- within Corporate/Commercial Law topic(s)

- in United States

- within Strategy topic(s)

Introduction

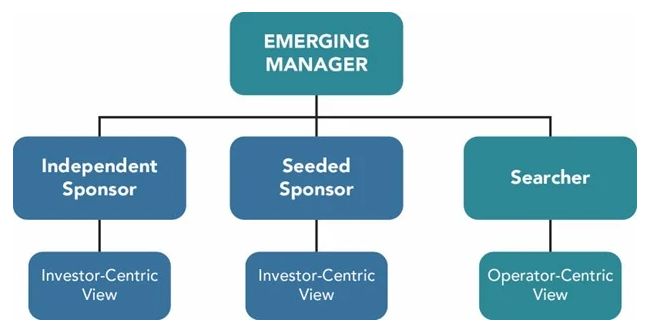

Over the past 15 years, the meaning of the term "sponsor" in the private equity context has evolved to include several alternatives to the standard committed private equity fund model. These "nontraditional" or "alternative" sponsors have established their relevance in the lower-middle market and are even competing for – and winning – true middle market deals.

The authors of this article have previously published articles and alerts highlighting and describing various elements of "independent sponsor" and search fund transactions. In addition to seeing an increasing number of independent sponsors, self-funded searchers and traditional search fund-backed searchers as participants in lower-middle market transactions, there are also increasing instances of hybrid deal sponsorship models that fall somewhere in between a traditional committed private equity fund model and the independent sponsor/self-funded searcher models.

This Holland & Knight article is a high-level overview of the emerging private equity sponsor model that the article's authors have labeled as the "seeded sponsor" model.

Holland & Knight is an active participant in the emerging manager space. The Independent Sponsors Team regularly represents sponsors, along with their equity investors and other financing partners, in their mergers and acquisitions (M&A) and other investment transactions across a range of industries, geographies and transaction sizes. We invite any interested parties to contact us for additional information.

Distinguishing the Seeded Sponsor Model from Other Models

What Is the Seeded Sponsor Model?

The seeded sponsor model is a construct in which an individual or group of individuals first raise "seed capital" at the sponsor vehicle or general partner (GP) level and then leverage that capital to finance the period of time during which the sponsor sources, diligences and negotiates the recapitalization or acquisition of a target company and raises the additional equity and debt capital needed to consummate that transaction.

The term "seeded sponsor" refers to both the sponsor vehicle or GP entity that receives the seed funding and the managing principals of said entity. The seeded sponsor model is an emerging construct in the independent sponsor market, but it is the progeny of a number of other fairly well-established structures (most notably, the committed private equity fund, independent sponsor and "search fund" models). To further explain this model, it is important that the reader first understand the models from which it has evolved.

Other Models

An "independent sponsor" can be best described as an individual or group of individuals who first source, diligence and negotiate the structure of an acquisition of a privately held company, enter into a letter of intent with the acquisition target – which provides the sponsor "exclusivity" and then subsequently (or contemporaneously) seek debt and equity financing to fund a minority or control transaction. Unlike a traditional private equity fund, an independent sponsor does not raise a blind pool of committed capital but rather raises capital on a transaction-by-transaction basis without first obtaining binding investor commitments. We also note that independent sponsors typically consider themselves as investors rather than operators – an independent sponsor typically does not become an executive officer of the acquisition target; rather, it looks for a strong management team to continue post-closing or engage search firms to help locate and hire a new management team.1 When not using a seeded sponsor approach, independent sponsors typically "bootstrap," or self-fund, their organizational, deal sourcing and due diligence costs (many of which are often reimbursed at the closing of the transaction).

