- within Food, Drugs, Healthcare and Life Sciences topic(s)

- in United States

- within Antitrust/Competition Law and Insolvency/Bankruptcy/Re-Structuring topic(s)

On Oct. 31, the Centers for Medicare and Medicaid Services (CMS) released the 2026 Physician Fee Schedule Final Rule (Final Rule), which outlines the changes to payments under the Medicare Physician Fee Schedule (PFS) for next year. Among other changes, the Final Rule details significant reimbursement updates, including:1

- Separate Conversion Factors: In 2026, there will be separate conversion factors for qualifying alternative payment model (APM) participants (QPs) and providers who are not QPs.

- Overall Increase: The non-qualifying APM conversion factor for 2026 will be $33.40, a 3.26% increase over the current conversion factor. The qualifying APM conversion factor for 2026 will be $33.57, a 3.77% increase.

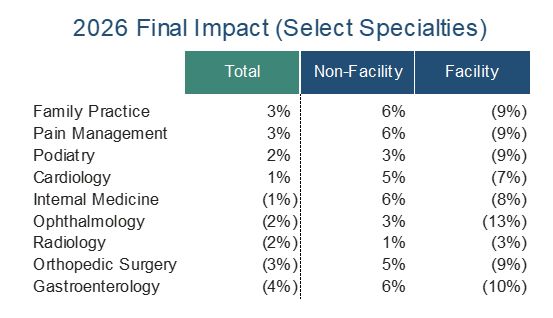

- Impact by Specialty: While reimbursement under the Medicare PFS will increase overall, the impact by specialty varies:2

- Impact by Place of Service: CMS finalized an update to its methodology in determining practice expense relative value units (PE RVUs). While the original methodology —established decades ago — assumed physicians maintained separate practice locations even while providing facility-based services, this updated methodology is intended to recognize the reduced number of physicians working in private practice. As a result of these changes, reimbursement for procedures performed in the non-facility setting is expected to increase 4% overall, while reimbursement for the facility setting will decrease 7%.2

The reimbursement changes outlined in the Final Rule are generally similar to those originally proposed and are likely to be viewed favorably by healthcare operators overall. The PFS conversion factor declined 10.4% from 2020 to 2025, and an increase to Medicare reimbursement is expected to provide relief to providers facing elevated operational costs.

About Ankura Healthcare Transaction Advisory Services

Healthcare transactions are inherently complex. With deep industry experience, Ankura delivers insights to make informed investment decisions in mergers, acquisitions, and partnerships.

Ankura's healthcare transaction advisory team is deeply rooted in the healthcare sector, leveraging extensive industry knowledge and expertise to anticipate critical financial accounting aspects of transactions while also understanding the operational drivers. This enables us to proactively address critical financial accounting aspects and operational drivers of transactions.

What sets us apart is the collaboration between our financial accounting due diligence experts and Ankura's specialized teams in healthcare valuation, healthcare operations, tax, information technology, commercial strategies, and human capital. This collaboration ensures a seamless, integrated reporting process for you, combining diverse expertise to provide a holistic view of every transaction. Our approach guarantees that you receive nuanced, actionable insights in a unified and strategic manner.

With senior deal professionals engaged in every transaction phase, we provide immediate updates on significant deal factors and a dedicated analysis of any critical issues, ensuring a thorough understanding and resolution of underlying concerns.

Connect with one of our healthcare transaction advisory experts to navigate the complexities of healthcare with confidence.

Footnotes

1 Calendar Year 2026 Medicare Physician Fee Schedule Final Rule Fact Sheet

2 Calendar Year 2026 Medicare Physician Fee Schedule Final Rule; excludes 0.75% and 0.25% updates to the qualifying APM and nonqualifying APM conversion factors, respectively, and the single year increase of 2.50 percent to the conversion factor

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.