- within Technology topic(s)

- with readers working within the Retail & Leisure industries

AI in 2025: Key Takeaways on Deal Trends, Fundraising & Market Outlook, Key Takeaways: AI Investment, Dealmaking & Market Outlook (H1 2025 Report)

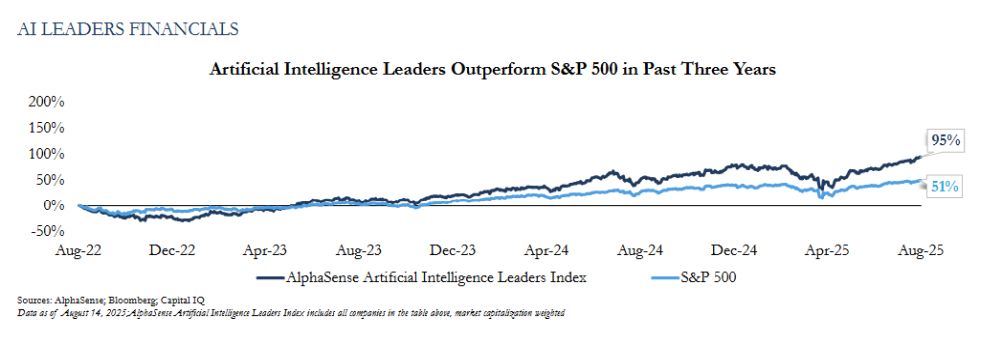

- Despite uncertainty in global markets, AI remains a strategic priority among business executives, investors, and government, fueling sustained investment in AI infrastructure and dealmaking with AI developers and AI-enabled companies.

- Amid geopolitical tension, nations are vying for pole position as governments funnel subsidies, grants, and incentives to AI innovation hubs like Silicon Valley and Beijing.

- Private capital has also represented a major catalyst for AI

innovation.

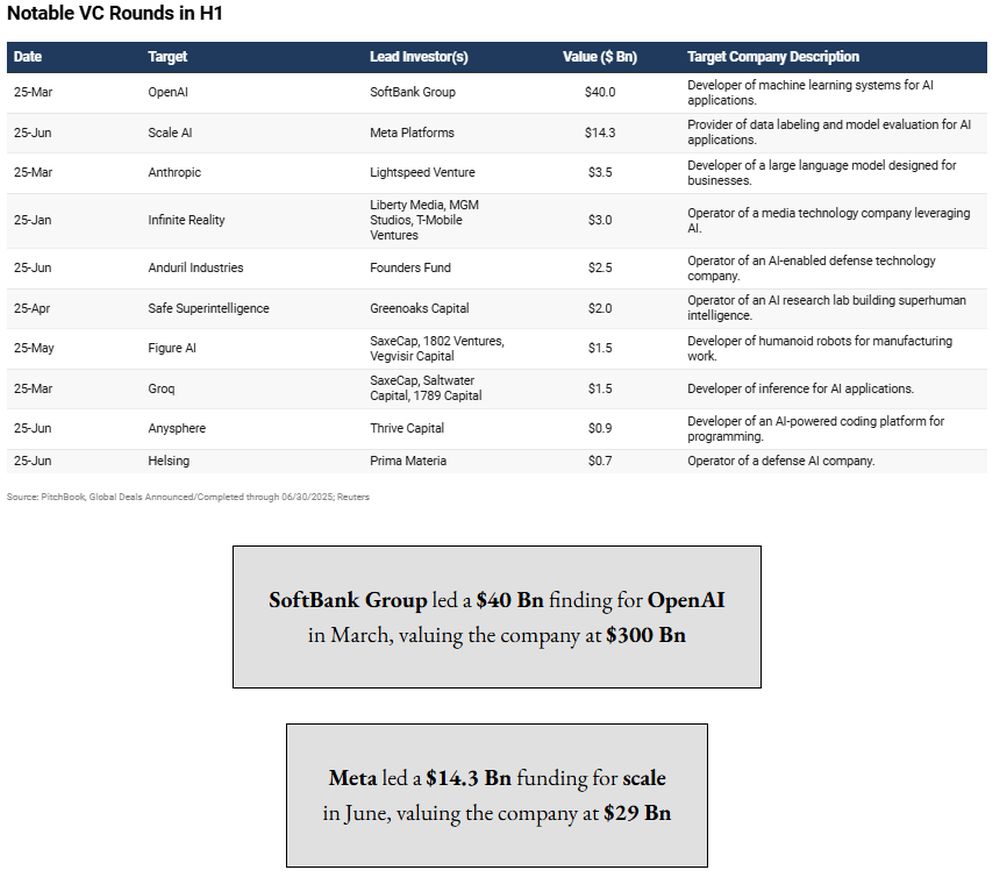

- Venture capital (VC) firms are funding emerging AI platforms and businesses as well as the next wave of AI innovation.

- Private equity (PE) firms are focusing their investment on AI-related data infrastructure and add-on acquisitions that bolster the ability of their portfolio companies to compete against AI disruptors.

- While total private capital (VC and PE) fundraising for AI has declined 40% Year-over-Year (YoY), an unprecedented proportion of capital raised during H1 2025 is earmarked for AI investments.

- With businesses striving to maintain competitiveness amid rapid AI-driven technology change and disrupted markets, acquisitions of AI companies by strategic investors have accelerated in 2025 and are key to bolstering the ability of legacy businesses and product offerings to compete in the face of AI disruption.

-

- While the adoption of AI is expensive, the cost of inaction is much larger; 40% of respondents in PwC's recent CEO Survey indicated that their companies won't survive the next decade if they don't chart a new path amid looming existential change driven by AI.

