- with readers working within the Pharmaceuticals & BioTech industries

- within Cannabis & Hemp, Law Practice Management and Insolvency/Bankruptcy/Re-Structuring topic(s)

This is a complete practical guide to gender pay gap reporting obligations for companies of all sizes and sectors in Great Britain. The FAQ format is designed to help employers to calculate your gender pay gaps and prepare your gender pay gap reports. Based on our experience of advising employers of all sizes and across all sectors since 2016, we show you how to get it right, avoid common pitfalls, and ensure your gender pay gap reporting is accurate, compliant and credible.

Introduction

This guide draws on our years of experience advising employers of all sizes and sectors on gender pay gap reporting – from small regional care providers to leading retailers, advertising agencies, law firms, and tech companies.

It answers both the common and tricky questions employers face, giving practical, actionable guidance based on experience rather than theory.

This guide is primarily for those leading gender pay gap reporting in their organisations: HR professionals (including senior HRDs), Reward Leads, in-house employment lawyers, and Payroll Managers. It is designed to help employers avoid legal and reputational risk, comply with gender pay gap reporting regulations, and provide fast, reliable answers to the hardest gender pay gap reporting questions.

In practice, we frequently see employers inadvertently make avoidable mistakes: data errors, misinterpreted calculations, or narratives that fail to satisfy stakeholders. Gender pay gap reporting involves many decisions and judgement calls, and the wrong ones can cause significant issues later. This guide shows you how employers can get it right, avoid common pitfalls, and ensure gender pay gap reporting is accurate, compliant, and credible.

Scope and obligations for gender pay gap reporting

This section sets out who needs to report their gender pay gap and how to work out which employees are in scope. In our experience advising employers on gender pay gap reporting, many employers aren’t sure which of their workers fall in scope. This section will therefore be most useful for employers who have a variety of workers on their books across multiple sites and entities, or those who are not sure which workers are in scope for reporting, including apprentices, agency workers, partners (LLP members) and TUPE-transferred employees. When these issues aren’t clarified early on the in process, we find that employers will have to go back to the start: collecting data and running calculations again. The questions below are designed to help employers avoid this and help to get it right from the beginning.

- Who needs to report gender pay gap data?

All employers with 250 or more employees on the “snapshot date” of 5 April (or 31 March for public sector employers). You must report by 4 April the following year (or 30 March for public sector employers).

The gender pay gap reporting regulations applies to employers to Great Britain i.e. England, Wales and Scotland, but not Northern Ireland. - Do employers with fewer than 250 employees need to

report a gender pay gap?

No. If an employer had below 250 employees on the snapshot date, it does not need to report. For employers that have reported in the past, and who expect to report again in future, we would suggest keeping a close eye on your headcount. - How is the “snapshot date” determined for

gender pay gap reporting?

The snapshot date is fixed by the gender pay gap reporting regulations: 5 April for private sector employers and 31 March for public sector employers. - If my headcount falls below 250, do I still have to

report?

If headcount was 250 on 5 April (or 31 March for public sector employers), you must report. If it subsequently drops below 250, then the reporting obligation does not disappear. You must still report by 4 April of the following year (or 30 March for public sector employers). You would not have to in subsequent years of your headcount remains below 250. - Can different legal entities in a group report

separately?

Yes, different companies must report separately. There is no aggregation of employees across a group. For example, if there are three companies in a group, each of which has 200 employees, then there is no reporting obligation. - What is an “employee” in gender pay gap

reporting?

“Employee” is broadly defined. It includes employees, workers and some self employed contractors who are personally engaged to do work. Essentially, if someone is treated as an employee for the purposes of discrimination law, they are likely to be considered an employee for gender pay gap reporting purposes. - Are part-time, job-share, zero-hours workers included

in the count?

Yes. The definition of “employee” is broad in the gender pay gap reporting regulations. It includes part-time, job-share and zero-hours workers.

Some employers will operate a “bank” staffing system with a number of employees on the books that they offer work to from time to time. Because these remain employees, they will count towards the headcount, and must be included in all statistics. - Are contractors included in gender pay gap reporting

calculations?

Yes, but it depends on nature of the engagement. It includes contractors if they provide “personal service” (broadly if you’re paying them specifically for a particular task or role and they can’t substitute another person). Someone engaged via a personal services company (Joe Bloggs Ltd) will be outside of the scope of gender pay gap reporting.

These days, we rarely see contractors being engaged personally. Many employers changed their processes when IR35 changes were implemented. Most contractors are being engaged through personal services companies and so are outside of the scope. - Does the 250-employee threshold include casual staff or

bank workers who did no shifts in April?

Yes, they still count towards the headcount and must be included in the bonus gap and bonus proportions statistics. But as they did no work and received no pay during the month containing the snapshot date (April, or March for public sector employers), they would not be considered “full pay relevant employees” and so not included in the pay gap or quartile statistics. - Do apprentices count toward the 250-employee

threshold?

Yes. - How do you count employees if your company has multiple

sites in Great Britain?

What matters is the number of employees that an entity has. Whether there are employees in multiple locations does not affect the reporting obligation.

However, it would be very relevant when seeking to explain the gender pay gap. These sorts of geographical pay differences (e.g. London weighting) might explain some of the gaps. - Are LLP members counted as employees for gender pay gap

reporting?

No. They are outside the scope.

In the legal sector, it is best practice (and recommended by the Law Society) to report gender pay gaps both without LLP members (in order to comply with the gender pay gap reporting regulations) but also including the LLP members. This gives a more realistic idea of the gap across the whole workforce. - Do agency workers count toward the headcount for gender

pay gap reporting?

No, not unless they are employees of the reporting company. Agency workers are usually employees of the agency, not the end user. - Can overseas workers be included in your gender pay gap

report? How do you handle multi-jurisdictional employees in the

gender pay gap calculation?

It depends. What matters is whether someone falls within the definition of employee, and this is essentially whether they count as an employee for the purposes of discrimination law.

The general approach that most employers will take is to include outbound secondees but exclude inbound secondees. But this general approach isn’t perfect and might not capture all “employees” for gender pay gap reporting purposes. A case by case examination of the particular facts is usually required. - Are terminated employees who left before the snapshot

date included in the dataset?

No. Someone only counts if they were employed on the snapshot date (5 April for private sector employers or 31 March for public sector employers). - How should retailers handle large volumes of seasonal

staff in gender pay gap reporting?

Only those employed on 5 April (since retailers are private sector employers) will count towards the headcount and statistics calculations. Those employed for a limited period, such as summer workers and Christmas workers, will not be included – their employment will have ended by the time the snapshot date comes around (unless they remain a “bank” employee). - If a group restructures (mergers, demergers) between

the snapshot date and reporting date, does the obligation

transfer?

The obligation to report attaches to the legal entity. If the entity still exists, it must report (even if it is empty and all employees have been TUPE-transferred out) – but it would not have to report subsequently unless it still has 250 employees on the next snapshot date. - Are TUPE-transferred employees included if the transfer

occurs either before or after the snapshot date?

If TUPE transferring employees transfer before the snapshot date they will be included as employees of the new entity.

