- within Environment topic(s)

In this edition, we look at the prospects for data centres in the UK, what to watch out for in the Budget and whether EU objections could derail UK planning reforms. We also discuss the clean energy aspects of the UK's Industrial Strategy, the impact of consumer law on the energy and infrastructure sectors, recent developments in sustainability reporting and the National Underground Asset Register.

- Data centres in the UK: meeting the challenge

- Infrastructure and energy: what to watch out for in the Budget

- Could EU objections somehow scupper UK planning reform?

- What does the UK's Industrial Strategy say about clean energy?

- UK cyber-security Bill targets data centres, large load controllers and "critical suppliers"

- UK sustainability reporting and transition planning: rolling back or pushing forward?

- National security scrutiny of infrastructure and energy deals: an update

- What does the National Underground Asset Register mean for the infrastructure and energy sectors?

- How consumer law impacts on the infrastructure and energy sectors

- Carbon border adjustment: where are we now?

- Recent experience

- Key contacts

Data centres in the UK: meeting the challenge

With AI turbo-charging demand, strong Government support and the recent announcement of £38 billion in investment by the likes of Google, Microsoft, Nvidia and Blackrock, there's little doubt that data centres represent a major opportunity for investors in and operators of UK infrastructure. But what are the key challenges to development of new data centres – and how can investors and operators overcome them?

Making data centres happen

On 30 September 2025, Travers Smith hosted a bespoke event entitled "Making Data Centres Happen", exploring key themes in the evolution of this essential infrastructure asset class with a panel and a live audience. Our briefing looks at some of the key themes of that event, which included the following:

Finding a site, planning consent and power supply

- How hard is it to find a suitable site? Whilst still a challenge for larger developments, particularly hyperscalers, the importance of low latency (i.e. the need for a very fast speed of response between the data centre and the end user) has driven demand for smaller, "edge" data centres, located closer to end users, which can typically be accommodated on smaller sites.

- Is planning consent still a key barrier? Amendments to the National Planning Policy Framework and designation of data centres as Critical National Infrastructure have made it easier to obtain consent, resulting in a raft of recent approvals. In future, AI Growth Zones (see below) are also expected to ease this problem.

- What about power supply? Data centres are notoriously power-hungry, which remains a challenge. However, the Government is taking action to address this problem, such as improving the grid connection process. In the longer term, new nuclear generation capacity may assist, with Great British Energy – Nuclear having recently announced that its first Small Modular Reactor (to be built in North Wales).

Finance and investment opportunities

The panel also outlined key trends in the financing of data centres, noting that opportunities for more sophisticated equity financing structures are emerging, including joint ventures which enable investors to pool their risk. This is likely to prove particularly relevant, given the substantial (and increasing) capital requirements for data centre development.

What about environmental concerns?

Environmental concerns around data centres typically relate to power consumption, water use, heat and noise – but there are ways of mitigating these concerns (for example, excess heat can be directed into heat networks to provide low carbon heating and hot water for nearby homes and offices). Overall, environmental challenges, though genuine, should not represent an insurmountable obstacle to data centre development in the UK.

AI Growth Zones: what are they and how will they help?

The UK Government has also announced the creation of AI Growth Zones, the first of which will be in Culham, Oxfordshire, a site that benefits from a major powerline connection that was previously used for an experimental nuclear reactor (now being decommissioned). This is expected to be used to power a 100MW AI data centre, with potential to scale up to 500MW. Over 200 applications for further zones have been received from local and regional authorities across the UK. The policy was specifically designed to promote investment in data centres and the application criteria reflect this, with local or regional authorities expected to demonstrate adequate power, water and land availability, together with strong digital connectivity, sufficient to support at least 500 MW of AI infrastructure. Sites will also be expected to have existing planning consent or be able to demonstrate a viable pathway for full consent by 2028. The aim is to "crowd in" private capital by addressing many of the key barriers to data centre development upfront through the AI Growth Zone designation process. Whilst there has also been talk of streamlining the planning process for developments within AI Growth Zones, this would be likely to require additional measures. However, as explained above, the designation process itself should bring advantages from a planning perspective.

Travers Smith's data centre practice

Our cross-practice data centre team can support you with all aspects of data centre development and investment, including real estate and planning, regulatory considerations (such as National Security and Investment Act scrutiny – see section 7), key leasing and contractual arrangements, ESG analysis, cyber-security (see section 5) and disaster recovery/business continuity.

