- within Tax topic(s)

- in Ireland

- with readers working within the Law Firm industries

- in Ireland

- within Compliance and Employment and HR topic(s)

Introduction

With the enactment of the Foreign Exchange Management Act, 1999, India had advanced towards a more liberalized regime for management of foreign exchange. The law was changed from regulation and control to management of foreign exchange by decriminalizing the violations. The Reserve Bank of India ('RBI') regulates foreign exchange in India and, in furtherance of liberalization, had granted wide powers to the authorized dealer banks to allow foreign exchange transactions. However, with the increase in volume and complexity of cross border trade, investments and other transactions, there has been an increase in non-compliances/violations of the foreign exchange laws, either bona fide or otherwise. While the foreign exchange law generally permits settlement/compounding of the violations by approaching the RBI, in case of failure to compound, the person may be exposed to investigation, penalty and other consequences.

About Enforcement Directorate

The Directorate of Enforcement ('Enforcement Directorate/ED'), a multi-disciplinary organization under the Department of Revenue, Ministry of Finance, Government of India is mandated with the responsibility of enforcement of foreign exchange laws amongst certain other economic offence laws. The Enforcement Directorate conducts investigations into contraventions of foreign exchange laws and consequent proceedings for imposition of penalty. The Enforcement Directorate is headquartered in New Delhi with several regional offices and zonal offices across India.

Manner and steps of investigation, inquiry and adjudication

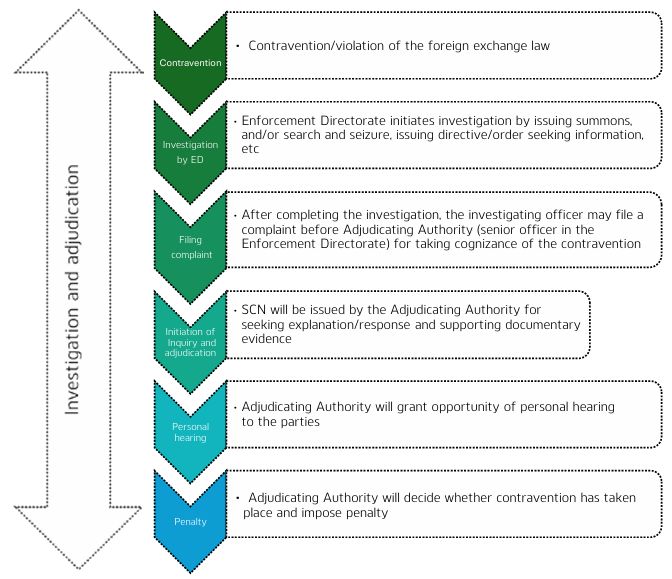

Investigation is a fact-finding exercise where the officers of the Enforcement Directorate discover and collect evidence. The term 'Investigation' is not defined in FEMA, but it makes its appearance in section 37 of FEMA which grants powers to officers of Enforcement Directorate to investigate contraventions. Generally, issuance of any summons seeking any information or summons requiring personal presence for recording statements or conduct of search and seizure action by the Enforcement Directorate, etc. can be considered as initiation of investigation. The summons generally mentions the details of investigation in respect of which the information is sought. Therefore, the entity receiving summons will know whether it is subject to the investigation or not. The manner and steps related to investigation, inquiry and adjudication under FEMA can be encapsulated as follows:

Powers of officers of Enforcement Directorate to investigate

The powers granted to the officers of Enforcement Directorate to conduct investigation are similar to the powers conferred on income tax authorities under the Income-tax Act, 1961 ('IT Act') and are to be exercised subject to the limitations laid down under the IT Act1.

Recording of statements

The officers of the Enforcement Directorate have powers to summon any person, requiring his personal attendance to obtain evidence/record statement.

The summon in such cases is for personal attendance and therefore, the person cannot seek assistance of lawyer during the recording of statements as a matter of right. However, a lawyer can accompany the individual with prior approval of the summoning officer. Non-compliance of summons may invite penalty. Further, the statement recorded by the Enforcement Directorate under FEMA is admissible as evidence.

Power to conduct search and seizure

In order to investigate and gather evidence, the officers of Enforcement Directorate have powers to conduct search and seizure which include power to:

- enter and search any building, place, vessel, vehicle or aircraft where he has reason to suspect that such books of account, other documents, money, bullion, jewellery or other valuable article or thing are kept;

- break open the lock of any door, box, locker, safe, almirah or other receptacle where the keys thereof are not available;

- search any person who has got out of, or is about to get into, or is in, the building, place, vessel, vehicle or aircraft, if the authorized officer has reason to suspect that such person has secreted about his person any such books of account, other documents, money, bullion, jewellery or other valuable article or thing;

- require any person who is found to be in possession or control of any books of account or other documents maintained in the form of electronic record, to afford the authorized officer the necessary facility to inspect such books of account or other documents;

