- within Finance and Banking topic(s)

- in Asia

- with readers working within the Banking & Credit and Retail & Leisure industries

- within Finance and Banking topic(s)

- in Asia

- in Asia

- in Asia

- with readers working within the Retail & Leisure industries

- within Real Estate and Construction and Strategy topic(s)

Foreword

The Alternative Credit Council and Dechert LLP are pleased to share the findings of our latest research exploring current fund structuring and product design trends in private credit. This builds on the findings of our initial 2023 paper, providing a time series of data on product design trends as well as new insights on investor preferences.

Private credit has become one of the most dynamic and influential segments of global capital markets. As the industry matures, so too does the need for clear insights into how funds are structured, governed and accessed by investors. This report provides timely and practical analysis that will benefit investors, asset managers and policymakers alike.

For investors, the findings offer a unique window into how managers are responding to their evolving demands. Our research highlights how the needs of investors are reshaping fund structuring across multiple dimensions – liquidity, leverage, customisation, retail participation and the specific needs of insurers, as well as the need for tax neutrality and fee structures which align interests. These insights will enable investors to better evaluate fund offerings, assess alignment of interests and make informed decisions that match their portfolio objectives.

For asset managers, the report highlights the tools and structuring solutions that their peers are deploying to remain competitive. The research captures both the opportunities and the operational complexities that managers must navigate when serving their clients. This is particularly true in the way that firms are developing products aimed at retail clients and investing in 'retail grade' product, operations and marketing teams. This allows firms to integrate retail investors into their investment strategies alongside institutional clients.

We see a similar pattern for firms with insurance clients who require a specific combination of structuring and transparency from private credit fund managers. The experience of US managers using rated note feeders provides valuable insights for non-US managers and investors into the specific benefits and complexities of these structures.

The paper also provides regulators and policymakers with data and insights into a sector that is often accused of opacity. The research shares valuable insights into how private credit funds are tailored to serve the specific needs of their clients, and how the sector is successfully overcoming operational challenges and building sustainable ways for investors to manage their exposures. The findings also shed light on how managers and investors adapt their structuring considerations to different regulatory frameworks, as well as lessons on global practices that can assist policymakers seeking to support capital formation and boost investor confidence in private markets.

We would like to thank the firms and individuals who supported this research and contributed their time and expertise. We hope that investors, private credit managers and policymakers will find our data and insights useful.

Executive Summary

Increased demand for liquidity, customisation and co-investments

- 64% of survey respondents report rising investor demand for liquidity, up from 49% two years ago. 66% now operate at least one vehicle allowing investors periodic redemptions, with private credit fund managers using a broad range of liquidity management tools in their funds to offer a limited degree of liquidity.

- LP demand for co-investment has surged from 70% to 92% between 2023 and 2025. Investors are seeking tailored solutions, which is driving widespread use of SMAs, side letters and co-investments vehicles.

- The prevalence of small bespoke vehicles is declining, with far fewer managers (6% in 2025 v. 23% in 2023) willing to offer SMAs below US$50 million commitments than in prior years.

- The use of leverage in fund structures remains moderate and stable overall. 72% of respondents employ leverage in their private credit strategy either at the fund or asset level, a proportion largely unchanged from recent surveys.

Retail investors need retail-grade infrastructure

- 57% of surveyed managers have retail clients, with 64% considering targeting retail capital in upcoming funds. The biggest growth is in the HNW and "semi-professional" investor segments rather than mass retail, though managers are increasingly interested in the latter.

- Private credit fund managers are growing this client base through a mixture of feeder funds, partnerships with wealth management platforms and private banks, as well as through regulated vehicles that can be marketed to retail clients.

- Firms are making considerable investments in their operational infrastructure, as well as their marketing and educational materials to support retail clients' understanding of the market.

Structuring and transparency paramount for insurance investors

- While many insurers participate in the market via traditional funds or simple feeders, rated note feeders have emerged as a critical structuring tool for insurance companies investing in private credit – 63% of respondents have considered setting them up for US clients, while 35% have considered setting them up for European and Asian insurers.

- Rated feeders can be resource intensive and have structuring challenges that may not always make them suitable for investors. Insurers are also gaining indirect exposure to private credit by acting as lenders to private credit funds.

