- in Asia

- with readers working within the Advertising & Public Relations and Basic Industries industries

- within Law Department Performance, Insolvency/Bankruptcy/Re-Structuring and Consumer Protection topic(s)

Welcome to the latest edition of M&A insights, where we explore the forces shaping transactional activity and predict what will drive dealmaking in the year to come.

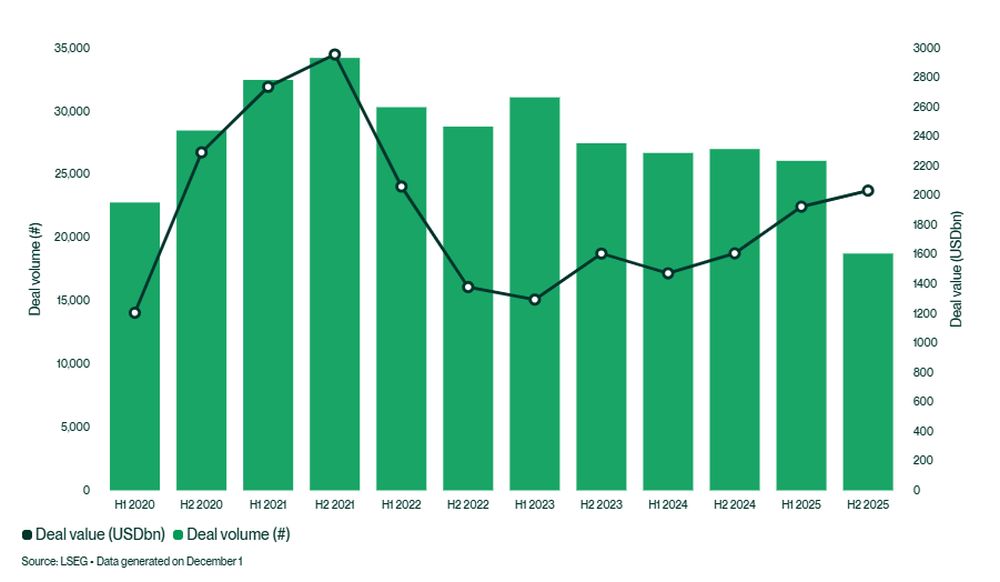

Megadeals return as global M&A hits four-year high

Aggregate deal value rises sharply to levels not seen since 2021

M&A data for 2025 reveals more confidence among market participants to execute big-ticket transactions in the second half of the year, including the battle to acquire one of the biggest names in Hollywood, which if approved will be one of the largest M&A transactions in history.

Deal count for the first six months of 2025 was the lowest H1 total since 2020. However, deal value remained robust at USD1.93 trillion, up 20% on H2 2024 and the highest H1 figure for three years.

M&A values performed even better in H2 2025 at USD2.03tn, with a marked uptick in larger transactions. The rally was led by a Q3 surge in the U.S., where M&A by value more than doubled year-on-year in October on the back of interest rate cuts by the Fed.

Europe's M&A landscape followed a similar pattern; aggregate values rose by 23% in H2 2025 compared to H1, particularly in markets including the Netherlands and Germany. We saw a number of significant deals between July and December, while ongoing regulatory reforms across the EU are expected to maintain this momentum as we head into 2026.

Summary

- Policy and regulatory shifts are shaping dealmaking timelines and strategies globally.

- AI, life sciences and energy transition assets are in buyers' sights.

- Private capital - particularly sovereign wealth – is increasingly influential.

- The boards best positioned for success are those aligned with management teams on deal strategy, enabling confident decisions under pressure.

Dealmaking in the Middle East was strong throughout the year, driven by the region's sovereign wealth funds in particular. Aggregate M&A by value to December 1 was 170% higher than the total for 2024. Here, U.S. policy shifts facilitated access to advanced semiconductors, while regional governments continued to leverage their strategic neutrality to invest in both U.S. and Chinese assets. The region's IPO markets – particularly in Saudi Arabia - performed well, with good pipelines for the year ahead.

Activity in Asia-Pacific was buoyed by record inbound investment into Japan and regulatory reforms in China, which spurred domestic consolidation deals and higher outbound investment. We expect heightened interest in Australian critical minerals assets following the recent framework deal with the U.S., although a recent case raises new M&A execution risks linked to the country's foreign investment screening regime.

Looking ahead, stabilizing interest rates, regulatory reforms, and sectoral innovation are set to underpin continued growth in global M&A activity in the months to come.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.