- within Tax topic(s)

- in European Union

- in European Union

- in European Union

- within Law Department Performance, Corporate/Commercial Law and International Law topic(s)

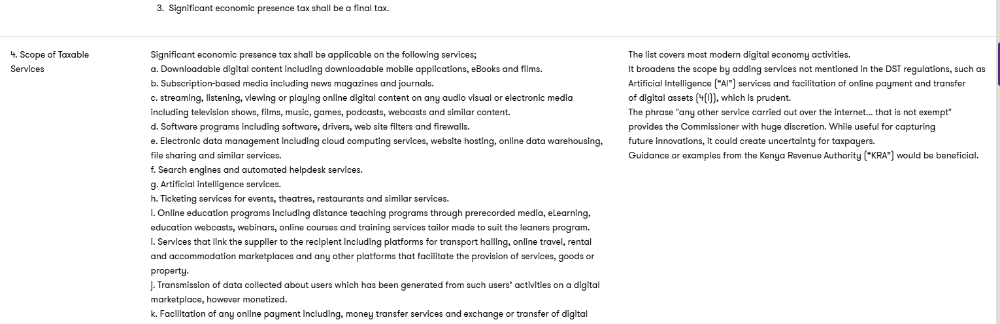

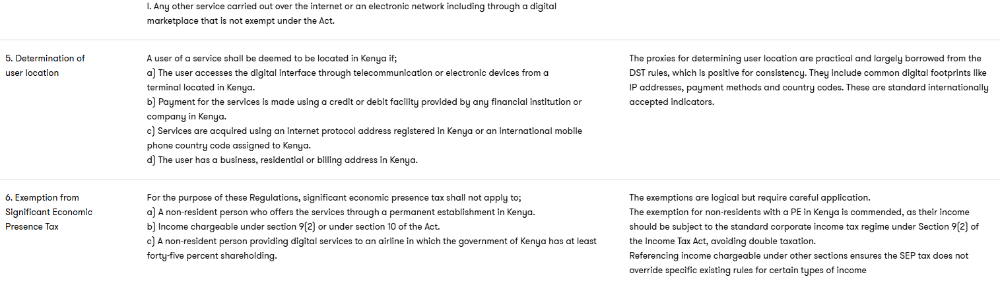

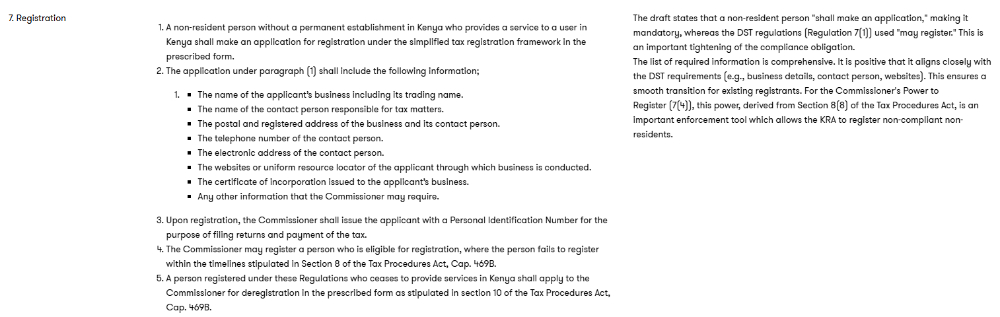

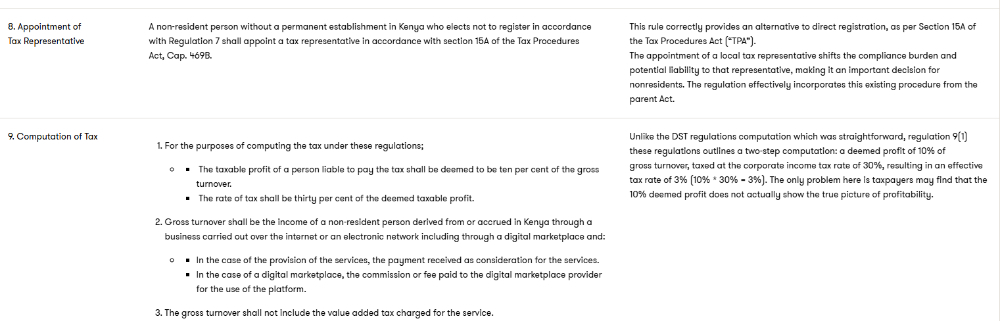

On September 22nd 2025, the Commissioner General on behalf of the Cabinet Secretary, National Treasury and Economic Planning issued the draft Significant Economic Presence Tax (Regulations 2025).