- Regulatory capital treatment for private credit assets remains a key consideration for European investors, with hope that reforms under consideration in the UK and EU will provide more certainty.

Certainty and transparency driving fund formation

- Investors retain a preference for a handful of established fund domiciles. Luxembourg, the Cayman Islands, the US, Ireland and the UK remain the top five domiciles for private credit funds.

- US tax considerations are an integral part of fund structuring discussions for any fund with exposure to US private credit assets. 33% of respondents now use double tax treaty-based vehicles and there has been an uptick in respondents that rely on treaty and blocked structures compared to prior years. Alternative strategies like 'season and sell' are also being employed, though there is no onesize-fits-all solution.

- 66% of respondents now use tiered management fee schedules, often taking in several variables. Investors continue to seek transparency beyond headline management and performance fee rates when assessing how remuneration structures align private credit managers' interests with their own.

Research Methodology

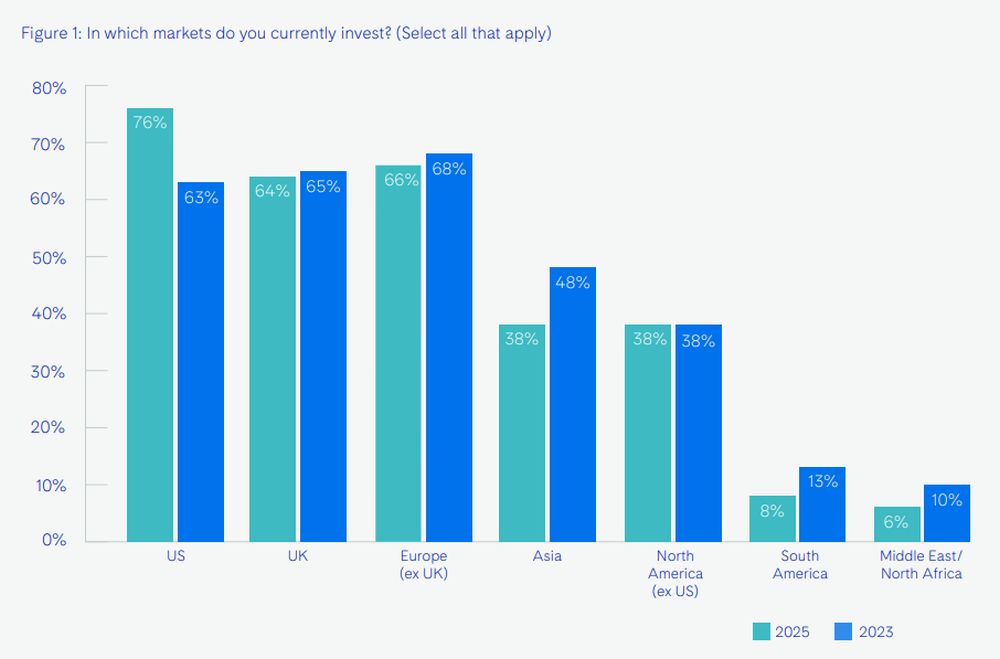

This research paper is based on data from several sources. The Alternative Credit Council ("ACC") and Dechert conducted a survey that received responses from 50 private credit managers. Respondents collectively manage an estimated US$1.5 trillion in private credit investments and invest across a broad cross-section of jurisdictions. The survey data was then explored by the ACC and Dechert in a series of one-on-one interviews.

Chapter 1 Product design

Key findings

- Demand for liquidity is being met by supply: A modest uptick is evident in the liquidity features of private credit funds, which is expected to continue as nearly two-thirds of survey respondents report rising investor demand for liquidity in their funds. GPs are addressing this demand by exploring evergreen or hybrid fund structures and other tools to provide limited liquidity while managing asset-liability mismatches.

- Leverage usage is stable and targeted: The use of leverage in fund structures remains moderate and stable overall. Around two-thirds of managers employ some leverage in their private credit strategy either at the fund or asset level, a proportion largely unchanged from recent surveys. Levered sleeves or share classes are becoming slightly more common. Notable regional differences persist: European investors tend to be cautious about leverage, whereas US investors are more comfortable with it, leading to a gradual uptick in leverage use for European funds attracting US LPs.

