- within Environment topic(s)

This In Practice article looks at the key features of net asset value facilities (NAV facilities) for private equity real estate funds and discusses some of the points of difference when compared to NAV facilities for private equity buyout funds.

Net asset value facilities (NAV facilities) are facilities provided to a private capital fund (or, more commonly, to an aggregator vehicle directly below the fund) which "look down" to the fund's investments, with the lender having security over – and recourse to – the net asset value of those investments and the cashflows they generate.

NAV facilities originated in the secondaries space as a form of acquisition finance to purchase and leverage portfolios of secondary interests. NAV facilities have subsequently been adopted by fund managers across asset strategies, and that has been particularly true for private equity buyout funds (PE Funds) and private equity real estate funds (PERE Funds) over the last few years, against a backdrop of rising interest rates and rising inflation (among other macroeconomic issues) which have created a challenging exit environment and a corresponding requirement for funds to source alternative liquidity.

There are significant variations in the structure and key terms of NAV facilities used by different fund strategies. This article looks at the key features of NAV facilities for PERE Funds and discusses some of the points of difference when compared to NAV facilities for PE Funds.

KEY STRUCTURAL FEATURES

NAV facilities made available to any fund, regardless of fund strategy, are by their very nature bespoke products with key terms that vary depending on (among other things) the structure of the fund itself, the number of investments held by the fund, and the anticipated exit horizon for those investments. NAV facilities to PERE Funds and NAV facilities to PE Funds will however be structured in similar ways.

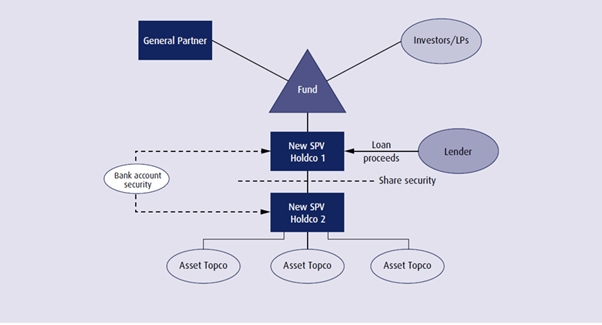

In both cases, the NAV facility will be made available to either the fund or to an aggregator vehicle directly below the fund, which is usually a limited company (but can be a limited partnership). In the paradigm NAV facility structure, there would be two holding companies below the fund (see diagram). "New SPV Holdco 1" is the borrower under the NAV facility and grants security over its shares in "New SPV Holdco 2". The pledge over the shares in New SPV Holdco 2 gives the lender an indirect pledge over the entire fund portfolio.1 A lender will also take security over the bank accounts held by New SPV Holdco 1 and New SPV Holdco 2 into which the realisation proceeds and other distributions from the investments are required to be paid pursuant to contractual undertakings in the facility agreement.

In the absence of an aggregator vehicle below the fund that sits above the portfolio, a lender will not be able to take an indirect pledge over the portfolio but could, as an alternative, take security over the top holding company (each a "TopCo") of each (or some) eligible investment(s).

This is often less palatable from a lender's perspective, as it means there is no single point of enforcement. Equally, borrowers may well favour the indirect pledge route on the grounds of cost – especially where the Topcos are established across multiple different jurisdictions, which necessitates share pledges (and legal opinion coverage) in each relevant jurisdiction.

In a PE Fund that structure can be challenging as the management team of each investment are likely to have shares or other interests at the TopCo level, and there will also often be co-investors either at the Topco level or further down the holding company structure, which may in both cases require change of control consent to grant the security (which can usually be avoided with the "indirect" pledge) and to enforce that security. For that and other reasons, the first step in structuring a NAV facility for a PE Fund will often be to insert an aggregator/holding company below the fund if there is not one already, in order to facilitate the NAV financing.

The same problem does not usually arise in PERE Funds. The holding company structure for properties held by PERE Funds is usually more straightforward than it is for PE Funds; there may only be two or three holding companies between the PERE Fund and the property, there will not usually be any management shareholders, and co-investors will typically also be more limited. It is therefore easier and more common in a PERE Fund to grant security over the shares in each TopCo to a lender.

DUE DILIGENCE

Given the simpler holding structures and the limited number of management and co-investors in PERE Fund structures, as well as the nature of the investments, the legal and commercial due diligence a lender will need to undertake for a NAV facility to a PERE Fund is usually more streamlined than for a NAV facility to a PE Fund. Verifying ownership is a quicker exercise if there are fewer holding companies, and the limited number of third-party stakeholders in the investment holding structure makes the change of control analysis on both taking and enforcing the indirect pledge or TopCo share security significantly more straightforward. There are also likely to be fewer (or no) antitrust and regulatory issues to factor into any enforcement analysis.