Infrastructure and energy: what to watch out for in the Budget

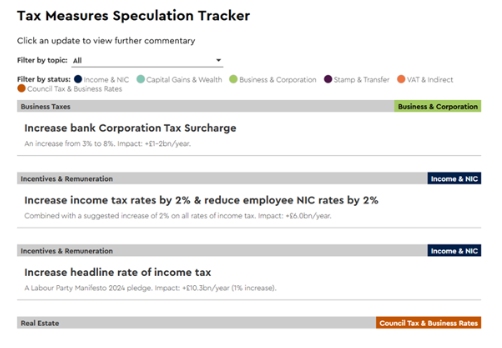

The next Budget is due to be delivered on 26 November 2025 and, against a challenging economic backdrop, speculation is rife that HM Treasury is considering a broad range of tax policy changes.

Our Tracker highlights some of the more prominent proposals that have surfaced in the run-up to the Budget – including a number that may be relevant to the infrastructure and energy sectors (see below - the Tracker provides more detail on all these issues). Whilst the Chancellor's"scene-setter" speechdid not give much away, it has created expectations of significant tax raising measures. On the other hand, with growth as the Government's number one priority, it's striking that a number of the proposals highlighted below relate to measures which might help investors and operators in the infrastructure and energy sector.

Budget Tracker: proposals relevant to infrastructure and energy sectors

- Abolish the Energy Profits Levy (EPL)

- Reduce VAT on domestic fuel & power

- Enhance tax reliefs for investment

- Expand the scope of the UK Emissions Trading Scheme

- Changes to corporation tax

- Increase rates of CGT

- Broaden VAT taxable base

- Increase fuel duty

- Introduce road pricing

See also our discussion in section 4 about whether budgetary pressures will lead to cuts in the amount of money allocated to Great British Energy.

Of course, whether HM Treasury will actually pursue any of these measures remains to be seen – we will find out at the end of November. ACCESS THE TRACKER.

Could EU objections somehow scupper UK planning reform?

Reforms contained in the Planning and Infrastructure Bill currently before Parliament are critical to the UK Government's plans for infrastructure and energy and its wider ambitions to drive economic growth. They also bring into sharp focus the inherent tensions between the Government's wider priorities, which include kick-starting a meaningful increase in housing delivery, and the effective functioning of the planning system, which is tasked with balancing the need for development against existing safeguards and protections, most notably environmental. An already difficult set of reforms may now be further complicated by reports of EU concerns over their environmental impact.

EU concerns

A recent newspaper report claimed that the EU has raised concerns with the UK Government about changes to environmental protections in the Bill, including whether these were compatible with the UK's commitments under the UK-EU Trade and Cooperation Agreement (TCA) (reflecting concerns raised in an EU report leaked earlier this year).

It's unclear at this point how credible these reports are – but what if the EU were minded to pursue these objections? Could it undermine UK planning reform? Certainly it seems that the Government has taken such criticisms seriously, having made a series of amendments to the environmental parts of the Bill over the summer with the intention of trying to quell some of the disquiet.

Could the EU raise objections under the TCA?

The short answer is yes. The TCA contains a "non-regression" clause on environmental protection (Article 391). The clause states that a Party "shall not weaken or reduce, in a manner affecting trade and investment between the Parties, its environmental levels of protection or its climate levels of protection below the levels that are in place at the end of the transition period." This commitment is subject to the level playing field provisions of the TCA, including a rebalancing mechanism which the EU could invoke if it believes that there are "significant divergences [....] impacting trade or investment between the Parties in a manner that changes the circumstances that have formed the basis for the conclusion of this agreement." The EU would first have to seek to resolve the issue through consultations with the UK – but if this failed to produce a resolution within 90 days, the EU would (among other things) be free to:

- convene a panel of experts to consider the specific matter complained of; or

- take unilateral measures designed to remedy the alleged imbalance.

How challenging would it be for the EU to invoke the TCA provisions?

The EU would need to show that any weakening of environmental protections in the UK would affect "trade and investment" between the parties – for example, that as a result of the changes, a US data centre investor would be likely to choose the UK rather than the EU. This may not be entirely straightforward, as there are usually many reasons why investors choose one country over another. The TCA also affirms that the UK is entitled to set its own policies and priorities i.e. it is not required to align fully with the EU, provided that levels of protection do not drop below those in place at the end of the transition period on 31 December 2020.

That said, if the EU were minded to take unilateral measures under the rebalancing mechanism, it could do so without first having to satisfy any panel or other neutral body that its actions were justified – it would simply need to have gone through the process of holding 90 days of consultations with the UK, as described above. Of course, the UK would be very likely to challenge the EU's measures – and at that point, the EU would have to justify its approach to a panel of arbitrators (including demonstrating that any unilateral measures were "proportionate"). However, in the meantime, the UK economy would be experiencing the "pain" of the unilateral measures – which would be likely to act as a further obstacle to the Government's growth ambitions. As a result, the way the TCA works gives the EU substantial negotiating leverage in this area.