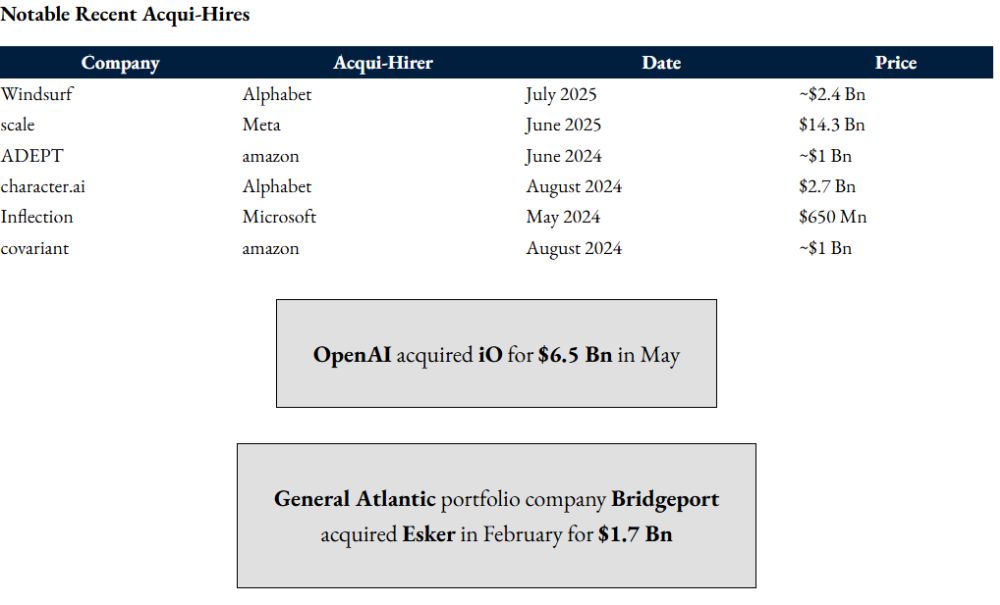

- Big Tech companies are arming themselves for the next wave of AI-led innovation, bringing in top talent from fast-growing AI startups and investing significant capital in AI-related infrastructure to integrate AI across workstreams and product offerings.

- While total deal volume involving AI targets in H1 (aggregating across strategic M&A, PE, and VC) was down 20% from H1 2024 (which we believe was due in significant part to a slowdown in the broader VC fundraising market), total deal value involving AI targets has increased 127% from H1 2024, with investors paying significant premiums for promising startups and AI tech talent, and making bold moves to position themselves for the next wave of AI-led innovation and productivity gains in their sectors.

Sources: PitchBook, Global Deals Announced/Completed through 06/30/2025; PwC

AI Deal Trends

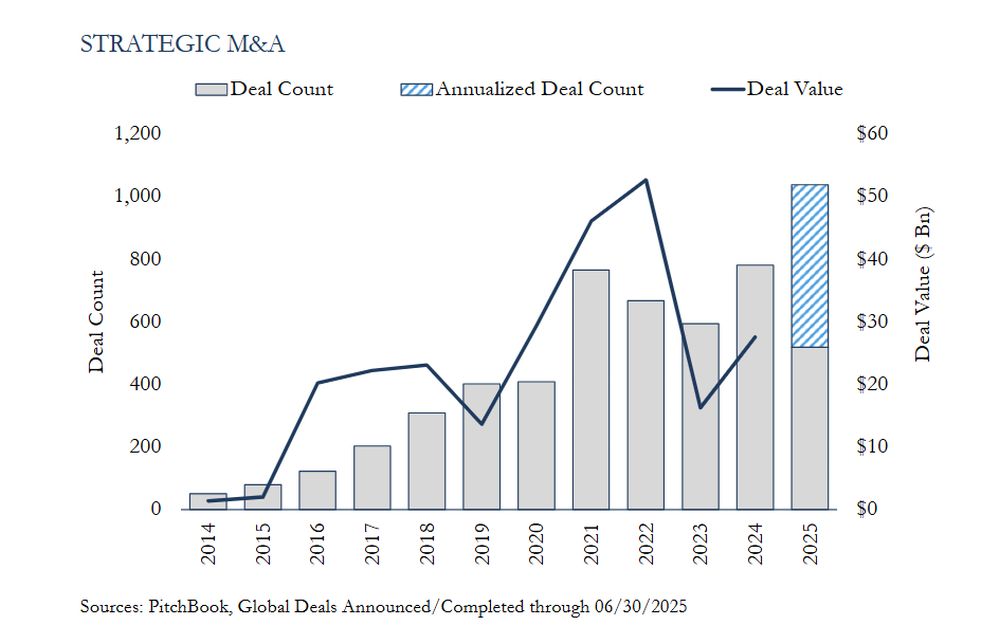

STRATEGIC M&A

- Strategic M&A involving AI-related targets has been strong through H1 2025, with full-year deal volume and value on pace to exceed those of the prior year by 33% and 123%, respectively.

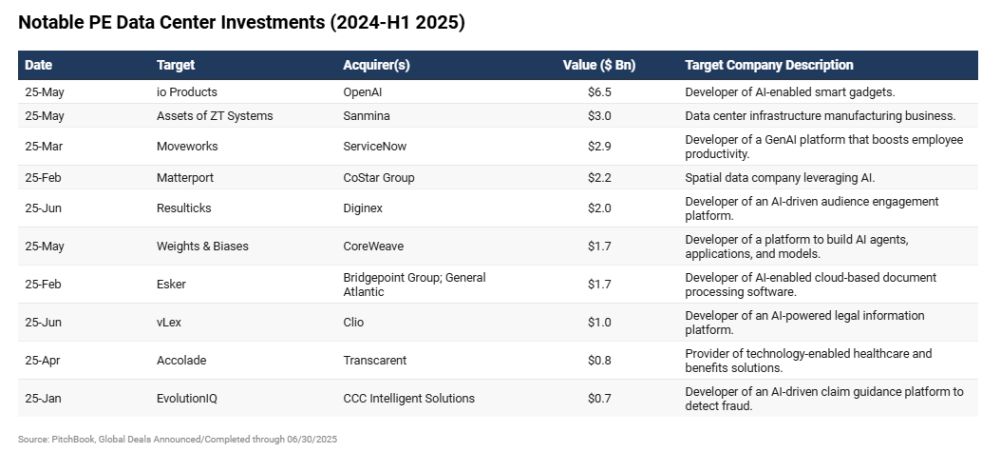

- Due to rapid technology developments in the AI space, the next six to 12 months will be critical for business leaders to reposition their companies for the next wave of AI-driven innovation. The short timeline to adapt will fuel capability-driven deals in which large companies acquire smaller targets that expand product suites or add key AI talent to their organizations to bolster AI capabilities going forward. This is exemplified by OpenAI's $6.5 billion acquisition of io Products and Meta's $14.3 billion investment in Scale AI.

