- within Real Estate and Construction topic(s)

- within Compliance and Tax topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Accounting & Consultancy and Law Firm industries

After much anticipation, on October 7, 2025, the B.C. government announced the introduction of Bill 20, the Construction Prompt Payment Act. The bill is at first reading, and its implementation will follow the legislative process and a transition period.

The proposed legislation will bring transformative change for construction owners, contractors, consultants and project lenders by expediting payment and introducing adjudication dispute resolution.

Aligning with other Canadian prompt payment and adjudication regimes (like Ontario and Alberta), B.C.'s new legislation will require owners to pay contractors promptly upon receipt of a "proper invoice," compel timely downstream payment, and provide an interim, binding adjudication procedure to keep projects moving when disputes arise.

Stakeholders should begin thinking about project delivery within the new prompt payment regime, and how these reforms will impact (and require changes to) contract language, invoice templates, internal processes and project controls.

Objectives of the Construction Prompt Payment Act

Bill 20's central objective is to restore predictability to construction cash flow by setting clear timelines for invoice payment and effective dispute resolution. The Province cites cashflow uncertainty, schedule impacts and increased frequency of liens and claims as drivers for reform.

The legislation is expected to apply broadly to both private and public projects, though certain exemptions may be set out by regulation. Parties should assume application to new contracts once the legislation is in force.

Key features of the regime

1. Proper invoices and payment timelines

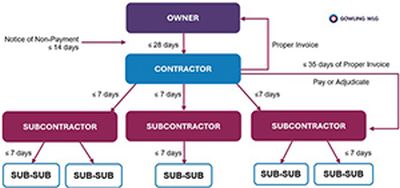

Payments will be subject to strict timelines and invoicing requirements (see flow chart in Figure 1):

- Contractors must deliver to owners a "proper invoice" each month, unless the contract says otherwise.

- Receipt of a proper invoice triggers the owner's obligation to pay within 28 days, unless the owner delivers a notice of non-payment (described below) within 14 days that specifies the disputed amount and reasons for non-payment.

- The owner must still pay any undisputed portion within the 28‑day window.

- After contractors receive payment from the owner, they typically have seven days to pay their subcontractors.

- If the owner fails to pay within 28 days, or pays only in part, the contractor is still required to pay affected subcontractors within 35 days of its proper invoice, unless it delivers a notice of non‑payment and undertakes to refer the matter to adjudication.

Comparable rules apply for parties down the chain of contracts: payment within seven days of receipt, or if there is no upstream payment, within 42 days of the proper invoice unless a notice of non‑payment and undertaking to refer the matter to adjudication are given.

A proper invoice is a written request for payment that contains certain prescribed information, including the name and address of the contractor, the work or materials supplied, the period of time or milestone covered, the amount payable and payment terms.

A contractor's invoice is deemed to be proper, unless the owner, within 7 days of receipt, notifies the contractor that the invoice does not meet the prescribed requirements and specifies what must be corrected.

Figure 1: Prompt payment flow chart

2. Notices of non‑payment

Notices of non‑payment are a core safeguard and key compliance risk. Owners disputing a proper invoice must issue a compliant notice of non-payment (in prescribed form) within 14 days. Contractors and subcontractors must issue their own notices of non-payment shortly after receiving an upstream notice or reaching their non‑payment deadline.

Notices of non-payment must state the amount being withheld and the reasons for non‑payment. If the amount is not being paid because of non-payment upstream, the notice must also include (i) a copy of any notice of non-payment received in connection with the upstream payment, and (ii) an undertaking to refer the non-payment to adjudication within 21 days. Parties remain obligated to pay any undisputed portion of the invoice.

Failure to deliver a compliant notice of non-payment could have serious consequences, including losing the ability to defer payment, accrual of interest on outstanding amounts, and adverse adjudication outcomes. Contract clauses purporting to defer or condition payment outside the statutory framework are expected to be unenforceable, as the regime is mandatory and parties cannot contract out of its obligations.

3. Fast‑track adjudication: interim, binding determinations

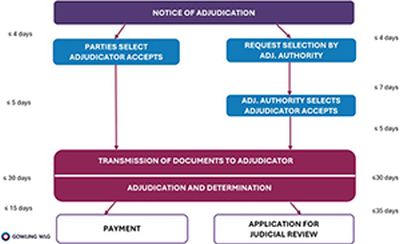

Interim adjudication is intended to resolve payment disputes quickly and maintain project cash flow (see flow chart in Figure 2).