What about the UK-EU "reset"?

The UK is also in the process of negotiating a "reset" with the EU – which, like planning reform, is also key to the UK Government's growth ambitions. The EU could in theory refuse to progress those negotiations unless the UK agrees to address its concerns over environmental protection. It may prefer to use this approach to achieve its aims, keeping the threat of the TCA non-regression and level playing field provisions in the background.

Is there a significant risk to the UK's planning reforms?

As noted above, it's unclear whether the report accurately reflects the EU's position or its level of concern. It is possible that it sees the issue more as a negotiating tactic to be used to push back against UK demands for greater access to EU markets in the reset negotiations. Another possibility is that the EU raised the issue primarily in order to "fire a shot across the bows" of the UK in relation to proposals for more radical planning reform, which the Treasury is known to have been considering – but we simply don't know yet.

Even if the EU has both genuine and significant concerns about the Planning and Infrastructure Bill, it's important to bear in mind the following:

- the Government has already rowed back on some of the more controversial aspects of reforms to environmental protection in the Bill;

- at this stage, it is difficult to say for sure what the overall effect of the proposed reforms would be on environmental protections – much of the commentary to date is speculative at best, with secondary legislation and supporting guidance being required to flesh out the detail;

- many of the key reforms do not relate specifically to environmental protection and are focussed on streamlining the process of obtaining planning consent - such procedural measures should not be at risk; and

- there are strong incentives for the UK and EU not to allow any difference of views over environmental protections to derail the ongoing "reset", which – if successful – should benefit both sides.

On balance, therefore, our current view is that - whilst there is some degree of risk from EU objections - the more likely outcome is that the UK will be able to proceed with many, if not most, of the key measures envisaged in its reform of the planning rules.

What does the UK's Industrial Strategy say about clean energy?

In our last issue, we focussed on the Spending Review and the UK Government's 10 year Infrastructure Strategy – but alongside the latter, the Government also published its 10 year Industrial Strategy, including a separate Sector Plan for Clean Energy Industries. Meanwhile, in September, it released its statement of priorities for Great British Energy. So what does all this tell us that we didn't already know?

Great British Energy: a recap

The Government had already made clear Great British Energy (GBE) would act as developer on clean energy projects, with the National Wealth Fund (NWF) acting as bank/finance provider – and with £8.3 billion earmarked for clean power investment. The statement of priorities provides some additional clarity on GBE's role, explaining that its investment and development activities should involve:

- "leading the development of clean energy assets from inception, and owning and operating these assets for the taxpayer over the long-term"

- "co-developing, building and operating projects with partners, through equity stakes and joint ventures"; and

- "investing in more developed projects that are entering construction or are already in operation, to help build GBE's development expertise as it scales up"

There is also a strong emphasis on de-risking projects needed to meet net zero targets and a key objective will be to "crowd in" private investment alongside public funding.

How will the £8.3 billion be spent?

The Sector Plan makes clear that, of the £8.3 billion in funding for clean energy, £1 billion will be directed towards clean energy supply chains (this includes £300 million for offshore wind supply chains, which had already been announced). As regards how the remaining £7.3 billion will be spent, there is less clarity – because the statement of priorities for GBE is extremely high level. Specific mention is made of solar, with GBE directed to "take advantage of further opportunities to increase deployment of renewable generation and associated technologies on public buildings" – but no figures are attached to this. Whilst this support is directed primarily at the public sector through initiatives such as this one, there is likely to be a significant role for the private sector in installing new solar capacity.

Similarly, GBE is directed to "use its capital expertise to drive deployment of both nascent and established technologies" required to hit the Government's 2030 targets – although again, no figures are attached to how funds should be split between different technologies (GBE is merely directed to maintain a balance between the UK's short-term and long-term clean energy needs). However, the statement does make clear that "nascent" technologies only include those at Technology Readiness Levels 6-9, which is generally understood as the final stages of development (i.e. moving from a functional prototype to a fully operational, proven system). For technologies below this level, it would appear that the Government envisages funding from general R&D programmes (see below). Given the Government's ambitious 2030 net zero targets, it seems likely that a greater proportion of the remaining £7.3 billion of funding (i.e. £8.3 billion less the £1 billion allocated to supply chains) will be directed towards renewables projects based on more established technologies, including new nuclear projects. There is also an expectation that by 2030, GBE will have a plan in place to become self-financing i.e. by 2030, it will need to be making a portfolio level return on investment (even though there is an acceptance that not all projects will generate positive returns, given the need for GBE to take on a reasonable degree of risk).