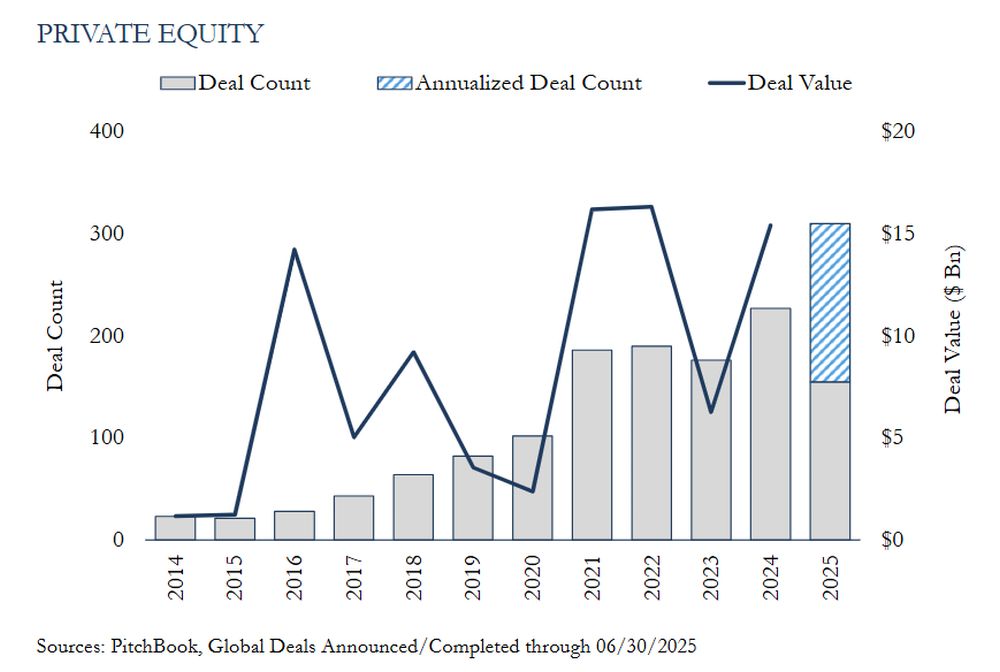

PRIVATE EQUITY

- While PE firms have been less active investors in AI companies relative to their VC peers, deal volume is on pace to reach an unprecedented level in 2025, with 155 deals already announced or completed through H1, compared with just 104 in H1 2024, representing a 49% increase on a YoY basis.

- PE firms have demonstrated selectivity, preferring mature companies with proven use cases and financial performance.

- Instead of placing risky bets on AI startups, PE firms have been deploying capital in data infrastructure investments needed to support the AI infrastructure build-out.

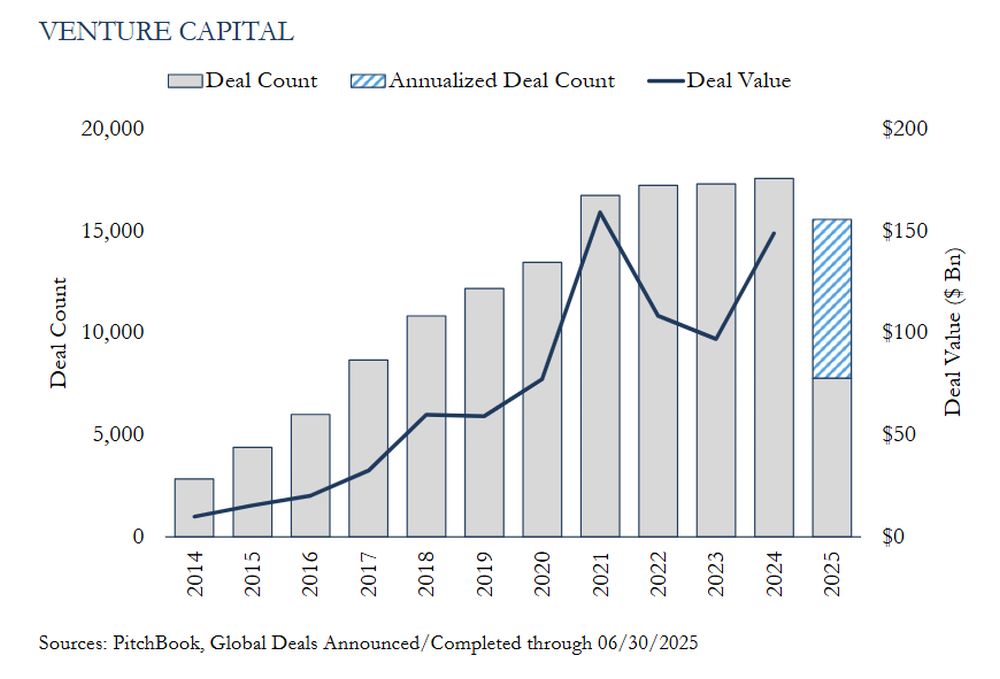

VENTURE CAPITAL

- While VC deal count for rounds involving AI targets is on pace to finish the year down 12% YoY, this is primarily a reflection of a slowdown in the broader VC market, as venture dollars invested in AI are on pace to exceed all previous years and outsized deals involving promising AI targets continue to take place.

- Amid prolonged sluggishness in the broader VC deal market, AI has been a bright spot. AI-related investments accounted for the majority of VC deal value in H1 2025 (51%), compared with just 12% of total VC deal value in 2017.