If they transfer after the snapshot date, they will not be included in the dataset as they were not employed at the relevant time (they would be included in the old employer’s dataset). - Can charities or non-profits be exempt from

reporting?

No. Any employer with 250 or more employees on 5 April (or 31 March for public sector employers) must report.

Understanding gender pay gap reporting regulations

This section sets out what information counts as “pay” and “bonus” in gender pay gap calculations and what should (or shouldn’t) be included. This is an area where employers often get stuck and we see elements of remuneration wrongly being included or excluded from calculations. We set out the most common elements of remuneration and advise on whether these should be included.

- What counts as “pay” in gender pay gap

calculations?

Ordinary pay includes the employee’s basic pay (their salary including pay for leave, plus any allowances, shift premia and standby allowances).

It also includes salary sacrifice i.e. the amount that the employee has sacrificed. Salary sacrifice is best thought of as being a “negative payment” rather than a deduction; salary sacrifice reduces the amount of gross taxable pay and gender pay gaps must be calculated from gross pay. - What counts as “bonus” in gender pay gap

calculations?

“Bonus pay” has a very broad definition. It covers cash, shares (including share options), and vouchers.

Bonus payments must relate to “profit sharing, productivity, performance, incentive or commission”. This broad definition means most cash payments can be capable of being a bonus: all payments are likely to be an “incentive” of one sort or another.

It excludes redundancy pay or other termination payments. - Can something be both a bonus and pay?

No. A payment cannot be both pay and bonus. A payment will be one or the other (or neither) but never both. Some types of payments can be borderline and so a judgment call will need to be made.

Generally, a regular payment will be more likely to be pay, whereas a one off payment will be more likely to be bonus (but this is not a hard and fast rule). - Are redundancy payments included in gender pay gap

reporting?

No, these are outside of the scope of the gender pay gap reporting regulations. - Is salary sacrifice taken into account in gender pay

gap reporting?

Yes. All calculations must be based on the employee’s actual pay after salary sacrifice.

When collating your data, make sure you take all sacrifices into account. This is because salary sacrifices are not a true deduction, but instead a negative “payment”. A salary sacrifice is an agreement to get paid less on condition that a benefit is provided.

In our experience, a common issue that employers can overlook are bonus sacrifices – where someone elects to put their whole bonus into their pension, instead of taking the tax hit. This can often make no intuitive sense. Salary sacrifices are choices made by the individual employee, so why should an employee’s choice have an impact on pay gaps? There are arguments for and against calculating on this basis, but at the moment, the legal position is clear: the figures used in the calculations must be post salary sacrifice. - Do you include benefits in kind in gender pay gap

reporting?

No. Only pay and bonus is within scope. Pay must be a cash payment. Bonuses can be cash, vouchers or shares.

For example, a car allowance would be included as pay. But a company car would not be included at all in any calculations. When companies are acquired and bring with them these sorts of differences, it can affect pay gaps. Extra analysis can be useful to determine the impact that this has. - What is a “full-pay relevant

employee”?

Employers only need to report the pay gap and pay quartile calculations for “full-pay” employees, meaning those employees who receive their normal pay during the relevant pay period.

A “full pay relevant employee” is someone who received full pay in the pay period that includes the snapshot date (5 April, or 31 March for public sector employers).

Someone is not a full pay relevant employee if, because of leave, they received reduced pay in the pay period that includes the snapshot date (either 5 April or 31 March). It does not have to be completely unpaid leave – if pay is reduced only slightly, this will stop them being a full pay relevant employee.

For example, someone started maternity leave on 30 April and was paid 90% of full pay from this point onwards. Although just one day in April was reduced, and it was reduced only by a small amount, they cannot be a full pay relevant employee.

Relevant employees who are not full pay employees still count in determining whether the employer has 250 or more employees, and in the calculations for the bonus gap. - Is someone who left mid month in April a full pay

relevant employee?

Yes, unless there are other reasons why their pay was reduced (such as unpaid leave, maternity leave or sick leave, for example).

If someone received less pay during April because they left mid month (eg 15 April), then they are not a reduced pay employee. For the period that they worked which includes the snapshot date of 5 April, they received full pay. You should use a different pay period when calculating the hourly rate and when pro rating bonuses (i.e. if someone left on 15 April, use 15 days as the pay period and not the full month).

In practice we see that this is a common pitfall that employers can often get wrong. - How do you treat employees on leave (maternity,

paternity, sabbatical etc) in the calculations?

What matters is whether they were on reduced pay during the snapshot period because of leave. If someone is on full pay maternity/paternity leave, full pay sick leave, or any other period of leave being paid full pay, they are a “full pay relevant employee” and included in the pay gap and quartile calculations.

Where employers can often make mistakes here is with employees who transfer from full pay to reduced pay during the April pay period. Even if just one day is paid at a reduced rate, the employee will no longer be a “full pay relevant employee” and must be excluded from the pay gap and quartile calculations. - What if a contractor is inside the scope of gender pay

gap reporting but the data isn’t available?

Where contractor data is missing, and it is not reasonably practicable to get the data (for example, hours or gender data isn’t held on your systems), a contractor can be removed from the reportable statistics. However, they would still count towards the headcount.

In practice, although gender data can be easily obtained by simply asking the contractor, hours information may not be available. This is especially where a contractor is engaged to complete a task/project, rather than being paid a day rate. - How do you treat zero-hours contract workers?

The gender pay gap reporting regulations state that, for employees working variable hours, a 12 weekly average should be used for the number of hours to use in the calculation unless there is “some other reason” why this can’t be used.

For zero-hours contracts workers (who are paid according to an hourly rate), a 12 weekly average can lead to distorted and inaccurate results.

For example, someone working just a few hours a week but then working full time in April would have low average hours. The calculated hourly rate using average hours would be much higher and unrealistic. It would mean that people getting paid the same in April for the same work would have different hourly rates for gender pay gap reporting.

For this reason, we would suggest using the actual hours worked during the April pay period, rather than an average, and relying on the “some other reason” alternative discussed above. This will give more accurate hourly rates. This approach is in line with the government’s gender pay gap reporting guidance.

If a zero hours contract worker did not do any work during April (or March for public sector employers), meaning there is no pay or hours with which to calculate the hourly rate, they should be removed from the pay gap and quartile calculations as they are not a full pay relevant employee, but they should be included in the bonus gap and bonus proportions calculations. - How do flexible working and part-time roles impact

gender pay gap calculations?

Flexible and part time roles should not impact gender pay gap calculation. This is because gaps are calculated from hourly rates, and these hourly rates take into account the fact that people work different hours.

That said, these sorts of roles can affect the bonus gaps. This is because bonus gaps do not take into account the fact that people may have received reduced (pro rated) bonuses because of their part time status.

When this has a big impact on the bonus gaps, we suggest voluntarily reporting an additional statistic showing what the gap would be if this were taken into account. - Are employees on garden leave included?

Yes, as they remain employees until their leave is over and their employment terminates. - How do you classify employees paid via umbrella

companies?

These would not be “employees” for gender pay gap reporting –if they are genuinely engaged via an umbrella company then this takes them outside of the scope. They would be employees of the umbrella company. - How do you treat GB-based employees who are

tax-resident elsewhere?

