- in United States

- with readers working within the Law Firm industries

- within Insurance topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Banking & Credit, Insurance and Healthcare industries

Overview and Key Practical Takeaways

The last several years have seen notable developments in the North American representations and warranties insurance (RWI) market. More regularized M&A volumes since the frenzied pace of 2021, coupled with more RWI insurers in the North American market, has led to increased competition and more favourable terms for RWI buyers.

The maturation of the RWI market also brings with it more detailed RWI claims data. Savvy RWI buyers will leverage this information while (1) devising their due diligence strategies, and (2) negotiating their RWI terms and coverage. The claims data also illustrates the potential advantages of obtaining an RWI policy.

We review a recent North American RWI claims study (the Study)1 to highlight key takeaways and provide practical commentary. We note, among other things:

- RWI claim frequency has been steadily trending upwards.

- Certain types of RWI claims represent the great bulk of losses paid.

- A notable share of RWI claims occur outside typical post-closing limitation periods.

- RWI damages claims on a multiple (e.g., EBITDA multiple) basis2 are trending upwards.

For more Fasken M&A thought leadership, visit our Capital Markets and M&A Knowledge Centre and subscribe. See also Fasken's Private M&A in Canada: Transactions and Litigation (LexisNexis 2024).

RWI Claim Frequency is Increasing

The Study reports that, historically, RWI claims have been made on approximately 18% of RWI policies. This frequency dipped downward in the years immediately before the pandemic, with claims made on only 15% of RWI policies in claim year 2020. However, claim rates have been trending steadily back upwards since then. Indications are that, by the close of the three-year policy period for claim year 2023, claim rates for the year could reach historically high levels.

Commentary: In our experience, an average RWI claim rate of 18% is markedly higher than the rate of post-closing claims in the absence of RWI (i.e., post-closing litigation). This demonstrates a clear benefit of RWI. This divergence is likely explained by a combination of factors, which could include, depending on the transaction, (1) less thorough buyer due diligence in reliance on the RWI policy, (2) broader representations made by the seller given the RWI policy and the seller's reduced potential liability, (3) a greater tendency of buyers to claim in RWI deals than in non-RWI deals, e.g., given the lower costs of a policy claim than bringing litigation, and/or (4) in vendor rollover deals (or other transactions involving continued business relations between sellers and buyers post-closing), fewer potential internal issues arising from claiming a seller breach than in non-RWI deals (and a rational and dispassionate claims process through the insurer).

Certain Types of RWI Claims Represent the Great Bulk of Losses Paid

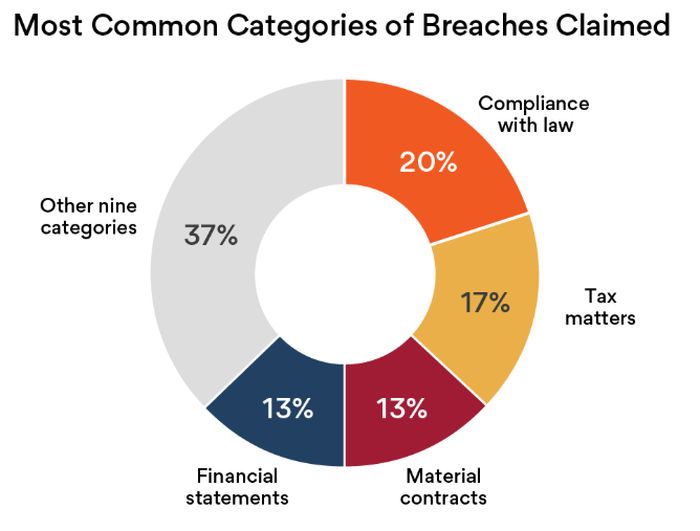

The Study reports that, among its 13 categories, the four most common categories of breaches claimed are:

- Compliance with law – 20% of claims.

- Tax matters – 17% of claims.

- Material contracts – 13% of claims.

- Financial statements – 13% of claims.

These four categories therefore together represent 63% of RWI claims while the remaining nine categories only represent 37% of claims. The Study reports that these figures are relatively consistent with previous years, with the exception of tax matters, which was only 12% of claims in the 2024 study.

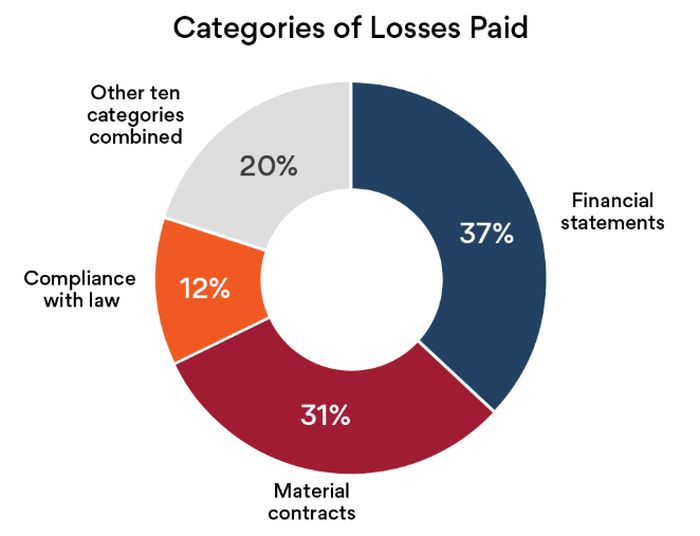

Regarding claim severity, the Study reports that, among its 13 categories, three categories represent the great bulk (80%) of losses paid. These are:

- Financial statements – 37% of losses paid.

- Material contracts – 31% of losses paid.

- Compliance with law – 12% of losses paid.