THE LTV RATIO, MATERIAL INVESTMENT EVENTS AND CONCENTRATION ADJUSTMENTS

NAV facilities are sized by reference to the net asset value of the fund's investments (being the value of the assets of the fund less the liabilities, principally, any asset level debt) which is measured through the loan-to-value ratio (LTV Ratio). The LTV Ratio is calculated as the outstanding financial indebtedness of the borrower/fund under the NAV facility as a percentage of the aggregate net asset value of the investments owned by the fund.

Typically, only those investments which are "eligible" are taken into account for the value side of the LTV Ratio, with eligibility determined by reference to a pre-determined set of eligibility criteria. An eligible investment can then cease to be "eligible" during the term of the NAV facility (and will no longer be included in the LTV Ratio) if certain adverse events occur in respect of that investment, which are usually defined as "Material Investment Events" (MIEs). The aggregate NAV of the eligible investments is often further adjusted through a series of concentration limits, which operate to limit the percentage value of an eligible investment that would otherwise count towards the aggregate eligible NAV.

Eligibility criteria, MIEs, and concentration limits will vary between NAV facilities to PERE Funds and NAV facilities to PE Funds.

Eligibility criteria are transaction-specific depending on the lender's risk appetite and the nature of the fund's investments. Whilst there are eligibility criteria that will often be applicable to both PERE Funds and PE Funds (for example, a requirement for investments to be in specified jurisdictions, or wholly or majority owned), because eligibility criteria look at the nature of the investments there will be natural differences between PERE Funds and PE Funds – common eligibility criteria for PERE Funds (that would not be relevant to a PE Fund) include asset class (for example, inclusion or exclusion of logistics/office/retail/ residential/light industrial) and a requirement for the property to be fully let (or for a specified percentage of the property to be let) and/or not under construction.

A reasonably standard set of MIEs has developed in NAV financings and these would be common to both PE Funds and PERE Funds – they include:

- a material event of default and/or acceleration under any principal asset level financing;

- an entity within the Holdco stack becoming insolvent or subject to insolvency proceedings; and

- distributions from the investments being restricted.

In addition, the MIEs for PERE Funds might include forfeiture proceedings (or the equivalent in the relevant jurisdiction) being commenced in respect of an eligible property, the compulsory purchase of an eligible property, or material damage or destruction to an eligible property in circumstances where insurance proceeds are not sufficient to reinstate and/or compensate for loss of rent.

Concentration limits are also transaction-specific – their purpose is to reduce concentration risk in the portfolio. A common concentration limit for both PERE Funds and PE Funds is a limit on the percentage value of the largest investment or investments that can be taken into account when calculating the aggregate NAV of all eligible investments. Other concentration limits in NAV facilities to PERE Funds will often be property specific and could be based on geographical location of the Property, whether or not the property is under construction or based on asset class.

"LOOK-THROUGH" LTV RATIO

As noted above, the LTV Ratio is calculated on the net asset value of the fund's investments. To give a better picture of a fund's overall leverage there might, in addition to the LTV Ratio, be a "Look-Through" LTV Ratio. This measures all the debt in the fund (both the NAV facility and any other external debt at asset level or elsewhere in the investment holding structure) as a percentage of the gross asset value of all of the eligible investments and any freely available cash. Look-Through LTV Ratios are common in NAV facilities to PERE Funds, in addition to LTV Ratios.

VALUATIONS

The LTV Ratio in NAV facilities for both PE Funds and PERE funds is typically calculated quarterly, by reference to the valuations provided in the most recent quarterly report prepared by the general partner (GP)/manager of the Fund for its investors. Those valuations are prepared internally by the GP/manager by reference to valuation guidelines and policies set out in the fund's governing documents.

Given that the fund is valuing its own investments without third party input (albeit in accordance with various policies and industry guidelines), lenders will often negotiate valuation challenge rights in NAV facilities, giving the lender the ability to call for an independent third party valuation of the investment(s) in circumstances where the lender believes that the fund's valuation of the investment(s) is overstated.

These Lender valuation challenge rights will be a key point of negotiation and the nature of the challenge rights varies considerably between deals. However, obtaining a third-party valuation of real estate is typically more straightforward – and less expensive – than obtaining a third-party valuation of private companies. This relative ease by which a third party valuation can be obtained for real estate will often feed through into the valuation challenge rights in NAV facilities for PERE Funds – challenge rights might be more frequent than they would be in a PE Fund NAV facility, for example, or the PERE Fund might negotiate a counter challenge right, with the ability to call for its own independent valuation to challenge the independent valuation obtained by the lender (with the value of the property for the purposes of the LTV Ratio often then being the midpoint between the two independent valuations).

CONCLUSION

The similarities between NAV facilities to PE Funds and NAV facilities to PERE Funds are arguably greater than their differences but there are, as we have shown, fundamental points of departure between the two. These factors need to be considered when structuring and executing a NAV facility for a PERE Fund.

Footnote

1. Certain lenders – typically, private credit funds lending to PE Funds – will forgo the share pledge and undertake only light touch due diligence in exchange for increased pricing and speed of execution.

This article was first published in the October 2025 issue of Butterworths Journal of International Banking and Financial Law.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]