- Customisation via SMAs and co-investments: Managers are increasingly offering separately managed accounts ("SMAs") or single-investor funds alongside commingled funds, as well as other types of customisation options. While the majority of private credit AUM remains in commingled flagship funds, investors are seeking tailored solutions, driving widespread use of SMAs, side letters and co-investments vehicles, with demand expected to continue to grow. That said, the prevalence of small bespoke vehicles is declining, with far fewer managers willing to offer SMAs below US$50 million commitments than in prior years.

Agility is crucial, and we aim to ensure that our structuring supports portfolio managers in delivering the alpha they are capable of achieving. We strive to avoid creating any obstacles that could impact the performance that our portfolio managers generate through their asset selection process."

Greg Beauchamps

Head of Fund Structuring, Tikehau Capital

Liquidity management in private credit

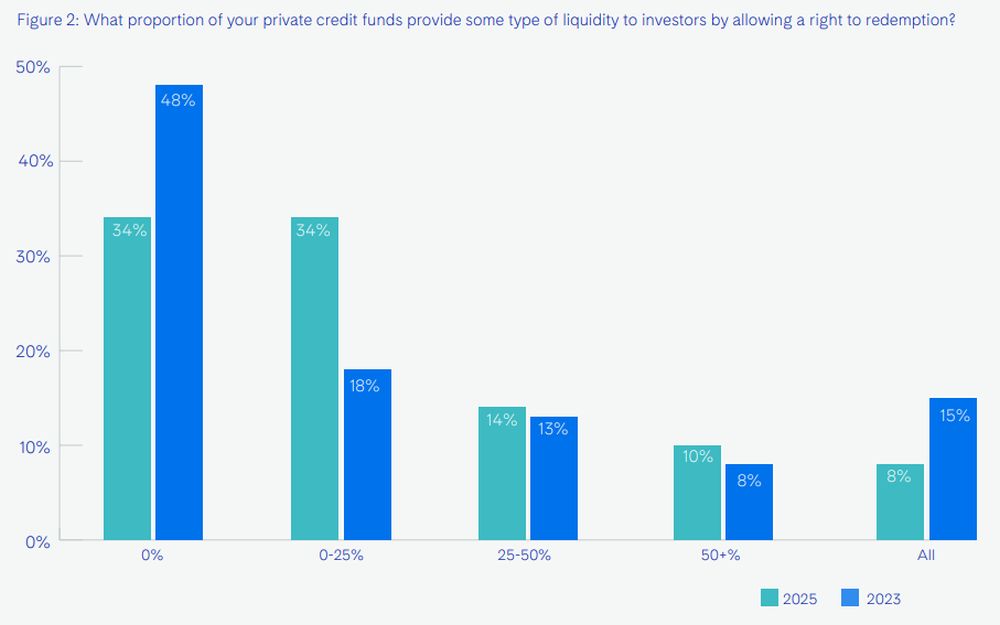

Liquidity management is one aspect of product design that continues to evolve. While a large share of private credit capital is still managed in closed-ended drawdown funds with no liquidity for investors (see Figure 2), the demand for and supply of liquidity in private credit has been steadily increasing over the past few years. Indeed, in 2025 we observe a modest increase in liquidity available to investors compared to prior years. More than two-thirds of managers surveyed now have at least one fund that allows some form of periodic redemptions or investor exits, whereas in 2023 only around half offered any such liquidity. Furthermore, investor appetite for liquidity has grown (see Figure 3): nearly two-thirds of respondents report that net demand for liquidity from their LPs is rising, a notable jump from roughly 49% who anticipated increased demand in our last survey in 2023.

Our open-ended fund is one of the first of its kind in the market. We launched it before any talk of retailisation. The main reason for us at that time was to give investors the option to place capital in this open-ended fund in between our closed-ended fundraises."

Arunas Jakumavicius

Head of Tax, Park Square Capital

Evergreen structures with built-in liquidity are gaining traction. The key issue is the interplay between structure and the ability to offer liquidity, which most investors want."

John Convery

Managing Director, Oak Hill Advisors

Credit is customisable. The Broadly Syndicated Market has some liquidity, so you can play with that and use both BSL and private credit to make sure that the product is suitable for investors that demand liquidity."

European-focused private credit fund manager

There are multiple and interrelated explanations for this ongoing trend. There is an increasing demand from institutional investors for structures that provide them with the ability to rebalance their private credit exposure, which can be a useful complement to their overall portfolio management toolkit. The growth of more liquid structures also reflects a desire to reduce the operational costs associated with investing in successive funds with the same manager.

