- within Insolvency/Bankruptcy/Re-Structuring topic(s)

- in Canada

- within Insolvency/Bankruptcy/Re-Structuring topic(s)

- with Senior Company Executives and HR

- with readers working within the Law Firm industries

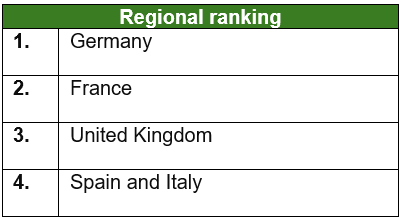

The latest Weil European Distress Index (WEDI) reveals that Retail and Consumer Goods remains Europe's most distressed sector, with conditions now surpassing levels last seen during the 2009 financial crisis. Retail was one of only two sectors (alongside Financial Services) to see distress worsen this quarter, as distress remains high across Europe. Relief seen in Germany has been modest and not substantial enough to alter its position as Europe's most distressed market, while France has overtaken the UK for second place. Spain continues to expand, though Italy slipped into mild contraction in 2Q25 – its first since mid-2023. Despite this, Spain and Italy remain the least distressed markets tracked by the index. With retail distress at historic highs and overall corporate distress still elevated but easing slightly this quarter, the UK prepares for the Autumn Budget amid continued uncertainty for businesses already under pressure.

Regional spotlight

- Germany: Corporate distress remains the

highest in Europe, despite easing slightly from recent peaks. The

downturn reflects weaker investment, falling output across key

industries and ongoing pressure from trade and manufacturing

slowdowns.

- While distress has come down from earlier highs, the latest data shows that the economy is still struggling. GDP fell 0.3% in Q2, the steepest drop in a year, and although consumer confidence has inched up, business sentiment has slumped to its lowest in over a year. Policymakers are pushing through tax reforms and major infrastructure plans, but the Bundesbank expects growth to remain broadly flat through 2025, with recovery delayed until 2026 or 2027.

- France: Distress increased further, overtaking

the UK as the second-most distressed market, as businesses are

being squeezed by cash shortages, rising borrowing costs and weak

investment.

- Political turmoil driven by government attempts to cut spending and bring down the fiscal deficit is adding to the strain, weighing on investor confidence. Households are also cautious, with consumer confidence stuck at a two-year low, major purchases slowing and the national savings rate now at its highest level in 45 years.

- United Kingdom: Distress eased slightly on the

quarter but remains higher than a year ago. Falling profits,

strained cash reserves and nervous investors are keeping conditions

fragile, with the Autumn Budget on 26 November looming as a major

test.

- Speculation over a £50bn fiscal gap and potential new sector taxes is already weighing on sentiment, particularly in retail and consumer-facing industries. The economy grew 0.3% in Q2, beating forecasts, but the impact on confidence has not yet been seen, with the GfK Consumer Confidence Index falling to -19 in September, its weakest reading in more than a year.

- Spain & Italy

- Italy, however, slipped into a 0.1% contraction, its first since mid-2023, reversing growth from the previous quarter. The downturn was driven by weaker exports, tariff threats and commodity volatility. While consumer confidence edged higher to 96.8 in September, resilience looks fragile amidst persistent trade and export pressures.

Sector spotlight

- Retail and Consumer Goods: Distress in the Retail and Consumer Goods sector has risen again, surpassing levels seen during the 2009 financial crisis. Weak demand, fragile confidence and tariff disruption are weighing heavily on the sector. In the UK, concerns over the Autumn Budget have dominated – and while the Chancellor is expected to review business rate thresholds for larger retailers, uncertainty over the final package is still weighing on confidence.

- Financial Services: Alongside Retail and Consumer Goods, Financial Services also deteriorated this quarter, with distress now well above last year's levels and ranking as the sixth most troubled sector. Banks and lenders are under strain from shrinking margins, falling valuations and rising concerns over credit quality, making it one of only two sectors to see conditions worsen this quarter.

- Industrials: Industrials remains the second-most distressed sector, but conditions eased slightly this quarter, defying expectations of a sharper downturn. The improvement suggests firms are proving more resilient to tariffs and trade tensions than feared in the Spring, though high costs and weak demand for capital goods continue to weigh heavily.

- Healthcare: Distress eased modestly compared with last year but remains above the long-run average due to cost inflation, wage pressures and operational supply chain challenges.

Looking ahead

As some markets show tentative signs of improvement, businesses will still need to navigate a fragile outlook, with high interest rates and ongoing trade disputes set to weigh on performance. Political uncertainty adds further risk, with France facing austerity, Germany struggling to restart growth until at least 2026 and the UK's Autumn Budget a pivotal moment for retailers and consumer-facing firms already under strain.

Click here to read the full report

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.