- seize any such books of account, other documents, money, bullion, jewellery or other valuable article or thing found as a result of such search (other than stock-in trade);

- place marks of identification on any books of account or other documents or make or cause to be made extracts or copies therefrom;

- make a note or an inventory of any such money, bullion, jewellery or other valuable article or thing;

As the powers related to search and seizure are similar to the powers available to the income tax authorities under the IT Act, the safeguards and limitations on powers to conduct search and seizure are applicable to the search actions by the officers of the Enforcement Directorate. These safeguards include requirement of proper authorization of search by the approving authority after recording reasons to believe, search only at the premises covered in the warrant of search, search to be conducted by authorized officers, recording of statements by authorized officers only, presence of independent witnesses at the time of search, conducting search in the prescribed manner, etc. Any search proceedings wherein the aforesaid guidelines are not followed may be challenged as invalid search.

Survey action under FEMA

A Survey is distinct from a search action and is generally conducted to gather information related to contravention of foreign exchange laws. The information gathered during the survey can be used by the Enforcement Directorate for investigation purposes and for filing a complaint before the Adjudicating Authority. These powers are similar to the powers available to income tax authorities and are to be exercised subject to limitations under the IT Act.

Special provisions related to seizure and confiscation of 'value equivalent' in India

Section 37A of FEMA provides power to the Enforcement Directorate to seize property as 'value equivalent' within India if an asset in form of foreign exchange, foreign security or immovable property, situated outside India, is held in contravention of Section 4 of FEMA. Section 4 of FEMA provides that saves as otherwise provided in FEMA, no person resident in India shall acquire, hold, own, possess or transfer any foreign exchange, foreign security or any immovable property, outside India. Thus, a foreign asset can be held by an Indian resident only in accordance with FEMA. For Section 37A of FEMA to be triggered, the aggregate value of foreign exchange, foreign security or immovable property, situated outside India should be more than Rs. 1 Crore2.

This power of seizure is similar to provisional attachment under PMLA3 The seizure made by the Enforcement Directorate is required to be confirmed by the Competent Authority, an independent authority, i.e. Commissioner of Customs (Appeals). However, the confiscation of the seized property depends upon the outcome of the adjudication proceedings. If during the course of adjudication proceedings, the

Adjudicating Authority finds that the asset is held in contravention of Section 4 of FEMA, it may order confiscation of such seized property.

Power to arrest

There is no power to arrest during investigation or adjudication proceedings under FEMA. However, a person can be prosecuted and subject to imprisonment upon conviction in certain exceptional scenarios. This includes scenario wherein a person holds foreign exchange, immovable property, or foreign security, outside India in contravention of Section 4 of FEMA4. Further, in case of non payment of penalty, the defaulter can be subject to civil imprisonment.

Time Limit for investigation

FEMA does not provide any time limit for the Enforcement Directorate to complete the investigation. In Union of India & Anr. v. Citi Bank5, the Supreme Court held that the proceedings must be initiated within a reasonable period of time. The reasonable period will depend upon the facts of each case.

Filing of complaint upon completion of investigation

The Investigating Officer, upon completion of the investigation, may file a complaint with the Adjudicating Authority (senior officer in the Enforcement Directorate) for adjudication of contravention. The complaint will contain details of the transactions and the relevant provisions of FEMA alleged to have been contravened. The complaint also contains the relevant information and documents relied upon by the investigating officer.

Adjudication by the Adjudicating Authority

The Central Government has appointed officers of Enforcement Directorate to act as Adjudicating Authority for purposes of holding inquiry and adjudication under FEMA. The Enforcement Directorate has several offices across India which are divided into regional offices and zonal offices. The Central Government has issued notification6 specifying the pecuniary limits for exercise of jurisdiction by the officers of Enforcement Directorate.

Upon receipt of the complaint, the Adjudicating Authority issues notice to parties requiring them to explain as to why an inquiry should not be held against him. The person is granted an opportunity to file reply/ objections to the notice. If the Adjudicating Authority is not satisfied with the explanation, it will commence adjudication proceedings and grant an opportunity to submit such documents or evidence which the parties want to rely upon. Further, the Adjudicating Authority grants the opportunity of personal hearing. After considering the replies, documents and other evidence, the Adjudicating Authority may pass an order imposing a penalty and ordering confiscation.

Time limitation for issuance of show cause notice

FEMA itself does not prescribe a time limit for completion of investigation or for issuance of show cause notice. However, the Supreme Court has held that the proceedings must be initiated/completed within a reasonable period of time, depending upon the facts and circumstances of each case7.