However, there have also been some suggestions that the Government is watering down its commitment to GBE, with reports in the summer that the Government had effectively cut £2.5 billion from the £8.3 billion budget to fund Great British Energy - Nuclear (which has just announced that the UK's first small modular nuclear reactors will be built in North Wales). With a difficult budget for the Government coming up, many stakeholders will be watching to see if GBE funding commitments are further reduced or redirected.

Key points for private sector investors

Private sector investors looking to attract support from GBE should note the following:

- GBE will be expected to demonstrate that its investments generate social value which would not have occurred in its absence.

- Although mobilising additional private finance into a project or enabling it to increase its scale could count towards this, GBE is also required to consider whether projects will give rise to wider benefits aligned with its other strategic objectives.

- This could include community benefits, job creation or wider market benefits (such as "trailblazer" projects demonstrating commercial viability, thus helping to boost private sector investment in similar projects in future).

More generally, private sector investors should also be aware that GBE's investments may be subject to scrutiny or challenge under the UK's subsidy control regime.

Other funding commitments

The Sector Plan for Clean Energy Industries also lists a number of other funding commitments which – though not solely directed at the clean energy sector – are expected to provide at least some additional support for it:

- At least some of the British Business Bank's £4 billion of financing for scale-up and start-up (expected to crowd in £12 billion in private funding) is expected to be deployed in support of climate tech.

- Similarly, some of the economy-wide R&D funding (e.g. £86 million for fast growing sectors and £500 million for the R&D Missions Accelerator Programme) is expected to be directed towards clean energy.

- £20 million will be provided over 7 years through UK Research and Innovation's Sustainable Industrial Futures programme to support transition of UK manufacturing to net zero.

UK cyber-security Bill targets data centres, large load controllers and "critical suppliers"

On 12 November 2025, the UK Government introduced the long-awaited Cyber Security and Resilience (Network and Information Systems) Bill to Parliament. The Bill will reform the UK's existing cyber security regime, which is based on the Network and Information Systems Regulations 2018 (NIS). We will report on this in more detail in the coming months, but key headline points for the infrastructure and energy sectors include the following:

- Data centres in scope: The scope of the current regime will be expanded to include data centres, with Ofcom and the Department for Science, Innovation and Technology (DSIT) acting as joint regulators. As a general rule, data centres with a rated IT load of 1 MW or more will be in scope, although for enterprise data centres (those operated solely for the IT needs of the person who owns the facility), a higher threshold of 10 MW or more will apply.

- Large load controllers: Organisations managing electrical load for smart appliances (for example, to support electric vehicle charging during peak times) will also be brought within the scope of the cyber-security regime. For example, load controllers for EV charging smart appliances with a combined potential electrical capacity of 300MW or more will be in scope.

- "Critical suppliers": Other players in the infrastructure and energy sectors could also be brought within scope because regulators will gain the ability to designate certain businesses as "critical suppliers", even where they are not otherwise caught by the new regime. For example, this could include certain key suppliers to businesses in the energy, transport, digital infrastructure and water sectors, where the latter are already caught by the existing regime.

- Managed service providers: The Bill also brings IT managed service providers within scope. Since many businesses – including those in the infrastructure and energy sectors – outsource much of their IT provision to such entities, this is probably a positive move, as it will mean that managed service providers will face additional pressure from regulators to ensure robust cyber-security and resilience.

What else will the Bill do?

Other changes introduced by the Bill include:

- overhauling the incident reporting regime to expand the scope of reportable incidents and require notification of regulators within 24 hours;

- creating a more "joined up", coherent framework for the 12 different regulators involved in the sector;

- strengthening the enforcement regime (in particular to allow higher civil fines to be imposed); and

- allowing regulators to recover more of their costs from regulated entities.

We will provide a fuller analysis of the implications of the Bill for the infrastructure and energy sectors in our next issue.

UK sustainability reporting and transition planning: rolling back or pushing forward?

While 2025 has seen the EU roll back its ambitions on sustainability reporting (see our briefings on the EU's sustainability omnibus and delays to EU sustainability reporting rules), the UK Government cautiously pushed forward with its own, somewhat delayed, sustainability reporting rules. Three key consultations were held relating to these proposals over the summer as follows:

- UK Sustainability Reporting Standards ("SRS"): This set out the proposals for a disclosure and assurance framework for sustainability-related financial disclosures

- Sustainability Reporting Assurance Framework: A further related consultation on the design of a potential assurance framework for sustainability related information; and

- Transition Plans: This discussed the options for the potential introduction and design of climate transition plan-related requirements for certain UK entities.

