- with readers working within the Retail & Leisure industries

AT A GLANCE

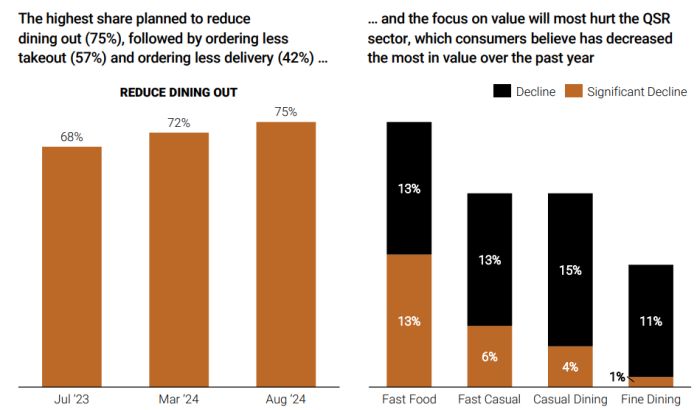

- Consumer debt is rising, but rather than trading down, diners are reducing visits and prioritizing dine-out occasions. Steady price hikes are hitting fast food and casual dining restaurants the most—over a quarter of consumers say QSR offerings have declined in value.

- Operators have an opportunity to right the value proposition through targeted menu innovation, promotions, and consistency

- Where operators once viewed AI and automation as a key threat, they are now investing in AI solutions across customer-facing, administrative, and operational functions. Nearly 3 in 5 operators see AI as their biggest opportunity

- Almost 9 in 10 (87%) respondents to the U.S. Restaurant Worker Survey say new technologies in the restaurant have positively impacted their job duties and responsibilities and improved efficiency and customer satisfaction. Their desire for DE&I initiatives to improve employee belonging has increased slightly.

FINANCIAL ANXIETY PULLS THE TABLECLOTH OUT FROM RESTAURANT SPENDING

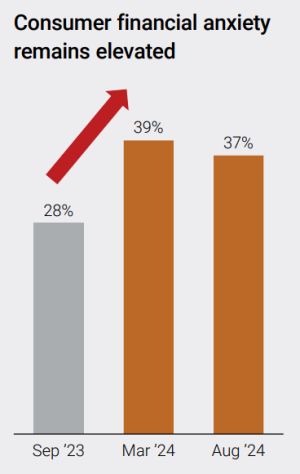

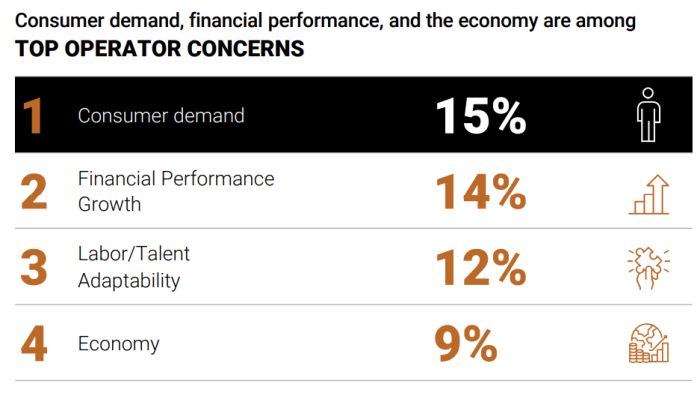

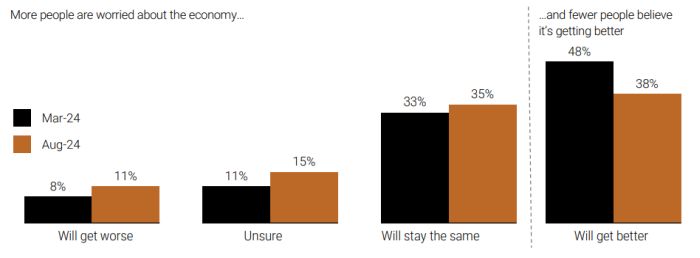

Consumers are showing signs of financial exhaustion: the share of respondents who reported financial distress rose from 28% in fall 2023 to 39% in spring 2024 and remained elevated here at the end of summer at 37%, while 75% said debt levels had increased in the past six months. Our U.S. Restaurant Consumer Pulse Survey finds that the need to cut back will have the harshest effect on QSRs. This is on CEOs' minds; respondents cited concerns such as "guest's ability to continue to eat out considering the rise in costs."

A focus on "experiential" spending means that consumers are less willing to trade down to cheaper restaurants or items, instead reducing the number of visits to restaurants while prioritizing opportunities to dine-out over cheaper drive-through or takeaway options. There is a dramatic difference in perception between sectors, suggesting a near-term focus for struggling casual dining operators needs to be quality, execution, and guest experience to drive value—not price.

Fine dining surprisingly shows the greatest resilience in an inflationary atmosphere, while fast food is perceived as showing the largest declines in value (26% believe value has fallen), followed by fast casual (19%). Younger consumers (Gen Z) are the most likely to pull back on their spending overall.

Across segments, there are opportunities to preserve and gain market share as the disparate fortunes of big restaurant companies show: comparable transactions declined 6% in the U.S. for one of the major coffee chains in Q3 2024 while a fast-casual chain saw 11% growth in transactions. Similarly within one restaurant group with multiple concepts, there were mixed results, with traffic growing 1-2% while another casual dining concept showed retrenchment—there are many winners and losers within segments.

What is the financial outlook for your household for the remainder of the year?

Consumers continue to suggest that they are less willing to trade down to cheaper restaurants or items.

To view the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]