- within Corporate/Commercial Law topic(s)

- with Finance and Tax Executives

- in United States

- with readers working within the Media & Information and Metals & Mining industries

Once the passion projects of billionaires and family dynasties, professional sports franchises—from the NFL to Europe's top football leagues—are now attracting serious attention from private equity (PE) firms.

With soaring media rights deals, global fan bases, and the inherent "scarcity value" of major league teams, sports assets combine exclusivity with long-term growth potential in a way few other investments can match.

But investment in sports is not like other "traditional" investments. Sports franchises have broad range of often vocal stakeholders from league officials to players, coaches to fans, management to broadcast networks.

While PE can strengthen franchises commercially, its benefits do not replace what leagues and fans value most: long-term stewardship, deep community connections, and the cultural identity of the sport. The challenge for private equity investors is to figure out the playbook that creates 'value' for all the stakeholders.

The surge in PE investment

Historically, most major leagues, particularly the NFL, barred PE ownership. Teams were required to remain under individual or family control, with strict limits on passive investors.

Even under new rules, PE firms can hold only minority stakes—typically up to 10% in the NFL and 30% in the NBA, MLB, and NHL—and these stakes come without voting rights or management authority. Leagues also carefully vet which funds are eligible, approving a select group of institutional investors to maintain stability and safeguard governance standards.

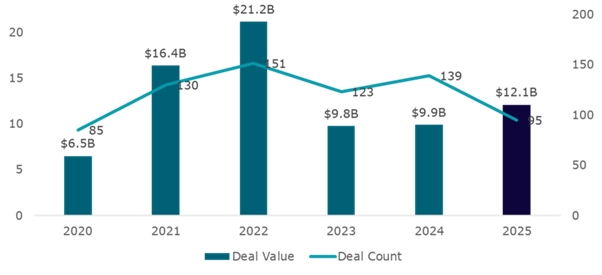

Despite these restrictions, PE activity in sports has accelerated rapidly. From 85 deals totaling $6.4 billion in 2020, activity has grown to 95 deals worth $12.1 billion as of September 2025. Deal activity peaked in 2022 with 151 investments valued at $21.1 billion, followed by 139 deals totaling $9.9 billion in 2024.

This acceleration was driven by two major factors: league rule changes and pandemic-driven liquidity needs. The NBA led the ownership shift in 2020, followed by MLB and the NHL in 2021, which allowed for minority stakes to be held by institutional investors. Pandemic-era revenue losses prompted team owners to welcome new capital, while firms such as Arctos Partners, Sixth Street, and RedBird Capital moved quickly to capitalize on emerging opportunities.

Source: PitchBook (as of September 16, 2025)

In the NFL alone, approved PE groups—including Arctos Partners, Ares, Sixth Street, Blackstone, CVC Capital Partners, and a consortium led by Carlyle, Dynasty Equity, and Ludis Capital (founded by Hall of Famer Curtis Martin)—plan to deploy up to $12 billion across multiple franchises, including leverage.

Sixth Street, managing about $75 billion in assets, is raising its first sports-focused fund after acquiring a stake in the San Antonio Spurs in 2021 and purchasing a National Women's Soccer League franchise in the Bay Area. TPG has launched TPG Sports to pursue a range of diverse opportunities. Harbinger Sports Partners, co-founded by Mark Cuban, has introduced a $750 million fund targeting minority stakes in professional teams.

Private equity investment in sports is becoming a reality. The question is, how can it make investments that benefit all stakeholders?

PE's strategic value in sports

Sports franchises are generally well-managed and commercially minded. Many teams already operate as highly professional businesses, generating billions from media rights, licensing, and sponsorships, and flagship franchises run with disciplined management and strategic planning.

Still, there remain opportunities for private equity to create value. This does not need to be at the expense of the team—or, importantly, fan—experience.

PE involvement might still influence capital structure, investment in facilities, or growth into adjacent markets, but it would build on an already well-managed foundation rather than fundamentally reshaping team operations.

