- within Transport, Media, Telecoms, IT, Entertainment and Employment and HR topic(s)

- with Inhouse Counsel

- in China

Fund secondaries transactions have grown enormously over the last 20 years or so. Recently, funds have been under pressure to return capital to investors in the context of a range of market constraints on traditional exit routes for PE buyers. We have seen turbulent capital markets restricting traditional IPO exits, changes to leverage models resulting from higher interest rates and more generally a pricing mismatch between the expectations of buyers or sellers, all of which have impacted fund-level liquidity.

Secondaries have to a significant extent plugged the gap by providing LPs with liquidity which they may not otherwise be getting from distributions. There has been huge growth in "GP-led" secondary solutions, including a large increase in the number of continuation vehicles in the market. Those vehicles allow fund managers (GPs) to move assets from an existing fund into a new vehicle to enable follow-on investments and potentially extended holding periods beyond the investment horizon of the original investing fund. LPs in the original fund then usually have the option to roll-over into the new fund or cash out their interest to a secondary buyer sourced by the GP.

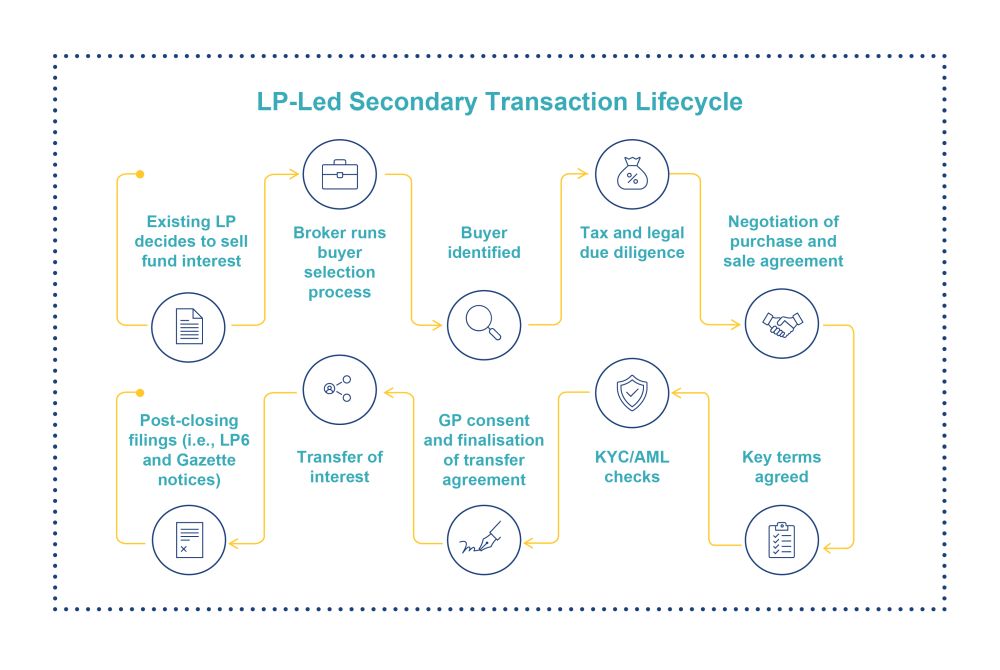

Although those GP-led solutions have been catching the headlines, LP-led secondaries are in fact a bigger part of the overall secondaries market. In these transactions, a LP sells its interest in a fund or portfolio of funds to a secondary buyer, who takes up the position in the fund and assumes certain rights and obligations of the selling LP. LP-led deals can provide liquidity more simply for a given investor who wants to realise cash or otherwise rebalance their portfolio. We are seeing a marked uptick in the number of LPs, globally but notably in Asia, who we would not have thought of as traditional sellers of fund investments but who are now entering the secondary market. On the buy-side, that demand for liquidity is met by a huge amount of capital that has been raised by specialist secondaries funds in recent years.

This article explains how an LP secondary sale works and some of the common issues that come up in the process.

Pricing

The key commercial term to be agreed on these deals is the price to be paid for the interest in the fund that is being sold. That price is normally set by reference to a valuation as of a specific date (often defined in the purchase and sale agreement (PSA) as the 'Cut-off Date'). This date is usually the most recent quarterly valuation date of the target fund. The purchase price will be adjusted for any distributions or contributions made to, or by, the selling LP prior to closing but after the 'Cut-off Date' (unless such distribution or contribution is accounted for in the fund's capital accounts).

Secondary transactions are normally made at a discount to the underlying fund's net asset value, recognising both the potential uncertainty of those valuations as well as the value of the liquidity being provided by the buyer. A selling LP will often engage a broker to run an auction process for their portfolio to gain transparency on market pricing and to obtain the lowest discount available. It may be that a portfolio can be split between different buyers who want different fund interests but at better aggregate pricing. It may also be possible to achieve better pricing terms based on an acceptance of deferred consideration payments.

What is the key documentation required for a secondary?

A secondary transaction can be light on documentation with the potential for only two agreements being necessary from the selling LP's perspective.

