In Dealmaker's Digest, read the top 10 latest developments in global transactions. We offer insights into M&A activity across industries and borders. To receive our M&A thought leadership, please join our mailing list.

Key Takeaways

- September megadeals drove nearly $500 billion in global M&A value for the month (+40% month-over-month; +32% year-over-year).

- PE led the rebound: Sponsor-backed activity surged (+126%) to nearly $300 billion in September, the highest monthly total since 2021.

- Cross-border momentum continued: U.S. inbound and outbound deal activity in Q3 noticeably outpaced Q1-Q2 trends.

Global M&A Activity Update

1. Monthly Deal Value Trends

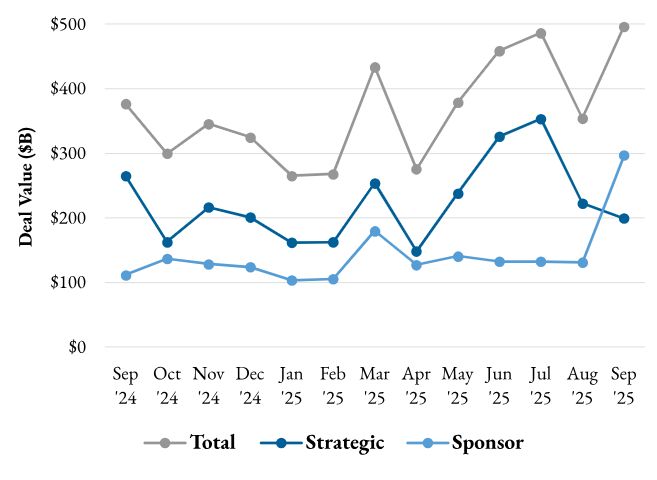

Global monthly deal value1 climbed 40% month-over-month to nearly $500 billion as a wave of late-quarter megadeals were announced throughout September. Year-over-year, global deal value increased 32%.

Strategic deal value declined 10% month-over-month and fell 25% year-over-year, underscoring a continued softness among corporate buyers despite the broader September rebound.

Financial, or sponsor, buyer activity led September's gains, up 126% month-over-month to nearly $300 billion – the highest since 2021 – and up 165% year-over-year; lower rates and improved market visibility supported late-quarter sponsor execution.

2 Monthly Deal Count Trends

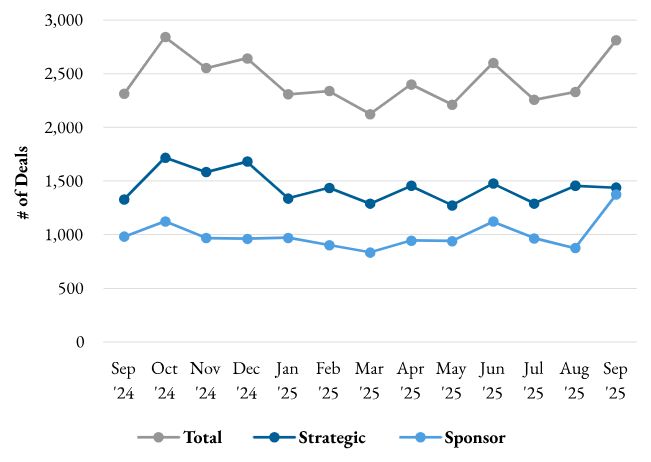

Global deal count neared a 12-month high in September, up 21% month-over-month and 22% year-over-year.

Strategic buyer deal count held essentially flat month-over-month (-1%) and rose 8% year-over-year.

Sponsor buyer deal count in September hit a three-year high, jumping 57% month-over-month and 40% year-over-year.

Monthly M&A Industries (U.S. Targets)

3 By Deal Count

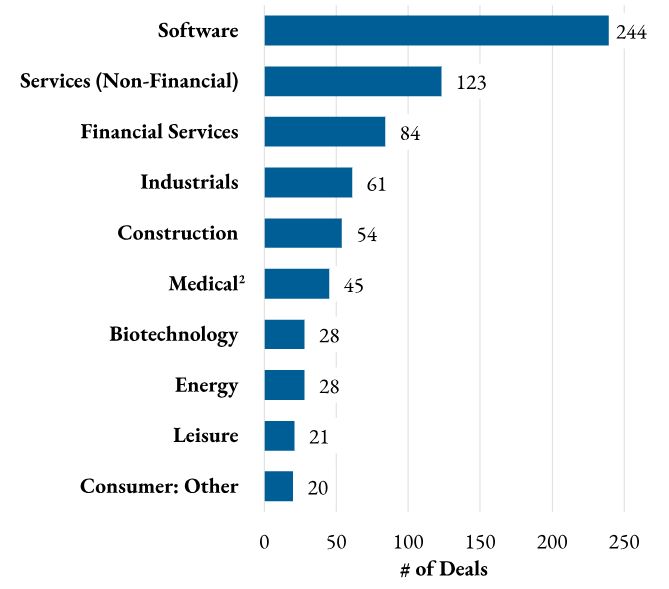

- The software industry led U.S. M&A by deal count in September, with nearly double the volume of any other sector.

