Basel Endgame implementation plans that HM Treasury and the Prudential Regulation Authority (PRA) decided to delay UK implementation (including of the FRTB) by a year to 1 January 2027. The transitional arrangements in the rules will be reduced to three years to ensure full implementation remains at 1 January 2030. 1 January 2027 will also be the implementation date for the Strong and Simple capital regime for smaller banks. Taken together the changes mean UK banks of all sizes can benefit from greater risk-sensitivity and proportionality from 2027.

US

In the US there are currently no details of regulations published or publicly announced implementation dates in relation to the Basel Endgame proposals.

The US will assume presidency of the G20 in 2026 and therefore will lead on the global agenda for banking regulation. The direction of travel remains to be seen and any outcome that means the capital requirements for US banks are significantly lower than those imposed by other jurisdictions would undermine the global system. However, comments made by US Treasury Secretary Scott Bessent in July this year at the Federal Reserve Capital Conference suggested that the US may be considering reforms more in line with the EU approach. So, warnings of international fragmentation may prove to be overdone – but we will need to see how positions develop over the next couple of years, with the costs vs longer-term benefits debate ongoing.

For its part, the BCBS will continue to monitor jurisdictions' Basel 3.1 implementation, including the impact of any material deviations from the framework, as part of its Regulatory Consistency Assessment Programme (RCAP).

In summary, more than a decade on from the global financial crisis, this central element of the BCBS' response remains a live exercise for all concerned. Time will tell whether the extension to the original implementation timeframe and the potential for regulatory divergence across key jurisdictions will affect the ultimate goal of restoring credibility and confidence in global banking systems.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]