The tone of the consultations suggest the Government is mindful of the recent shift in emphasis, particularly in the EU, towards competitiveness (and, arguably, deregulation) and will be mindful of not appearing to overly burden businesses with new reporting requirements. That said, it made a manifesto commitment on transition planning (more on this below).

Aligning with international trends

In proposing to adopt (with only a small number of modifications) the International Sustainability Standards Board's (ISSB) two sustainability reporting standards as the first UK SRS, the Government is seeking to align with international trends and areas of common ground in sustainability reporting regulation. The UK is in good company here – as of September 2025, the International Foundation of Reporting Standards reported that 37 jurisdictions, amounting to about 60% of global gross domestic product (GDP), had "already decided to use or are taking steps to introduce ISSB Standards in their legal or regulatory frameworks".

A UK sustainability assurance framework

The Government's consultation on the UK SRS also discusses the potential creation of a framework for the registration of service providers for sustainability assurance, which is currently served by a limited market dominated by accountancy firms. These approved assurers could potentially provide assurance for the purposes of multiple sustainability reporting regimes (including under UK SRS as well as under EU and other international IFRS-based sustainability reporting regimes).

While assurance requirements may increase investor confidence in disclosures, they can also add significantly to compliance costs. Indeed, this cost issue has been one of the early thorns in the side of the EU's sustainability reporting regime, with recent Omnibus proposals walking back on the move in future years from limited to (a more intensive and costly) reasonable assurance requirement. The Government will no doubt be keeping this in mind – the consultation positions it firmly on the fence as to whether or not assurance might be required over UK SRS reports in future.

Transition planning

In its transition plan consultation, the Government reaffirmed its manifesto commitment to mandate UK-regulated financial institutions and FTSE 100 companies to develop and implement credible transition plans that align with 1.5°C target of the Paris Agreement. The Government sought views on whether to:

- require entities to report on transition plan implementation (on a "comply or explain" basis); or

- go further with a requirement to align their plans with the 1.5°C target, and to take steps to implement the published plan.

While the first of the options put forward ("comply or explain") would not actually fulfil the original manifesto commitment, we have previously examined the case for lighter-touch regulation in regards to achieving that manifesto pledge, and suggest that a "comply or explain" approach might encourage more honest, decision-useful reporting, be more appropriate for certain firms, and reveal weak spots in firms' action to reach 1.5°C alignment. A less prescriptive regime could also prevent the critical strategic thinking process from turning into a check box exercise and inform targeted policy interventions by Government to remove identified barriers to decarbonisation.

Disclosure of transition plans

The consultation also sought views on the extension of the transition plan disclosure rules to all "economically significant entities", potentially including large private companies, not just FTSE 100 companies. With wider adoption comes greater exposure to and understanding at both investor and consumer level of the climate-related financial risks and opportunities of UK businesses. For this group, a one-size-fits-all approach is particularly jarring, given that the climate impact of large companies across the economy and their ability to manage that impact varies enormously.

Results of the consultations and final texts of the UK SRS were expected this autumn, but at the time of writing (mid-November 2025) had yet to appear. It remains to be seen therefore whether the Government and the Financial Conduct Authority can meet their own ambitious timetables to consult on mandating reporting (and critically, the scope of any such reporting) prior to the end of the year.

For more information on the consultations on sustainability reporting and transition plans, see our detailed briefings.

National security scrutiny of infrastructure and energy deals: an update

The National Security and Investment Act 2021 (NSI Act) has now been in force since January 2022. We look at the latest developments, including the fourth NSI annual report.

The NSI Act: a reminder

It enables the UK Government to scrutinise M&A deals and a range of other transactions (including acquisitions of assets only, without any related business or enterprise) on grounds of national security (see our detailed briefing for more). Many of the sectors where prior notification (for qualifying transactions) is mandatory relate to infrastructure, including communications and data, energy and transport. Unlike similar regimes in other countries, there is no requirement for a foreign (non-UK) investor to be involved. There are also no financial thresholds or de minimis exemptions - instead the focus is generally on the nature of the underlying business or asset in which an interest is being acquired (and whether it falls within the list of sectors/activities that the Government is concerned about).

What does the fourth NSI Act annual report tell us about the direction of travel?

The latest NSI Act annual report is the first to cover almost a year of the Labour Government. Whilst sectors involving Defence and Military/Dual-Use still top the numbers of notifications and deal interventions, the application of the NSI Act to wider infrastructure remains clear. Our briefing covers the key findings, including:

- Notification numbers are on an upwards trajectory. Whilst "call-ins" are also up, they still amount to less than 5% of deals (i.e. a 95% clearance rate without further investigation).