The search fund model is an investment structure designed to provide investors the opportunity to participate in the sequential financing of the acquisition of a privately held company in partnership with an aspiring entrepreneur (a searcher) who typically becomes the CEO of the acquisition target post-transaction. These searchers will form a search fund that raises initial search capital from outside investors to fund these searchers' salaries, along with administrative and deal-related expenses, for the period during which they source, structure, diligence and negotiate an acquisition of a privately held company (the search phase). The unifying characteristic of independent sponsors and searchers is that they do not have the equity capital needed for the acquisition in advance (i.e., there is no committed fund behind them). Unlike independent sponsors, however, searchers typically view themselves as operators rather than investors.2

Similar to seeded sponsors, committed private equity funds (including those raised by former independent sponsors) raise all of their deal sourcing, diligence and operational capital ahead of actually commencing with the deal execution work but, critically, they also simultaneously raise the capital to actually fund numerous underlying transactions. Committed private equity funds typically use the vast majority of their committed capital for actual acquisition investment purposes but have allowances in their fund documents for organizational, diligence, structuring and even "dead-deal" costs that are incurred in furtherance of that investment purpose. Although the committed fund approach makes life easier on sponsors in many ways (and, to wit, is the end goal for many independent sponsors regardless of whether they are seeded sponsors), it also is typically only available to sponsors with significant track records and strong investor connections.

Finally, we would be remiss to not at least mention that aspects of the seeded sponsor model (most directly the future investment rights discussed below) borrow from the "pledge fund" model, which allows investors to choose which deals they participate in within a fund on a deal-by-deal basis. Unlike the traditional "blind pool" private equity model, pledge fund investors make "soft commitments" to the fund but are permitted to opt in or opt out of each investment opportunity the fund undertakes. This model is often used by emerging managers to cater to investor preferences for control over investment decisions but still lacks the upfront seed capital that helps searchers and seeded sponsors get to the closing of an acquisition.

Given the similar capital needs and execution risk inherent in the early stages of independent sponsor-, search fund- and pledge fund-backed deals, combined with the increasing prevalence of alternative sponsors in lower-middle market transactions, the emergence of a solution to address these initial capital needs is not surprising. The key then is to understand customary terms for a seeded sponsor transaction so that seeded sponsors can maximize the likelihood of closing on such a capital raise while not giving away too much value in exchange for their seed capital.

The Seeded Sponsor Model in Detail

When helping an emerging manager self-identify as either an independent sponsor or searcher, the first question that the members of our team will ask is, "How do you view your role in the post-closing operation of the target company?" It is important to note that a seeded sponsor is, fundamentally, just a type of independent sponsor. Accordingly, seeded sponsors view their role in the post-closing operation of the target company as that of "investor" rather than "operator" and that of "sponsor" rather than "executive officer." Furthermore, the seeding component of the search fund model is a well-established option for emerging managers with "operator-centric" views. In this article, we primarily discuss the seeded sponsor model as a variation on the bootstrapped independent sponsor model, given their shared goal of being private-equity investors in the post-closing operation of their portfolio companies.

A fundamental identifying characteristic of the independent sponsor model and source of monumental stress to the independent sponsor is the "fundless" nature of this approach. As experienced industry participants in this space, the members of our Independent Sponsors Team continue to earn the "counselor" title when bleary-eyed clients call after sleepless nights of wondering from where the debt and equity financing to fund transaction will come. To this end, independent sponsors may appear envious when analyzing the search fund model in which a searcher draws a salary and other benefits during the lengthy, sometimes arduous process of sourcing a deal, negotiating a deal and, ultimately, closing a deal.

Key Economic Terms

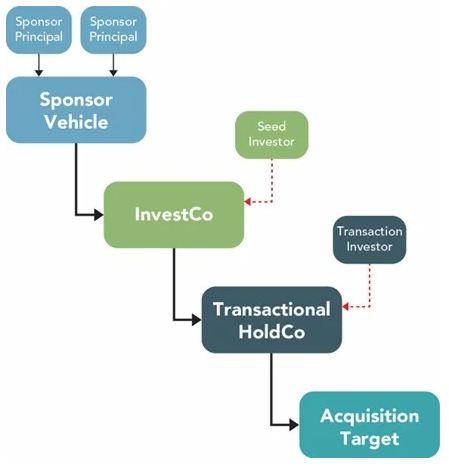

For purposes of this discussion, please note the following terms (which are also set forth in the structure chart in the grahpic below):