It depends on the facts. A GB based employee (England, Wales or Scotland) who is employed by the GB entity, is managed by GB managers, and paid in pounds will probably still be an “employee” for gender pay gap reporting purposes.

Deciding how to include international employees (if at all) can be a tricky area for employers and the facts of each case are really important. Ultimately, a judgment call needs to be made but it needs to be defensible. International employees can be highly paid and their inclusion/exclusion can materially affect the pay gaps. Do seek advice for specific cases. - How do you handle transgender individuals?

The government guidance says that transgender employees should be included in the calculations for the gender that they identify with. A recent decision of the Supreme Court that the definition of “sex” in discrimination law is based on biology may now mean that reports should be based on biological sex, but we recommend continuing to follow the government’s current guidance on this point. - How do you handle individuals whose gender is not

recorded or who identify as non-binary?

As the statistics only cover men and women, we recommend that employees who do not have a recorded gender or are non-binary should count towards the headcount but not be included in any of the statistics. - How should you deal with bonus payments that are

irregular or retrospective?

The gender pay gap reporting regulations refer to bonuses paid to the employee in the 12 months ending on the snapshot date – 6 April to 5 April the following year (or 31 March to 30 March for public sector employers). The period those bonuses relate to isn’t taken into account. This means both irregular and retrospective bonuses will be within scope.

For example, a company pays annual bonuses in March of each year normally. But its bonuses were delayed until May last year before being paid as usual in March the following year. This means that there would be two annual bonuses that both fall within the 12 month period. The fact that one bonus should have been paid earlier, and relates to a different period, is irrelevant.

The position is very different when considering pay, the hourly rate, and whether to include retrospective payments. - Is commission treated as pay or a bonus for gender pay

gap reporting?

Commission is “bonus”. It should generally not be included as “pay”. But seek advice for specific cases. - Are sales incentives always bonuses, or can they be

pay?

Sales incentives are usually “bonus” and should generally not be included as “pay”. But seek advice for specific cases. - Are allowances (London weighting, location allowances,

skill allowances) considered pay?

Yes, the definition of pay includes allowances. Location allowances are within the scope of “pay”. - Should car allowances be treated as pay for gender pay

gap reporting?

Yes, the definition of pay includes allowances. Car allowances are within the scope of “pay”. - How do you treat backdated pay awards in the hourly

rate calculation?

Pay must relate to April (or March for public sector employers), so any backdated payments or backpay must not be included. - Do acting-up allowances count as pay?

Yes, the definition of pay includes allowances. Acting-up allowances are within the scope of “pay”. - Are taxable benefits included anywhere in gender pay

gap reporting?

No, they are outside of the scope of gender pay gap reporting and should not be included. - How do you treat employees on long-term sick

leave?

It depends upon whether they are receiving full pay or not. If they are receiving full pay (whether directly or from an insurer), then they are a full pay relevant employee and included in all calculations. If they are not receiving full pay, then they are only included in the bonus gap and bonus proportions calculations. - How do you handle a bonus that relates to multiple

years?

When calculating the bonus gap, all that matters is the amount of the bonus, and not the period that it relates to. If a payment relates to one month or 10 years, it makes no difference. The methodology required for the bonus gap doesn’t allow for (or require) any pro rating.

The answer is different for calculating the pay gap. Any bonuses that were paid in the snapshot pay period must be pro rated and then included alongside pay to calculate the hourly rate (and then the pay gaps). The appropriate way to pro rate a bonus will depend upon the details of that bonus.

For example, a long service award relating to 10 years’ service will be relatively straightforward. Simply divide by 3652.5 days (10 years x 365.25 days in a year) then multiply by the pay period (30.44 days for employees paid monthly).

But a more complicated commission scheme or share award might require that different bits of the bonus be pro rated separately, then combined. - Are referral bonuses included?

Yes, referral bonuses are within the definition of bonus. If paid in April (for private sector employers, or March for public sector employers) and needing pro rating, look at whether the referral bonuses are contingent upon anything. For example, if only paid out once the referred employee completes their 3 month probation, use 3 months (30.44 x 3 = 91.32 days). If half paid out after probation and half paid out after 12 months service, then the second instalment would be pro rated differently: using 365.25 days - Are sign-on bonuses treated as bonuses or pay?

Sign-on bonuses are within the definition of bonus. If paid in April (or March for public sector employers) and needing pro rating, look at whether there is any clawback provision. For example, if the sign on bonus is paid in April and be must be repaid in the event the employee leaves within 12 months, then use 365.25 days when pro rating. - Are retention bonuses included for gender pay gap

reporting?

Yes. Retention bonuses are included as they fall within the definition of “bonus”. - How do you treat profit-sharing payments?

These are bonuses – the definition of bonus expressly mentions “profit sharing”. - How do you treat share vesting where the value is nil

due to being underwater?

If the value is nil, and no income tax is payable upon vesting, then there is nothing to include. - Are dividend equivalents on shares included?

No. These are not within the definitions of pay or bonus. - Should LTIP awards be valued using market price or

vesting date value?

Vesting value. What matters is the taxable value for income tax purposes.

Data and calculations for gender pay gap reporting

This section sets out how to go about gathering your data and the calculations that you need to make to get the relevant information for each employee. It also includes information about different types of pay (e.g. share options, shift premia and back pay) and how this should (or shouldn’t) be included in your gender pay gap reporting, and how to deal with employees with variable hours. In our experience, we often see employers calculating inaccurate statistics as a result of not following the required methodology in the gender pay gap reporting regulations.

- How much data do you need?

You need 13 months’ worth of payroll data.

You need April payroll data so that you have pay and bonus information with which to calculate the hourly rate of each employee, and ultimately the pay gaps.

You also need bonus data for the 12 months prior to this. For most employers, this will be the payroll data for April (of the previous year) to March as this usually covers the period required by the gender pay gap reporting regulations (6 April of the previous year to 5 April). - How do you calculate the hourly rate?

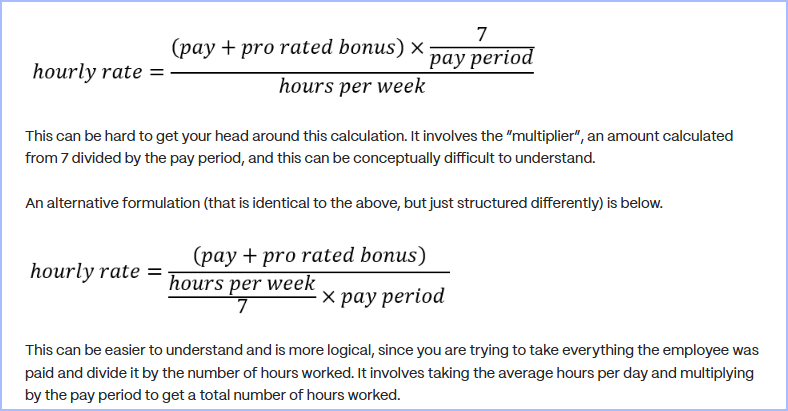

The hourly rate is calculated using the below formula:

- What is the “multiplier” used in the hourly

rate calculations?

It is seven divided by the pay period. This value is used in the calculation for the hourly rate.

