- within Transport topic(s)

On January 7th, 2026, the Competition Authority ("Authority") has published the Mergers and Acquisition Outlook Report regarding with mergers, acquisitions and privatisation transactions occurred in 2025 ("Report").

The remarkable data of the Report are as follows:

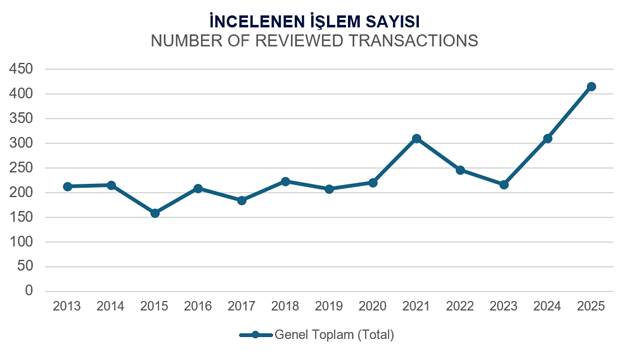

- Total number of Merger and Acquisition transactions reviewed by the Authority in 2025 is: 416

Compared to 2024's data, the number of transactions increased from 311 to 416 with an increase of 33,8%. The average number of transactions examined between 2013 and 2025 was 241, and the total number of mergers and acquisitions examined by the Authority in 2025 reached the highest number in the last thirteen years:

|

İŞLEM TARAFLARININ KÖKENİNE

GÖRE İŞLEM SAYILARI (2025) |

||

|

Tarafların Tümünün Türkiye Kökenli Şirketler Olduğu İşlemler / Transactions which All Parties are Companies Originating in Turkiye |

Tarafların Tümünün Yabancı Kökenli Şirketler Olduğu İşlemler / Transactions which All Parties are Companies Originating in Foreign Countries |

Taraflarından En Az Birer Tanesi Türkiye ve Yabancı Kökenli Şirketler Olduğu İşlemler / Transactions which, at least, one of the parties are Companies Originating in Turkiye and Foreign Countries |

|

95 |

219 |

74 |

- Total number and total transaction value of merger and

acquisition transactions that involving a Turkish origin company as

the target company reviewed by the Authority in 2025: TRY

466 BILLION 113 MILLION ($ 11,81 BILLION) with

162 transactions

(Compared to the 2024's data, the number of transactions

increased from 131 to 162.)

- The average total transaction value in mergers and acquisitions

over the last thirteen years amounts to TRY 87.8 billion ($ 7.06

billion).

Meanwhile, the transaction volume for 2025 stands out as the highest level recorded since 2013, when the Mergers and Acquisitions Outlook Report began to be published, both in terms of Turkish Lira and U.S. Dollar values.

Compared to the previous year, transaction volumes increased by approximately 142.9% in nominal terms in Turkish lira and by 101.8% in dollar terms.

- The total transaction value of mergers and acquisitions reviewed by the Authority, in which the target company was of Turkish origin and all parties involved were of Turkish origin, in 2025: TRY 165 BILLION 836 MILLION ($ 4.20 BILLION)

- The total transaction value of mergers and acquisitions reviewed by the Authority, in which the target company was of Turkish origin and all parties involved were of foreign origin, in 2025: TRY 6 BILLION 484 MILLION ($ 164 MILLION)

- The number of mergers and acquisitions involving investments by

foreign investors in Turkish companies in 2025:

55

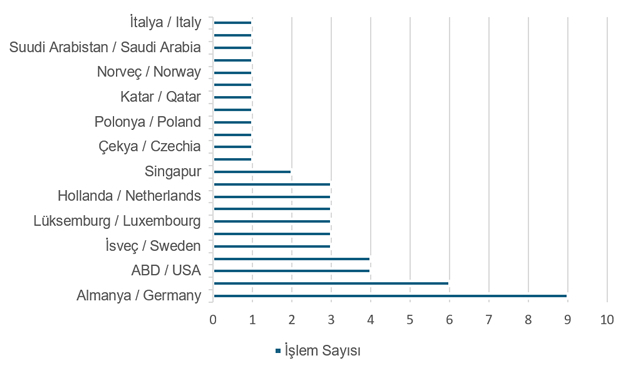

- According to the ranking of foreign investors among the

transactions reviewed by the Competition Board in 2025, the most

investing foreign country is: GERMANY / 9

transactions

BİRLEŞME VE DEVRALMALARDA YABANCI

YATIRIMCILARIN ÜLKELERE GÖRE DAĞILIMLARI

(2025)

DISTRIBUTION OF FOREIGN INVESTORS IN MERGERS AND ACQUISITIONS BY

COUNTRY (2025)

- Investment amounts, which had remained at relatively limited

levels in Turkish Lira terms for an extended period, increased to

TRY 68 billion in 2023 and TRY 99 billion in 2024, and in 2025

recorded an approximately threefold increase

compared to the previous year, reaching TRY 277.5 billion, the

highest level during the period under review.

- The fact that foreign investment amounts reached USD 7.03

billion in 2025, marking the highest level of the past two

years, reflects the real expansion observed in foreign

investment volume in 2025.

- The MOST invested sectors across the world in 2025:

|

SIRA NO / RANKING NO |

SEKTÖR / SECTOR |

|

1 |

Yazılım programlarının yayımlanması / Release of software programs |

|

2 |

Bilgisayar programlama, danışmanlık ve ilgili faaliyetler / Computer programming, consulting and related activities |

|

3 |

Sinema filmi, video ve televizyon programı faaliyetleri / Cinema film, video, and television program activities |

|

4 |

Parasal aracı kuruluşların faaliyetleri / Activities of monetary intermediary institutions |

|

5 |

Temel kimyasal maddelerin, kimyasal gübre ve azot bileşikleri, birincil formda plastik ve sentetik kauçuk imalatı / Basic chemicals, chemical fertilizers and nitrogen compounds, primary plastics and synthetic rubber manufacturing |

- The most common area of economic activity in mergers and

acquisitions among the transactions that the target company is of

Turkish origin reviewed by the Authority in 2025:

"COMPUTER PROGRAMMING, CONSULTING AND RELATED

ACTIVITIES" and "ELECTRIC ENERGY

GENERATION, TRANSMISSION AND DISTRIBUTION"

- The economic activity area with the highest transaction value

in mergers and acquisitions among the transactions reviewed by the

Authority in 2025 that the target company is of Turkish origin:

"ACTIVITIES OF MONETARY INTERMEDIARY

INSTITUTIONS"

- The main fields of activity of the companies of Turkish origin that the MOST investments were made in terms of transaction volume in 2025:

|

SIRA NO / RANKING NO |

ANA FAALİYET ALANI / MAIN FIELD OF ACTIVITY |

TOPLAM İŞLEM DEĞERİ / TOTAL TRANSACTION VALUE |

|

1 |

Toptan ve perakende ticaret, motorlu kara taşıtlarının ve motosikletlerin onarımı / Wholesale and retail trade, repair of motor vehicles and motorcycles |

110,7 milyar TL / TRY 110.7 billion |

|

2 |

Finans ve sigorta faaliyetleri / Finance and insurance activities |

95,9 milyar TL / TRY 95.9 billion |

|

3 |

İmalat / Manufacturing |

92,7 milyar TL / TRY 92.7 billion |

Conclusion

The 2025 data indicate that mergers and acquisitions activity in Türkiye reached a historical peak in terms of both transaction volume and value, with a notable strengthening of foreign investor interest. This trend points to an accelerated structural transformation, particularly in strategic sectors such as technology, energy, and finance.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.