- in United States

- in United States

- within Criminal Law and Insolvency/Bankruptcy/Re-Structuring topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Insurance, Healthcare and Law Firm industries

On October 2, 2025, the Ministry of Economic Development, Job Creation and Trade launched a 45-day consultation on draft regulations under Ontario's Special Economic Zones Act, 2025 (the "Act").

The Act is intended to create a streamlined development process for projects and proponents that meet certain criteria in designated special economic zones ("SEZs"). In short it will allow for a faster permitting process. For further background on the Act and the omnibus bill with which it was enacted, please see our bulletin here.

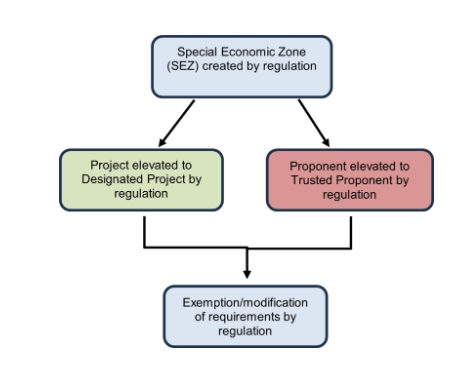

An overview of the process established under the Act is shown below:

Image caption: Overview of the SEZ process—from zone creation to potential regulatory modifications for Trusted Proponents attached to Designated Projects.

As the Act is a slim piece of legislation it will depend on regulations for its implementation. The draft regulation (the "Draft Regulation") will determine which:

- areas merit a SEZ designation;

- entities can be recognized as "Trusted Proponents"; and

- projects can be designated as "Designated Projects".

The Draft regulation will be of particular interest to developers, investors, municipalities, Indigenous communities, and industry participants planning major projects in Ontario, as well as lenders and other stakeholders involved in financing and advancing large-scale infrastructure and resource development across the province.

Which Areas can be Designated as SEZs?

A SEZ will be a single, geographically defined, area within Ontario that, in the opinion of the Lieutenant Governor, has significant economic activities taking place (or planned to take place) that are of strategic benefit to Ontario.1 In designating a SEZ, the area must be no larger than necessary to encompass the significant activities.

Unless exempted or otherwise modified, as a default rule all provincial laws apply in a SEZ. Any modifications or exemptions will only be applied to Trusted Proponents attached to Designated Projects in a given SEZ and not across the SEZ as a whole.2

Who are Trusted Proponents?

Entities recognized as Trusted Proponents can be granted exemptions or modifications to government acts, regulations, permits, and approvals.3

The Draft Regulation states that Trusted Proponents must be attached to a Designated Project or a project the Minister is designating as such under the Act.4 Similarly, the Draft Regulation and the Draft Policy Intent for SEZ Criteria and Guiding Questions provide that a SEZ, Designated Project, and Trusted Proponent must all be in place for regulatory modifications to take effect.5

Trusted Proponents may be the Crown or a Crown agency, a municipality, or a for-profit or non-profit entity. The proponent must meet the regulatory criteria to advance the project and demonstrate a strong compliance record across health and safety, environmental protection, labour standards and financial matters (including for contractors).6

There are also corporate governance requirements, such as Minister approval for any change in control or ownership of the Trusted Proponent.7

Finally, proponents must establish that their team includes individuals with experience successfully working with Indigenous communities and present a credible engagement plan for ongoing collaboration.8

It remains to be seen what reporting will be used to determine whether compliance standards are met and whether international compliance records or the records of related entities and their officers and directors will also be considered.

What is a Designated Project and How Does It Get Designated?

A project does not automatically become "designated" just because it is in a SEZ. It must meet the specified criteria, undergo Ministerial and Cabinet review and be the subject of a specific regulation. The Minister may designate either a single project or class of projects as Designated Projects.9

A Designated Project must be located within a SEZ and satisfy the following criteria:10

- Economic Benefits: The Minister must be of the opinion that the project will have significant long-term economic benefits such as sustained job creation, strengthened supply chains, increased innovation, contributions to GDP growth, higher wages, and enhanced tax revenues.

- Community Benefits: The Minister must also be of the opinion that the project will have a clear benefit to communities both in and outside of the SEZ, including Indigenous communities, and that it will increase revenues or otherwise strengthen businesses in those communities.

- Chance of Success: The Minister must be of the opinion that the project will likely succeed after considering factors like the project's financing support, plans for engaging with Indigenous and other communities, and the risk-mitigation measures to address potential health, environmental, and other impacts of the project.

- Increased Speed and Likelihood of Success due to Designation: Finally, the Minister will consider whether designation will make it possible to complete the project more quickly and increase its likelihood of success.

The Draft Regulation raises several questions about the nature of the review process when choosing Designated Projects. One of the objects of the consultation on the Draft Regulation should therefore be to result in further details on the designation process to ensure criteria are rigorous enough to confirm only strategically valuable projects are designated, whether measurable Indigenous benefits should be required, and how long-term benefits can be quantified and measured against the likelihood of success.

Indigenous Communities Consultation Feedback

Ontario has stated that consultations with Indigenous communities have shaped the Draft Regulation. The results can be reviewed in the Indigenous communities consultation feedback document (the "Indigenous Feedback Report") available on the ERO website here.

