- within Insolvency/Bankruptcy/Re-Structuring topic(s)

- with readers working within the Law Firm industries

- within Insolvency/Bankruptcy/Re-Structuring topic(s)

- with readers working within the Oil & Gas and Law Firm industries

- within Insolvency/Bankruptcy/Re-Structuring, Finance and Banking and Transport topic(s)

Introduction

Corporate finance is one of the backbones of commercial transactions. But when debts pile up and repayment becomes impossible, the recourse available to a company's creditors is limited due to the corporate veil and limited liability of companies. What happens then? And how does the creditor navigate such situation? Nigerian law provides structured options and protections to assist the creditors in the recovery of debts during corporate insolvency. In this note, we will discuss the realities of corporate insolvency and the legal rights available to creditors.

Implications of Corporate Insolvency:

In simple terms, corporate insolvency refers to a situation where a company is unable to pay its debt.1 The Companies and Allied Matters Act, 2020 (CAMA 2020), as amended by the Business Facilitation (Miscellaneous Provisions) Act, 2022, comprehensively provides for the several implications that would be triggered by corporate insolvency for both the company and its creditors, all of which are geared towards the protection of the creditors as well as the prevention of corporate malpractices. These include:

- Suspension of Directors' Control: the onset of corporate Insolvency generally results in the directors ceding control of the company to insolvency practitioners such as liquidators, receivers, or administrators.

- Moratorium on Individual Actions: the creditors of an insolvent company are usually prevented from instituting or continuing separate legal actions against the company, unless permitted by the court.2

- Collective Enforcement: debts of an insolvent company are usually enforced collectively to ensure overall fairness to all the creditors involved and avoid fraudulent preference of certain creditors over others.

- Potential business rescue arrangements: the CAMA 2020 allows room for the rescue of companies undergoing corporate insolvency through the introduction of administration and voluntary arrangements.

- Impact on Shareholders: where the company is limited by shares, then the liability of the shareholders to the company's creditors would be limited to the amount unpaid, if any, in respect of the shares held by them in the company.

- Review of Prior Transactions: corporate insolvency may trigger the review of prior transactions of the company that were at gross undervalue or without any consideration3 or in fraudulent preference of any creditors.4

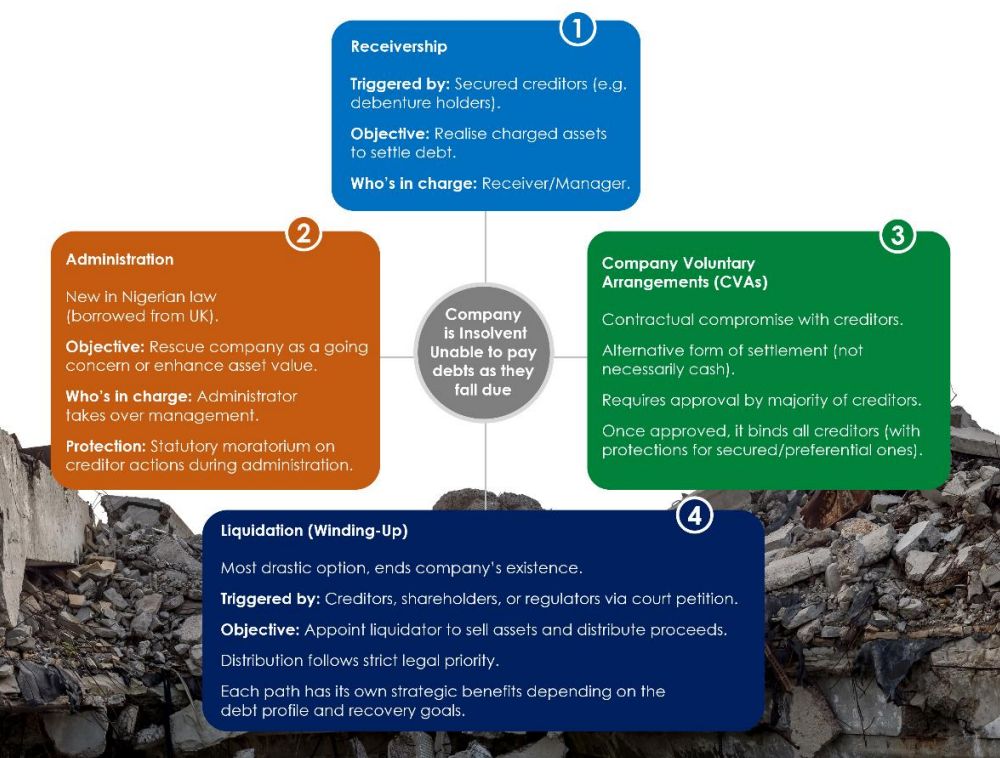

Corporate Insolvency Options

Under the CAMA 2020, both creditors and companies have a variety of insolvency mechanisms that may be utilised depending on the circumstances as well as the objective of the creditors/companies. The various corporate insolvency options are discussed in the paragraphs that follow:

