- within Tax topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Accounting & Consultancy, Basic Industries and Business & Consumer Services industries

This information that follows is taken from sources including The Car Connection, Autoweek, Green Car Reports, and other industry sources.

Our advisors are pleased to assist you or your clients. Please do not hesitate to contact us if you require assistance.

Curb On Rare Earth Exports - More Disruptive Than Microchip Shortage

Restrictions on Chinese exports of rare earth minerals and

magnets used in a variety of automotive parts are threatening to

create the industry's next major crisis. Automakers and

suppliers around the globe are scrambling to mitigate the

restrictions, which could lead to shortages of key components found

in everything from electric vehicle motors to alternators to power

windows. China produces a vast majority of rare earths but curbed

their flow out of the country amid an ongoing trade war with the

U.S. Already, some automakers and suppliers have had to idle

assembly lines because of a lack of parts. Trade groups and

industry executives are sounding the alarm about the potential for

more imminent shutdowns to create bottlenecks even worse than what

the industry grappled with during the microchip shortage.

"You're going to find things at least partially comprised

of rare earth metals in not just vehicles, but almost all consumer

products," Sam Abuelsamid, vice president of market research

at Telemetry, told Automotive News. "So many components rely

on them — solenoids for your engine, solenoids for your power

steering. If we can't get rare earth metals, then we're in

big, big trouble."

Source: Automotive News

Hyundai Motor Has A Rare Earths Stockpile That Can Last About A Year

Hyundai Motor has a rare earths stockpile that can last about a

year, and it does not expect any near-term impact from global

supply chain disruptions caused by China's export curbs, said a

person who attended a company investor call. China's decision

in April to restrict exports of a wide range of rare earths and

related magnets has tripped up the supply chains central to

automakers, aerospace manufacturers, semiconductor companies and

military contractors around the world. The stockpiling by Hyundai,

the world's No.3 automaker along with its affiliate Kia Corp

indicates it is better-placed than many competitors to withstand

restrictions that have already impacted production or the supplier

network of companies including Ford and BMW.

Source: Reuters

China's Rare-earth Export Restrictions Threaten New-car Production

China's restriction on exports of rare earths and magnets

threatens to shut down vehicle and parts assembly in the coming

weeks, industry executives and analysts said. The materials are

crucial for a wide range of automotive components — from

motors and sensors used in electric vehicles to automatic

transmissions and speakers. The auto industry, like other sectors,

is heavily reliant on China for the rare earths and magnets used in

those parts, and companies have said securing the materials has

become exceptionally difficult since China restricted exports in

April in response to U.S. tariffs. The auto industry, already

grappling with other tariff impacts, is now on the brink of its

third major supply chain shock this decade, following the pandemic

and the microchip shortage.

Source: Automotive News

18 To 34 Demographic Challenges

The automotive market is facing a troubling decline in new

vehicle purchases among the highly sought-after 18 to 34 age

demographic. Considered a vital growth segment for original

equipment manufacturers, this group is now facing unprecedented

market conditions that impact their status as key players for new

vehicles. Affordability remains a major concern for young adults,

as new vehicle prices climb, and monthly payments have increased by

30% in the past four years. The share of new vehicle registrations

by adults aged 18-34 has fallen from 12% in Q1 2021 to below 10% in

the past two quarters—a troubling trend.

Source: CBT News/S&P Global

Tariff Impacts Now Appearing

Tariff Impacts Begin as Vehicle Shipping Volume Drops by More Than 70%

The volume of cars getting shipped to the U.S. via sea routes has

plunged as a result of President Donald Trump's tariffs on

imported vehicles. Maritime import volume for motor vehicles

dropped by 72.3 percent in May compared with the same month a year

earlier, according to Descartes Datamyne, a trade database.

Importers shipped about 9,380 fewer 20-foot equivalent units of

vehicles to the U.S. last month. One 20-foot equivalent unit is

about one vehicle depending on its size, according to Descartes.

The precipitous drop indicates that vehicle tariffs are having a

concrete impact on automaker decisions. The 25 percent auto tariffs

that took effect in April may have prompted companies shipping

completed automobiles overseas to hold off, betting that Trump will

eventually pull back the most punishing duties.

Source: Automotive News

Edmunds Data Reveals Tariff Fears Shift Car Buyer Behavior

Tariff speculation is influencing the behavior of American car

shoppers as the renewed push for tariffs under the Trump

administration creates uncertainty for both shoppers and dealers. A

recent survey and market data by Edmunds reveal that consumers are

either accelerating or delaying their vehicle purchases even before

widespread price hikes take effect. So far, the impact of tariffs

hasn't been as significant as expected. Despite concerns, the

average transaction price (ATP) of new vehicles remained stable and

aligned with seasonal norms. In April, ATP reached $48,422,

representing a 2.7% uptick from March and a 2.2% year-over-year

increase. Chief Economist for the National Automobile Dealers

Association (NADA), Patrick Manzi, believes that the actual impact

of the auto tariffs won't be fully felt until 2026.

