- with Senior Company Executives and HR

- in European Union

- in European Union

- with readers working within the Business & Consumer Services, Pharmaceuticals & BioTech and Retail & Leisure industries

On July 4, 2025, the legislation commonly known as the One Big Beautiful Bill Act (OBBBA or H.R. 1) became law. Much of the initial commentary on the OBBBA's energy provisions has focused on the rollback or modification of various tax credits for US consumers (e.g., Sections 25C (energy efficient home improvement credit), 25D (residential clean energy credit), 25E (used clean vehicle credit), and 45L (new energy efficient home credit)). However, H.R. 1 also has far-reaching implications for foreign investors and manufacturers and investments in industrial-scale energy storage projects, including battery energy storage systems (BESS) and related components and technologies.

Our focus here is on H.R. 1's extension and expansion of pre-existing foreign entity of concern (FEOC) restrictions for each of the tax credits most likely be relevant to large-scale energy storage projects under Sections 45Y, 48E, and 45X of the Internal Revenue Code. These restrictions introduce significant new risk, compliance, and due diligence obligations for affected entities and generally mark an escalation in the restrictions applicable to investors from the People's Republic of China (PRC), a covered nation under the regulations.

Key takeaways include the following:

- H.R. 1 significantly rolls back or repeals many of the clean energy tax credits and incentives introduced with the Inflation Reduction Act of 2022, but energy storage projects are generally not as severely impacted as wind and solar, as energy storage projects beginning construction before 2033 remain eligible for key credits.

- However, H.R. 1's sweeping new restrictions on "Prohibited Foreign Entities" are specifically designed to restrict investment by PRC investors and reliance upon PRC manufacturers. It is not immediately clear how significant an impact these new restrictions will have on the development of energy storage capacity in the United States.

- The prohibition on "material assistance" by Prohibited Foreign Entities for most projects that begin construction after 2025 imposes complex due diligence requirements on taxpayers to determine the "material assistance cost ratio" for qualified facilities, energy storage technologies, or eligible components—essentially, the share of a project's direct costs that are attributable to inputs from Prohibited Foreign Entities.

- The prohibition on ownership by Prohibited Foreign Entities will require taxpayers to seek more expansive disclosure of the ownership structure of foreign suppliers, including the entities that hold the debt of such suppliers. Relatedly, the prohibition on "effective control" by Prohibited Foreign Entities will require taxpayers to reevaluate and potentially revise their contractual and licensing arrangements with key foreign suppliers from the PRC and elsewhere to assess whether such suppliers possess any of the wide range of rights that may be deemed to constitute "effective control" under the statute. Notably, a taxpayer'sentry into or modification of a licensing agreement with a "Specified Foreign Entity" after July 4, 2025 will be considered as providing that Specified Foreign Entity with "effective control" within the meaning of H.R. 1.

- As discussed below, further guidance from the Secretary of the Treasury and the Internal Revenue Service (IRS) is expected. However, as a general matter, the broader disclosure and labelling of entities as "Prohibited Foreign Entities" required under H.R. 1 could have broader implications for companies, as the statute effectively creates a new category of PRC-linked entities that may draw greater US government scrutiny outside of the tax context.

New restrictions on "Prohibited Foreign Entities" under H.R. 1

H.R. 1 expands the FEOC restrictions by introducing the new concept of "Prohibited Foreign Entities" (PFEs), which includes any "Specified Foreign Entity" (SFE) or "Foreign-Influenced Entity" (FIE). As a general matter:

- Status as either a SFE or FIE—or receipt of "material assistance" from a SFE or a FIE—disqualifies a taxpayer from eligibility for key tax credits such as those under Sections 45Y, 48E, and 45X.

- However, FIE status is derivative of a connection to a SFE and is therefore generally more complex to determine, as it turns on issues such as indirect control or debt thresholds.

In brief, although the tax-related penalties for SFE or FIE are substantially similar, companies will face the burden of properly classifying relevant entities and updating such determinations for each taxable year in which a credit is claimed.

A. Specified Foreign Entities

The term SFE is defined more broadly than FEOC. It includes any of the following entities:

- The government of, or any entity organized in, or with a principal place of business in, a covered country (i.e., the PRC, Russia, Iran, North Korea), or any person who is a citizen or national of those countries (excluding US citizens, nationals, and residents), or any entity owned, directly or indirectly, 50% or more by such persons. Any PRC company or 50-50 joint venture with a PRC company is therefore an SFE.

