- within Corporate/Commercial Law topic(s)

- in United States

- with readers working within the Business & Consumer Services, Media & Information and Securities & Investment industries

- within Food, Drugs, Healthcare, Life Sciences, Environment and Law Department Performance topic(s)

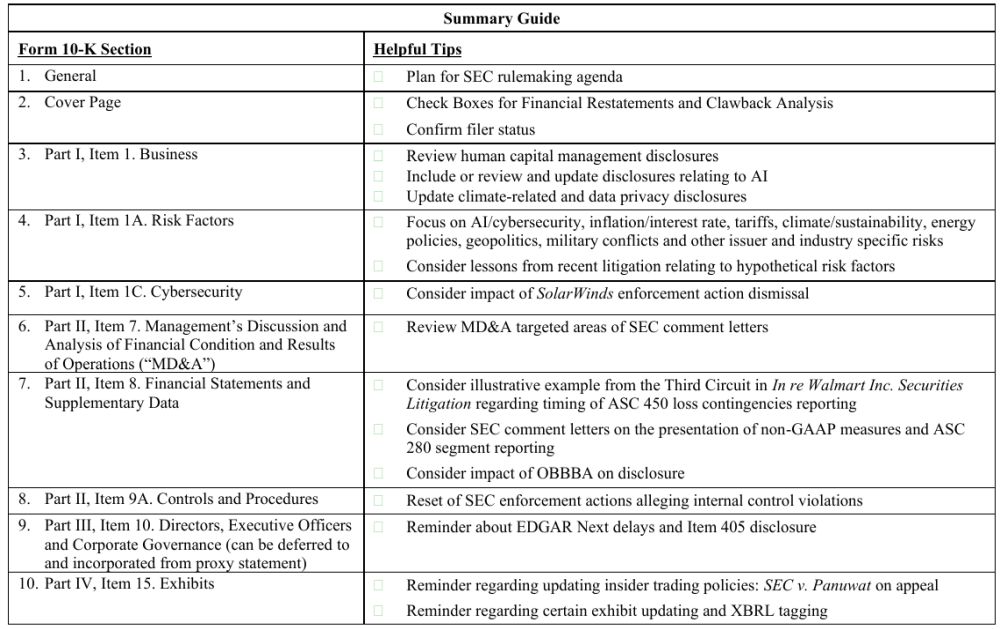

This Alert highlights the latest trends and considerations for issuers preparing to file their Form 10-K in 2026 for the fiscal year ended December 31, 2025, including:

- Insights from recent U.S. Securities and Exchange Commission (SEC) comment letters, guidance, position statements, enforcement proceedings and litigation; and

- Developments from the new U.S. administration's priorities and other regulatory and geopolitical events.

1. General

- The SEC's Regulatory Agenda is currently focused on, among other things, rules shifting financial reporting obligations from a quarterly to a semi-annual basis, enhancing emerging growth company (EGC) accommodations, simplifying filer status for reporting companies and modernizing shelf registration. The SEC is also seeking public comment on how Regulation S-K can be revised to "focus on eliciting disclosure of material information and avoid compelling the disclosure of immaterial information." Statement on Reforming Regulation S-K by Chair Paul Atkins (Jan. 13, 2026).

- Issuers should have an internal process in place to monitor SEC rulemaking proposals and be prepared to implement applicable changes to company practices.

2. Cover Page

Check Boxes for Financial Restatements and Clawback Analysis

- Reminder regarding two Form 10-K checkboxes for issuers with

securities listed on a U.S. stock exchange – one of which

must be checked if the financial statements of the issuer included

in the filing reflect the correction of an error to previously

issued financial statements and the other must be checked if any of

those error corrections are restatements that required a recovery

(or clawback) analysis of incentive-based compensation received by

the company's executive officers during the relevant recovery

period.

- Checkbox covers both "Big "R" (which stems from an error that was material to previously issued financial statements, requiring a company to file an Item 4.02 Form 8-K) and "little r" restatements (which corrects errors that were not material to previously issued financial statements but that would result in a material misstatement in the current period if (i) the error was left uncorrected in the current period or (ii) the correction of the error was recognized only in the current period).

- Item 402(w) of Regulation S-K requires disclosure of actions to recover erroneously awarded compensation pursuant to the issuer's NYSE/Nasdaq mandated clawback policy. Even if incorporated by reference from the proxy statement, the checkbox on the cover of the Form 10-K must still be checked.