Having gained more experience with the asset class, investors are also seeking more customised solutions to private credit than they may have done in previous years. It is also clear that the drive for retailisation, which will be explored in more detail below, is a key factor as more survey respondents are now seeking to cater for retail clients who are more likely to expect liquidity. Several interviewees also highlighted that the proliferation of semi-liquid private credit funds has begun to reshape investor expectations. Newer investors are less likely to want structures that see their capital locked up for seven years or more. To accommodate this growing demand, managers are expanding the use of evergreen and hybrid fund structures that offer a level of limited liquidity.

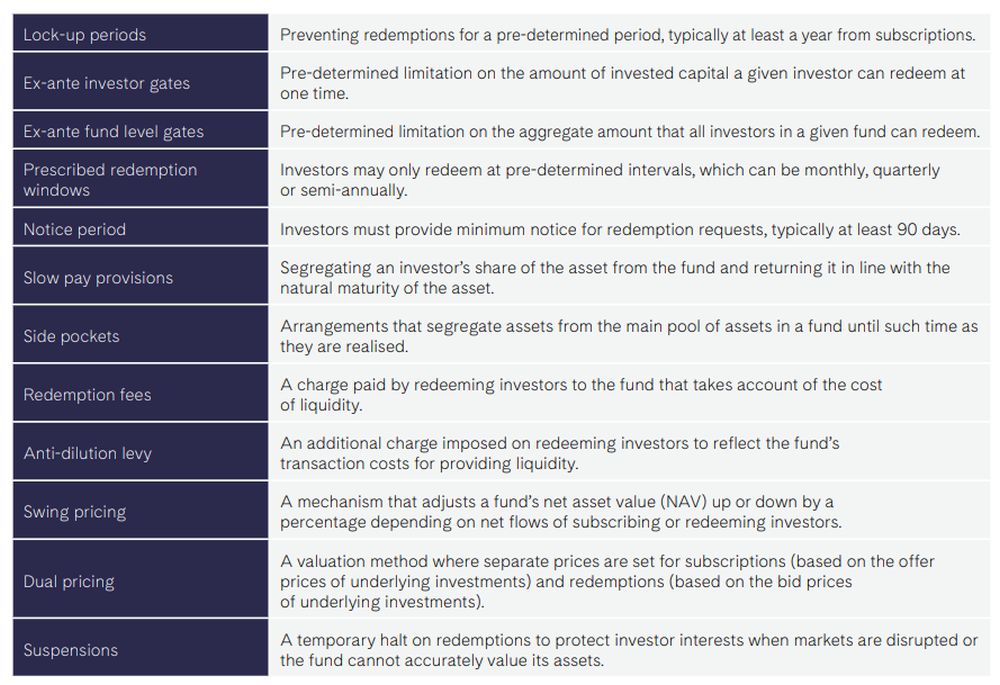

In practice, most of these vehicles offer regular subscriptions alongside periodic or limited redemption opportunities. Interviewees emphasised that structuring redemption opportunities in this manner is necessary to align with the natural liquidity of the underlying loans and investment strategy. Figure 4 highlights the typical Liquidity Management Tools ("LMTs") that private credit fund managers may use.

There are many institutional investors who tend to not want to receive monthly liquidity, as this can create more work for them and they are usually comfortable with the existing systems and arrangements of a closed-ended fund."

Luke Varley

General Counsel, Park Square Capital

Figure 4: Typical liquidity risk management tools employed by private credit fund managers

Another finding from our research was that the concept of 'liquidity' encompassed a much broader set of options than simply providing a redemption of interests to investors in the traditional sense. Figure 5 summarises some of the liquidity solutions that may be available as an alternative to redemptions. While traditional redemptions for cash are often the preferred option for investors, these alternative liquidity options provide private credit managers and their investors with greater choice and flexibility for generating liquidity.

In addition to the above, managers also have the option to include more liquid assets such as broadly syndicated loans in the underlying fund's portfolio. This is sometimes referred to as a liquid asset sleeve, which ensures there is a base level of liquid assets that can be used to satisfy redemptions. Such approaches may have a detrimental effect on the overall returns of the fund or investors may not want exposure to liquid assets in this format.

To view the full article, click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.