For example:

- If someone worked for a week, the multiplier is 7/7 = 1

- if someone worked for 14 days, the multiplier is 7/14 = 0.5.

- If someone worked a full month, the multiplier is 7/30.44 = 0.23

- How do you calculate the mean and median gender pay

gap?

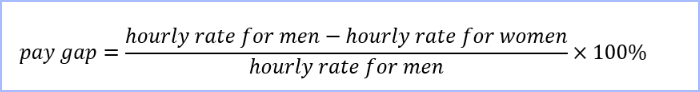

Pay gaps are calculated by taking the average (mean or median) hourly rate for men, subtracting the same for women, then dividing by the average (mean or median) rate for men.

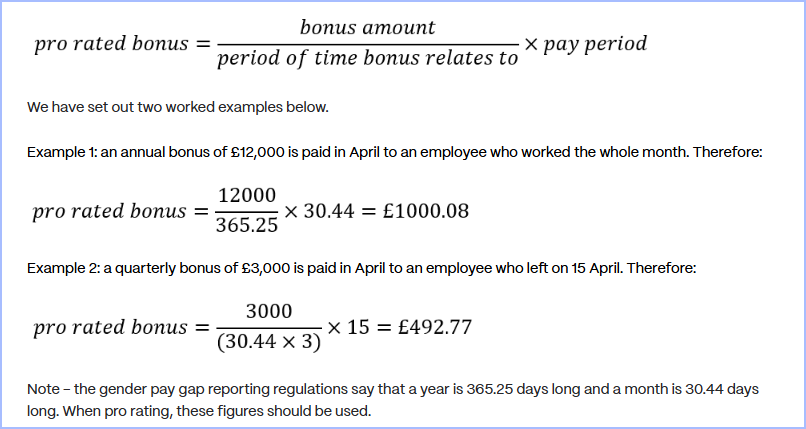

- How do you pro rate bonuses?

- When do you use pro rated bonuses in the

calculations?

Pro rated bonuses are only used when calculating the hourly rate, which is then used to calculate mean and median pay gaps. - How do you merge multiple payrolls for reporting

purposes?

This is important: don’t confuse different payrolls with different entities. This is a common mistake. If you have employees employed by the same legal entity but paid using different payrolls, then you will need to consolidate the data. This is likely to be a manual task involving copying and pasting data and columns until the dataset is consistent. - What do you do if multiple people straddle a quartile

boundary?

Employees must be allocated proportionately equally across quartile boundaries. This is easiest to understand in an example.

An employee has 400 full pay relevant employees and so each quartile needs to have 100 men and women in each. There are 15 employees all with the same hourly rate which separates the lower and lower mid quartiles. These 15 employees are 5 men and 10 women ie a ratio of 1:2. The lower quartile (in this fictional example) needs 6 employees to make it up to 100. Because of the requirement that employees be allocated in proportionately equal amounts, you cannot just put 6 men in the lower quartile to make the quartile figures look better. You need to allocate men and women in that same 1:2 ratio i.e. 2 men and 4 women. This then leaves 9 employees (3 men and 6 women) to be allocated to the lower mid quartile.

In this example, the numbers involved have been chosen to demonstrate the point simply. In practice, that might not be the case. You may have 3 employees to allocate to one quartile but there are 9 employees straddling the boundary and they are 1 man and 8 women. You therefore will need to allocate employees in as proportionately equal way as possible (which in this case would mean 1 man and 2 women, even though this is some way off the 1:8 ratio). - What do you do if payroll data is missing or incomplete

for some employees?

If you are missing data, you may be in breach of the gender pay gap regulations if you do not investigate this and capture the relevant figures in your data. If the data cannot be found, you should estimate this for the relevant employee. - How do you calculate hourly rates for employees whose

hours change week to week?

For those who work variables hours, we suggest using the actual hours worked in the period that includes the snapshot date. This will give the most accurate hourly rate.

The gender pay gap reporting regulations refer to using a 12 weekly average number of hours, unless there is “some other reason” to use another amount. Using a 12 weekly average will almost always provide an inaccurate and unrealistic hourly rate so in our experience using the actual hours worked (and actual pay received) for variable hours employees will give the best result.

Any overtime should be excluded. - Which pay period should you use if your payroll runs

from mid-month to mid-month?

You need to use the payroll period that includes your snapshot date (5 April for private sector employers, 31 March for public sector employers).

For those employers that pay for the whole month, this would be either the April payroll (for private sector employers) or the March payroll (for public sector employers).

For those employers that have a payroll that runs from mid March to mid April, use this data in your pay gap calculations. - Should you include overtime in hourly rate

calculations?

No. Overtime is expressly excluded from the definition of pay in the gender pay gap reporting regulations. - How do you treat shift premia, call-out allowances and

standby allowances?

These are all allowances within the definition of “pay”. They must be included. - If someone receives back pay in April, does this go

into pay or bonus?

Neither. It must be excluded from the dataset.

Only pay that relates to the pay period must be included. Since back pay would relate to another pay period (i.e. not April), it must be set aside and removed from the calculations. - How do you handle share option exercises that span

multiple tax years?

Look at when the options are exercised – that is the important date, rather than when someone became able to exercise. This is when an income tax charge will arise (in relation to the discount on the value of the shares). - How do you pro rate the value of share option

exercises?

This will be relevant if the options are exercised during the pay period that includes the snapshot date (5 April for private sector employers). The appropriate way to pro rate a share option will depend upon the specific details of the option. It’s complicated and tricky to do, and can have a big impact on your gaps if done incorrectly (as the values can be high). - How do you deal with employees who have multiple roles

with different hourly rates?

Anyone with multiple roles is still just one employee. Their pay from their multiple roles should be added together into one total (the same is done with hours) and this is then be used to calculate their hourly rate. - Can you use estimated hours where actual hours are not

recorded?

The starting point should be the employee’s contractual hours. We suggest making changes to your systems to improve how you record hours for any employees working variable hours if they are not currently recorded accurately (as this is important for other reasons too). If you do not have actual hours for a particular employee, it is better to use your best estimate rather than omit them from the figures. - How do you treat negative pay (e.g., clawbacks or

corrections) in the April pay period?

These should be ignored. Pay must relate to April only (or March for public sector employers), so any revisions from previous months must be set aside. - What are the most common data errors employers make

(and how to avoid them)?

We often see the below:

- Ranges in formulas missing data

- Incorrect cell references created from dragging formulas and not using absolute references (i.e. formulas with $ signs in them).

- Data not formatted properly e.g. a mixture of dd/mm/yyyy and mm/dd/yyyy

- Spaces in things like gender details causing formulas to skip cells e.g. “M ” instead of “M”

- Typos

Interpreting gender pay gap statistics and writing your narrative

This section is about the narrative you should create behind your pay gap statistics, and reputational risk. In practice, the mistakes we often see are making inaccurate statements (particularly about statistics), not providing enough well-informed clarity about the scale of any gender diversity problems, and being overly confident or over-promising on future actions. Our advice is to focus on long-term trends in gaps, as well as good governance and future long-term planning on improvements.

- We have an x% gap. What’s wrong with saying

“men get paid x% more than women”?

This is statistically inaccurate.