- Sponsor Vehicle.This is the sponsor entity, typically a limited liability company formed for the benefit of the Sponsor Principals to 1) collect management and other fees for the seeded sponsor, 2) undertake legal obligations of the seeded sponsor (e.g., engagement letters, letters of intent with potential Acquisition Targets, etc.) and 3) hold the seeded sponsor's equity in the deal (e.g., carry, rolled fee, additional GP commitments, etc.).3

- Sponsor Principals.The equityholders of the Sponsor Vehicle (i.e., the individuals who comprise the sponsor).

- InvestCo.A newly formed entity (typically a limited liability company) into which the Seed Investors make their seed capital investments and, in some cases, to whom the Seed Investors make capital commitments to fund Acquisition Transactions (if any).

- Seed Investors.The investors in the InvestCo providing seed capital and, in some cases, equity commitments to finance the Acquisition Transaction.

- Transactional Holdco.A newly formed entity (typically a limited liability company) formed for the purpose of acquiring the Acquisition Target. A given InvestCo may have numerous Transactional Holdcos (or Acquisition Targets) in its portfolio.

- Transaction Investors.The investors in the Transactional Holdco providing equity capital to finance the Acquisition Transaction. Some Transaction Investors may also be Seed Investors.

- Acquisition Target.The target company ultimately acquired as part of the Acquisition Transaction.

- Acquisition Transaction.The transaction through which a Transactional Holdco acquires an Acquisition Target.

Like independent sponsors, seeded sponsors should expect to receive management fees, carried interest (also known as "promote") and some economics at closing. These fees and other economics to be received by seeded sponsors at the Transactional Holdco level are no different from what an independent sponsor would expect to receive. (For a detailed overview of management fees, carried interest and closing economics, see Holland & Knight's previous alert, "Independent Sponsors: Market Trends and Industry Insights," Oct. 17, 2023.) It is what occurs at the Sponsor Vehicle or InvestCo level that distinguishes seeded sponsors from independent sponsors.

Sponsor Principals will seek initial seed capital from a Seed Investor (typically at the InvestCo level) to fund a salary, along with administrative and deal-related expenses, for the duration of their deal sourcing, diligence and closing phase.4 In exchange for this investment, a Seed Investor will receive economic and other rights in a handful of different ways. In all cases, such rights are subject to negotiation between the Seed Investor and Sponsor Principals based on the various economic and governance rights that would otherwise flow solely to the Sponsor Vehicle – namely, carried interest economics, management and/or add-on fees, closing economics and future investment opportunities.

Given this fact-specific and nuanced negotiation between the Seed Investor and Sponsor Principals, there is no one-size-fits-all solution or model to these arrangements. Where a Seed Investor in one transaction may place a premium on future investment opportunities, a different Seed Investor may focus more on participating in the economics otherwise flowing to the Sponsor Vehicle. Where one group of Sponsor Principals may hold firm on retaining maximum control over their investments (including all the way down to the Acquisition Target), other Sponsor Principals may resist sharing closing economics and other fees with Seed Investors, even if it means a bit less control. We outline below several categories of rights that aspiring seeded sponsors can use to induce Seed Investors are outlined. Though there is no defined "market" for the extent to which each right is granted, most seeded sponsor transactions contain one or more of these components at levels that are subject to Seed Investor investment objectives, seeded sponsor strategic goals and the overall negotiating leverage of the parties. Our Independent Sponsors Teamis well equipped to help guide market participants through this process to help craft the appropriate formulation for a given transaction.

Option 1: Carry Share

In a majority of cases, the most valuable economic asset that seeded sponsors have is their carried interest economics. The uncapped upside of most carry structures allows sponsors to create substantial value for themselves by sourcing good deals, growing good companies (both organically and through M&A) and producing successful exits. As such, in order to attract Seed Investors, seeded sponsors often include a small portion of their promote in the package that a Seed Investor receives in exchange for its seed capital investment.

