- within Consumer Protection, Strategy, Litigation and Mediation & Arbitration topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Banking & Credit, Business & Consumer Services and Consumer Industries industries

A recent Adjudication (Body Corporate for Mihi Grove, 27 February 2025) provides a compelling reminder that all Bodies Corporate must be aware of their insurance obligations.

Background

Mihi Grove is a 43 lot scheme in the Ipswich City Council (ICC) region.

During the 2022 flood event Mihi Grove was inundated with water. It was assessed as eligible for the Voluntary Home Buy-Back program[i].

At the time of its application, the ICC had acquired 41 of the 43 lots, with the intention of terminating the Scheme once all lots had been acquired.

ICC was unable to obtain insurance that met the coverage required by the Body Corporate and Community Management (Accommodation Module) Regulation 2020 (Accommodation Module).

The ICC applied for authority to implement an alternative insurance cover (an Alternative Insurance Order).

The Test

The Adjudicator identified two elements that must be satisfied before an Alternative Insurance Order can be made:

- The Body Corporate must be unable to implement insurance cover to meet its obligations; and

- The alternative insurance cover proposed by the Body Corporate must be "as close as practicable" to the cover it is obliged to obtain.

Body Corporate Insurance Obligations

Bodies Corporate registered under a Building Format Plan (BFP) or a Volumetric Format Plan (VFP) must obtain insurance that covers:

- Full replacement value of all buildings that contain a lot

- Damage

- Costs incidental to the reinstatement or replacement of the

buildings including:

- Debris removal

- Architect and other professional advisers

- Reinstatement to an as new condition

Additionally, Bodies Corporate registered under a Standard Formal Plan (SFP) must obtain insurance with the same coverage as above, but only over:

- buildings on adjoining lots that share a common wall.

The Decision

The Adjudicator accepted the Body Corporate was unable to obtain insurance that provided the required cover.

The Adjudicator determined the proposed insurance cover "does not, to any meaningful extent, meet the requirements".

The Adjudicator refused to give an Alternative Insurance Order, notwithstanding:

- the majority of lots in the Scheme were owned by the ICC pursuant to the Voluntary Home Buy-Back program; and

- the Scheme was slated for imminent termination.

Implications

If a Body Corporate's insurance is inadequate, then the Body Corporate is "liable to pay any contribution that has to be made to the cost of reinstatement or repair because the reinstatement insurance is not for the full replacement value of the insured property. "

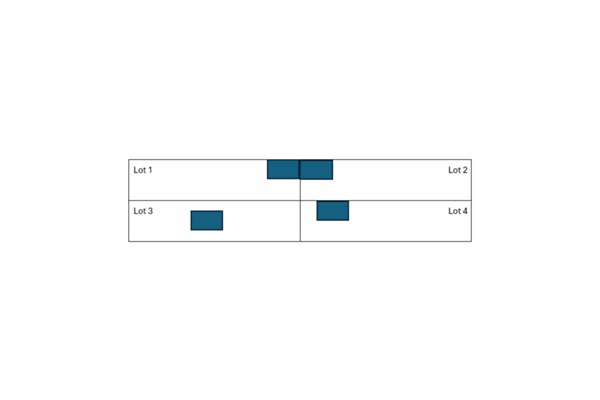

A Body Corporate under a SFP must take out "replacement" insurance on buildings that share a common wall with a building on an adjoining lot. This may result in some inequities. Consider the 4 lot Scheme below:

A similar sized building is constructed on each lot.

The buildings on lots 1 and 2 share a common wall.

The building on lot 3 does not border another lot.

The building on lot 4 shares a boundary with lot 2, but does not share a common wall with a building on lot 2.

The Body Corporate is responsible for insuring the buildings on lots 1 and 2, but not the buildings on lots 3 and 4.

The Body Corporate's insurance premium is paid annually and is collected as part of the administrative fund levy (based on each lot's respective lot entitlements).

This means the owners of lots 3 and 4 will contribute, via their levies, to insuring the buildings on lots 1 and 2 AND either pay to insure their own buildings, or go without building insurance.

If lot 2, with appropriate permission, is later improved by extending the existing building, or constructing a new building, and the improvement shares a common wall with the building on lot 4, then the Body Corporate will become responsible for insuring the improvement AND the building on lot 4.

The Solution

Instead of collecting the insurance premium as part of the administrative fund levy, bodies corporate can calculate a separate insurance levy based on a system other than lot entitlements (generally, a benefit to lot ratio will be used).

Contact us if you want to discuss this, or any other Body Corporate-related matter, further.

[1] Voluntary Home Buy-Back program: Administered by Qld Reconstruction Authority. Eligibility based on:

- Location within one of 39 affected local government areas

- Damage sustained (building envelope to have been inundated with water)

- Risk of recurrence

Relevant Local Council can buy back the properties, generally to demolish and perhaps rezone

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.