- Receivership: receivership is a corporate insolvency option whereby a company's creditors holding debentures or secured interest appoints a receiver or receiver/manager to take control of the company's assets charged in order to realise the assets of the company for the purpose of settling the debt owed to the creditor(s) by the company. During the period of the receivership, the receiver or receiver/manager is duty-bound to act in the interest of the appointing creditor(s), however, they are also obligated to act in good faith towards other creditors and the company.5

- Administration: administration is a relatively new insolvency mechanism under Nigerian insolvency laws and the principles guiding this mechanism were mostly adopted from the insolvency law of the United Kingdom. As a corporate insolvency option, the primary objective of an administration is the rescue of the company as a going concern or to improve the assets or value of the company for distribution during liquidation. During an administration, the appointed administrator takes over management, and during this period, a statutory moratorium restricts creditor actions against the company.6

- Company Voluntary Arrangements (CVAs): CVAs are contractual restructuring tools that are utilised by companies for negotiating compromises or arrangements with creditors for the settlement of the debts. CVAs take the form of accord and satisfaction, whereby creditors may accept a form of settlement that differs from the debts owed to them, in full and final settlement of those debts. This tool may be utilised where a company does not have sufficient assets to fully settle its debts but is able to offer any other form of consideration to the creditors in place of the financial settlement. If the CVAs are approved by the requisite majority of the company's creditors, then such arrangement would bind the creditors.

- Liquidation (Winding-Up): liquidation remains the most drastic corporate insolvency option which should only be adopted where the objective of the instigators includes the dissolution of the company; in other words, bringing the existence of the company to an end. Where a company is insolvent, then a liquidation may be initiated by the company's creditors, members or regulatory authorities through the filing of a petition before the appropriate courts. The purpose of this procedure is to appoint a liquidator to take account of the assets of the company and manage the distribution of such assets for the settlement of the liabilities of the company in accordance with the order of priority set out under the law.

Rights of Creditors in Corporate Insolvency

The rights of creditors under corporate insolvency would largely depend on the type of debt owed to such creditors as well as the corporate insolvency option adopted for the recovery of such debts. In the paragraphs that follow, we have presented a highlight of the key rights that accrue to creditors under the various corporate insolvency.

- Right to Commence Corporate Insolvency Proceedings: The creditors of a company are generally entitled to activate any of the corporate insolvency options against the company. The creditors may appoint receivers, administrators, or commence winding up proceedings against the company for inability to pay its debt, provided that such debts are not disputed by the company.7

- Priority Rights: priority rights are vital in corporate insolvency because they determine the order of settlement of the outstanding debts of the company. The nature of the debt owed to each creditor determines their priority rights. Creditors of a company that are secured by fixed charges have priority over all other debts of the company, including preferential debts.8 However, preferential debts of a company,9 such as the company's taxes, rates and charges, employee deductions and contributions, as well as their salaries and entitlements, have priority over the debts owed to the company's creditors that are secured by floating charges.10 The holders of floating charges are paid after the company's fixed charge holders and preferential debts are fully paid. The unsecured creditors on the other hand are only paid after the secured creditors (i.e. holders of fixed and floating charges) and preferential debts are fully paid,11

- Rights to Access Corporate Information: the creditors of a company undergoing insolvency are entitled to inspect the company's corporate books and papers12, including the company's register of charges, copies of the instruments creating registered/registrable charges, the register of debenture holders of the company and the trust deed securing the company's debentures. In addition to the foregoing, a creditor of a company is entitled to inspect and obtain the liquidator's books as well as the liquidator's statements regarding the ongoing liquidation during a court ordered winding up.