- Services industries remained active, again rounding out the most active sectors in September by deal count.

4 By Deal Value

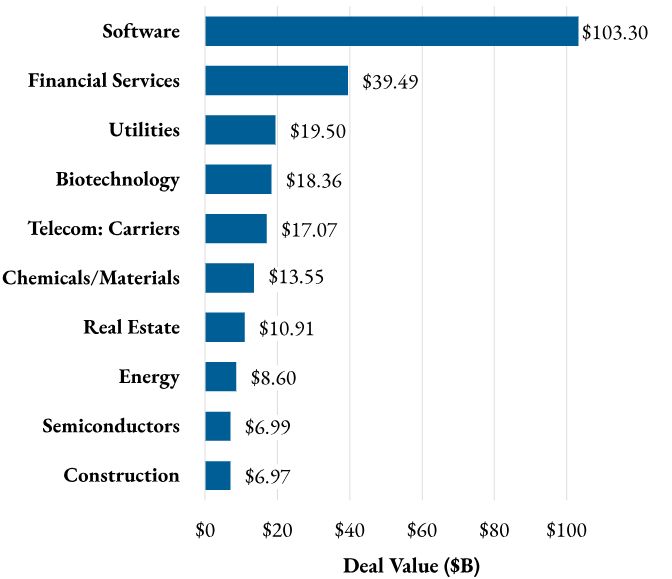

- Software acquisitions also led by deal value with more than 2.5x the runner-up; over half of September's aggregate software value came from a single transaction (the $55 billion Electronic Arts deal highlighted below).

- Financial services and utilities ranked second and third, respectively, with $10+ in billion transactions in each sector during the month.

Monthly Blockbuster Deals

5 Largest U.S. Strategic Deal

- SpaceX has agreed to acquire satellite spectrum licenses from EchoStar for a mix of cash and stock valued at approximately $17 billion.

6 Largest U.S. Sponsor Deal

- A consortium of PIF, Affinity Partners and Silver Lake has agreed to acquire Electronic Arts (EA) in an all-cash transaction valued at approximately $55 billion.

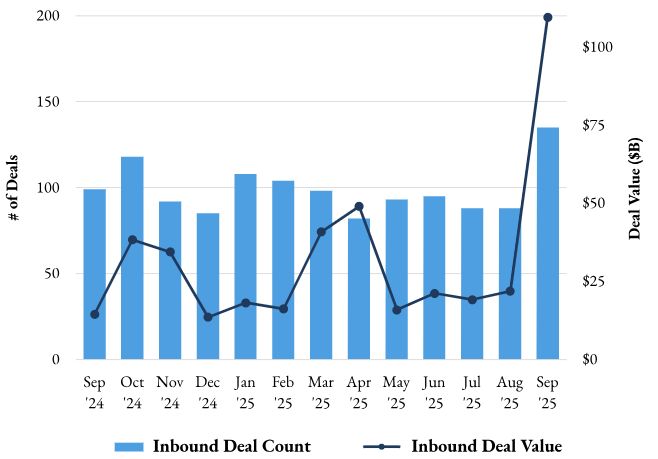

7 Monthly Inbound U.S. M&A Activity

- U.S. inbound activity quintupled by value in September and neared $110 billion (+402% month-over-month; +655% year-over-year), led by the pending acquisition of EA by a cross-border consortium of investors. The $55 billion transaction is the largest all-cash sponsor take-private on record.

- By deal count, acquisitions of U.S. targets by non-U.S. acquirers rose 53% month-over-month (nearing a two-year high) and increased 36% year-over-year.

- Canada and the United Kingdom led inbound activity with 27 and 22 deals, respectively, followed by Japan with 12.