All gender pay gaps are calculated with reference to the average (mean or median) rate for men, expressed as a percentage.

Percentages cannot be flipped around – if there is a gap of 20%, it means women are paid 20% less than men. It does not mean men are paid 20% more than women.

For example, if the average bonus was £8k for women and £10k for men, then this is a 20% gap since (10-8)/10=0.2 (x100% = 20%). But using the same figures it means men are paid 25% more than women since (8-10)/8=0.25 (x100% = 25%).

To be accurate, always say “women are paid x% more/less than men”. - How do you explain a widening gender pay gap in your

narrative?

It depends on why the gap is widening. Possible causes could be:

- Your strategy isn’t working (or you don’t have one). A gap might be widening because more men are joining in higher level or specialist roles (such as sales or engineering). If this is the case then your explanation should own up to this. It should set out what you’ll be doing differently in future to try to address it.

- Growth: acquisition / organic. Companies that grow quickly can have gaps that increase a lot. The balance and need for different types of roles will shift. For example, while in the early stages of a company’s growth cycle most employees might hold technical, development or R&D roles, in later stages a larger proportion might be sales roles. To keep gaps low, and ensure you’re not missing out on talent, it’s important at all stages of growth to ensure that there are no barriers for women in the workplace.

- New female talent pipeline. Gaps might have increased as a result of a large number of women joining into entry level or junior roles. This would push gaps up as mean/median pay for women would fall. However, over the long term, this would reduce gaps as this new cohort of women progress and reach better, higher paying jobs. Your narrative in this case should focus on how you are ensuring that women will stay in the workforce (are there any cultural issues? Is there an issue with the parenthood penalty?) and achieve promotion to more senior roles.

- How should you frame year-on-year changes in your

gender pay gap narrative?

Long term trends are more important than year-on-year changes. Avoid being over celebratory if a gap reduces in one year – it may not the following year. If you take responsibility for the wins, it means that you also have to take responsibility for the losses. We would suggest language which talks about being “pleased” if a gap reduces “or cautiously welcome” the reduction. Conversely, use language such as being “disappointed” that a gap has increased. But, in either case, always emphasise that “long term trends are important”. - What is the audience for a gender pay gap report? Who

reads gender pay gap reports?

A gender pay gap report is read by job applicants, employees, media, competitors, investors, suppliers, and customers. Each audience interprets the same data differently. if your report focuses solely on compliance, this risks misalignment, misunderstanding, and reputational harm.

- Job applicants. Job applicants read gender pay gap reports as an indicator of workplace culture and progression. They tend to focus on senior representation, transparency, and whether the organisation acknowledges structural issues rather than dismissing them. Tone and credibility matter more than technical detail.

- Press and media. The press reads gender pay gap reports to identify stories. Large gaps, significant year-on-year changes, unexplained movements, or tension between the figures and the narrative are common points of interest. Overly defensive or generic explanations increase media risk.

- Current employees. Employees read gender pay gap reports to assess fairness and trust in leadership. They tend to look for clarity, honesty, and credible action rather than reassurance alone. Poorly framed narratives can damage confidence even where pay practices are lawful.

- Competitors. Competitors use gender pay gap reports for benchmarking. They will compare headline figures, trends, and explanations against sector norms. Consistency and coherence across reporting years are often more important than absolute gap size.

- Investors. Investors treat gender pay gap reporting as a governance and risk signal. They are likely to focus on trend direction, leadership accountability, and data control. Persistent or widening gaps without clear explanation can raise concerns about workforce strategy and long-term resilience.

- Suppliers and partners. Suppliers increasingly review gender pay gap reports as part of ESG and responsible business assessments. They will look for alignment between stated values and reported outcomes, particularly in long-term or reputationally sensitive relationships.

- Customers and clients. Customers use gender pay gap reports as a trust and reputation indicator. In consumer-facing and public sector-adjacent organisations, figures and narrative can influence brand perception and purchasing decisions.

- How can you make your gender pay gap narrative

meaningful for employees and investors?

Employees want clarity and fairness, while investors want evidence of good governance and long-term workforce planning. A good narrative should address both sets of concerns.

Be specific about what’s driving your gap, what’s being done about it and how progress will be tracked, avoiding vague commitments or generic statements. Showing that the report is not just a compliance exercise but part of a broader people strategy makes the narrative relevant for every audience. - What are common red flags to avoid in gender pay gap

reports?

There are a few common errors to avoid:

- Overpromising. Don’t set targets that are not realistic. A target should stretch and be challenging, but be achievable.

- Make sure you follow through with promises. If you say you are going to implement new measures to improve your gaps, make sure you do.

- Over confidence on equal pay. Many reports will state that representation is the cause of gaps, not equal pay issues. It is also common for employers to state their “confidence” that there are no equal pay issues. Unless you are genuinely confident (and have, for example, carried out a robust pay equity analysis and have a good job levelling system in place), we’d suggest not making statements such as this. In the event of an equal pay claim in future, misplaced or unchecked confidence such as this could become the subject of cross examination in the Employment Tribunal.

- How do you tell a “story” with your gender

pay gap data without overselling it?

They key is to understand what’s causing your gaps. It’s impossible to tell a compelling or accurate story without this. Carry out a deep dive analysis to understand the causes of your gaps, and make sure you know how big the change needs to be (and where) to eliminate them – you can obtain these insights by carrying out simulations. - Can you use your gender pay gap report as a recruitment

tool?

Absolutely. More and more people look at gender pay gap reports when considering where to seek careers. - How do you deal with the “bonus gap”

narrative when bonus pay is variable?

Bonus gaps are very variable. This is because of the way they are calculated – they are calculated only from a subset of employees (i.e. those who received a bonus) rather than all employees. When pay gaps are high, bonus gaps are higher. When pay gaps are low, bonus gaps tend to be lower. They are a function of pay gaps. Tackling pay gaps will inevitably tackle bonus gaps and special “bonus gap” strategies aren’t needed. The same narrative for explaining pay gaps can largely be used for bonus gaps. - What internal approvals should your narrative have

before publishing?

This will depend on your organisation. At a minimum, a statutory director will need to approve your report – this is a legal requirement as it must be signed off to confirm its accuracy.

Typically, approvals will also be needed by HR, comms/marketing and/or legal. - What is considered a good or low gender pay gap?

Between -5% and 5% should be the target. - How much year-on-year movement is normal?

Around 2-3% variation is normal. If there is this much change (up or down), then gaps could be described as largely staying the same. What matters is the long term trend. If there is 2-3% reduction in gaps from year to year, this is a sustainable amount of reduction and a sign of an effective strategy. - Why are median and mean gaps sometimes very

different?

This is because of outliers. Outliers will affect the mean, but not the median. A small number of highly paid, senior men might cause the mean pay gap to be much higher than the median.

Neither the mean nor median statistic is “best”. They provide different information, so interpret them together. - Should you prioritise the mean or median gap in your

narrative?

Neither should be prioritised. They should both be discussed in your narrative, rather than focus placed only on one. This is because the mean and median gaps provide different information. - Why do bonus proportions matter, and how should you

explain them?