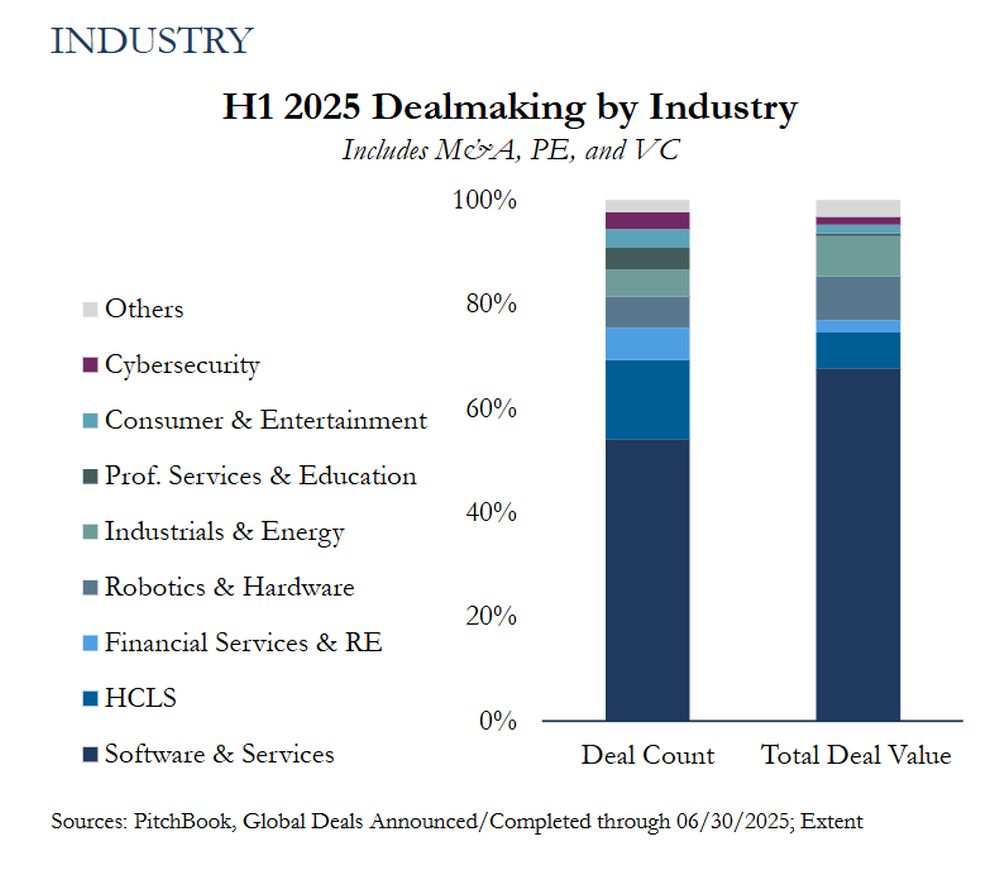

INDUSTRY

- In H1, the majority of AI deal activity on both a volume (54%) and a value (68%) basis across M&A, PE, and VC was in the Software & Services segment.

- Healthcare & Life Sciences (HCLS) had the second-highest share of AI-focused deals by volume but ranked fourth on a total value basis due to the prevalence of a higher number of smaller transactions and deals with undisclosed values.

- Despite ranking fourth by deal count, the Robotics & Hardware segment had the second-highest total deal value in H1.

REGION

While AI is becoming ubiquitous and dealmaking is occurring globally, a few countries have secured hub status.

United States

- In H1, the US accounted for 47% of deal volume (across M&A, PE, and VC) involving an AI target, and an impressive 83% of total transaction value.

- The US is positioned as a dominant force in AI, driven by a strong startup ecosystem and accessible resources for capital-intensive innovation.

United Kingdom

- In H1, the UK comprised the second highest proportion of AI deal volume (M&A, PE, and VC) and deal value at 8% and 2%, respectively.

- The UK also views AI as vital to national ambitions, and it benefits from a large quantity of startups and a mature VC ecosystem.

China

- In H1, China was third by volume (4%) and value (2%) for deals involving an AI target (M&A, PE, and VC).

- While ranked third, China is expected to become a pivotal force in AI innovation, with an ambitious development strategy that involves investment across the government, private sector, and education system paired with a fleet of over 4,500 AI-related startups.

Sources: PitchBook, Global Deals Announced/Completed through

06/30/2025; Extent

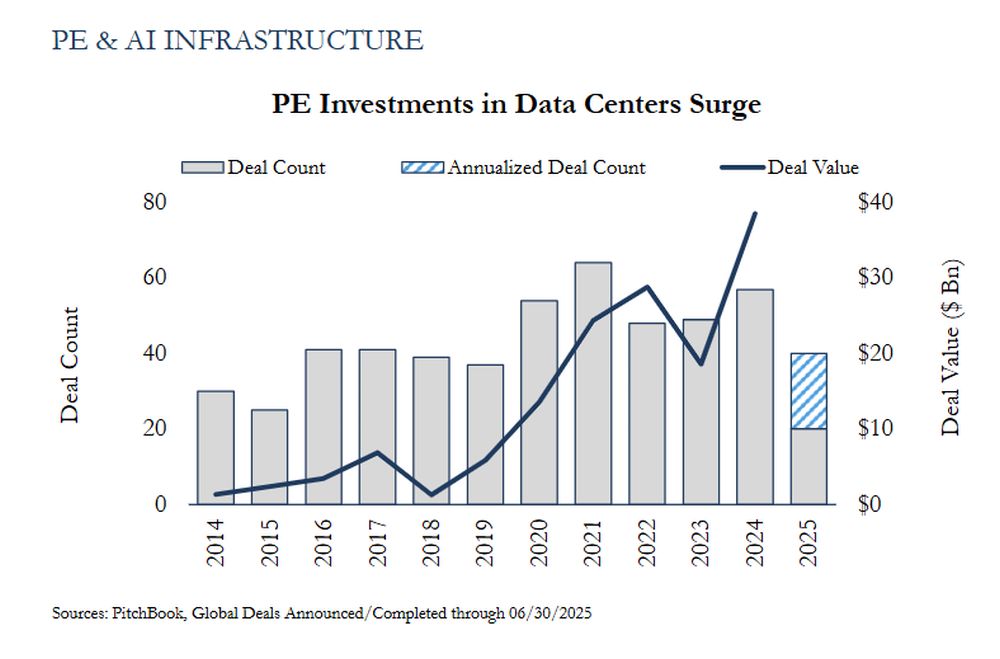

PE & AI INFRASTRUCTURE

- While PE firms have pursued add-on acquisitions to enhance AI

capabilities in their portfolio companies, their broader AI

investment strategies remain focused on the digital infrastructure

underpinning the technology's large-scale deployment.

- PE deal value involving data center targets more than doubled in 2024 (52% increase) and is on pace for another strong year in 2025.

- For PE investors, AI infrastructure represents a less risky avenue for PE to capitalize on the proliferation of AI.