The PSA is the agreement under which the selling LP agrees to sell the relevant fund interests to the buyer. Most secondary PSAs follow a structure that is relatively standard across the market and, while there are still points to negotiate, the PSA is a much more straightforward document than a sale and purchase agreement that you may see on a corporate M&A deal.

As well the sale and closing mechanics, the PSA will also detail certain obligations, expenses or losses that the purchasing investor will not assume upon transfer of the interest in the fund (commonly defined as the 'Excluded Obligations'). The 'Excluded Obligations' will normally cover certain obligations, expenses or losses accruing prior to the closing date. The selling LP will also provide representations and warranties to the buyer including to confirm: (i) it is the legal and beneficial owner of the interest being sold; and (ii) it has paid drawdowns or other amounts due to the underlying fund in accordance with the terms of the underlying limited partnership agreement(s) (LPA). The purchasing investor will also give representations as to its capacity and authority to enter into the PSA and perform its obligations.

The legal transfer of the interest in the fund is affected by way of a transfer agreement. This is nearly always prepared by the GP's counsel and is normally a tri-partite agreement between the selling LP, the purchasing investor and the GP or manager of the relevant fund. A transfer agreement usually contains the GP's consent to the transfer (which will very likely be required under the fund's LPA). It will also include obligations on the buying LP to adhere to the LPA and a corresponding release of the selling LP from its obligations. The transfer agreement will likely include an agreement for the buyer and/or seller to bear the costs of the GP's counsel and any other costs incurred by the GP as part of the transfer. As the allocation of liabilities as between the buyer and seller under the transfer agreement may be different from the terms they have agreed under the PSA, it is important that the PSA is expressed to take precedence in the event of a conflict between the documents.

The transfer agreement will often contain obligations on the purchasing investor to deliver documentation to the GP (such as a form of the fund's subscription questionnaires and additional KYC/AML documentation). Additional documentation may be required if the selling LP had certain side letter rights that the purchasing investor wishes to acquire, for example.

What are the key things parties should consider early on in the proposed transaction?

As a starting point, the transferring parties should ensure they have reviewed the applicable transfer provisions in the underlying fund LPA and confirmed what is required. Common conditions to transfer contained in LPAs include: (i) that the GP's written consent is obtained, (ii) that the transfer may only occur on specified dates (ie, a quarter calendar date) – note this may not be a contractual requirement but a practical one in terms of aligning transfers with fund valuation and regular distribution dates; (iii) that the GP may request a legal opinion on the status of the purchasing investor; and (iv) that the transferring parties agree to bear the costs and expenses of the GP. If the transferring parties cannot, or do not want to, satisfy all conditions in the LPA, the GP should be contacted to see whether a waiver may be sought. Parties should also consider whether it is necessary for any filings to be made to effect the transfer at law, for example in the context of English or Scottish limited partnerships the filing of a Form LP6 and notification in the relevant Gazette. This is a matter for the GP to attend to, but transferring parties should ensure it is considered.

GPs may require refreshed KYC on the seller LP, as well as a range of KYC documentation in relation to the buyer LP, as part of the process. While this is largely an administrative task, it can take a lot of time and it is important that the requirements are identified early in the process. More broadly, as the GPs' input and consent to the transaction is essential to closing, PSAs which deal with a portfolio of interests often have mechanics for multiple closing dates across different calendar quarters, with partial payment of the purchase price being made as against the transfers made at each given closing.

Tax is also a key consideration, as the transfer of fund interests can give rise to transfer taxes at the fund level, or withholding obligations on the fund and/or buying LP. In particular, where a fund holds assets which produce "effectively connected income" (ECI) in the US, there may be an obligation to withhold tax in respect of that ECI; the obligation can fall on both the buyer, out of the purchase price payable to the seller, or on the fund itself out of distributions which would otherwise be made to the buyer. It is common for purchasing investors, especially those with US structures, to seek certain US tax certificates, representations or warranties from the selling LP and/or the underlying fund to confirm that no such withholding is required (for example because there is no ECI in the fund). This may even be the case where the fund is a non-US entity and has not invested in US assets, given market practice on the point. Funds may also need to consider ECI on a go-forward basis, and may limit foreign investors or require certification from purchasers to ensure they are exempt from ECI withholdings. The need for US tax advice and comfort on these points should be considered early on in the transaction to avoid unnecessary delays.

Similarly, stamp duty or (primarily in respect of funds holding real estate or infrastructure assets) similar land transfer taxes applicable, in either case, in different jurisdictions may be relevant, depending on the governing law of the PSA and transfer documents, the structure of the funds involved and their target assets. Early diligence of those matters is recommended, allowing consideration of potential mitigations for any tax charges, as well as the allocation of tax risks as between buyer and seller.

Herbert Smith Freehills Kramer's global fund secondaries team is well placed to assist with these issues. We work for buyers and sellers of fund interests worldwide and can offer US and other local tax advice as part of an integrated service. For larger portfolio transactions, our Digital Legal Delivery offering can help coordinate and project manage the closing process across hundreds of lines of fund interests per quarter at an efficient, cost-effective price point.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]