Bonus gaps are affected by the proportion of men and women who receive a bonus; this is because the methodology for bonus gaps requires you to calculate mean and median bonuses only from those that received a bonus. By reading the bonus gaps alongside the proportion of each gender receiving a bonus, it will help you understand how much inherent variation there might be in the bonus gaps. - Who should write your gender pay gap narrative: HR,

legal, comms or analytics?

It could be drafted by any one of these groups.

Very often, a lot of different stakeholders will want to provide their input on the gender pay gap report (for good reasons). But be aware that this can slow down the process and can result in a report lacking a cohesive “voice” or message. - How long should a gender pay gap report be?

Five sections is a good structure, with the total length being 2 to 3 A4 pages:

- Introduction. Possibly including a quote from the CEO, CPO or other senior figure in the business.

- Gender pay gap vs equal pay. Gender pay gaps are caused by representation, not pay differences. A company can be a perfect equal pay employer, paying all equal value jobs equally, but still have a high gap (and the converse is also true).

- The statistics. Set these out simply and clearly.

- The causes of the gaps. Explain why the gaps are what they are.

- The measures you’re taking. Explain what you are doing to improve the gaps. Where possible, include some evidence that your measures are the right ones and are effective, e.g. “since implementing this policy, applications from women have gone up from x% to y%”

- How do you avoid making your narrative

defensive?

We suggest the below in order to avoid being overly defensive.

- Use clear and direct language e.g. “At x%, our gender pay gap is too high”.

- If you gap will stay high, don’t avoid talking about this: “At x%, our gender pay gap is high, and because of issues x, y, and z, we expect that it will continue to be high over at least the medium term”. This helps manage expectations for future reports.

- Avoid too many comparisons against others. While context is relevant and important, it is not a compelling argument to say “our gaps aren’t as bad as others”. Better language might be along the lines of “like many in our sector, our gaps are high”.

- Should your CEO sign the narrative as well as the

director declaration?

It’s not essential or legally required, but is often a good idea.

Having a CEO co-sign a gender pay gap report shows that the issues are being “owned” by those at the very top. It takes gender pay gap reporting from appearing to be a mere compliance obligation into something bigger: a strategic part of how you do business and who you are. - How do you balance being transparent with avoiding

creating litigation risk?

There are two ways gender pay gap reports can create litigation risk.

- Equal pay. If you are carrying out regular equal pay audits and can truly be confident that there are no equal pay issues, then state this in your narrative in your gender pay gap report. If not, avoid making unfounded claims. This is because if you make statements that “we are confident that equal pay issues are not affecting our gaps”, and there is a subsequent claim, you expect to be cross examined on this point in the Tribunal if an employee makes an equal pay claim.

- Inference of bias against men. An overzealous approach to gender pay gap reporting could be risky: an employer lost a discrimination claim after trying to reduce its gender pay gap. Your gender pay gap report should be focused on identifying barriers that women face in your workplace, and the measures you are taking to remove them so that women can compete equally with men. It is not about “obliterating” men to force the gap to be lower – this is unlawful sex discrimination.

Visuals and presenting your gender pay gap statistics

Here we provide our tips on how best to present your gender pay gap statistics in a visual way to make it easier to understand your data. A mistake that we often see companies making is overthinking the visuals and trying to be too “fancy” – the statistics don’t need to have complex infographics. It’s better to have clear and simple graphs. We find that, when it comes to gender pay gap graphs, substance beats style.

- Charts vs tables: which works better in gender pay gap

reporting?

It depends on what you’re trying to show. All data visualisations should make it easier to understand data.

Bar charts are good for most types of gender pay gap statistics. Use them for pay gaps and bonus gaps. Use stacked bar charts for the quartiles.

Pie charts can work for the bonus proportions but it’s probably overkill (simply stating the statistic is clear and concise e.g. “x% of men received a bonus”). - How can you highlight trends in your gender pay gap

report over time?

Plot the results on a graph (a line graph is good for displaying this data, but a bar chart would work too). If there is a lot of variability between years, add a line of best fit to show whether the trend is broadly up/down/flat. - What mistakes do companies make in presenting bonus

data visually?

A key issue is overthinking it. Gender pay gap statistics don’t need to have complex infographics, full of interesting looking but unclear graphs (such as radial bar charts, 3D exploded pie charts, or charts overloaded with data. - How do you avoid using misleading charts or graphs in

your report?

Charts should make it easier to understand the data, not harder.

Pie charts are frequently overused (and inappropriately used). They are suitable only for data which has a binary response i.e. yes/no. In gender pay gap reporting, they can be sensibly used for the bonus proportions statistics, and quartile statistics.

Bar charts are useful to show differences between numbers. They can be used to show pay gaps and bonus proportions. Stacked bar charts can be particularly useful to show the quartiles. - Should you split data by business units or keep a

single entity view?

If you have one entity then multiple business units within it, then you may want to report figures for the entire legal entity (to comply with your legal obligations) but then also report gaps for each business entity. Each business entity will have different issues affecting its gap, so your gender pay gap “story” will be best told by looking at each one separately but then also discussing how this affects the overall figure for the legal entity. - How often should you update the online version of your

gender pay gap report?

Gender pay gap reports must stay on your website for three years from the date published, rather than three years from the snapshot date the report relates to.

For example, if you publish gaps for 5 April 2025 in a report on 4 April 2026 (just before the deadline), then it needs to stay on your website until 4 April 2029.

Smaller companies and simplified gender pay gap reporting

This section will be most useful for smaller companies, for example those with close to 250 employees (which therefore do not meet the reporting threshold), or companies just over the headcount threshold with limited data or changing employee numbers year-on-year.

We often see employers delaying their reporting and starting to look at their data in January/February, when the 4 April deadline is fast approaching. This leaves little time to address any gaps or make improvements before the next deadline comes around. Our advice is to start to look at pay gaps in May of each year.

- How should smaller organisations (close to 250

employees) prepare for reporting?

A dry run will be really helpful. You can identify your gaps and discover what’s causing them, without having to report this information externally. You can then use these insights to develop a plan to reduce your gaps before you have to talk about it externally. By hitting the ground running, not only will your gaps reduce sooner, but if you publish voluntarily (whether internally or externally) you’ll build significant trust with your employees by doing something before you are legally required to. Any messages you then offer around being committed to reducing gaps will appear more sincere and genuine, and build trust with your workforce. - What can a company with limited data do to produce a

credible narrative?

Running a deep dive analysis to try to get to the root cause of your gaps will help you to achieve a more in-depth understanding of your organisation. Identifying the deficiencies in your data and addressing these early on will help you further down the line and in future years.

But if you can’t get better data/insights, then don’t let perfection be the enemy of the good. Use the insights available to you to take action to try to tackle your gaps. - What are the risks of delaying reporting when your

headcount is just over the threshold?

Delaying reporting is a common mistake that we see employers make. The best date to look at your gender pay gap reporting is in May – just after the snapshot April date (for private sector small companies).

This is because if you wait until January or February, when the deadline is fast approaching, there is little time to take action to address any gaps or make improvements before the next snapshot date comes around, leaving you ultimately with two years of potentially bad results to have to explain. - Can smaller companies produce a “light”

version of their gender pay gap report?