"In some ways, it's like selling shovels to people looking for gold. I don't know who is going to find gold or be the largest AI platform, but whoever is doing anything in that world needs an environment, i.e. a data center, to deploy it." – Jon Mauck, Senior Managing Director and Head of Data Center Investment Strategy at DigitalBridge (Pitchbook, January 8, 2025)

Notable AI Transactions: M&A

M&A

- Corporate repositioning is a major driver of M&A transactions involving strategic buyers and AI targets, as demonstrated by CoStar acquiring spatial data company Matterport.

- Quickly growing AI unicorns have utilized M&A to bolster offerings and penetrate new subsegments, as demonstrated by OpenAI's acquisition of hardware startup io Products.

- While PE has focused on data infrastructure investments, sponsors remain interested in value creation opportunities and defensive acquisitions, and are adding AI-enabled products to existing portfolio company offerings via add-on acquisitions.

- Big Tech has invested in AI through corporate VC investments, acqui-hires, and robust capital spending to support AI deployment and adoption.

Venture Capital

- VC firms have demonstrated a strong appetite for AI technology

with broad commercial applications, as businesses are expected to

continue to adopt AI technology to drive growth and productivity

gains, and reduce costs.

- This is demonstrated by the Anthropic, Groq, Anysphere, and FigureAI rounds.

- AI-enabled Defense Tech has also attracted VC investment, supported by ongoing geopolitical volatility, as shown by the Anduril and Helsing rounds.

- Corporate venture capital (CVC) participation in AI funding

rounds has risen from 54% of deal value in US VC AI rounds in 2022

to 75% (as of June 9, 2025), driven by Big Tech companies.

- These CVC investments have also afforded Big Tech investors an opportunity to develop relationships with key players in the AI ecosystem.

- In a strategy more akin to PE roll-ups than traditional VC, some firms, including Khosla Ventures and General Catalyst, are acquiring mature, people-intensive businesses and optimizing them with AI.

- General Catalyst has already backed seven such companies, including Long Lake.

AI Private Capital Fundraising

GLOBAL FUNDRAISING ACTIVITY

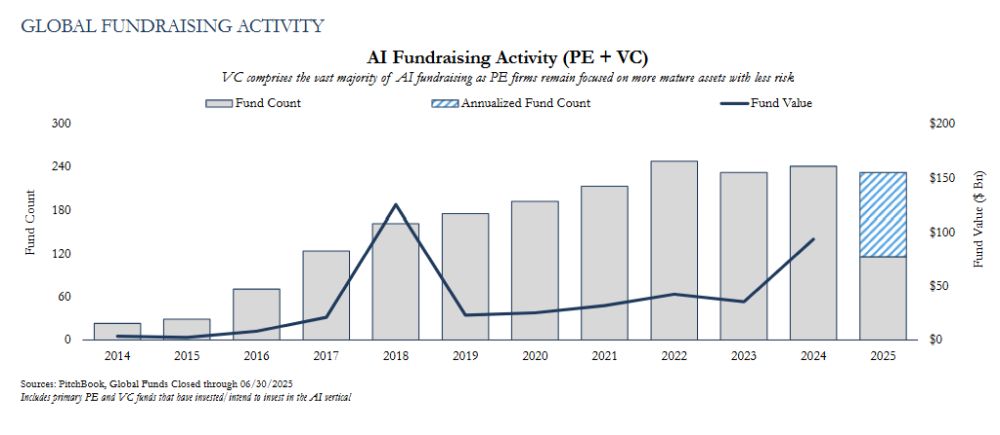

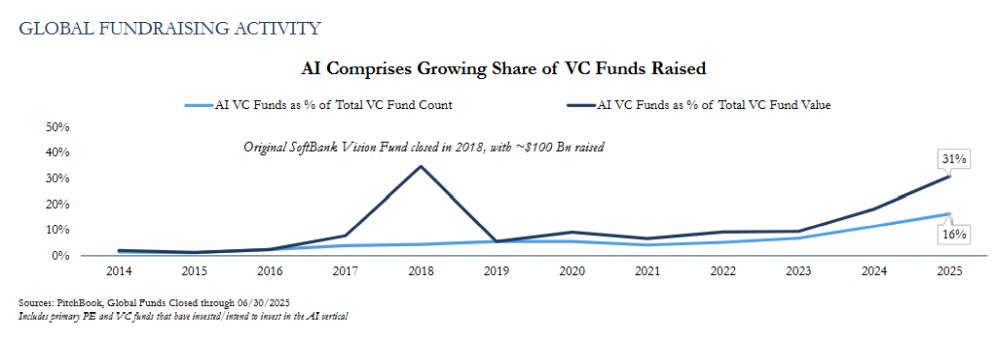

- While private capital fundraising remains suppressed across nearly all industries due in part to LPs having restricted new capital commitments until distributions from existing funds transpire, funds with trusted expertise and a track record in the technology sector have found success in raising funds to pursue AI-focused investments.

- Private capital fundraising by funds focused on AI investments is on pace to be nearly flat relative to the prior year on a fund count basis, while new capital raised by these funds is expected to decline 28% YoY if the current pace of capital raised is maintained for the remainder of 2025.

- Primary fundraising for all PE and VC funds is on pace to decline 26% (on a fund count basis) and 16% (on a total capital raised basis) YoY.

- VC firms account for the vast majority of private capital raised for AI investments in H1 2025. Excluding fundraising by PE funds, VC funds focused on AI investments accounted for 31% of total capital raised by all VC funds in H1 2025.

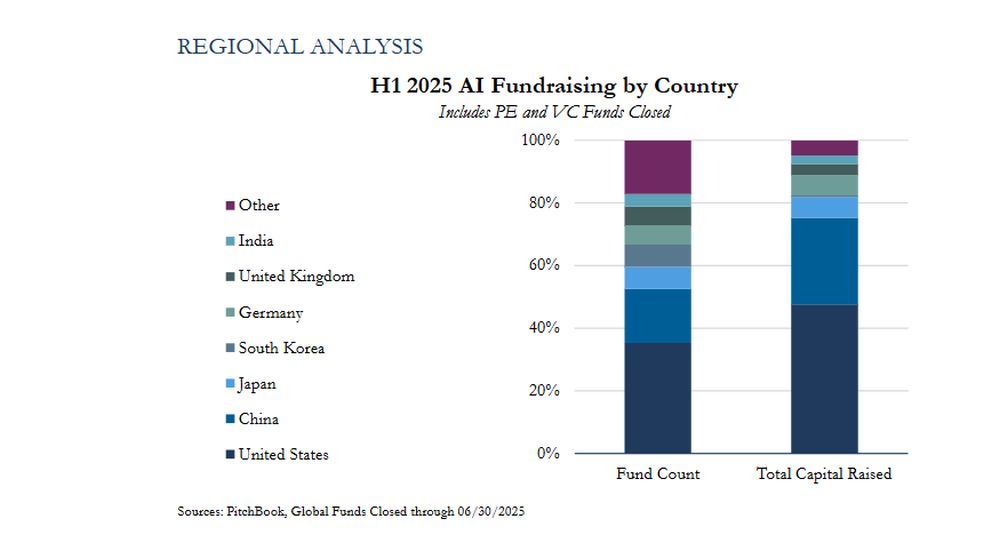

REGIONAL ANALYSIS

- The US and China have dominated private capital fundraising for AI investments in H1 2025, accounting for 53% by fund count and 75% of total capital raised.

