- within International Law topic(s)

- with readers working within the Media & Information industries

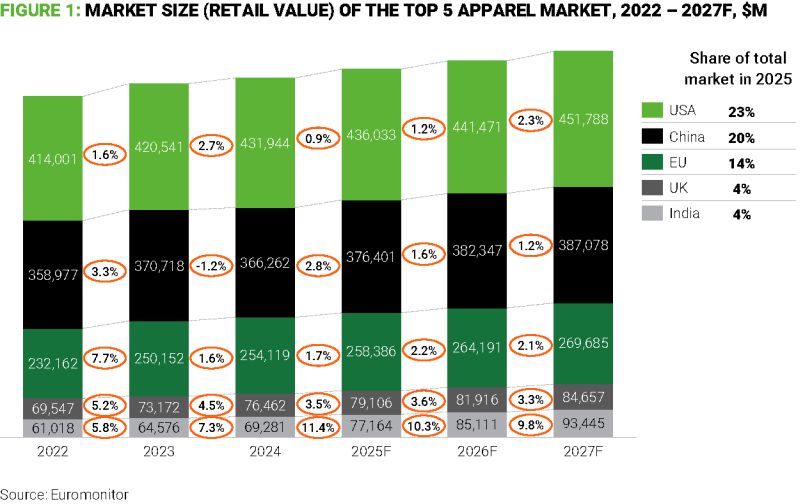

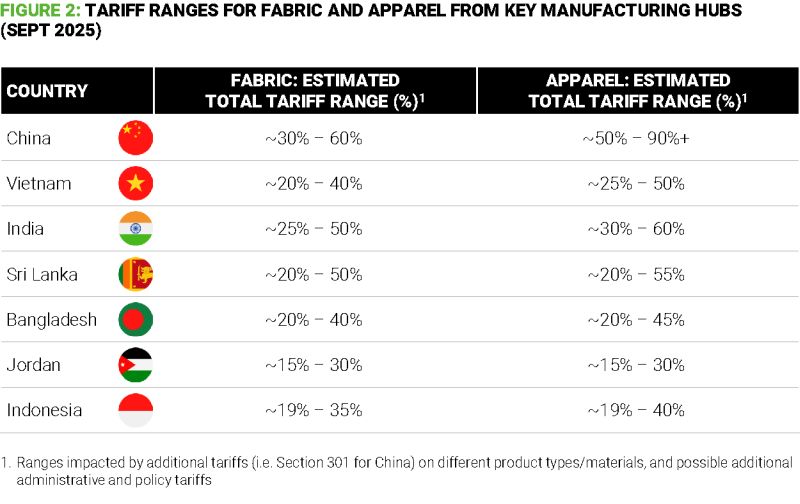

The global apparel sector is undergoing significant change. Growth is slowing across major markets, even in previous outliers like India. Tariffs have added uncertainty and extra costs, leaving the world's fabric and cut-and-sew sourcing hubs, primarily based in Asia, feeling the pressure.

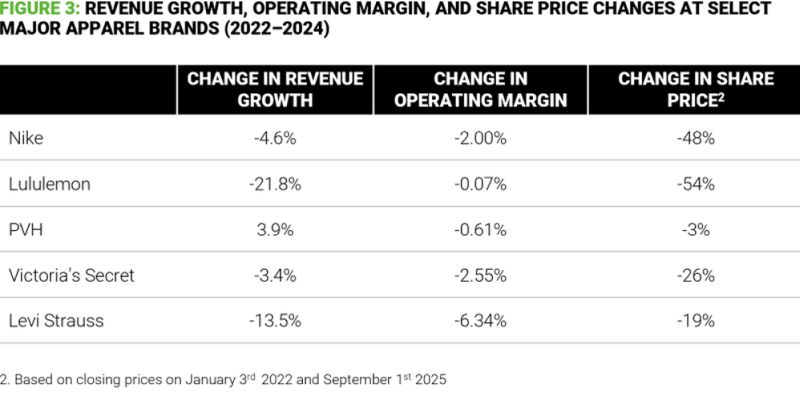

These developments have also had a clear impact on the financial performance of leading apparel brands, who have been struck by declining revenues, weaker margins, and falling share prices.

Those brands will be looking to recover and shore up through a range of changes, including:

- Nearshore production for a faster response to changing fashion trends and customer buying behaviors, and to minimize inventory write-offs

- Exercising greater control over the supply chain, by selecting raw material suppliers and freight providers and managing material flows

- Passing the pricing pressure up the value chain, while setting target prices for major cost components

The retooling imperative

The Asia-based apparel industry serving these global brands is naturally affected by its position further up the value chain. As well as sharing the burden of their customers, its players face their own challenges, including:

- Rising raw material, labor and utility costs

- Geopolitical risks and turbulent labor relations

- Investments in capacity that created higher fixed costs yet proved difficult to monetize

- Investments to support customer priorities that no longer apply

Historically, Asia's apparel manufacturers have relied on low-cost labor to remain competitive. Today, the potential for cost arbitrage is limited. To remain viable, these players will need to retool their operating models to become simple, standardized and of better value to investors.

