- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Pharmaceuticals & BioTech and Law Firm industries

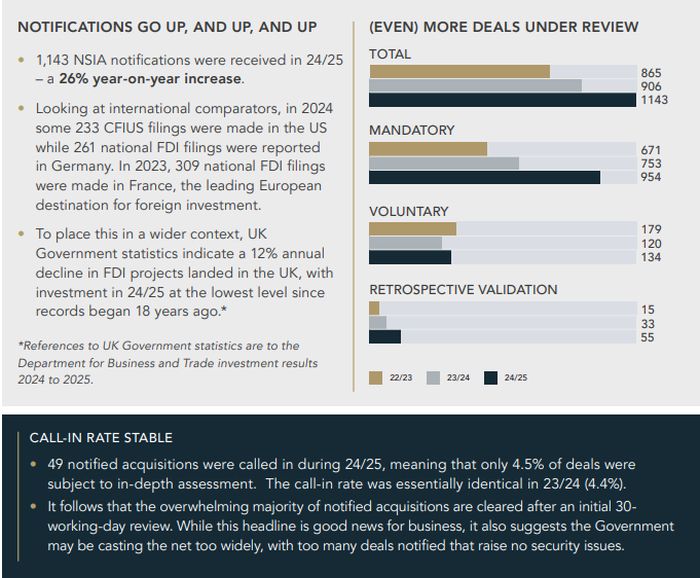

On 22 July 2025, the UK Government published its fourth Annual Report on the operation of the National Security and Investment Act 2021 (NSIA). On the same day, the Labour administration unveiled proposals to reform the NSIA regime, with a view to reducing the burden on business.

Below are selected headlines and notable takeaways from the latest Annual Report, including a comparative, year-on-year assessment of notable trends. With an eye to proposed reforms, key points are highlighted that are relevant to M&A planning in the near term.

KEY SECTORS UNDER INVESTIGATION

- Most notifications (56%) received in 24/25 were associated with Defence. This perpetuates a trend seen since the introduction of the NSIA regime. Defence has consistently accounted for roughly half of all mandatory notifications.**

- Acquisitions relating to Defence and Military/Dual Use appear to be particularly at risk of detailed assessment, together accounting for 65% of all 24/25 call-in notices. The majority of Final Orders issued in 24/25 also related to Defence (9 out of 17 Final Orders).

- The intense scrutiny of deals in the Defence sector is likely to persist. In its new Industrial Strategy paper (June 2025), the Government emphasised "new threats to our security" and the urgent need to strengthen the UK's economic and national security as we enter a "new era of geopolitical competition." At the same time, however, the Industrial Strategy identifies Defence as a priority growth sector for which greater investment is to be targeted and secured.

TOP ECONOMIC SECTORS FOR MANDATORY NOTIFICATIONS

| 2022/23 | 2023/24 | 2024/25 |

| 1. Defence | Defence | Defence |

| 2. Critical Supplies | Critical Supplies | Critical Supplies |

| 3. Data Infrastructure | Military/Dual Use | Military/Dual Use |

| 4. Military/Dual Use | Data Infrastructure | Data Infrastructure |

| 5. Artificial Intelligence | Advanced Materials | Advanced Materials |

CONSULTATION ON REFORM PROGRAMME

In its Industrial Strategy, the UK Government announced reforms intended to deliver a "predictable, proportionate and transparent investment screening framework." This included a 12-week consultation to update the definitions of the sensitive areas of the economy subject to mandatory notification under the NSIA.

The public consultation was launched on 22 July 2025. It concludes on 14 October 2025. Key proposals include the following:

- Introduction of greater clarity by carving out Critical Minerals and Semiconductors from Advanced Materials and establishing new standalone sector definitions in relation to each of these two areas.

- Cases where "off-the-shelf" consumer AI is being used for low-risk, internal processes will no longer be within the scope of the mandatory notification regime. The sector definition will focus on more significant AI development activities.

- A new sector definition will be introduced to cover the acquisition of regional water and sewerage monopolies that provide critical infrastructure services.

- Clarifications or changes in the scope of sector definitions relating to areas including Critical Suppliers to Government, Data Infrastructure and Energy.

On 20 July, the Cabinet Office also announced that as part of the Government's "Plan For Change" agenda it proposes to "reduce unnecessary red tape" by ensuring mandatory notifications are no longer required for certain forms of internal reorganisation or the appointment of liquidators, special administrators and official receivers. The introduction of exemptions for these categories of activity could appreciably amaterially benefit business.

STEP-CHANGE IN INTERVENTION LEVELS ****

- 17 Final Orders were issued in 24/25, compared with 5 Final Orders in 23/24.

- Viewed over a broader time horizon, however, 23/24 might be viewed as anomalous – 22/23 saw the Government adopt 5 prohibition decisions and make a total of 15 Final Orders. This level of intervention is broadly consistent with activity in the 24/25 reference period.

- The concept of national security is not defined in legislation and the focus is evolving. 24/25 saw conditional clearances and remedies in deals relating to areas as varied as semiconductor technology, telecommunications, cybersecurity and advanced manufacturing. The first conditional national security clearance issued under the Labour Government related to radiation detection equipment.

- A key trend is the increased willingness of Government to consider remedies, with common features of remedies including governance arrangements to reduce foreign influence on strategic decisions, information safeguards, and commitments to maintain strategic capabilities that support UK supply chain security and resilience.

**** The total number of notifications received in a reference period is not identical to the total number of notifications reviewed or decisions adopted in the same period. Please also note that analysis of outcomes does not take account of subsequent variation or revocation orders.

FINAL OUTCOMES - INCREASED ENFORCEMENT

Visit us at mayerbrown.com

Mayer Brown is a global services provider comprising associated legal practices that are separate entities, including Mayer Brown LLP (Illinois, USA), Mayer Brown International LLP (England & Wales), Mayer Brown (a Hong Kong partnership) and Tauil & Chequer Advogados (a Brazilian law partnership) and non-legal service providers, which provide consultancy services (collectively, the "Mayer Brown Practices"). The Mayer Brown Practices are established in various jurisdictions and may be a legal person or a partnership. PK Wong & Nair LLC ("PKWN") is the constituent Singapore law practice of our licensed joint law venture in Singapore, Mayer Brown PK Wong & Nair Pte. Ltd. Details of the individual Mayer Brown Practices and PKWN can be found in the Legal Notices section of our website. "Mayer Brown" and the Mayer Brown logo are the trademarks of Mayer Brown.

© Copyright 2025. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.