- Entities or persons included on US national security or

sanctions lists, i.e., entities that have been

specifically designated by US authorities, such as:

- The SDN List;

- The FTO List;

- The Chinese military companies list (CMC List) of companies designated pursuant to Section 1260H of the National Defense Authorization Act of 2021; and

- The Uyghur Forced Labor Prevention Act Entity List (UFLPA Entity List) maintained by US Customs and Border Protection.

- Seven Chinese battery manufacturers and their successors, which are expressly named in Section 154(b) of the National Defense Authorization Act for Fiscal Year 2024 (Public Law 118–31) (available here);

- Entities identified by the Attorney General as having been convicted of offenses under certain national security statutes;

- Any entity "controlled" by the government, agency, instrumentality, citizen or national, or entity organized under the laws of the PRC, Russia, Iran, or North Korea (excluding certain publicly traded entities).

- The term "control" refers to ownership (by vote or value) of more than 50 percent of the stock of a corporation; or ownership of more than 50 percent of the profits interests or capital interests in a partnership; or for any other corporate structure, ownership of more than 50 percent of the beneficial interests in the entity. As a practical matter, entities with a more complex structure may face a more onerous compliance burden, since companies must identify direct and indirect owners, including through holding companies, trusts, and beneficial ownership. Since PFE status is generally determined at the end of the taxable year, companies must in principle make an annual determination regarding PFE status.

B. Foreign-Influenced Entities

In addition to SFEs, H.R. 1 imposes restrictions related to FIEs (other than certain publicly traded entities). An entity may be deemed a FIE using one of two tests.

Under the first test, a FIE is any entity for which any of the following were true, in the relevant taxable year:

- An SFE had direct authority to appoint a covered officer of the entity (e.g., a member of the Board or executive level officer);

- An SFE owned at least 25% of the entity;

- One or more SFEs owned in the aggregate at least 40% of the entity; or

- 15% of the debt of the entity has been issued, in the aggregate, to one or more specified foreign entities.

Under the second test, an entity will be deemed to be a FIE if, in the previous taxable year, it made a payment to a SFE pursuant to a contract, agreement, or other arrangement that entities the SFE (or a related entity) to exercise "effective control" over any of the following:

- Any qualified facility or energy storage technology of the taxpayer (or any person related to the taxpayer);

- With respect to any eligible component produced by the taxpayer (or any person related to the taxpayer) for the extraction, processing, or recycling of any applicable critical mineral or for the production of an eligible component that is not an applicable critical mineral.

The second test does not state whether an entity deemed to be a FIE for a given taxable year is only deemed to be a FIE with respect to the single project implicated by the above test, or whether the entity will be deemed a FIE for all credits claimed by that entity in connection with unrelated projects. Since FIE status can be triggered by a single payment, the broader interpretation that FIE status, once obtained, is not project- or contract-specific and instead applies to all credits, could have significant implications for affected companies.

H.R. 1 defines "effective control" differently (i) before guidance has been issued; (ii) after guidance has been issued; and (iii) in the context of licensing arrangements. Before guidance has been issued, "effective control" means the "unrestricted contractual right" of a counterparty to do any of the following:

- determine the quantity or timing of production of an eligible component produced by the taxpayer;

- determine the amount or timing of activities related to the production of electricity undertaken at a qualified facility of the taxpayer or the storage of electrical energy in energy storage technology of the taxpayer;

- determine which entity may purchase or use the output of a production unit of the taxpayer that produces eligible components;

- determine which entity may purchase or use the output of a qualified facility of the taxpayer;

- restrict access to data critical to production or storage of energy undertaken at a qualified facility of the taxpayer, or to facility or energy storage technology of the taxpayer, to the personnel or agents of such contractual counterparty; or

- on an exclusive basis, maintain, repair, or operate any plant or equipment which is necessary to the production by the taxpayer of eligible components or electricity.

OBBBA provides that guidance will be issued no later than December 31, 2026 as necessary to carry out the purposes of this provision, including anti-avoidance rules.