Structurally, the Seed Investor would invest into InvestCo and receive a number of units of InvestCo in exchange. Those units issued to the Seed Investor would allow the Seed Investor to share in a to-be-negotiated portion of the seeded sponsor's promote; however, this "carry share" isn't typically an absolute right, and seeded sponsors should be careful in negotiating a carry share. Often, such a right is limited in some way, chiefly to distributions flowing through the InvestCo related to a finite 1) number or type of investments (i.e., one to two acquisitions of Acquisition Targets), 2) amount of capital deployed, 3) aggregate return to the Seed Investor or 4) other bespoke metric. Sponsor Principals should work carefully with a seasoned advisor to craft a "carry share" package that does not serve as an anchor around their necks for the rest of their private investing career.

From a funds flow perspective, the InvestCo would hold "carry units" issued by Transactional Holdco, and distributions from Transactional Holdco to the InvestCo would then be distributed out of InvestCo to the Sponsor Vehicle and the Seed Investors pro rata (subject to any negotiated limitations). The InvestCo's organizational documents would also include covenants covering the Sponsor Vehicle and Sponsor Principals that would prevent such parties from circumventing the intent of the seed investment terms (e.g., by investing or taking a promote through other vehicles).

Option 2: Participation in Fee Revenue Streams

As detailed above, seeded sponsors will also be entitled to certain fee income during the life of an investment. Fees related to pre-closing diligence and transaction structuring, the ongoing monitoring and management of portfolio companies, and add-on acquisitions are commonplace in sponsor-backed deals and provide a consistent revenue stream, a portion of which the seeded sponsor can also offer to Seed Investors in exchange for their seed capital.

Though lacking the upside and tax efficiency of a carry share, fee income can provide a consistent return for Seed Investors. Similar to a carry share, though, the duration and amounts of a Seed Investor's participation in fee revenue streams should be limited. For example, many seeded sponsors offer only a portion of their fee income with respect to the pre-closing diligence and transaction structuring fees for the initial platform transactions. The rationale here is that the seed capital only helped the seeded sponsor only get the platform deal done, whereas ongoing management fees are paid in exchange for services directly provided by the seeded sponsor, with no need for Seed Investor support. Similarly, add-on fees may be excluded from a sharing of fee revenue streams for a similar reason as the exclusion of the ongoing management fees.

Option 3: Future Investment Rights

The final oft-used arrow in the seeded sponsor's quiver to entice Seed Investors is the granting of future investment rights. Investors are flocking to independent sponsors and lower middle market private equity funds in increasing numbers due to the access they have to deals that are often proprietary (i.e., non-banked), involving founder-owned companies that run excellent, if not smaller, businesses with plenty of room to mature, accept additional capital deployment and grow. As such, the right of a Seed Investor to invest in future deals led by a seeded sponsor is a valuable one, even if it means the Seed Investor will have to contribute capital in excess of its seed capital investment to exercise such right.

Most future investment rights are either "soft commitments," permitting the Seed Investor to opt in or opt out of each investment opportunity the seeded sponsors undertakes or "no commitment" participation rights to invest in future deals sponsored by the seeded sponsor (i.e., to purchase Preferred Units of various Transactional Holdcos), up to a certain 1) amount per deal, 2) percentage of the equity capital of a given deal, 3) aggregate amount over all opportunities presented, 4) aggregate amount of capital deployed over all opportunities presented, 5) other bespoke metrics or 6) combinations of the foregoing. Sometimes, seeded sponsors will offer future investment rights on a "no carry" basis, meaning that subject to certain limitations, the seeded sponsor would not receive a carry on the preferred units issued to the Seed Investor in connection with its investment in such Transactional Holdco. Hybrid structures also have a small portion of the future investment right on a "no carry" basis with a larger portion subject to a carry.