Confirm Filer Status

- In August 2025, the SEC issued new CDI 130.05, which provides guidance on when an issuer may become an accelerated or large accelerated filer after it loses its status as a smaller reporting company (SRC). Importantly, the SEC clarified that under the SRC revenue test – (paragraph (2) or 3(iii)(B) of the SRC definition) – issuers have one year after the loss of SRC status to continue as non-accelerated filers. For example, if a calendar year issuer loses its SRC status under the revenue test on December 31, 2025, it will be deemed a non-accelerated filer (irrespective of potentially qualifying as an accelerated filer or large accelerated filer) for all filings due in fiscal 2026. This means the applicable issuer can (i) defer for one year the Section 404(b) auditor attestation and (ii) report Form 10-Qs within 45 days of quarter end (rather than 40 days of quarter end for accelerated and large accelerated filers).

3. Part I, Item 1. Business

Human Capital Management

- On September 4, 2025, the SEC released its Spring 2025 United Agenda of Regulatory and Deregulatory Actions, reflecting the withdrawal of a number of rulemakings previously proposed during the Biden Administration, including rulemaking proposals on Corporate Board Diversity and Human Capital Management.

- Further, in light of the Trump Administration's executive orders focusing on certain diversity, equity and inclusion (DEI) initiatives (see Executive Order14173, Executive Order14168, and Executive Order14151), as well as guidance on unlawful discriminatory practices from federal agencies including the Department of Justice and the Equal Employment Opportunity Commission, issuers should review HCM disclosures in their Form 10 Ks responsive to Item 101(c) of Regulation S-K, sustainability reports or corporate websites, balancing the desire of various constituencies to see diversity data, the requirements Item 101(c) of Regulation S-K, and potential regulatory scrutiny.

Artificial Intelligence

- AI Products and Uses. Issuers should continue to describe

(particularly if previously highlighted in earnings releases, on

earnings calls or on their website): artificial intelligence and

machine learning (collectively, AI) products and initiatives; AI

research and development efforts; the impact of AI on the

issuer's products, services, relationships with customers or

suppliers; and AI competitive conditions. For example, a recent SEC

comment letter asked, in part, the following:

- "Please tell us, and revise future filings, to discuss your data science platform and the status of any AI integration efforts. In this regard, we note your disclosure on page [] that you are integrating generative AI tools into your systems. We also note discussion of your data science platform during the conference call to discuss your fourth quarter 2024 results . . . , including that it is "industry-leading" and one of the sources of your competitive advantage; and in the . . . press release . . . posted on your website."

- AI Washing. Issuers must continue to consider whether their regulatory filings, public disclosures and other relevant documents accurately reflect their AI-related capabilities, usage and risks. Federal regulators (including the SEC, Department of Justice (DOJ) and the Federal Trade Commission) and private plaintiffs are increasingly bringing claims alleging false and misleading statements regarding AI. For example, in April 2025, the SEC brought enforcement actions and the DOJ brought parallel criminal proceedings against (i) Albert Saniger, the former CEO of Nate, Inc. ("Nate"), who allegedly made false and misleading statements in a pitch deck used to solicit early stage capital about Nate's use of proprietary AI technology and its operational capabilities and (ii) Ramil Palafox, the founder of Praetorian Group International Corporation (PGI Global), alleging, among other claims, that he made false statements to investors regarding the development of an AI-powered crypto auto trading platform and other topics.

- AI Regulatory Developments. Issuers should discuss rapidly evolving AI regulatory developments, including the European Union's Artificial Intelligence Act, the Trump Administration's AI Action Plan published in July 2025 (which outlines many policy recommendations for agencies focused on promoting innovation, building infrastructure, and protecting national security as it relates to the proliferation of AI technologies) and almost all states that have enacted regulations aimed at AI technology and usage (but see the Trump Administration's December 2025 Executive Order on Ensuring a National Policy Framework for Artificial Intelligence, which seeks to limit state-level AI regulation).

Climate

- Greenwashing. Issuers should continue to ensure that sustainability-related disclosures are up to date and accurate, including targets and goals. See In re Keurig Dr Pepper Inc. (Sept. 10, 2024). The SEC under Chair Atkins will continue to bring enforcement actions against an issuer that discloses materially false and misleading climate related information.