- Right to Control Corporate Insolvency Process: during a creditor's voluntary winding up of a company, the liquidator is either appointed or approved by the creditors and the actions of such liquidator are controlled by the creditors.13 The liquidator is expected to act in accordance with the directions of the creditors and in the interest of the creditors in the management of the company. A creditor may challenge any actions or decisions of a liquidator that they are aggrieved by and seek reliefs from the court such as the setting aside of such action or decision or the removal of the liquidator amongst other things.14 In addition, the liquidator is expected to summon a creditors' meeting whenever requested to do so by the creditors of the company holding at least one-tenth of the company's total debt.15 The CAMA further allows creditors to participate in the public examination of promoters, directors, managers, or liquidators of the insolvent company.16

- Protection of Security Interests: in CVAs, the security and rights of each class of the company's creditors are protected from any form of modifications without the approval of those creditors. The CAMA prohibits a creditors' meeting from approving any arrangement that proposes a modification of a secured creditor's right to enforce their security without the consent of that creditor.17 In the same vein, the CAMA ensures that the rights of preferential creditors are also protected by prohibiting the approval of any arrangement that seeks to modify the entitlement of a preferential creditor unless that preferential creditor consents to such modification.18 The implication of these prohibitions is that even if most of the creditors approve any arrangement in the form of a CVA for the modification of the rights of any creditor, such arrangement will be invalid unless the creditor whose rights are to be modified consents to the arrangement and a creditor is entitled to challenge any CVA that offends these prohibitions.19

- Notification Rights: the creditors of a company undergoing insolvency are entitled to receive notice of the appointment of any administrator, receiver or receiver/manager or liquidator over the assets of the company, usually within 14 days of such appointment. The creditors are also entitled to receive notice of the conclusion of any of the insolvency proceedings involving the company. Furthermore, the creditors are entitled a reasonable notice of the realization, appropriation, or liquidation of any collateral used by the company under a collateral arrangement, unless the creditors agree to waive such notices.20

- Protected Contracts/Arrangements: the CAMA protects the enforceability of a class of financial contracts known as "netting agreements"21 from the effects of corporate insolvency.22 This protection gives creditors the right to enforce the terms of a netting agreement in line with their terms even against an insolvent company and the operation of insolvency or activities of a liquidator does not lead to the stay, avoidance, or limitation of the creditor rights that accrue under those netting agreements. Thus, where there is a netting agreement between the insolvent company and a creditor, the liquidator of such company is prevented from avoiding any transfers or obligations under such agreement unless it can be clearly shown that the netting agreement was merely used as an instrument to defraud the company, other creditors or any other interested party.23

Conclusion

Corporate insolvency in Nigeria is a structured process with far-reaching consequences for both companies and their creditors. While it often signals financial distress, it does not always mark the end of a company's existence. Depending on the insolvency option adopted, there may be opportunities for restructuring, debt compromise, or even business rescue. For creditors, the law provides a wide range of rights: from initiating proceedings and influencing the choice of insolvency mechanisms, to enforcing priority claims, inspecting records, and challenging irregular processes. These rights are designed to ensure fairness and transparency, while also balancing the interests of other stakeholders such as employees, shareholders, and regulators.

Ultimately, the path taken in any insolvency will depend on the specific facts of the case: the type of debts owed, the security available, and the objectives of creditors or the company itself. A creditor's strategic choice, whether to pursue liquidation, accept a voluntary arrangement, or support administration, can significantly affect recovery prospects.

Footnotes

1. Section 625(1), CAMA 2020.

2. Progress Bank (Nig.) Plc. v. O.K. Contact Point Ltd. (2008) 1 NWLR (Pt. 1069) 514.

3. Section 659, CAMA 2020.

4. Section 658, CAMA 2020.

5. In U.B.N. Ltd v. Tropic Foods Ltd [1992] 3 NWLR (Pt. 228) 231 p.244- 249, the Court of Appeal held that the company retains the legal right to challenge the appointment of a receiver/manager and may seek to prevent or halt any unjustifiable exercise of the receiver/manager's powers.

6. Section 409(2), CAMA 2020

7. In Oriental Airlines Ltd v. Air Via Ltd [1998] 12 NWLR (Pt. 531) 17 (CA), the Court of Appeal held that where a debt is disputed by the company, then it is more appropriate to commence an action for debt recovery rather than file a petition for winding up.

8. Section 207(4), CAMA 2020

9. Section 657(1), CAMA 2020

10. Section 657(4), CAMA 2020.

11. Section 643, CAMA 2020.

12. Section 683(2), CAMA 2020.

13. Section 590(1), CAMA 2020

14. Section 590(5), CAMA 2020.

15. Section 590(2), CAMA 2020

16. Section 613(3), CAMA 2020.

17. Sections 437(3) and 440(2), CAMA 2020.

18. Sections 437(4) and 442(3), CAMA 2020.

19. Sections 440 (2) and 442(3), CAMA 2020.

20. Section 721(7) of CAMA 2020.

21. Section 718, CAMA 2020 primarily defines a "netting agreement" to mean any: "agreement between two parties that provides for netting of present or future payment or delivery obligations or entitlements arising under or in connection with one or more qualified financial contracts entered into under a netting agreement..."

22. Section 718, CAMA 2020,

23. Section 721(6), CAMA 2020.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]