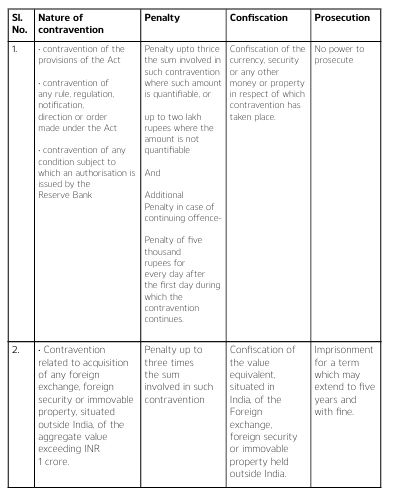

Penalty and confiscation

FEMA empowers the Adjudicating Authority to impose penalties for non-compliance, which shall depend on the quantifiability of the sum involved in contravention and frequency of the alleged act. Further, the Adjudicating Authority may order confiscation of the property, currency or security involved in the contravention8. In case of contraventions related to foreign exchange, foreign security

or immovable property, situated outside India, the Adjudicating Authority may order confiscation of the property of equivalent value in India9. The powers to impose penalty, order confiscation and initiate prosecution have been delineated in the table below:

Liability of directors and other personnel

The directors and other officers who are in charge of the entity or responsible for its affairs may also be penalized for any violations by the entity10. Further, in case contravention has been committed by a company with the consent or connivance of, or is attributed to any neglect of the director, manager, secretary or other officer of company who is in charge of the business of the company, such person will also be deemed to be guilty of the contravention and liable to be proceeded against and punished accordingly.

It has also been held by the Hon'ble Supreme Court in S.M.S. Pharmaceuticals Ltd v Neeta Bhalla11 that liability depends on the role one plays in the affairs of a company and not on designation or status. Accordingly, a director of a company who was not in charge of and was not responsible for the conduct of the business of the company at the relevant time, will not be liable under the provision or conversely, a person not holding any office or designation in a company may be liable if he satisfies the requirement of being in charge of and responsible for conduct of business of a company at the relevant time.

Appeal against orders of the Adjudicating Authority

The Central Government has appointed the appellate authority, i.e. Commissioner of Income-tax (Appeals) in different jurisdictions to act as appellate authority for appeal against penalty orders passed by the Assistant Director or Deputy Director of the Enforcement Directorate12. In all other cases, the appeal lies before the Appellate Tribunal for Foreign Exchange, New Delhi. Further, the second appeal against the order of the Special Director (Appeals) also lies before the Appellate Tribunal for Foreign Exchange, New Delhi. Further appeal will lie before the High Court. There is no provision in FEMA for an appeal to the Supreme Court from the order of High Court. Only a Special Leave Petition can be filed before the Supreme Court.

Only the person aggrieved by the order passed by the Adjudicating Authority gets the right to Appeal. The term 'person aggrieved' means a person who has faced any legal consequences and against whom a decision has been pronounced which resulted in wrongfully depriving him of something or affected his title over something13.

It is to be noted that before filing an appeal before the Appellate Tribunal, it is mandatory to pre-deposit the penalty levied as per the order that is being appealed against by the Appellant with the Directorate of Enforcement of the concerned zone14. If the Appellant fails to deposit the penalty amount, that may lead to dismissal of appeal. However, the Tribunal can grant full/partial waiver of the pre-deposit of penalty to the Appellant on the ground that the deposit of such penalty imposed by the Adjudication Authority would cause undue hardship to such person subject to certain conditions to safeguard the realization of penalty. The Appellate Tribunal while granting the interim relief of waiver of full/partial pre-deposit of penalty is required to establish that the payment of penalty will cause undue hardship that is excessive in nature and is not a mere economic hardship15.

On the other hand, there is no requirement to pre-deposit the penalty amount before filing the appeal before the Special Director (Appeals) and the Special Director (Appeals) has not been given any express power to stay recovery of penalty.

Recovery of penalty

The officers of Enforcement Directorate may initiate recovery proceedings in case of non-payment of the penalty amount. The defaulters may be subject to civil imprisonment16. Further, the Enforcement Directorate may initiate recovery by attachment and sale of the defaulter's movable and immovable properties17 in accordance with recovery provisions available under the income tax law.

Footnotes

1 Section 37 of FEMA

2 Notification GSR 701(E) dated 16.09.2015

3 Section 5(1) of Prevention of Money Laundering Act, 2002

4 Section 13(1B) of FEMA

5 (2022) 19 SCC 188.

6 S.O. 2128 (E) dated May 08, 2023

7 Union of India & Anr. v. Citi Bank [(2022) 19 SCC 188]

8 Section 13(2) of FEMA

9 Section 13(1A) of FEMA.

10 Section 42 of FEMA.

11 (2005) 8 SCC 89.

12 S.O. 3958(E) dated 24th September, 2021

13 Northern Plastics Ltd. v. Hindustan Photo Films Mfg. Co. Ltd. [1997(91) ELT 502 (SC)]

14 Notification No. S.O. 537(E), dated 01.06.2000.

15 Monotosh Saha v. Special Director [(2008) 12 SCC 359]

16 Section 14(1) of FEMA

17 Section 14A(2) of FEMA.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.