To start the process, any party can refer a dispute to adjudication by delivering a written notice of adjudication. Adjudication cannot be commenced more than 90 days after completion, certification, abandonment or termination of the head contract or subcontract, as the case may be (as determined by sections 1(2), (4) and (5) of the Builders Lien Act).

If the parties cannot agree on an adjudicator, the adjudication authority will appoint an adjudicator. Within 5 days of the adjudicator agreeing to oversee the adjudication, the referring party must deliver supporting materials. The responding party can provide their own materials. The adjudicator has investigative powers and must issue a written determination within 30 days of receiving the referring party's records.

Adjudication determinations are binding on an interim basis and enforceable as debts, subject to limited court oversight through judicial review. They do not displace parties' rights to litigate or arbitrate the underlying dispute on a final basis, but they are designed to be faster and more affordable than traditional proceedings.

Figure 2: Adjudication Flow Chart

4. Holdbacks and the Builders Lien Act

Payments under the new legislation will continue to be subject to the statutory holdback obligations set out in the B.C.'s Builder's Lien Act.

Generally, mechanisms and obligations under the Builders Lien Act will remain unchanged, with one significant reform: the abolition of "Shimco" holdback liens. Unique to B.C. and a regular source of confusion in the industry, Shimco holdback liens were recently affirmed by the B.C Court of Appeal in WQC Mechanical. Their abolition is a welcome standardization and simplification of B.C.'s lien regime.

5. Implementation and transition

The new legislation will not apply to contracts entered into before it comes into force, which will follow after the legislative process and a transition period.

During the transition period, government will designate the adjudication authority, certify adjudicators, and finalize regulations, including forms for proper invoices and notices, procedural rules for adjudication, and any sector exemptions.

What you need to know

For owners, it will be critical to issue valid notice of non-payment within 14 days of a proper invoice, or otherwise pay the invoice within 28 days. This timeline compresses internal approval cycles and requires clear roles for project managers, consultants and payment certifiers to meet statutory deadlines without compromising quality control. Owners should also align contracts with Bill 20's proper invoices requirements, certification practices, and adjudication provisions.

For prime contractors, the seven day downstream payment obligation requires robust project accounting and cashflow forecasting. Equally important is readiness to issue timely non‑payment notices where appropriate and to commence or respond to adjudications on short notice. Because the regime limits pay‑when‑paid arrangements, contractors should assume they will need to either pay promptly or move disputes to adjudication, and should plan pricing and risk management accordingly.

For subcontractors, including trades and suppliers, Bill 20 improves leverage to secure payment without immediately resorting to liens. While subcontractors do not have to deliver proper invoices, strong billing practices, quick response to notices, and readiness to use adjudication will be key. Contract negotiation should address prompt payment compliance provisions with clear flow‑down language.

Across the board, parties should expect interest to accrue on late payments and ensure contract interest provisions align with the new legislation. Effective document control, contemporaneous issue logs, and early engagement with counsel on brewing dispute and adjudication readiness will reduce risk.

How you can prepare

Bill 20 marks a sea change for construction in B.C. Even before the Construction Prompt Payment Act takes effect, stakeholders can take proactive steps to prepare:

- Review existing contracts and templates for necessary updates (for example, incorporating a compliant definition of proper invoice, removing any pre‑approval conditions for invoice issuance, and accommodating adjudication in dispute resolution procedures).

- Map internal workflows to meet the 14‑day notice window and the 28‑ and 7‑day payment deadlines.

- Deliver training to contract administration teams on drafting and delivering compliant notices of non‑payment and on assembling adjudication records.

- Have early discussions with project partners on how changes may affect future projects and consider adjudication playbooks for common issues such as change orders and set‑off.

How Gowling WLG can help

Stay tuned for upcoming presentations, webinars and updates as these reforms roll out.

Gowling WLG has been deeply involved in construction law reform across Canada, helping clients navigate new prompt payment and adjudication regimes through training, contract updates, process reviews, and adjudication support.

We encourage you to reach out to a member of our experienced team to see how these changes may affect your business and how you can prepare.

Read the original article on GowlingWLG.com

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.