- Although the US leads by a significant margin in terms of the number of private capital funds that are fundraising for AI investments and total capital raised, two of the largest AI-related funds closed in 2025 to date are domiciled in China.

- While the UK saw the second-highest deal activity (across M&A, PE, and VC) involving AI targets, AI-related fundraising by UK-domiciled funds has been limited relative to other nations.

- The AI ecosystem in China and the US is receiving significant support from government entities, with the Chinese state-backed National AI Industry Guidance Fund being active in early-stage AI investment in China, and the White House rolling out the AI Action Plan.

- State-backed private capital funds intended to support domestic AI innovation are expected to continue to gain traction amid growing trade tensions, particularly as AI is viewed increasingly as key to maintaining competitiveness in major industries, including defense, technology, healthcare, and manufacturing.

AI Disruption

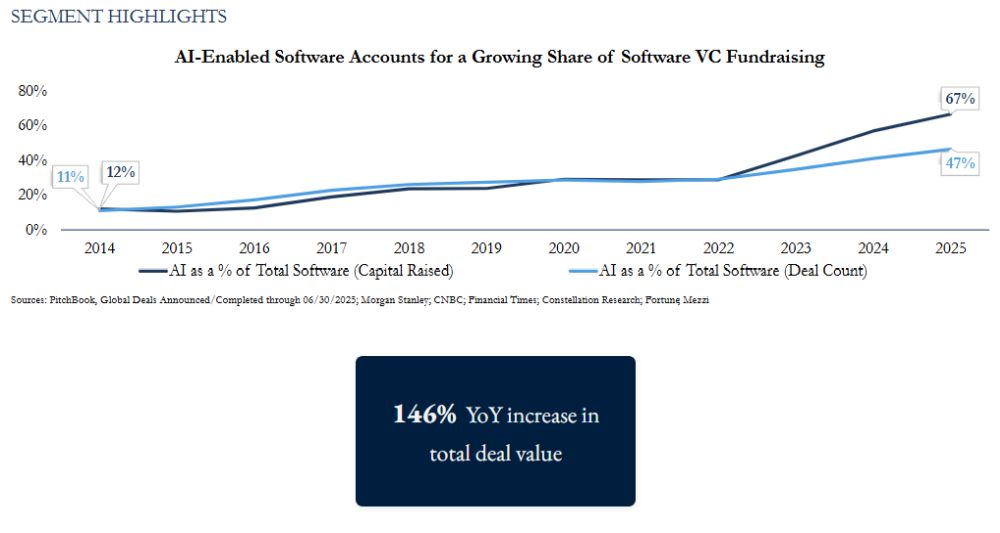

SOFTWARE & SERVICES

- The Software & Services segment accounts for the lion's share of M&A, PE, and VC activity within the AI vertical and has seen strong transaction activity in 2025 as strategics look to bolster existing platforms and offerings, while private capital investors aim to corner winners in the AI arms race.

- Transaction activity in the Software & Services segment is expected to continue to grow at a rapid clip in 2025 and beyond, supported by enterprises doing deals to add to product offerings and tech stacks, along with investors capitalizing on rapidly growing valuations as use cases and adoption proliferate.

- AI adoption is expected to fuel a wave of consolidation in the

Software & Services segment, as Big Tech companies acquire or

hire talent from late-stage unicorns and look to layer service

capabilities on top of their cloud computing infrastructure.

- Microsoft, Alphabet, Amazon, and Meta intend to spend a combined $320 billion on AI technologies and infrastructure in 2025, up from $230 billion in total capital expenditures in 2024.

- Agentic AI is poised to be the next frontier due to its ability to autonomously understand and execute tasks.

"LLMs are competing to deliver the best inference stack to enterprises, which includes reasoning capabilities and strong AI governance. With sophisticated reasoning and adaptive learning, agentic AI will be able to make decisions and take actions to achieve business goals with minimal human intervention." – Brett Klein, Head of East Coast Technology Banking at Morgan Stanley (March 20, 2025)

"Big Tech lines up over $300 Bn in AI spending for 2025" – Financial Times (February 2025)

"Disruption is coming for enterprise software." – Constellation Research (August 2024)

"Sorenson Capital raises $150 million third fund to chase security and enterprise software deals." – Fortune (June 2025)

HEALTHCARE & LIFE SCIENCES

- HCLS comprised the second-highest share of M&A and VC activity across the AI vertical, as strategics pursue assets that enhance existing operations and accelerate research & development. Recognizing the broad range of applications for AI across HCLS, VCs are racing to invest in transformational technology.