- Although defence tops the list for numbers of notifications, Data Infrastructure, Energy and Communications still feature heavily (accounting for well over 20%).

- There's a significant up-tick in final orders – 17 cases, up from 5 last year. Only one case, in the semiconductor space, required divestment but 5 deals were abandoned after call-in. Whilst Defence and Military/Dual-Use still top the numbers of final orders, Energy projects amounted to the sixth highest number (5).

- The largest number of final orders involved UK-based investors, followed by China and the USA. However, of those UK investors, a relatively large number involved corporate links associated with other countries.

- Whilst time taken from call-in to final order is up, caution should be used in drawing any trends yet, given the relatively small number of final orders last year.

So, largely a continuation of existing trends – but watch this space for more changes afoot in the NSI Act space, intended by Government to make the regime more targeted whilst also supporting its "pro-growth" agenda.

Consultation on changes to sector definitions

Of specific relevance to infrastructure investors, there is a consultation underway on changes to the NSI Act sector definitions. The proposed changes are designed to:

- Widen its scope in some areas – e.g. by proposing to add a new sector related to Water infrastructure and services, as well as to add third-party operated data centres (including data processing and data storage) to the scope of Data Infrastructure.

- Narrow its scope in other areas – e.g. by updating the AI sector to remove cases where "off the shelf" AI is being used as a tool within internal processes.

In some cases, the proposals embody a mixture of both approaches e.g. a proposal to narrow the Communications sector in some respects (through a turnover threshold applicable to "associated facilities" aimed at loosening the scope for transactions considered low-risk) whilst also widening it in other respects (by removing the turnover thresholds for critical infrastructure). The Government also proposes to narrow the Energy sector definition (to reduce unnecessary notifications through a new cumulative capacity threshold) but also bring new activities within its scope (e.g. those related to multi-purpose interconnectors, which link the UK's energy system with other countries).

There are also plans to exempt from mandatory notification certain internal reorganisations and liquidator appointments. Details are expected shortly.

What does the National Underground Asset Register mean for the infrastructure and energy sectors?

The National Underground Asset Register (NUAR) is a digital map of underground infrastructure such as pipes and cables. It's expected to be fully operational by the end of 2025, although it will not be fully comprehensive until 2027. Our briefing explains the NUAR in more detail, but the key points for investors and operators to be aware of are as follows:

Key takeaways

- Significant efficiency gains: NUAR is expected to deliver significant efficiency gains, reducing scope for accidental damage to infrastructure such as pipes and cables (currently estimated to cost the UK economy £2.4 billion per year) and allowing instant access to the information necessary to carry out excavations (as compared with an average delay of 6.1 days at present). Asset owners will also be relieved of the administrative burden of having to respond to requests for information on their underground assets, as businesses will be able to obtain the data via NUAR instead.

- Cost implications: Asset owners will now be subject to a fee to fund the running costs of the NUAR, although it is anticipated that these costs will be less than those currently incurred in responding to individual requests for their data (so the fees should not cancel out the efficiency gains). Current timelines suggest that fees are unlikely to be introduced before 2028.

- Compliance obligations: Asset owners will be obliged to provide data on their assets to NUAR. In some cases, the initial upload of data may require additional resources (e.g. because of the volume of assets and/or because current records are not in the format required by NUAR). The exercise of collating and reformatting this data could present a significant administrative burden for asset owners and could involve considerable costs. However, current timelines suggest that asset owners will have 12 months to complete their initial upload and the clock will not start on this period until spring 2027 at the earliest. While this provides sufficient time to prepare, we recommend that asset owners begin reviewing their data and establishing the necessary processes now to ensure they are ready to comply by the deadline.

How consumer law impacts on the infrastructure and energy sectors

The transition to net zero requires consumers as well as business to start using low carbon technology, ranging from new types of heating such as heat pumps and heat networks through to charging infrastructure for electric vehicles. Consumers are protected by a combination of sector-specific measures and general UK consumer law – both of which have seen recent changes.

For example, UK consumer law has recently undergone a significant overhaul as a result of the Digital Markets, Competition and Consumers Act 2024 (DMCCA), most of which came into force in April 2025. In particular, there have been important changes to the law on presentation of prices, fake or misleading consumer reviews and subscription contracts. Meanwhile, from 27 January 2026, a new sector-specific regulatory regime will see heat networks being required to comply with new consumer protection obligations. We look at what investors and operators in the infrastructure and energy sectors need to watch out for.