- SEC Mandated Climate-Related Disclosure. On April 4, 2024, the

SEC voluntarily stayed its previously adopted climate-related

disclosure rules, pending judicial review by the U.S. Court of

Appeals for the Eight Circuit. In March 2025, the SEC informed the

Court that it has ended its defense of the climate disclosure

rules. In July 2025, the SEC requested the Court to make a decision

about the rule. In September 2025, the Court placed the case into

indefinite abeyance until the SEC reconsiders the rule by notice

and comment rulemaking (or renews its defense of the rule).

- Although the SEC is unlikely to adopt prescriptive climate-related disclosure rules (whether in the form previously proposed or otherwise), many institutional investors and other stakeholders still expect issuers to disclose climate-related information, which is typically included in a sustainability report, separate from the Form 10-K. Such disclosures should be supported by disclosure controls and procedures and not include false and misleading information.

- Other Climate-Related Disclosure Requirements. Issuers should

be mindful of other climate and sustainability related regulations

when preparing this year's Form 10-K, including disclosures

around relevant regulations and risk factors.

- Entities preparing to comply with new California climate disclosure requirements face looming deadlines amid uncertainty. The compliance deadline for climate-related financial risk reports specified in California Senate Bill 261 is January 1, 2026, but enforcement of that deadline has been stayed pending appeal. On December 1, 2025, the California Air Resources Board (CARB) published an enforcement advisory stating that it would not take action against any covered entity that does not report by January 1, 2026, and that CARB will provide an alternate date for reporting after the appeal has been resolved. Scope 1 and Scope 2 greenhouse gas (GHG) emissions disclosures are due August 10, 2026, with Scope 3 disclosures due in 2027 (as required by California Senate Bill 253). Similar rules are under consideration in several states including New York and New Jersey.

- Additionally, the EU Corporate Sustainability Reporting Directive, which was first enacted in 2022 but is currently being amended to significantly reduce the number of companies in scope and a number of disclosure requirements, may also require U.S. issuers to provide extensive sustainability-related disclosures if they have large EU subsidiaries (with first disclosures due in 2028) and the U.S. parent meets certain size thresholds (with first disclosures due in 2029).

- Issuers should also review other regulations that may apply to subsidiaries and/or the parent issuer, including requirements based on the International Sustainability Standards Board standards that are being implemented in many countries.

Data Privacy

- Issuers that include disclosure regarding state and foreign data protection laws and compliance programs in relation to such laws should review their disclosures and update as necessary to reflect the additional states that have adopted these laws, including in Indiana, Kentucky, Rhode Island, and others.

4. Part I, Item 1A. Risk Factors

Issuers should ensure that risk factors are current, tailored, and consistent with disclosure in the remainder of the Form 10-K, including the business section, MD&A, market risks and the forward-looking statements disclaimer, as well as in earnings materials.

Artificial Intelligence and Cybersecurity

- AI adoption and usage is impacting almost every issuer and industry. Most (if not all) issuers should consider preparing tailored risk factors that are specific to the issuer and the particular AI tool at issue, and avoid boilerplate AI risk factors.

- Issuers should assess cybersecurity and data privacy threats and the potential impacts thereof, and provide appropriate risk factors addressing specific and general vulnerabilities that could impact operations and results.

Inflation and Interest Rates

- Because uncertainty remains concerning inflation and interest rates, including as a result of future U.S. government debt ceiling negotiations, interest rate cuts by the U.S. federal reserve, and trade wars, issuers should continue to review risk factors to ensure they appropriately account for the latest, specific inflation and interest rate risks to the issuer's business, results of operations and liquidity.

Tariffs

- Issuers should provide tailored risk factors to address actual or potential material impacts from tariffs, trade wars, and related trade uncertainties. Consider identifying impacted geographies, products, and supply chain disruptions.

Climate and Sustainability

- Issuers should continue to review the feasibility of achieving their previously announced climate and sustainability-related goals, and consider whether risk factors related to such goals need to be updated including to reflect any progress (or lack thereof).

Geopolitics

- Issuers should assess whether and how evolving geopolitical events could materially affect their business and warrant risk factor disclosure, including risks relating to increased deregulation, government shutdowns, shifts in energy policy (i.e., oil, solar and wind), changes in immigration policy, and changes in foreign policy with China, Russia, Europe, Venezuela, other countries in Central and South America, Mexico, Canada and/or the Middle East.

Military Conflicts

- Issuers should continue to include material risks relating to ongoing and potential global military conflicts (i.e., Ukraine, Venezuela, China/Taiwan and/or the Middle East), especially if the issuer does business in or with parties in impacted regions.

To read this article in full, please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.