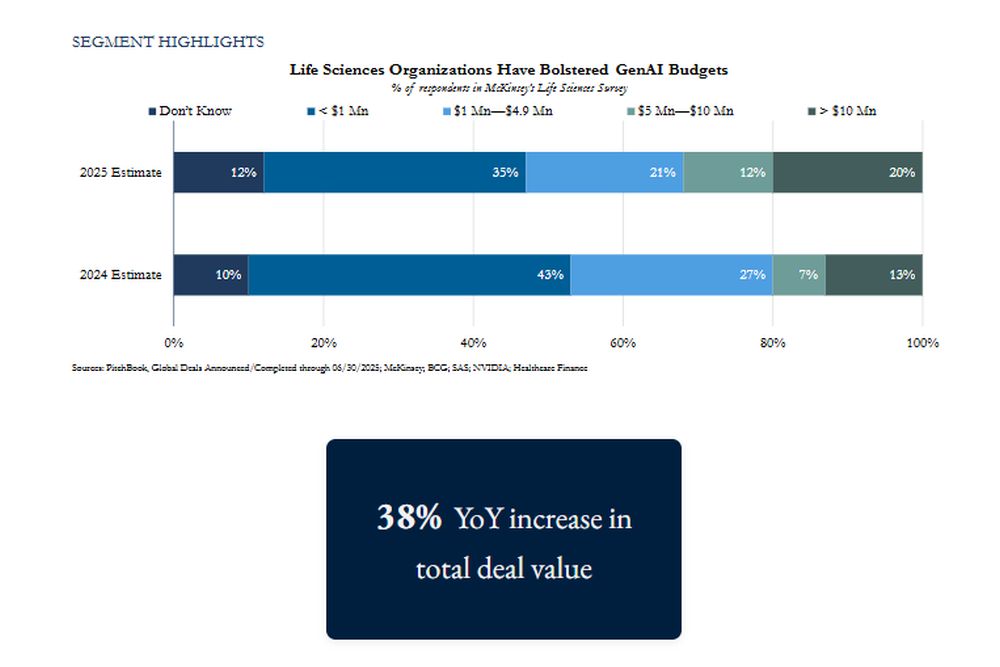

- Adoption of AI in HCLS organizations has occurred rapidly, with

all respondents in a McKinsey survey (summer 2024) of 100 Pharma

and MedTech leaders indicating that they have experimented with

GenAI and 32% indicating that their companies have taken steps to

scale the technology.

- While only 5% of respondents in the McKinsey survey indicated that they have used GenAI as a competitive differentiator to generate consistent and significant financial value, two-thirds of respondents plan to significantly increase investment in the technology in 2025.

- Life Sciences organizations have adjusted their 2025 GenAI budgets to accommodate capital expenditure needs, demonstrating bullishness regarding AI technology and an appetite for new investments.

- In a sign of rising optimism regarding the ability of AI to transform the HCLS industry, many of the new unicorns in 2025 are developing HCLS technology, including Pathos, Abridge, Isomorphic Labs, Hippocratic AI, and InSilico Medicine.

"Global GenAI study reveals optimism and opportunities for healthcare and life sciences." - sas (January 2025)

"Survey Shows How AI Is Reshaping Healthcare and Life Sciences, From Lab to Bedside." - NVIDIA (January 2025)

"AI driving uptick in venture capital investment in healthcare." - Healthcare Finance (January 2025)

ROBOTICS & OTHER HARDWARE

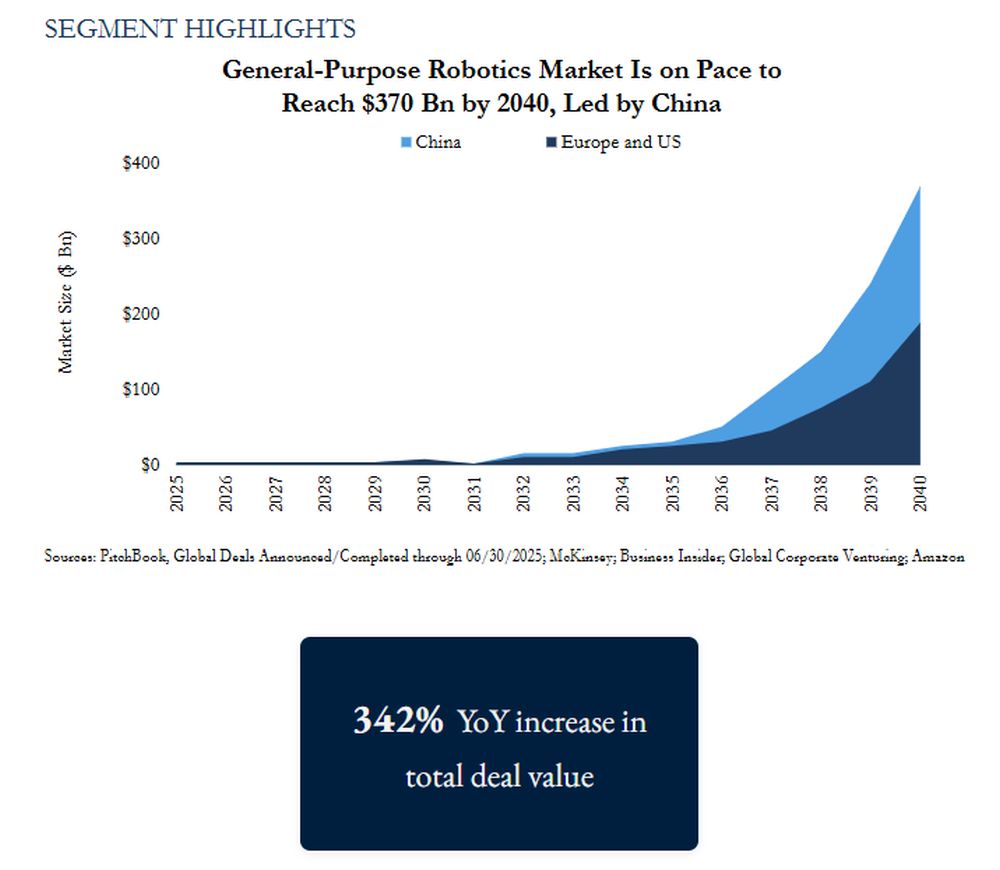

- Sophisticated foundational models have yielded "embodied AI," accelerating the leap from specialized to general-purpose robots.

- Embodied AI enables robots to analyze inputs, such as sensor data, and adjust responses based on those inputs in real time.

- Due to the prospect of general-purpose robots, investment has shifted to a new ecosystem including startups collecting data, creating foundational models for robots, and developing fleet software.

- General-purpose robotics funding grew fivefold from 2022 to 2024, surpassing $1 billion in annual investment, while patent filing volume has expanded at a 40% CAGR since 2022.

- While robots are being deployed in industries like manufacturing and construction, startups are developing software to bring robots into labor-intensive sectors like caregiving.