The Indigenous Feedback Report notes that, following consultations, the Draft Regulation has been updated to require environmental and health impact analyses, Minister approval for changes of control, contractor compliance checks, and Indigenous engagement plans, among other things.11

Still being considered are recommendations regarding how international companies are considered under the Act, resource revenue sharing, social and cultural impact assessments, and adding Indigenous governments as deemed Trusted Proponents.12

Some elements from the Indigenous consultations not reflected in the Draft Regulation include a registry of SEZs and projects, new Indigenous business supports, instituting an appeals process, monitoring and evaluation mechanisms, and federal-provincial alignment. While the government reiterates its commitment to appropriate consultations under s. 35 of the Constitution Act, the Indigenous Feedback Report notes that they have not opted to include explicit references to the United Nations Declaration on the Rights of Indigenous Peoples (UNDRIP) or Free, Prior and Informed Consent (FPIC).

Some Clarity on Criteria, but little Insight on Process

While the Draft Regulation offers some insight into what criteria will be used when evaluating SEZs, projects, and proponents, it does little to illuminate how, and through what channels, projects may be presented to the Minister for consideration. Similarly, it remains to be seen how modifications to existing regulatory frameworks will be applied to a given Designated Project or Trusted Proponent.

At the federal level we have recently seen the establishment of the Major Projects Office, with a mandate to streamline regulatory approvals for projects designated as being in Canada's national interest under the federal Building Canada Act. For more details on this development, please see our prior bulletin here. It is worth noting that designation of a SEZ, a Designated Project, or a Trusted Proponent does not affect federal review—projects requiring approvals under federal legislation must still navigate federal processes unless the federal regime itself provides streamlining (including for projects of "national interest").

On the west coast, the British Columbia government has recently introduced the Infrastructure Projects Act, which enables the newly established Ministry of Infrastructure to streamline approvals for provincially significant projects delivered by third-party proponents.13 Additional background can be found in our earlier bulletin here.

Differences between Ontario Regulation and the Federal Act?

While arguably the federal Building Canada Act establishes a clearer process than the Draft Regulation for how projects will be designated, it is worth emphasizing that the Building Canada Act does not purport to exempt the application of existing federal regulatory frameworks to projects of "national interest". Rather, the Building Canada Act contemplates the amendment of certain conditions that otherwise would have applied to the project under the given legislation. In this regard, the Ontario approach to potentially exempting certain legislation from application to a Designated Project and Trusted Proponent may be seen by some project proponents as going further towards the realization of projects that have, to date, not been viable due to aspects of the existing regulatory framework.

This bulletin will be updated as more details on the administration of the SEZ framework become available.

Conclusion

The Act presents new opportunities to fast-track projects. While each project and proponent will be considered on a case-by-case basis, it is important to consider the potential Indigenous, environmental, social, and health and safety impacts at an early stage. Based on the response received during the consultation on the Act prior to its enactment from Indigenous groups, environmental activists and the public generally, similar concerns will likely be raised during the designation and consultation process for potential Designated Projects and Trusted Proponents, and proponents should plan for these before entering the process.

Ontario's consultation on the Proposed Special Economic Zones Criteria is open until November 16, 2025 and can be accessed here.

Footnotes.

1 Draft Regulation s. 1: https://ero.ontario.ca/public/2025-10/3.%20SEZ%20Draft%20Regulation%20%28Designation%20Criteria%29_0.pdf.

2 Draft Policy Intent for SEZ Criteria and Guiding Questions, p. 1: https://ero.ontario.ca/public/2025-10/1.%20Draft%20Policy%20Intent%20for%20SEZ%20Criteria%20and%20Guiding%20Questions_0.pdf; Indigenous Communities Consultation Feedback at p. 1: https://ero.ontario.ca/public/2025-10/2.%20Indigenous%20Communities%20Consultation%20Feedback_0.pdf.

3 Draft Policy Intent for SEZ Criteria and Guiding Questions at p. 2: https://ero.ontario.ca/public/2025-10/1.%20Draft%20Policy%20Intent%20for%20SEZ%20Criteria%20and%20Guiding%20Questions_0.pdf.

4 Draft Regulation s. 2: https://ero.ontario.ca/public/2025-10/3.%20SEZ%20Draft%20Regulation%20%28Designation%20Criteria%29_0.pdf.

5 Draft Policy Intent for SEZ Criteria and Guiding Questions at p. 2: https://ero.ontario.ca/public/2025-10/1.%20Draft%20Policy%20Intent%20for%20SEZ%20Criteria%20and%20Guiding%20Questions_0.pdf.

6 Draft Regulation s. 2: https://ero.ontario.ca/public/2025-10/3.%20SEZ%20Draft%20Regulation%20%28Designation%20Criteria%29_0.pdf.

7 Draft Regulations s. 3: https://ero.ontario.ca/public/2025-10/3.%20SEZ%20Draft%20Regulation%20%28Designation%20Criteria%29_0.pdf.

8 Draft Regulation s. 2: https://ero.ontario.ca/public/2025-10/3.%20SEZ%20Draft%20Regulation%20%28Designation%20Criteria%29_0.pdf.

9 TheSpecial Economic Zones Acts. 4: https://www.ontario.ca/laws/statute/25s04a.

10 Draft Regulation, s. 3: https://ero.ontario.ca/public/2025-10/3.%20SEZ%20Draft%20Regulation%20%28Designation%20Criteria%29_0.pdf.

11 Indigenous Feedback Report at p. 2: https://ero.ontario.ca/public/2025-10/2.%20Indigenous%20Communities%20Consultation%20Feedback_0.pdf.

12 Indigenous Feedback Report at p. 2: https://ero.ontario.ca/public/2025-10/2.%20Indigenous%20Communities%20Consultation%20Feedback_0.pdf.

13 https://news.gov.bc.ca/releases/2025PREM0018-000403.

The foregoing provides only an overview and does not constitute legal advice. Readers are cautioned against making any decisions based on this material alone. Rather, specific legal advice should be obtained.

© McMillan LLP 2025