A tougher enforcement environment

The DMCCA gives the UK's lead consumer regulator, the Competition and Markets Authority (CMA), much tougher enforcement powers, including the ability to impose fines of up to 10% of turnover and require redress payments to consumers. Sectoral regulators were not given the same direct enforcement powers in respect of general consumer law – although we understand that that energy regulator Ofgem would like the Government to reconsider this aspect of the DMCCA (currently, it would have to go court in order to enforce general consumer protection law). However, licences issued by Ofgem to operators in the energy sector engaged in consumer-facing activities often contain numerous conditions designed to ensure consumer protection (and have done for many years). Ofgem is able to enforce these directly; for example, over the last 6 years, it has imposed fines totalling over £30 million and ordered redress payments of over £462 million. Water regulator Ofwat and telecoms regulator Ofcom have similar powers. It's also worth bearing in mind that, although the CMA may sometimes choose to defer to sectoral regulators such as Ofgem, it can still enforce general consumer law in the energy sector (for examples, see below under "Greenwashing"). Recent statements from the CMA also suggest a shift in tone, with more emphasis on enforcement action.

Heat networks

Historically, heat networks have not been regulated in the same way as other utility providers – although they were subject to general consumer protection legislation. However, from 27 January 2026, a new supervisory regime will be introduced under the Energy Act 2023, with Ofgem as regulator. Among other things, this will require heat network operators – and some landlords – to comply with specific consumer protection obligations relating to:

- pricing and billing

- performance standards and compensation

- unbundling of the service charge from heat supply (so consumers can easily see how much their heating/hot water is costing); and

- treatment of vulnerable consumers, such as the elderly or disabled.

Ofgem will be able to enforce these obligations as licence conditions i.e. in more serious cases, it will be able to impose fines and require consumer redress payments. For more detail, see our briefing: Heat networks: less than 3 months until "go live" date for regulation

Misleading pricing

The CMA has been consulting on draft guidance setting out how prices should be presented to consumers – including delivery charges, booking or admin fees, local taxes, joining fees and other sums that may make up the total price for a product or service. It is particularly concerned about misleading "headline" prices, which don't include additional charges that most consumers will end up having to pay. Our briefing explains how the DMCCA tightens up the law in this area, in particular by making it significantly easier for regulators to enforce.

Fake or misleading consumer reviews

Customer service is now a key driver of competition between utility providers – and firms will often point to consumer reviews as evidence of high levels of customer satisfaction. Although regulators are likely to welcome such competition, they are also keen to ensure that reviews are genuine and that aggregate review information (e.g. "average rating 4.8 stars") is fairly presented. The DMCCA has introduced a new requirement on businesses to take reasonable and proportionate steps to prevent publication of fake or misleading review information. As we explain in our briefing, this new duty is likely to require most businesses to take at least some action to comply – and now that the DMCCA has been in force for over 6 months, the CMA will be looking for potential enforcement targets.

Subscription contracts

The DMCCA introduces a complex and prescriptive regime for subscription contracts – although importantly, contracts for the supply of water, gas or electricity, together with heating, cooling or hot water via a heat network are excluded (on the basis that sector-specific consumer protection measures will apply, usually by virtue of relevant licence conditions – see above). One area where the new regime might bite on the energy and infrastructure sector is in relation to businesses offering services such as heat pump or boiler maintenance, based on e.g. annual subscriptions. However, if the consumer is in fact being an offered a contract of insurance (whose benefits happen to include e.g. a regular service and repair services if the heat pump or boiler goes wrong), it will be excluded from the new subscriptions regime on the basis that the consumer would normally be protected by financial services regulation instead (e.g. the business offering the insurance will need to comply with FCA's "consumer duty"). This highlights the importance of working out which consumer protection regime applies.

Although not expected to be brought into force until Autumn 2026 (recently postponed from April 2026), if the new subscription contracts regime applies, it is quite likely to necessitate changes to sign-up and customer-relationship management processes. Look out for our briefing on this in the coming months.

Greenwashing

With many consumers keen to "do their bit" for the environment, promoting the "green attributes" of a particular product or service is an attractive marketing strategy. However, regulators have taken action against businesses over potentially misleading environmental claims. Examples include the CMA's 2023-4 investigation into boiler manufacturer Worcester Bosch, which agreed to amend its marketing practices relating to its description of its boilers as "hydrogen blend ready". The CMA has also published guidance to the heating and insulation sector on misleading green claims. It's worth noting that the Worcester Bosch case predated the DMCCA; if a similar case came to the CMA's attention now, it would not only be able to order the relevant business to change its practices (without having to go to court, as previously) but also impose a fine for non-compliance and, potentially, require compensation to be paid to any consumers who had been misled.

Carbon border adjustment: where are we now?

The EU Carbon Border Adjustment Mechanism ("CBAM") Regulation introduced an innovative framework to discourage the offshoring of manufacture of carbon intensive goods destined for the EU. But as we explain below, it has recently been modified in response to concerns that it was overly burdensome for business.