Finally, in the context of a licensing agreement for intellectual property in connection with a qualified facility, energy storage technology, or the production of an eligible component, the term "effective control" refers to any of the following:

- A contractual right retained by the contractual counterparty to specify or otherwise direct 1 or more sources of components, subcomponents, or applicable critical minerals utilized in a qualified facility, energy storage technology, or in the production of an eligible component;

- A contractual right retained by the contractual counterparty to direct the operation of any qualified facility, any energy storage technology, or any production unit that produces an eligible component;

- A contractual right retained by the contractual counterparty to limit the taxpayer's utilization of intellectual property related to the operation of a qualified facility or energy storage technology, or in the production of an eligible component;

- A contractual right retained by the contractual counterparty to receive royalties under the licensing agreement or any similar agreement (or payments under any related agreement) beyond the 10th year of the agreement (including modifications or extensions thereof);

- A contractual right retained by the contractual counterparty to direct or otherwise require the taxpayer to enter into an agreement for the provision of services for a duration longer than 2 years (including any modifications or extensions thereof);

- Such contract, agreement, or other arrangement does not provide the licensee with all the technical data, information, and know-how necessary to enable the licensee to produce the eligible component or components subject to the contract, agreement, or other arrangement without further involvement from the contractual counterparty or a specified foreign entity;

- Such contract, agreement, or other arrangement was entered into (or modified) on or after July 4, 2025.

- The foregoing does not apply with respect to a bona fide purchase or sale of intellectual property.

Impact of "Prohibited Foreign Entities" restrictions on energy storage projects post-H.R. 1

For each of the below categories of credit (among others), H.R. 1 imposes two substantial new restrictions: (i) the "material assistance" restrictions; and (ii) the ownership restrictions. In addition, Section 48E credits are subject to a 10-year recapture or clawback penalty.

The "material assistance" restrictions apply to projects that begin construction after December 31, 2025, while the ownership restrictions apply to credits claimed for taxable years beginning after July 4, 2025 for SFEs and beginning after July 4, 2027 for FIEs.

A. Tax credits relevant for energy storage projects

Among others, the following three tax credits are especially relevant to energy storage projects. All are impacted by the Prohibited Foreign Entities restrictions introduced in H.R. 1:

- Section 45Y. The Clean Electricity Production Credit under Section 45Y (the PTC), 26 U.S.C. § 45Y, permits a taxpayer to obtain a tax credit based upon the quantity of clean electricity generated and sold by "qualified facility" that is placed in service after December 31, 2024. The credit is awarded per kilowatt-hour (kWh) of clean electricity produced.

- Section 48E. The Clean Energy Investment Tax Credit under Section 48E (the ITC), 26 U.S.C. § 48E, permits a taxpayer to obtain a tax credit for a "qualified facility" or "qualified energy storage technology" that is placed in service after December 31, 2024. Section 48E's ITC, when combined with bonus credits or "adders" for domestic content and location, has been a key driver of growth in the battery storage sector in the United States.H.R. 1 increases the level of required domestic content needed to qualify for this adder which could also have an impact on purchases from foreign entities.

- Section 45X. The Advanced Manufacturing Production Credit under Section 45X (the AMPC), 26 U.S.C. § 45X, permits a taxpayer to obtain a tax credit for "eligible components"; it is a per-unit incentive for US manufacturers of components for clean energy projects such as batteries, battery cells, modules, and critical minerals, which is aimed at fostering the development of domestic sources and supply chains. The credit is structured as a dollar amount per component, per watt, or as a percent of cost, depending upon the specific item.

B. Material assistance restrictions under H.R. 1

The above credits are not available if a PFE provided "material assistance" in the construction of the relevant facility or component. While the "material assistance" rules do not apply to Section 45Y or 48E credits for projects that begin construction before December 31, 2025, the Section 45X credit will be unavailable if the eligible components were produced with "material assistance" from a PFE in any taxable year after July 4, 2025.

The "material assistance" provisions are triggered when the "material assistance cost ratio" falls below the given threshold percentage. The concept of the "cost ratio" is designed to establish a floor for the percentage of a qualified facility, energy storage technology, or eligible component that is not attributable to "material assistance" from a PFE. These non-PFE floors are increased each year, with the goal of decreasing the percentage of PFE-derived content over time. For example, the threshold percentage for qualified facilities under Sections 45Y and 48E for facilities the construction of which begins in 2026 is 40%. This means that just under 60% of the qualified facility can be attributable to material assistance from a PFE.

In practice, applying the "material assistance cost ratio" involves two essential steps:

First, the taxpayer must calculate the percentage of the "total direct costs" that are not attributable to items mined, produced, or manufactured by PFEs.