These regulations are intended to replace The Income Tax (Digital Service Tax) Regulations, 2020, if passed into law. The Commissioner General invites public participation for consideration in the finalisation of these Regulations to be received on or before 7th October 2025.

The Significant Economic Presence (SEP) Tax was introduced through the Tax Laws (Amendment) Act, 2024, which was assented to on 11th December 2024 and came into effect on 27th December 2024. This law repealed the earlier Digital Service Tax (DST) and replaced it with SEP Tax to better capture revenue from non-resident digital businesses operating in Kenya without a physical presence.

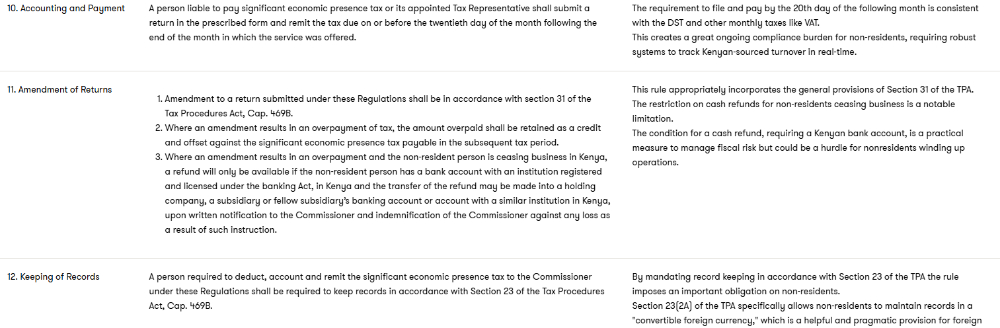

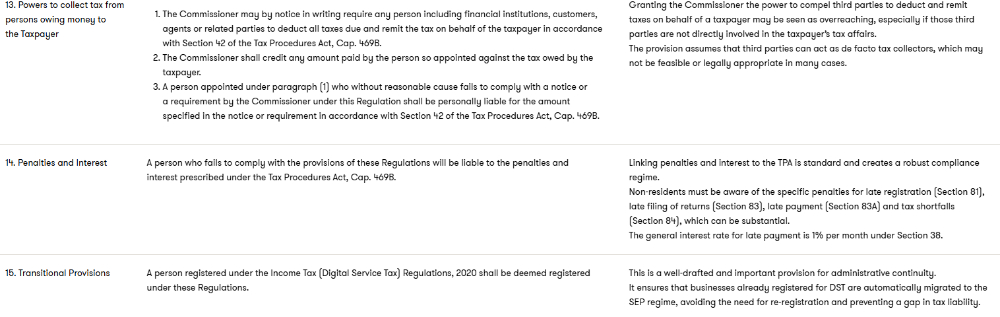

The SEP tax rate charged at an effective rate of 3% of gross turnover and payable by the 20th day of the following month. Our summary and comments on the key highlights of the above draft Regulations are presented below

Summary

.jpg)

Key Take Aways

The proposed Significant Economic Presence ("SEP") Tax expands the scope of the Digital Service Tax ("DST") it replaces. It now applies to "any service" delivered online and captures emerging areas like AI and digital assets. It deems a taxable presence based simply on a user's location in Kenya. The effective tax rate is 3%, it is calculated through a new two-step process that deems a 10% profit on gross turnover, which is then taxed at the 30% corporate income tax rate.

The new regime introduces a stricter compliance burden, making registration mandatory for non-residents and requiring monthly filings. Notably, KRA is granted powerful enforcement tools, including the ability to collect the tax directly from Kenyan customers and agents of non-resident companies, making local parties liable for ensuring the tax is paid.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.