Yes – any employer can produce a “light” report. The legal minimum requirements are to report your statistics alongside a statement of accuracy from a statutory director. Any content beyond this is voluntary (but recommended). - How do you handle reporting for organisations with

changing employee numbers year-on year?

What matters is headcount on the snapshot date: 5 April (or 31 March for public sector employers). If headcount varies a lot over the year, perhaps because of seasonal issues, and April doesn’t give a realistic snapshot of your workforce, you can report more. You could voluntarily calculate and report gaps at other points in the year to provide extra context.

Deadlines and compliance for gender pay gap reporting

In this section we set out the common questions employers often ask about deadlines, compliance and enforcement. This includes when/where to publish your data. We also set out what happens when the deadline for submitting and publishing your gender pay gap data is missed, and the scale of risk involved.

- What is the deadline for submitting and publishing

gender pay gap data?

The last date for publishing your report and uploading it to the government website is 4 April the following year after your 5 April snapshot (i.e. by 4 April 2027 given a 5 April 2026 snapshot) - or 30 March the following year after your 31 May snapshot for public sector employers. - What happens if you miss the deadline for your gender

pay gap report? What are the penalties for non-compliance?

It is not clear whether the Equality and Human Rights Commission (EHRC) currently has the legal power to enforce gender pay gap reporting. The EHRC obtains its power from the Equality Act 2010 and can enforce breaches of it. Although the gender pay gap reporting regulations were created under the Equality Act, they are a separate piece of legislation. The gender pay gap reporting regulations contain no express powers for the EHRC to take any enforcement action against an employer that fails to report (whether accurately or at all), and we are not aware of them having tried to take such action.

If the EHRC were to bring enforcement action against an employer, it might be challenged via a judicial review. But since this type of legal challenge would be both costly and likely to result in negative press, it might well be simpler and cheaper for that employer to just report the mandatory statistics.

The bigger risk is damage to reputation caused by naming and shaming by the EHRC (see the answer below). - Are there consequences for late or incomplete gender

pay gap reports?

After the deadline for reporting, the EHRC will send letters and emails to those employers who it believes need to report their gender pay gaps but who have failed to do so. Those companies who continue not to report their pay gaps, or who consistently report late, will be “named and shamed” publicly on the EHRC website. This is likely to cause adverse publicity for the affected employers and damage their reputation. - How far in advance should you start preparing your

gender pay gap report?

This will depend upon how you treat gender pay gap reporting – is it a compliance exercise or a framework to use to enhance gender diversity in your workforce?

If you treat gender pay gap reporting as a compliance exercise, starting in January (with reporting the following March or April) will be sufficient. This is enough time to obtain the data, calculate the results, draft (and approve) a narrative, and publish ahead of the deadline.

However, if you treat gender pay gap reporting as more of an opportunity to understand gender diversity and the problems you might have, we suggest starting shortly after the snapshot date i.e. in May/June. This is because the data you are considering will be more recent, giving you a longer opportunity in which to make changes ahead of the following year’s snapshot date. - Does the government gender pay gap service require any

prior notification if you fall below the

threshold?

It’s not clear how the government and EHRC determines who it thinks must publish a gender pay gap report (it may be from HMRC records submitted for April).

Reminders are often sent out around the start of the calendar year. When those reminders are incorrect, we suggest contacting the EHRC pre-emptively to correct the position. - Do you need to publish your narrative and underlying

data separately?

You only need to publish your report. You do not need to publish your underlying data, or your calculations. For data privacy reasons, we would strongly advise against publishing the underlying data. - What happens if an employer misses the gender pay gap

reporting deadline?

If an employer reports after the deadline, this will be flagged as “submitted late on [date]” on the government website. This late mark cannot be removed. - Can you republish or correct your gender pay gap report

after submission?

Yes. Any changes that are made before the deadline will not be flagged. If a change is made after the deadline, the submission will be marked as “late”. - How do you decide where to host your report on your

website?

The best places to put your gender pay gap report are on DEI pages, recruitment/HR pages, or corporate reporting pages. - How should multinationals align GB reporting with

global DEI reporting?

There is a long period of time from the snapshot date to the deadline for reporting, so gender pay gap reporting could be aligned with other countries. Plan ahead and think about when in the year to do this.

Action and follow-up after publishing your gender pay gap report

This section addresses suggested action points and next steps for employers once they have published their gender pay gap report. Gender pay gap reporting is best thought of as a catalyst to action. It’s a means to an end, not the end itself. It gives a framework and structure to ensure that companies regularly consider diversity issues and promote greater discipline in diversity efforts.

In this section, we also cover the typical trends that we see across different sectors: retail, financial services, advertising, law firms, and tech.

- Once you’ve published your gender pay gap report,

what should you do next?

You should treat gender pay gap reporting as an opportunity to assess the effectiveness of existing measures to reduce gaps. You should review what’s working and what isn’t. We recommend taking a data driven approach: are you seeing improvements in the proportion of women applying for senior roles? Are there any improvements in success rates? What parts of the recruitment process are barriers for women?

The publication of your gender pay gap report is not the end. It should be considered just one part of a gender diversity strategy, constantly iterating and evolving what you’re doing. - What are effective actions that companies have taken to

reduce their gender pay gap?

The Behavioural Insights Team has published a guide setting out measures which have proven to be effective at reducing gender pay gaps. These include:

Recruitment- Offer flexible working by default in job adverts (ie “flexible with full time available” rather than “full time with flexible available”)

- Use targeted referrals

- Run structured interviews

- Make decisions about applicants in batches

- Anonymise CVs

- Remove biased language from job adverts

- Make it possible to list experience in terms of years not dates on CVs

- Have at least two women on every shortlist.

- Sharing local support for parental leave and flexible working.

- Set targets to reduce gender pay gaps.

- Have clear policies and guidance around pay setting and progression, so that all employees know what is needed to progress.

- How often should you revisit your gender pay gap

strategy?

At least annually, but more frequently might be even more effective. Consider a 6 monthly analysis, or reviewing before and after any pay reviews or promotions take effect. - How can you link your gender pay gap report to other

diversity and inclusion metrics?

Start by mapping the causes of your gaps to measures such as representation by level, promotion rates, performance ratings, or turnover. When you analyse them together, you can identify both structural themes and precise issues — like progression bottlenecks or possible cultural issues. Numbers in isolation can’t reveal this. - How do sectors differ in typical gender pay gap

figures?

We’ve set out below some common trends that we see in different sectors:

- Retail. Usually retailers have a low or no median gender pay gap, but a higher mean pay gap. This is because they have workforces where a very large proportion of employees are in low pay roles, and these tend to be female dominated. Having a more male dominated HQ/back office function has little impact on the median pay gap, but will pull up the mean pay gap.

- Financial services. In financial services, gaps can be high. But often there might be some complex group structures involved meaning that any figures reported might be covering only part of the workforce. Financial services employers should be clear in their narratives what they are reporting on and which employees (performing which functions) are covered.

- Advertising. Both mean and median pay gaps can be high in advertising agencies. This is because creative roles tend to be well paid and male dominated. The focus for those in the advertising sector should be on encouraging the recruitment and retention of female talent into creative roles.