Key drivers of value creation

While the private equity 'playbook' for many businesses is well-established and built around capital structure and driving down expenses, for sports leagues, there are more ways for private equity to accelerate franchise value, including:

- Driving real estate and mixed-use development: Leveraging stadium-adjacent projects to create new revenue streams and enhance fan experiences.

- Accelerating strategic initiatives: Providing capital and operational support to help teams or leagues scale digital platforms, streaming services, and fan engagement programs.

- Optimizing team operations: Implementing advanced business systems, analytics, and strategic frameworks to improve efficiency and support growth into adjacent opportunities.

- Supporting competitive performance: Offering financial flexibility for marquee player acquisitions and investments in infrastructure that drive on-field success, exemplified by RedBird Capital's backing of AC Milan.

- Expanding brand reach: Targeting teams with strong local followings but untapped global potential, using capital and strategy to grow international fan bases and commercial opportunities.

A notable example is Centennial Yards in Atlanta, where private investors partnered with the Atlanta Falcons to create a $1.5 billion mixed-use development surrounding Mercedes-Benz Stadium, combining retail, office, and residential space while enhancing the overall fan and community experience.

What it may mean for teams and fans

Private equity investment can have a number of implications worth considering as PE firms (and leagues) chart a path forward to create value not only for investors but the teams and their loyal fans.

Private equity can have a positive impact on sports franchises, including:

- Operational and strategic enhancements: PE can provide capital and advisory expertise to support stadium upgrades, technology integration, and new revenue initiatives.

-

- For example, RedBird Capital's investment in AC Milan funded modern training facilities, enhanced scouting and analytics, and offered flexibility for player acquisitions—improving infrastructure and accelerating growth without changing day-to-day management.

- Enhanced experience: Fans may enjoy upgraded stadiums, enhanced media offerings, and more sophisticated engagement strategies. However, these improvements can also drive higher costs and increased commercialization.

- Long-term orientation: PE ownership often emphasizes financial returns, which can shape decisions on player acquisitions, squad investment, or operations. For example, some European clubs with PE backing focus on developing and selling talent for profit, balancing competitiveness with long-term financial sustainability. Sometimes this can be at the expense of immediate on-field results, but, ideally, it can build lasting legacy value.

At the same time, private equity has to take into consideration the importance of players, staff, and above all the fans – considerations that are not typical in non-sports investments. When this doesn't happen, the value for the stakeholder can erode:

- Players and staff turnover: With private-equity or finance-driven ownership, teams may face heightened scrutiny on costs and performance, leading to quicker changes in front-office or squad composition. For example, at Chelsea F.C., under Clearlake Capital, the new owners instituted key personnel departures and appointments amid a large reported loss—highlighting how a performance- and cost mindset can translate into operational turnover.

- Traditional fans can feel sidelined if commercial priorities overshadow club culture. European examples include Standard Liège supporters blockading the team bus after 777 Partners' acquisition, Bundesliga fans overturning a €1 billion media-rights deal, and Racing Club de Strasbourg Alsace supporters protesting BlueCo's multi-club approach—all highlighting the risk of eroding core fan loyalty.

Going forward

Private equity investment in sports franchises can benefit all parties, but it does call for a different PE playbook, one that balances financial rigor with the cultural and emotional fabric that makes sports unlike any other business.

Teams stand to gain from business acumen and capital, but fans and traditional stakeholders may see the essence of sport challenged by increased commercial pressures under PE operational control.

The path forward requires private equity to recognize that the different stakeholders involved—the league, the players, the coaches, the front and back offices, and above all else, the fans—may have different ideas of what "value creation" means to them.

Private equity has expanded investment access, deepened professional management, and introduced innovative commercial models.

Its growing presence is now a defining feature of the modern sports economy, offering both opportunities for financial and operational growth and challenges to preserving the traditions, culture, and fan loyalty that make sports unique. Those firms that get it right will not only create outsized returns for their investors but may also create winning franchises with even more loyal fans.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.