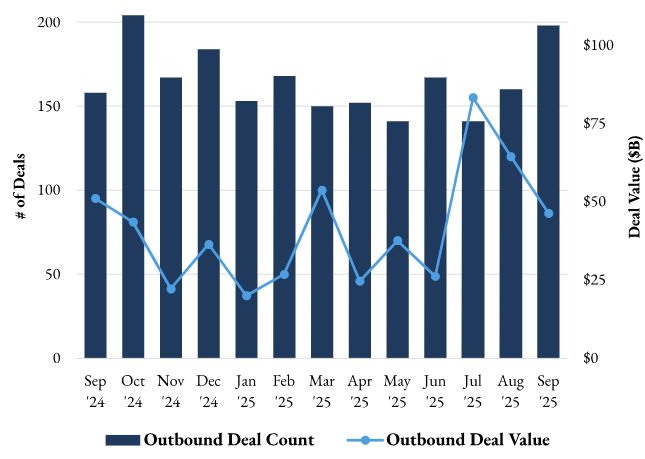

8 Monthly Outbound U.S. M&A Activity

- By deal value, acquisitions of ex-U.S. targets by U.S. buyers in September declined 28% month-over-month and 9% year-over-year.

- By deal count, outbound activity rose 24% from August and 25% year-over-year.

- U.S. acquirers focused on targets in the UK (51 deals) and Canada (21), with Germany and France tied for third at 11 each.

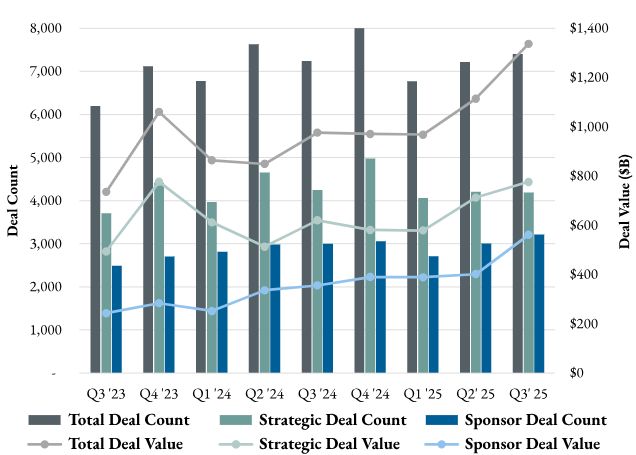

9 Quarterly Global M&A Activity

- Global Q3 2025 deal value rose 20% quarter-over-quarter to $1.34 trillion, a three-year high. Compared with the same period last year (Q3 2024), aggregate deal value increased 37%.

- Financial buyers led the gains: sponsor deal value rose 40% quarter-over-quarter (+58% vs. Q3 2024); strategic deal value increased 9% quarter-over-quarter (+25% year-over-year).

- Global deal count was essentially flat quarter-over-quarter (+3%), with activity by sponsors (+7%) outpacing strategics (0%). Compared to Q3 2024, deal count remained stable across buyer types.

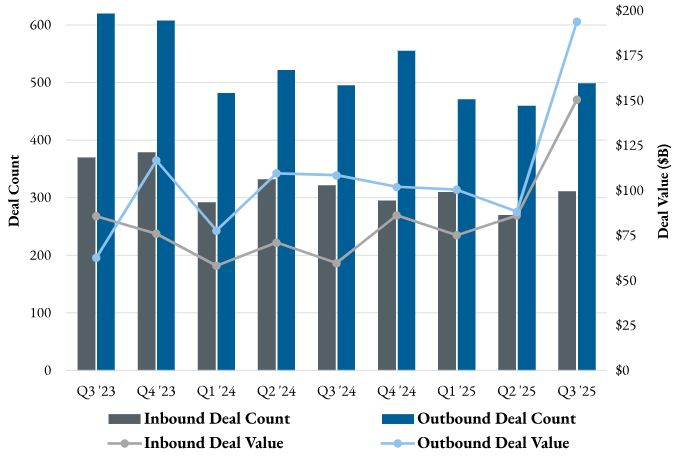

10 Quarterly U.S. Crossborder Activity

- Crossborder activity increased across the board in Q3 2025, with particularly large jumps in quarterly value among inbound (+75%) and outbound (+120%) U.S. transactions.

- Compared with Q3 2024, inbound deal value increased 152%; outbound deal value rose 79%.

- Crossborder activity increased more modestly by deal count: inbound volume rose 15% quarter-over-quarter, while outbound volume rose 8%. Year-over-year, quarterly crossborder counts (both inbound and outbound) held largely flat.

Footnotes

1. Unless otherwise noted, charts compiled using Mergermarket data for September 2025 as of October 6, 2025. Aggregate deal values by dollar amount are calculated from the subset of deals with disclosed values.

2. Medical industry classification principally includes medical devices/technology/services, excluding biotech and pharmaceutical deals.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.