Source: CBT News

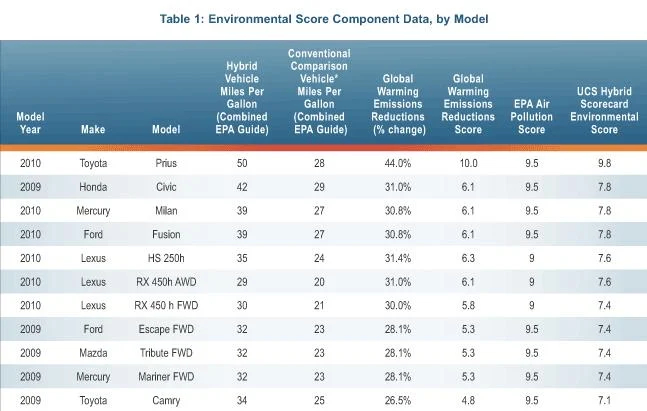

New Hybrid Scorecard Slams Carmakers For Loading On Luxury

It's long been known that hybrid buyers often choose them over luxury cars, and aren't buying them solely for the payback in gasoline savings. But a new Hybrid Scorecard, launched by the Union of Concerned Scientists, slams carmakers for inflating their prices by loading luxury into fuel-efficient hybrids, putting them out of reach to less affluent buyers. The Hybrid Scorecard is a guide to all 31 currently available hybrid vehicles from five carmakers: Toyota, Ford, General Motors, Honda, and Nissan. It includes ratings on different criteria and an explanation of UCS's methodology in calculating its scores.

"Hybrids don't have to be luxury vehicles," said

UCS analyst Don Anair, who supervises the guide. "They should

be within the reach of all Americans." Car buyers

shouldn't be forced," he continued, "to buy high-end

bells and whistles when fuel economy and reducing emissions are

their top priority." Such "unnecessary luxury

features" include, according to UCS, not only DVD players and

keyless entry systems but even leather interiors.

The top-scoring hybrid this year is the 2010 Toyota Prius, followed

by a three-way tie among the 2010 Honda Civic Hybrid, the 2010 Ford

Fusion Hybrid, and its twin the 2010 Mercury Milan Hybrid. One

reason the 2010 Prius outscored the second-place finishers is that

it has fewer "forced features" (roughly $1,600 worth)

than the Civic Hybrid and Fusion/Milan twins, which UCS says

include $3,000 and $4,000 of unnecessary embellishments

respectively.

Not surprisingly, the 2010 Lexus LS 600h L full-size luxury sedan

hybrid is the "worst offender," with $17,000 of

"forced features" over the base non-hybrid LS 460L

model.

Automakers might argue that buyers' willingness to pay higher

margins for added features offsets the cost of $3,000-plus for the

hybrid hardware, improving the affordability of the overall

package. In the end, buyers will decide for themselves. In our

view, the more information, the better.

Source: Green Car Reports

Ford Of Canada CEO Says Ev Mandate Should Be Repealed

Ford Canada CEO Bev Goodman has publicly called for the repeal

of a federal policy that requires 100 percent of new passenger

vehicle sales to be zero-emission by 2035. The mandate also

includes an interim benchmark of 60 percent EV models by 2030, a

pace Goodman describes as unrealistic given conditions. Ford, like

several other legacy automakers, has previously supported

electrification efforts through products like the Mustang Mach-E

and F-150 Lightning, as well as investments in battery and electric

vehicle production. However, according to Goodman, Canada's

mandated electric vehicle targets do not reflect consumer demand or

infrastructure readiness. "The targets on full

battery-electric vehicles need to be aligned with what customers

want, and customers have spoken," Goodman said at the recent

Canada Automotive Summit, per Automotive News. According to the

company CEO, Ford Canada's electric vehicle sales fell

"like a stone" following the end of a $5,000 federal

incentive program earlier this year. Automotive News reports that

nationwide zero-emission vehicle sales fell to 20,878 units in

February and March, a 44-percent decline year-over-year.

As GM Authority covered previously, General Motors electric vehicle

sales have also nosedived in Canada as a result of the end of the

incentive program. "Ultimately, it will have a negative

impact, if these mandates stuck, on the industry," Goodman

said. "It will have downward pressure on vehicle sales, it

will have upward pressure on pricing, and those are real concerns

for consumers and the industry as a whole."

Meanwhile, in the U.S. market, GM has announced that Chevy has

officially overtaken Ford in electric vehicle sales, with Chevrolet

posting over 37,000 electric vehicles sold in the U.S. market for

the 2025 calendar year through May, as compared to Ford's

34,000 units during the same time period. GM has also claimed the

number-two spot among all electric vehicle manufacturers

nationwide, with more than 62,000 electric vehicles sold

year-to-date. Tesla remains the number-one electric vehicle

manufacturer in the U.S. market.

Source: GM Authority

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.