On 27 November 2025, the final provisions of the Charities Act 2022, relating to 'ex-gratia' payments came into effect.

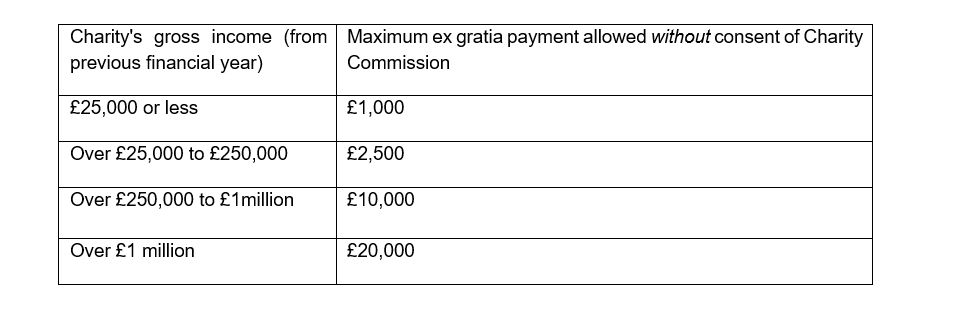

An ex-gratia payment is one made by a charity based on a moral (not legal) obligation. The provisions of the Charities Act 2022 provide charities with new powers to make 'small' ex gratia payments without the requirement of Charity Commission consent. A 'small' ex-gratia payment is defined by reference to the charity's gross income in the last financial year:

Payments over the above amounts will still require the Charity Commission's consent.

There are a number of museums and galleries who are excluded from the new provisions and the Department for Culture, Media and Sport has contacted all of the charities falling within this exclusion directly.

When making the payment, charities will need to be satisfied that 'it can be fairly said that if the charity were an individual, it would be morally wrong of him to refuse to make the payment' (as per the test set out in Re Snowden 1970). The new provisions also make the decision delegable from trustees which will streamline the ex gratia process for many charities.

The Charity Commission has updated its guidance ('CC7') on ex gratia payments which offers a helpful summary of the effect of the new provisions.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.