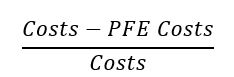

- For qualified facilities and energy storage technologies, the cost ratio is defined by reference to the total direct costs to the taxpayer of all "manufactured products" (including components) that are incorporated into a qualified facility or energy storage technology (Costs) and that portion of the Costs that represent products mined, produced, or manufactured by a PFE (PFE Costs). The formula is as follows:

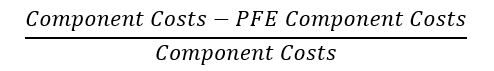

- For eligible components by reference to the total direct material costs that are paid or incurred (within the meaning of section 461 and any regulations issued under section 263A) by the taxpayer for production of such eligible component (Component Costs) and that portion of the eligible components that are mined, produced, or manufactured by a PFE (PFE Component Costs). The formula is as follows:

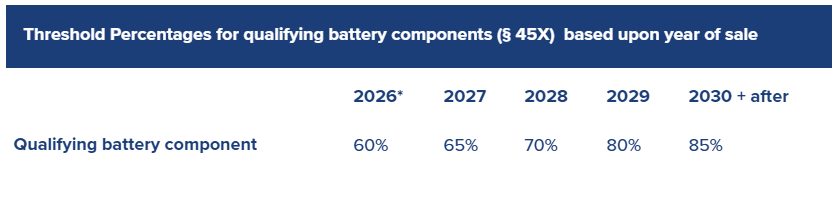

Second, the percentage obtained in step 1 (the Non-PFE Percentage) must be compared against the schedules provided in H.R. 1 (the Threshold Percentage). If the Non-PFE Percentage is lower than the applicable Threshold Percentage, the taxpayer cannot claim the credit. The Threshold Percentages for qualified facilities, energy storage technologies, and battery components are summarized below:

*The years refers to the "beginning of construction," which is well-established in IRS guidance. However, on July 7, 2025, President Donald J. Trump issued Executive Order 14315 ("Ending Market Distorting Subsidies for Unreliable, Foreign-Controlled Energy Sources") that, among other things, instructs the Secretary of the Treasury to issue new and revised guidance as he deems appropriate "to ensure that policies concerning the 'beginning of construction' are not circumvented, including by preventing the artificial acceleration or manipulation of eligibility and by restricting the use of broad safe harbors unless a substantial portion of a subject facility has been built."

*The years refer to the year in which the eligible component is sold.

H.R. 1 requires the Secretary of the Treasury to issue "safe harbor tables" or other guidance no later than December 31, 2026 that will identify the total direct costs of any manufactured product or eligible component attributable to a PFE and provide all rules necessary to determine the amount of a taxpayer's material assistance from a PFE.. Prior to the issuance of the safe harbor tables:

- The taxpayer may use the tables in IRS Notice 2025-08 to establish the percentage of total direct costs for any manufactured product or eligible component;

- Rely on certification provided by the supplier of the manufactured product, eligible component, or constituent element, material, or sub-component regarding (i) the total direct costs or total direct material costs not attributable to a PFE; or (ii) that such product or component was not produced or manufactured by a PFE.

Notwithstanding the above, if the taxpayer knows or has reason to know that a manufactured product or eligible component was produced or manufactured by a PFE, the taxpayer "shall treat all direct costs with respect to such manufactured product, or all direct material costs with respect to such eligible component, as attributable to a [PFE]"; and if the taxpayer knows or has reason to know that the certification is inaccurate, the taxpayer may not rely upon it.

The statute of limitations is extended to 6 years, and increased penalties apply with respect to material assistance issues. This includes penalties on suppliers for providing non-complying certifications.

C. Ownership restrictions under H.R. 1

In addition to the material assistance restrictions, H.R. 1 effectively precludes SFEs or FIEs from (i) owning or having "effective control" over a qualified facility under Section 45Y; (ii) owning or having "effective control" over a qualified facility or energy storage technology under Section 48E; and (iii) owning or having "effective control" over any eligible component.

As a practical matter, this means:

- Certain foreign investors (including from the PRC) are effectively precluded from owning or controlling investments that rely upon the referenced tax credits;

- The "effective control" provisions mean that, even where a PRC investor has no equity interest in the project, contractual rights that permit the PRC investor to exercise any of the functions listed above with respect to a qualified facility or energy storage technology, or eligible component may implicate or render the project as a whole ineligible for the relevant tax credits.

D. Recapture / clawback penalties under Section 48E

Finally, H.R. 1 imposes a strict recapture or clawback rule on taxpayers that claim the ITC for any taxable year beginning after July 4, 2027 under Section 48E but are found to violate the PFE-related restrictions on payments to SFEs.

Specifically, if, during the 10-year period after a project for which a taxpayer has claimed the ITC is placed in service, the taxpayer makes an "applicable payment" to a SFE, the taxpayer must repay all of the ITC benefit that it has received for that project. Applicable payments include direct or indirect payments or contractual arrangements made to a SFE that could confer "effective control" upon that entity.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.