"There's no question, we're not tied to a single piece of hardware. Right now, we're just coming out of the too-early stage. This is going to create the next trillion-dollar companies." – Howard Morgan, Chair of B Capital (Pitchbook, February 19, 2025)

"Corporate investors pile into the humanoid robot revolution." – Global Corporate Venturing (April 2025)

"Amazon launches a new AI foundation model to power its robotic fleet and deploys its 1 millionth robot." – Amazon (June 2025)

"Robotics will have a ChatGPT moment in the next 2 or 3 years, says Vinod Khosla." – Business Insider (July 2025)

"Robotics will take a little longer, but I think we'll have the ChatGPT moment in the next two to three years...almost everybody in the 2030s will have a humanoid robot at home." – Vinod Khosla, Founder of Khosla Ventures (Business Insider, July 1, 2025)

"With every technical transformation, there will be fewer people doing some of the jobs that technology actually starts to automate. Are there going to be other jobs? We're going to hire more people in AI and more people in robotics." – Andy Jassey, CEO of Amazon (Business Insider, July 1, 2025)

PRIVATE EQUITY

- While PE firms are investing in the AI infrastructure build-out, they are also harnessing the technology to enhance and accelerate deal sourcing, diligence, and execution.

- AI agents could represent the next frontier, as they can perform tasks traditionally handled by humans—enabling PE firms to streamline operations and enhance execution efficiency.

AI Is Revolutionizing PE Dealmaking Process

- Underwriting: AI accelerates underwriting decisions, which is especially critical in private credit where timely due diligence is essential to secure a deal.

- Investment Committees: Several firms, including General Atlantic and Schroders Capital, have established dedicated AI roles on their investment committees to enhance decision-making.

- Document Comparison: Firms are developing tools to analyze and compare contracts and documents to flag potential issues before deal execution, as demonstrated by Blackstone's Document AI.

- Deep Company and Sector Analysis: Firms are leveraging AI for in-depth company and sector analysis, enabling them to rapidly grasp industry trends and uncover opportunities ahead of competitors.

- Deal Sourcing: GenAI equips investment teams with insights on potential targets, which they then use to prompt AI agents to automate outreach–replicating the functions of a traditional deal origination team.

Sources: KPMG; PEI

AI Market Outlook & Performance

MARKET TRENDS

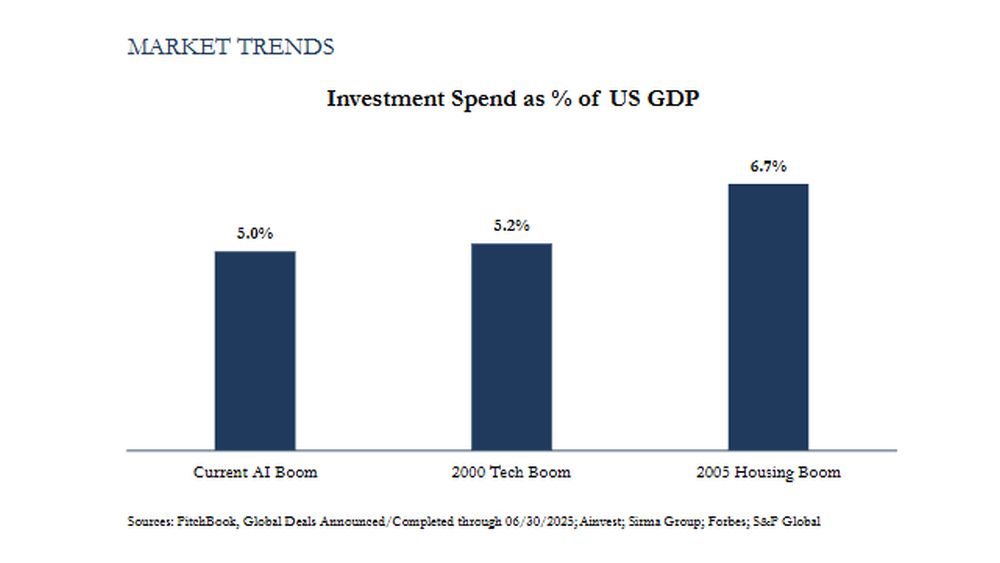

- Growth Trajectory: CoreWeave forecasts that AI will have a cumulative global economic impact of $20 trillion by 2030, with the total addressable AI market expected to grow to $400 billion by 2028.

- Arms Race: Amid geopolitical uncertainty, nations are competing for AI dominance, with the US, the UK, and China representing front-runners. The competition extends beyond corporate innovation, with national strategies prioritizing infrastructure investment, workforce reskilling, and AI-friendly regulatory frameworks to secure AI leadership.

- Agentic AI: AI systems capable of autonomous action with minimal human oversight, an area where GenAI remains limited, represent one of the next major growth frontiers for the technology. Sirma Group expects the Global Enterprise Agentic AI market to reach $24.5 billion by 2030, expanding at a 46.2% CAGR.

"This agentic AI workforce will do the soul-crushing work in every industry, in the tasks and productivity areas that humans don't want anyway." – Bill McDermott, CEO of ServiceNow (Forbes, February 28, 2025)

DEALMAKING OUTLOOK

- Strategic M&A: Corporate dealmaking is projected to remain robust, driven by mounting pressure to integrate AI technology across the enterprise—or risk being displaced by more technologically agile competitors.

- Big Tech: Big Tech companies, including Microsoft and Meta, plan to spend hundreds of billions of dollars in 2025 to build out AI infrastructure, sparking rapid growth in capital expenditure.

- Corporate Venture Capital: CVC activity is expected to remain robust, particularly as a strategy to develop relationships in the AI ecosystem that can be leveraged for M&A and talent recruitment.

- Venture Capital: While the overall VC market has been suppressed by capital cycle and macroeconomic headwinds, venture investors are expected to continue to allocate capital toward promising AI startups that could reshape and disrupt industries.

- Private Equity: PE firms are expected to primarily participate in the capitalization of the AI build-out through investments in AI infrastructure, and add-on and platform acquisitions of AI-enabled businesses.

"We don't want any of those risks for our investors. If you believe that 10 years from now, AI will be an important part of the fabric of IT or the way we operate this economy, then you want the picks and shovels, you want the infrastructure that goes with it." – Marc Lipschultz, Co-CEO of Blue Owl (S&P Global, June 5, 2025)

Sources: PitchBook, Global Deals Announced/Completed through 06/30/2025; Ainvest; Sirma Group; Forbes; S&P Global

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.