Change the model

Current operations are tailored for specific brands and products. This needs to be revised.

We see the need for distinct operating models for the dominant customer segments:

- Premium Global. For high-end brands that value innovation and close collaboration, and are willing to pay for verticality, location diversity, and other requirements

- Mass market, Western. For department stores with private labels, which seek large volumes and make only limited changes to their SKUs each year. These customers will commit to forecasts, in return for low price points.

- Mass market, Eastern. Brands building on the price-sensitive consumption of India and other developing Asian markets. ESG considerations are trumped by scale and low margins

Trying to fit all operating models within same organization structure will result in loss of differentiation, more resource waste, and low margins. Instead, manufacturers need to adopt the appropriate operating models and reconfigure their entire value chain accordingly.

We have identified several low-risk, high-impact changes they can make here:

Product development and marketing

There is a lack of strategic engagement between brands and manufacturers, which creates inefficiency and duplicity. Manufacturers need to move beyond merely taking orders. They need to equip their marketing teams to ascertain the end-to-end implications of brand requests. Meanwhile, digital product development and 3D sampling tools, such as Browzwear, can reduce the cycle time and help manufacturers respond to trends faster. With continuous improvement, designs can be finalized, and factory capacity confirmed, within a week.

Supply chain and procurement

Asian apparel manufacturers lag their CPG segment peers and industrials in supply chain and procurement. Raw materials represent more than 60% of the overall cost base for the region's cut-and-sew players, and over 70% of the cost base for its fabrics manufacturers. Supply chain operations are complex, too, which affects material flows.

Their highest priority improvements should include establishing visibility on material flows; driving down overall lead times; and establishing modelling capabilities, to help mitigate risks from tariff changes, shipping disruptions, and political unrest. These changes can create new revenue opportunities. Note the example of TAL Apparels, which even offers its brands downstream services such as order fulfilment and store replenishment.

Asian manufacturers also need a strong procurement function that works as a strategic partner to the business units, employs advanced sourcing methods, and uses digital and Gen AI tools to speed up its processes. Given the influence of commodity prices on margins, they also need to establish the right pricing models with brands and suppliers.

Manufacturing

Current manufacturing operations are highly people-intensive, and subject to risks around regulation, labor relations and retention. Recent attempts by Asian manufacturers to incorporate automated machinery have proven economically unviable (as automation was deployed in islands and investing in labour was still cost effective), but they can boost efficiencies through contract manufacturing, machinery rentals, and a temporary workforce; while tactical automations such as sensors and IoT devices can highlight productivity issues and sources of waste.

The innovations to track for future consideration include:

- Automated weaving, knitting and sewing. Advanced looms and knitting machines use automation and IoT to increase accuracy and reduce material waste

- Robotic sewing machines. Sewbots use computer vision to stitch garments with precision, reducing labor costs and improving consistency

- Smart finishing. Technologies such as plasma and laser treatments, as well as dry finishing methods, improve fabric properties while reducing chemical use. They also speed up production and reduce thread waste.

Better ways of working

To unlock these opportunities, apparel manufacturing companies must embrace changes to how they work, including:

- Better organization and governance. Asian manufacturers need to drive standardization and scale and, with brands looking to nearshore, they should also revisit their own footprint. Functions such as manufacturing, supply chain, procurement, IT, and finance must become more centralized. Governance and accountability need to be enhanced by using select KPIs for each layer of the organization

- Data and digital enablement. Asian companies tend to underinvest in foundational enablers, such as data. Before looking at AI and advance use cases, manufacturers need to establish a robust enterprise-wide data architecture and analytics mechanism, to establish visibility on KPIs and operating model parameters and facilitate key decisions

- Cross-industry collaboration. Apparel manufacturers share a number of local and market-specific pressures. For instance, those in Sri Lanka all face the same high costs in ocean freight and limited shipping guarantees. This is a prime opportunity for industry players to come together and address the challenges

Conclusion

The Asian apparel industry stands at a crossroads. Upstream players face intense pressure to improve margins and achieve returns reflecting the risks their investors take. Their operating models require significant change and standardization.

But it's worth noting that the disruption and squeeze from downstream they're facing are nothing new. Other industries have navigated these changes before. This is, in fact, a golden opportunity for apparel companies to go back to the fundamentals of value creation and prioritize investor returns. Their success will depend on the choices and changes they make.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.