The remaining 10 categories only represent 20% of losses paid. Tax matters, while representing 17% of claims, represent only 2% of losses paid.

Commentary: While every M&A transaction is unique, these relatively consistent statistics illustrate that certain seller representations much more frequently result in (1) policy claims, and (2) larger losses paid. When claim frequency and severity are considered together, the clear standouts are, first, financial statements claims, and, second, material contracts claims. The next notable category is compliance with law. The key practical takeaway is also clear: when negotiating policy coverage and conducting due diligence, these areas should be top of mind.

A Notable Share of RWI Claims Occur Outside Post-Closing Limitation Periods

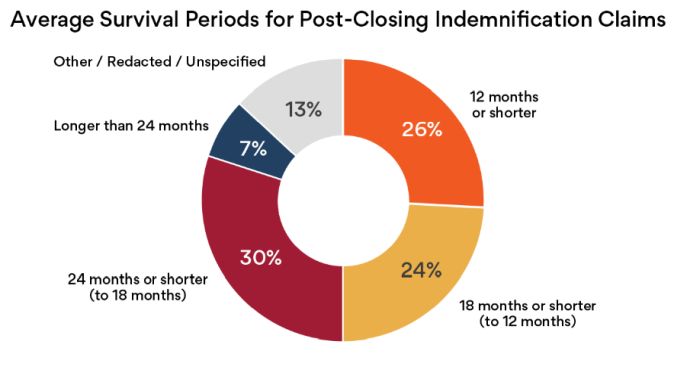

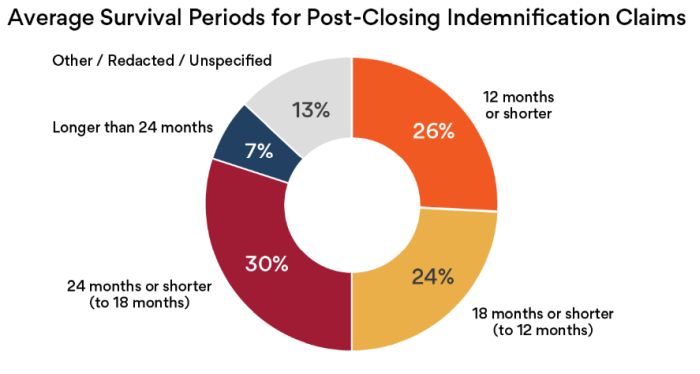

The typical RWI policy has a three-year policy period. By contrast, the typical post-closing limitation period for indemnification under a purchase agreement is notably shorter. According to the ABA Canadian Private Target M&A Deal Point Study (released in February 2025),[3] the average survival periods for post-closing indemnification claims are:

- 12 months or shorter – 26% of deals.

- 18 months or shorter (to 12 months) – 24% of deals.

- 24 months or shorter (to 18 months) – 30% of deals.

- Longer than 24 months – 7% of deals.

In comparison, the Study reports that 49% of RWI claims occur more than 12 months post-closing, with approximately:

- 20% of RWI claims occurring between 12-18 months post-closing.

- 7% of RWI claims occurring 18-24 months post-closing.

- 22% of RWI claims occurring more than 24 months post closing.

Commentary: These statistics demonstrate another benefit of RWI: that the three-year policy period stands to capture claims that may not be discoverable within the survival period under the purchase agreement, e.g., third party claims such as regulator claims or contractual counterparty claims. To this end, the Study reports that the five most common policy claims made more than 12 months post-closing are (1) compliance with laws (28%), (2) tax matters (16%), (3) financial statements (15%), (4) material contracts (10%), and (5) intellectual property (9%).

RWI Damages Claims on a Multiple Basis Are Trending Upwards

The Study reports that the frequency of RWI claims seeking damages on a multiple basis (as opposed to a dollar-for-dollar basis) is trending steadily upwards; from a low of 5% of claims in 2020, to 21% in 2022, to 32% in 2024. Whereas for RWI policies incepted between 2016 to 2019, only 14% of RWI claims were for losses greater than dollar-for-dollar, for policies incepted between 2021 and 2024, 23% of claims were for losses greater than dollar-for-dollar.

Commentary: Whether or not a buyer can claim for damages on a multiple basis will ultimately be a situation-specific, claim by claim analysis. Nonetheless, this trend is noteworthy. So too are recent court rulings addressing (1) when damages on a multiple (e.g., EBITDA multiple) basis may be appropriate in post-closing M&A disputes, and (2) what drafting in the purchase agreement (e.g., the definition of "losses") could impact the court's analysis. These developments should be considered in tandem.

Concluding Comments

RWI has become a fixture in Canadian private M&A over the last decade. The last several years have seen a greater number of RWI insurers enter the Canadian M&A market. This has led to greater competition and more favourable terms for RWI buyers in Canada. This includes in the lower mid-market, where RWI was previously less cost efficient.

The expansion and maturation of the North American RWI market brings with it increasingly detailed RWI claims data. Savvy RWI buyers will leverage this information while (1) devising their due diligence strategies, and (2) negotiating their RWI terms and coverage. The claims data also illustrates the potential advantages of obtaining an RWI policy versus relying on traditional indemnification regimes.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

Footnotes

1. See Aon, 2025 Transaction Solutions Global Claims Study (2025), available here (the Study). The Study covers the (i) North American, (ii) EMEA (Europe, the Middle East, and Africa), and (iii) APAC (Asia Pacific) markets. All statistics cited in this article relate only to the North American RWI market. Our reference to the Study does not constitute any endorsement of Aon relative to its competitors. Prospective purchasers of RWI are encouraged to consider all related policy and service providers. Learn more

2. See our related Fasken bulletin, EBITDA Multiples in M&A Agreements and Post-Closing Disputes. Learn more

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]