Though it may seem logical given the similarities between seeded sponsors and search funds, future investment rights in the seeded sponsor context very seldom include any right to a "stepped-up preferred" like investors in search funds may receive (i.e., the right to receive 150 percent of its investment value in "stepped-up preferred" in the acquisition vehicle). As independent sponsors and seeded sponsors are more aligned with traditional committed private equity fund structures, investors underwriting their M&A deals are expecting to pay economics to the sponsor only (and not for their co-investors to pay a lower price per unit). As such, economics going to Seed Investors nearly always come out of economics otherwise flowing to the Sponsor Vehicle, not to other Transactional Holdco investors.

Any commitments received by seeded sponsors to fund future deals are often made as "soft commitments," permitting the Seed Investor to opt in or opt out of each investment opportunity the seeded sponsor undertakes. Whether or not a Seed Investor is willing to provide any commitment, whether a "firm commitment" or "soft commitment," is subject to negotiations between the Sponsor Principals and such Seed Investor. Seeded sponsors accepting any capital commitments from Seed Investors should speak with their counsel regarding investment adviser regulations, as well as the reporting and other requirements under the Investment Advisers Act of 1940.

Bonus – Option 4 (Loan Based Seeding)

With the exception of this brief paragraph, this article does not cover structures in which a seeded sponsor raises seed capital simply by taking a loan from a third party. Given the risk involved with such a loan from the lender's perspective, institutional lenders are not participating in these transactions with any regularity. As a result, seed capital that is structured as a loan is typically provided by friends or family of a Sponsor Principal, subject to highly deal-specific terms from which a "market view" cannot be distilled.

Conclusion

Sponsor Principals will need to carefully evaluate the ultimate structure of the Sponsor Vehicle and related InvestCo(s) when determining 1) which entities will be the recipient of fees and other economics flowing up from the Transactional Holdco and its subsidiaries and 2) to which entity in that structure any Seed Investor makes its capital contributions or, if applicable, commitments. This structure will dictate where any related income flows and, importantly, whether and to what extent Seed Investors are entitled to participate in such income.

For a discussion on the considerations a sponsor should keep in mind regarding portfolio company governance, see Holland & Knight's previous alert, "Key Considerations for Independent Sponsors Regarding Portfolio Company Governance," April 10, 2024.

A Final Word

The market for the seeded sponsor model is just now beginning to take shape, resulting in a lack of fully developed benchmarks for the individual deal terms described above. We anticipate that investor allocations to seeded sponsor transactions and platforms will continue to grow and eventually result in widely accepted terms and best practices, in much the same way that the independent sponsor model has matured over the last 15 years.

Our team looks forward to continuing to represent the full spectrum of private equity market participants, including those in the committed fund, independent sponsor, search fund and seeded sponsor spaces, and welcome inquiries and dialogue with all interested parties.

Footnotes

1 For a detailed overview of independent sponsors, readers are encouraged to see Holland & Knight's previous alerts, "Independent Sponsors: Market Trends and Industry Insights" and "A Look Under The Hood Of Independent Sponsorship In M&A," penned by, inter alia, the authors of this article.

2 For a detailed overview of search funds, please see the latest Search Fund Primer published by the Stanford Graduate School of Business Center of Entrepreneurial Studies. For more information regarding search fund deal terms and structuring considerations, please see these articles published by Holland & Knight's Search Fund Team.

3 Note: In order to mitigate the risks associated with holding passive equity interests in a vehicle with operating obligations, some sponsors will bifurcate the Sponsor Vehicle into one "management company" that collects fees and undertakes legal obligations and one "equity holding company" that holds carry, rolled fee, additional GP commitments, etc.

4 Note: Though not the subject of this article, Seeded Sponsors should speak with their counsel regarding 1) tax-efficient methods for deploying their seed capital, including with respect to payment of employment compensation, and 2) federal and state securities laws governing success-based transaction fees.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.