- with readers working within the Retail & Leisure industries

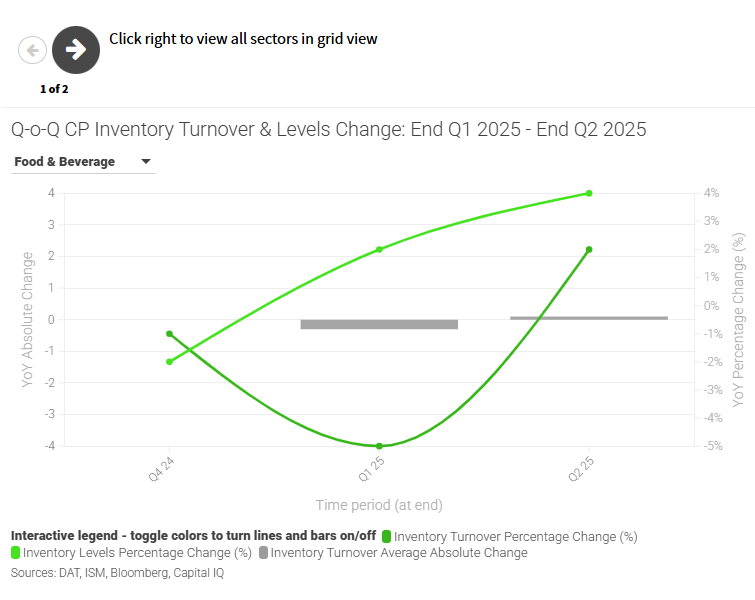

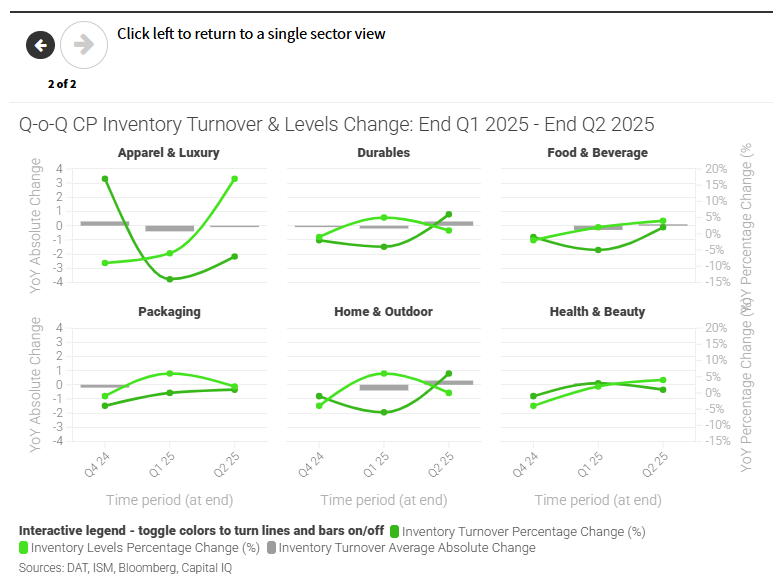

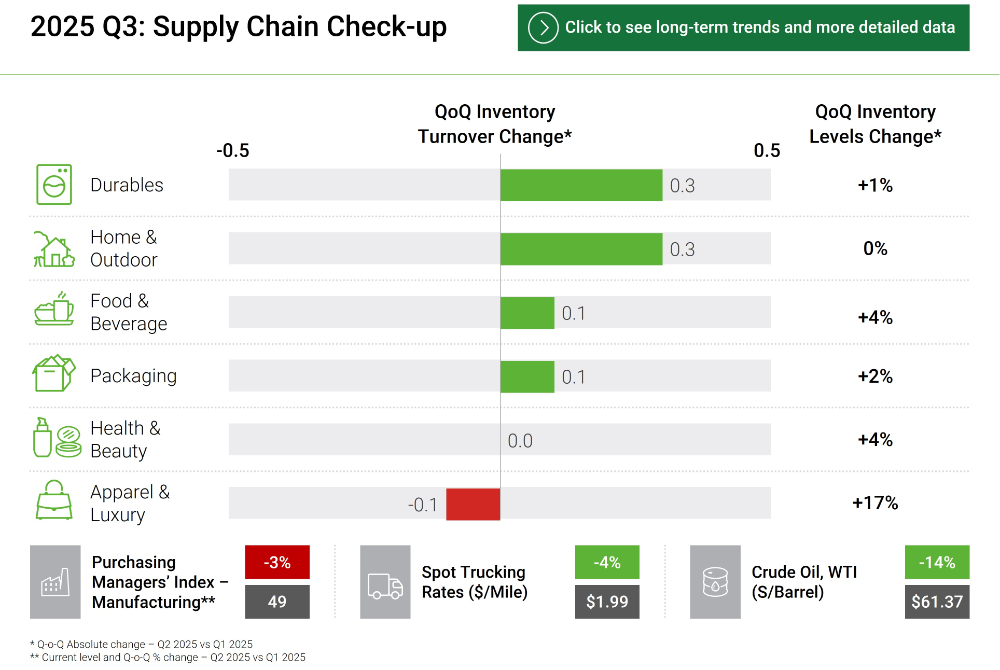

Between Q1 and Q2 of 2025, supply chain indicators showed differing signals across sectors. Inventory turnover improved in most categories, with notable gains in Home & Outdoor and Durables, suggesting better inventory efficiency. However, Apparel & Luxury saw a small decline. The Purchasing Managers' Index (PMI) fell by 3%, indicating a slight contraction in manufacturing activity. Meanwhile, crude oil prices dropped sharply, which may ease input and transportation costs. Supporting this, spot trucking rates also declined by 4%, reflecting reduced freight demand. Overall, while inventory metrics point to operational improvements, macro indicators suggest a softening in momentum.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.