- within Corporate/Commercial Law topic(s)

- in Canada

- with readers working within the Accounting & Consultancy industries

- within Corporate/Commercial Law, Food, Drugs, Healthcare, Life Sciences and Strategy topic(s)

Foreword

Private equity (PE) has traditionally relied on picking the right investment to release value through business transformation post-deal.

PE returns have traditionally had a component of financial leverage, multiple arbitrage and value creation — usually considering a combination of all these factors whilst surfing a wave of low interest rates and natural market expansion.

As those factors seem to evolve and fade — base rates have normalized, dry powder tops US $1.0tn, and there is more than US $3.0tn backlog of unsold assets in the exit pipeline — it becomes clear that the industry will need to evolve into looking for more sophisticated ways of creating tangible value in ever increasingly disputed markets.

In this sector, data is power. Hedge funds turned quants a decade ago. Public-market active managers quickly followed with factor signals and alternative data. Yet most buy-out houses still prefer to trust a more traditional approach towards value creation, based on expert judgment and financial analysis.

We believe that as market tailwinds fade, operational alpha — built on stochastic modelling, outside-in signals and predictive intervention — will become a real source of competitive advantage and a systemic and repeatable investment edge. We believe that the next decade belongs to houses that can manufacture operational alpha — systematic EBITDA uplift, delivered quickly and at scale.

In this paper we set out a five-capability blueprint for value creation next-gen alpha and illustrate — with data and case studies — how leading General Partners (GPs) are now tilting their models to becoming the next-gen 'quant PE house'.

Javier Rodriguez

Global Head of Strategy

KPMG International

01 Executive summary

A new playbook for private equity value creation

Traditional strategies for generating alpha are under pressure as a new market reality emerges. As a result, PE firms are expected to place greater emphasis on structured, data driven and professionalized approaches to identify and deliver operational alpha.

We feel that PE is at an inflection point. Fund-raising has contracted (–12 percent CAGR 2021–2025) while exits have stalled, leaving more than US$3.0tn of assets stuck in the pipeline. Median holding periods now exceed six years. Continuation funds have emerged as a stop-gap to ease distribution pressure, but they only defer the liquidity challenge, rather than resolve it.

Meanwhile, macroeconomic instability, tariffs and deglobalization are pushing capital towards localization. The old levers of leverage, multiple expansion and international roll-up no longer consistently deliver the alpha investors expect. Value creation must now be grounded in operational execution inside the portfolio.

We believe this makes it an imperative to professionalize the search and delivery of operational alpha: systematically capturing margin opportunities, embedding data-driven management, and preparing assets earlier and more comprehensively for exit.

Integrated value creation programs — prioritized, sequenced and rigorously executed — can separate winners from laggards. Continuation funds may buy time, but only disciplined transformation at scale can restore sustainable returns.

Key takeaways:

- Traditional value creation strategies are no longer sufficient.

- PE firms are increasingly exploring new and differentiated ways to unlock operational alpha.

- PE leaders are taking a more structured and disciplined approach to identifying and delivering operational alpha.

- The leaders exhibit five key capabilities and this report identifies them.

- The time to move is now

PE leaders are increasingly focusing on identifying external opportunities with precision, strengthening changemanagement capabilities, and executing transformations at scale to navigate rising capital costs and margin pressures.

Data will play a pivotal role. To enhance returns, PE firms are expected to bring greater structure to the way they identify and deliver operational alpha. This should involve identifying potential value opportunities early in the deal cycle and implementing structured transformation initiatives supported by stronger data management, focused talent strategies, enhanced change management, and clear financial objectives.

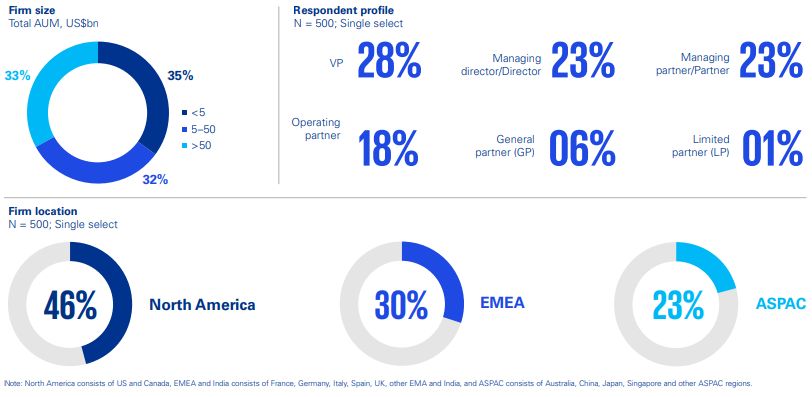

Conducted in October 2024, KPMG surveyed 500 PE leaders to understand their strategies and outlooks for achieving higher returns amid current market conditions.(f) This paper builds on insights from that survey to present an enhanced Value Creation playbook for PE firms. The playbook aims to help firms transform portfolio companies into high-performing, scalable and strategically aligned enterprises, reinforcing their standing as market leaders.

About thesurvey and methodology

The findings in this report are based on a global survey conducted on behalf of KPMG International in October 2024. The 500 respondents were evenly split across firm size (from fewer than 5 people to more than 50) with the majority of respondents representing the VP, Managing Director or Managing Partner level.

To build on this data, KPMG professionals reviewed the most recent market data — provided by external sources such as PitchBook, MSCI and the S&P Global and Market Intelligence — alongside an internal analysis and thought leadership. Supported by detailed analysis by our internal global services team, this report reflects key insights gathered from client work around the world.

Finally, the data and insights were validated by KPMG International's global Value Creation and Strategy teams, leveraging their hands-on experience and recent conversations in the market.

To view the full article click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.