CBAM: what is it and why does it matter?

The CBAM imposes a financial charge on the embedded carbon contained in carbon-intensive goods or their raw materials, such as cement, steel, iron, aluminium and electricity. It is intended to level the playing field between EU manufacturers subject to the requirements of the EU's Emissions Trading System ("EU ETS") and importers into the EU who choose to manufacture overseas, particularly in jurisdictions where the environmental protection regulation may not be so stringent.

See our legal briefing on CBAM here and here for further background on the regime.

What is the UK's approach?

Following Brexit, the UK left the EU ETS and introduced its own Emissions Trading System. This means that UK manufacturers are likely to be subject to financial charges under the CBAM unless the UK carbon price tracks that of the EU. However, it is hoped that, as part of the UK-EU reset, the UK and the EU will link their respective ETS.Indeed, on 13 November 2025, the Council of the European Union authorised the European Commission to open negotiations on ETS linkage.

EU simplification measures

Earlier this year, the European Commission put forward two 'Omnibus' legislative packages, designed to simplify existing legislation in the fields of sustainability and investment, respectively. The first package - "Omnibus I" – proposed several simplification and cost efficiency compliance improvements to the CBAM, aiming to reduce its regulatory and administrative burden whilst preserving its environmental integrity (i.e. ensuring that it covers the majority of emissions). The changes to the CBAM Regulation became effective on 20 October 2025.

Omnibus I changes

The amended law significantly raises the threshold for importers covered by the CBAM; instead of covering all shipments over a "negligible value", the newly amended CBAM applies only to importers who import over 50 tonnes of CBAM goods per year. This change alone is expected to exempt approximately 91% of importers, while still capturing over 99% of emissions from CBAM-covered imports. It significantly reduces the burden of the regime whilst seemingly preserving its efficacy.

Importers still in scope of the CBAM also benefit from simplification measures: emissions calculation has been simplified by the introduction of the option of using default emissions values, and the deadline for annual CBAM declarations has been pushed back to 30 September of the year following importation, providing additional time for compliance. Furthermore, the financial burden of the CBAM has been reduced, with a reduction in the amount of CBAM certificates declarants have to hold at the end of each quarter – rather than having to hold certificates corresponding to 80% of all embedded emissions in imported products for the year, importers will only need to hold certificates corresponding to 50%.

For more information on the proposed changes to CBAM, see our briefing.

What next?

The Commission launched a call for evidence in August aiming to gather stakeholder views on three central elements of the mechanism that still need to be finalised:

- the methodology for calculating embedded emissions;

- the rules on adjustment of CBAM certificates to reflect ETS free allocation; and

- the rules on the deduction of the carbon price paid in a third country.

The Commission announced plans in July to introduce a new measure to address the risk of carbon leakage for EU-manufactured goods produced in sectors affected by the CBAM. Although details have not yet been published, the proposal, expected by the end of 2025, should support producers of carbon intensive goods and improve the efficiency of the mechanism, even in the context of wider regulatory simplification. Seemingly separately, the Commission is also seeking views on the extension of the CBAM into downstream products rather than just raw materials, and to introduce further anti-circumvention measures.

The recent changes to the CBAM, and the proposal for its extension, reflect a growing tension between the EU's efforts to reduce the regulatory burden imposed on industry by regulations such as the CBAM and the achievement of its broader climate goals, which – though currently experiencing some turbulence – remain in place.

Recent experience

- Basalt Infrastructure Partners on sale of Manx Telecom Group to a strategic partnership of CVC DIF and Jersey Telecom.

- RBS International on an €80m NAV facility to Foresight Energy Infrastructure Partners.

- Arjun Infrastructure Partners on the increase of its stake in Danish biogas platform Bigadan.

- Ancala Partners on the financing and management arrangements for the acquisition of 300 telecom towers across Ireland from Phoenix Tower International.

- Nest Corporation on its €530m commitment to seed a new infrastructure debt fund, its first investment since becoming an owner of global investment manager IFM Investors.

- Ancala Partners on the acquisition of an additional 47% interest in Liverpool John Lennon Airport.

- Mizuho Financial Group on the acquisition of Augusta & Co, a leading independent specialist financial advisory firm serving the Renewable Energy and Energy Transition sectors.

- GTC, the UK's largest installer and operator of last mile multi-utility networks, on its new partnership with UK-based ground source heat pump provider, The Kensa Group.

- Optinet on its new agreement with Unibail-Rodamco-Westfield to install their full fibre network in both the Westfield London & Westfield Stratford shopping centres.

To view the full article please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.