- within Consumer Protection and Immigration topic(s)

- with Senior Company Executives, HR and Inhouse Counsel

- with readers working within the Insurance, Healthcare and Property industries

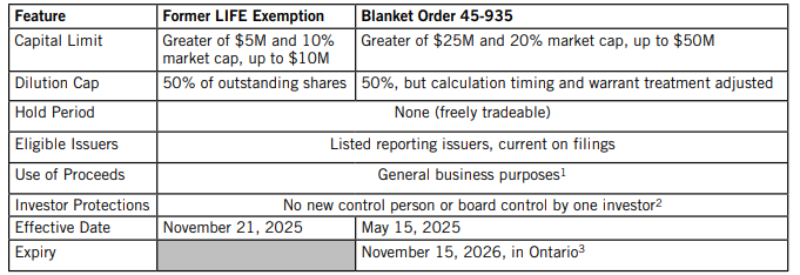

Canada's capital markets are undergoing a period of regulatory modernization. The Canadian Securities Administrators ("CSA") have introduced a series of targeted reforms aimed to: (i) support the competitiveness of Canada's capital markets by making it more efficient for companies to raise capital, (ii) ensure the regulatory environment remains responsive to the needs of market participants, and (iii) facilitate capital raising through the exempt market. Among the CSA's developments is Blanket Order 45-935 (the "Blanket Order") – an update to the Listed Issuer Financing Exemption ("LIFE"), which significantly expands capital-raising limits.

The LIFE Exemption Overview

LIFE was initially introduced in November 2022 under National Instrument 45-106 (the "Instrument") to help publicly listed companies raise capital more efficiently. Instead of having to prepare a full prospectus, which can be costly and time-consuming, LIFE allows eligible issuers to distribute freely marketable securities to a wider range of investors, including the general public, using their existing public disclosure and a simplified short-form document ("Form 45-106F19"), which does not require approval or confirmation of receipt from a security's regulatory authority, to offer securities to investors.

As outlined in the Instrument, LIFE permitted issuers to raise the greater of $5 million or 10% of their market capitalization, up to a maximum of $10 million per year. However, a number of market participants argued that the $10 million cap limited LIFE's utility.

Enter the Blanket Order. Effective May 15, 2025, this coordinated relief measure significantly expands capitalraising limits in Canada. While LIFE's core structure remains intact, this updated framework offers more flexibility for issuers seeking to raise capital quickly. Note that in Ontario, the Blanket Order is set to expire on November 15, 2026, unless it is extended.

What is New Under Blanket Order 45-935

The Blanket Order is not a separate exemption; instead, it provides relief from certain LIFE conditions by outlining alternative terms and conditions that must be met.

Capital-Raising Limits:

The Blanket Order significantly increases capital-raising thresholds set out in the Instrument by allowing issuers to raise the greater of:

- $25 million; and

- 20% of the aggregate market value of their listed securities, up to a maximum of $50 million in a 12-month period, subject to certain provisions related to the 50% dilution limit.

Dilution Calculation Adjustments:

While issuers are still subject to a total outstanding shares dilution cap of 50%, the Blanket Order changes how it's calculated:

- If no previous LIFE issuance occurred in the past 12 months, you measure the dilution from the date of the news release announcing the new offering.

- If there was a prior LIFE issuance in the last 12 months, you look back to the date of the news release for the first such offering.

- Warrants that are not exercisable within 60 days of closing may now be excluded from the dilution calculation – expanding flexibility compared to the original rule, which included all warrants regardless of their terms.

Investor Protection Conditions:

To maintain safeguards, the distribution must not:

- Create a new control person; or

- Allow any person or company to acquire securities sufficient to elect a majority of the board.

In addition, the issuer must include new, specific language on the cover page of Form 45-106F19, explicitly referencing reliance on the Blanket Order and confirming that the offering falls within the enhanced limits.

Why it Matters

The CSA's expansion of LIFE gives issuers a valuable tool to raise capital quickly, efficiently, and with fewer barriers. Traditionally, private placement exemptions in Canada, such as the accredited investor exemption, have limited participation to high-net-worth individuals or institutions, often leaving retail investors on the sidelines. The LIFE exemption fundamentally changes this landscape by enabling listed issuers to distribute freely tradeable securities to the public without a prospectus, significantly broadening the range of investors who can participate in these offerings.

By relying on their existing continuous disclosure and a simplified offering document, listed issuers can now more easily access retail investors and raise funds on more flexible terms. Unlike many other prospectus exemptions, which restrict participation to accredited or institutional investors, the LIFE exemption is specifically designed to open the door to retail investors, granting everyday investors access to new primary market opportunities that were previously out of reach. This democratization of capital markets is especially beneficial for small and mid-sized public companies, that often lack the time and resources for traditional capital-raising methods.

LIFE not only opens the door to retail investors but also allows the securities issued to be freely tradeable immediately - thereby avoiding the usual four-month hold period attached to private placements under National Instrument 45-102 Resale of Securities and are available to all investor types.

More broadly, the modernization of LIFE enhances Canada's competitiveness by making it more attractive for companies to go - and stay - public in Canada rather than seeking listings elsewhere.

That said, LIFE is not without conditions, including: issuers must still issue a news release, complete Form 45-106F19, and ensure the proceeds are not used for significant acquisitions or transactions that would otherwise require shareholder approval. This transaction is intended to ensure that LIFE is used for routine capital raising, such as funding ongoing operations or incremental growth, rather than for transformative transactions that would typically require more robust disclosure and direct shareholder input.

The Blanket Order marks a timely and practical evolution of LIFE. At a moment when many businesses are navigating economic uncertainty and heightened market volatility, the CSA has acted decisively to make capital more accessible, without compromising the regulatory principles that underpin investor confidence.

Issuers should consider the opportunities and obligations that come with relying on the expanded LIFE under Blanket Order 45-935.

Footnotes

1 Not available for significant acquisitions under Part 8 of National Instrument 51-102 Continuous Disclosure Obligations, a restructuring transaction, or any other transaction for which the issuer seeks approval of any security holder.

2 The distribution must not result in a new control person or in a person or company acquiring beneficial ownership of, or exercising control or direction over, such number of the issuer's listed equity securities that would result in such person or company being entitled to elect a majority of the directors of the issuers.

3 This order will cease in Ontario on November 15, 2026, unless it is extended.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.