- Law firms. In law firms, both mean and median pay gaps can be high. But there is often a difference between the mandatory figures and gaps that might exist in the “real” workforce. This is because partners (LLP members) must be excluded from the mandatory calculations. Many law firms therefore publish both mandatory figures and “whole workforce” figures for greater transparency)

- Tech. In the tech sector, gaps are often high. The main reasons for this are usually that there are large and well paid engineering and sales functions, both of which tend to be male dominated. While getting more women into sales is achievable (subject to any cultural issues), it’s much harder to shift the needle with technical/engineering type roles as they are specialist and depend on the numbers of women studying these subjects.

Using technology, AI and Automation in gender pay gap reporting

This section addresses how you can use AI and automation in your gender pay gap reporting. You can use AI to help save time, particularly when creating the first draft of your gender pay gap report, but we suggest approaching this with caution. You should ensure you provide enough information on your required output and give AI examples of your company “voice”, and make sure you check and edit any AI output carefully.

- Can you use AI tools to help write your gender pay gap

narrative?

Yes, and this may help save time at least with a first draft. But AI output is only as good as the prompt you put in – you shouldn’t just ask ChatGPT to “write my gender pay gap report”. Make sure you provide enough information on the structure, language, tone, and highest priority audience (employees, press, investors, applicants, competitors, etc). If you do want to use AI, consider feeding it with examples of reports that you like and want to emulate, and give it examples of your language and company “voice”, in order to avoid just more generic AI “slop”. Always check the output carefully for accuracy. - How can you automate the data collection for your

gender pay gap report?

Automating data collection will be hard. While you can develop streamlined processes for minimising the data collection struggle, there will always be individual circumstances and payments that will need a manual review and that you will need to make a decision about. To ensure your figures are accurate, always review manually and seek third party assurance where possible. - What templates are available for gender pay gap

reporting narratives and data tables?

There are 11,000 companies that must report their gender pay gaps and employers have been reporting since 2017. There are a lot of examples of reports available – we suggest looking at links on the government website for companies in your sector. - How do you measure the ROI of your gender pay gap

initiative for senior leadership?

Start by identifying the HR metrics that matter most to your board or leadership team: for example, retention of talent, reduced recruitment costs, improved promotion pipelines or lower legal/reputational risk.

Then link each gender pay gap initiative to a measurable change in those metrics, ideally using pre- and post-initiative data or simple cost-avoidance modelling (for example, estimating the savings from reduced turnover in hard-to-hire roles).

Miscellaneous / Advanced Questions

- How should you report gender pay gap data for a newly

acquired subsidiary?

Different companies must report separately and there is no aggregation of employees across a group. For example, if there are 3 companies in a group, each of which has 200 employees, then there is no reporting obligation. If the subsidiary has over 250 employees, then you do need to produce a gender pay gap report. - What do you do if your gender pay gap reflects a high

proportion of women in lower paid roles only?

You should deal with this in your narrative – you can say that your gaps are high but own this. Acknowledge that you need to attract, retain and promote women in your organisation in order to reduce your gaps, and that therefore you have work to do.

However, if you are in the retail sector, this may not be possible – we often see that the flexibility of low paid roles is more attractive to women who tend to want to balance work around childcare more, so societal issues such as “who is the primary caregiver” can have an impact. This is something you can explain in your report. - How do you account for historical pay differences in

your narrative?

We suggest that you do not mention these historical differences, unless you have a compelling reason to do so. Your narrative should be about differences in representation, not differences in pay - Do you need to explain gender pay gap differences

within job levels or grades?

No, not currently.

This is a requirement of the Pay Transparency Directive which applies across the EU from June 2026 .

Northern Ireland may be required to implement the Pay Transparency Directive and so this might become a requirement in future (however the position is unclear). - How should you communicate your gender pay gap results

to employees internally?

There are a range of options for communicating gender pay gap results internally. What is most appropriate for you will depend upon your own circumstances. Some options are set out below:

- Nothing. Just post the report on your website without any internal comms.

- Intranet. Post a link to your gender pay gap report on your internal intranet.

- Email to employees. Send a link round to all employees. This could be in any regular comms (weekly/fortnightly newsletters) or a one off email. This could be sent from HR, or a senior sponsor. Whoever send the email should be briefed and prepared to answer any questions.

- Town hall. A meeting to give employees any extra context not included in the report and give them a chance to ask questions directly. This is the most transparent option.

- How do you benchmark your gender pay gap against

industry peers?

You can use the publicly reported data on the government website. The industry categorisations might be too broad to be useful. Instead, enter the names of your competitors one by one manually and collate the results to see how your figures compare. If your gaps are high, those of competitors might be higher. While presenting a story that “our figures are not as bad as others” may not be a compelling or persuasive argument, it is at least important context. - Should you include intersectional analysis (e.g.,

gender + ethnicity + disability) in your narrative?

Intersectional analysis can be incredibly useful. It can show, for example, that while both women and ethnic minority employees might be well represented in a workforce, female ethnic minority women might not be. This might then prompt you to try some specific measures to tackle the underrepresentation of this group.

But unless your headcount is very high, intersectional analysis will be a challenge. This is because the groups you’re looking at will get smaller and smaller as you get more and more intersectional. This means that it’s harder to identify true underrepresentation from mere statistical variation.

Good practice would be to carry out intersectional analysis as part of your annual reporting project and, if small groups are an issue, monitor them each year to try to see what’s “real”. - How do you deal with volatility in bonus pay when

comparing year to year?

Bonus gaps are variable because they are calculated only from a subset of employees: those who received a bonus, and not all employees. Bonus gaps tend to be a function of pay gaps, so when pay gaps are high, bonus gaps will be higher. There is also more variable in bonus data, since bonuses can vary from nothing to millions. Pay data is, on the other hand, much more stable; no one will go unpaid in a given year (unless on reduced pay leave, in which case they would not be “full pay relevant employees” and so not be included in the pay gap calculations anyway).

This variability should be included when explaining your gaps as it is important context. - Do you need to secure board-level sign-off of your

gender pay gap narrative?

This is essential in order to be legally compliant. A gender pay gap report must be signed off by a statutory director or equivalent.

The report must contain a statement to the effect of “I confirm that the figures contained in this report are accurate and have been calculated in accordance with relevant legislation”.

To be able to provide this confirmation, the director signing it off may want to interrogate the data and processes followed. - What are the ethical considerations in publishing your

gender pay gap figures?

Ethically responsible reporting means being transparent without being misleading: present the numbers accurately, resist the temptation to over-explain them away, and avoid selective reporting that hides uncomfortable truths. The key is to be genuine and honest about limitations. Acknowledge your challenges, any gaps in data, and your areas for improvement. This builds far more trust than polished spin. - How can you use storytelling to engage employees with

your gender pay gap results?

Employees respond better to stories than spreadsheets, so frame your results around real experiences.

Use simple, relatable examples that show how policies, processes or behaviours impact opportunities across the employee journey and improve diversity (a few statistics can help here, e.g. “the proportion of women applying for senior roles has increased from x% to y% after implementing this measure”). The key is to focus on progress rather than perfection. Highlighting specific actions and inviting employees into the story builds credibility and participation.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]