- with readers working within the Media & Information industries

- within Corporate/Commercial Law topic(s)

- within Transport, Media, Telecoms, IT, Entertainment and Tax topic(s)

- with Inhouse Counsel

- with readers working within the Law Firm industries

In August 2025, there were three Rule 2.7 announcements made across the UK public M&A market and one further possible offer announced.

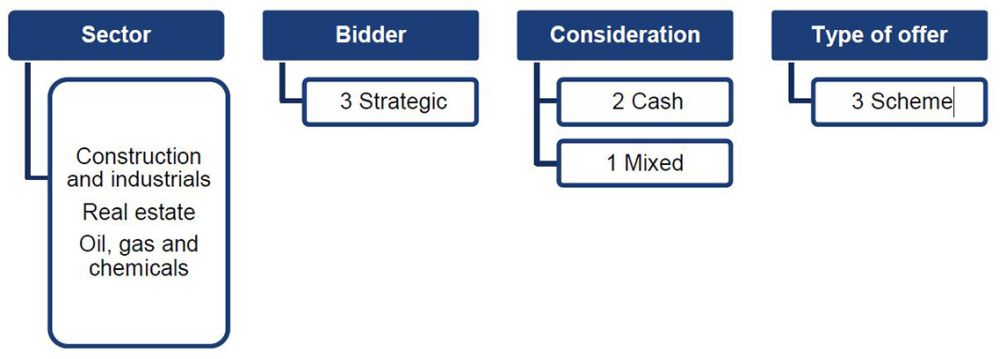

Firm Offers announced this month:

- Recommended cash offer by Laumann Stiftung & Co. KG for Epwin Group plc – £167.3 million

- Recommended cash and shares offer by The Unite Group plc for Empiric Student Property plc – £723 million

- Recommended cash offer by Dar Al-Handasah Consultants Shair and Partners Holdings Ltd for John Wood Group PLC – £207.6 million

Possible Offer announced this month:

- Possible cash offer for Permira Advisers LLP by JTC plc

Firm Offers breakdown this month:

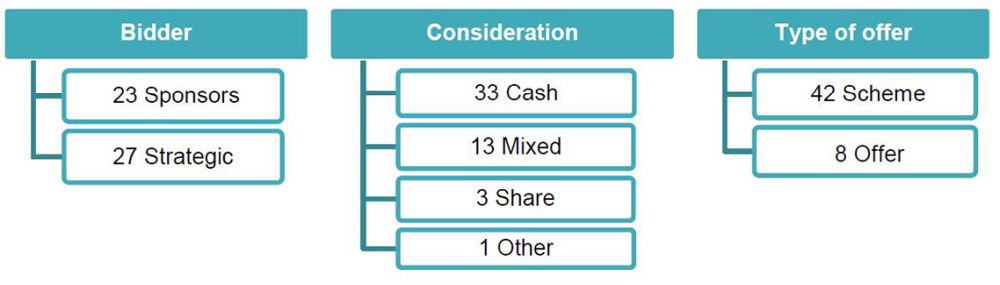

Year to date breakdown:

August 2025 Updates:

UK Public M&A podcast Ep 37: UK takeover panel practice statement on profit forecasts and synergy statements

In this episode, we talk about Practice Statement 35 which the UK Takeover Panel published recently, on profit forecasts, synergy statements (referred to in the Takeover Code as quantified financial benefits statements or QFBSs) and connected investment research.

Areas we discuss include:

- the regime in the Takeover Code for profit forecasts;

- how the rules apply where a target has unequivocally rejected an approach;

- the Panel Executive's approach to reports on synergy statements where a deal leaks;

- its approach where a target provides a profit forecast to a bidder as part of the due diligence exercise;

- when a forward-looking statement will be an aspirational target;

- how the regime applies to profit forecasts for financial periods which end more than 15 months in the future; and

- when the Executive may grant a dispensation from the rules that apply when a connected firm publishes investment research.

To listen to the full conversation please visit SoundCloud, Spotify or Apple.

All episodes in our UK public M&A podcast series are available

on our public M&A podcast page.

August 2025 Insights:

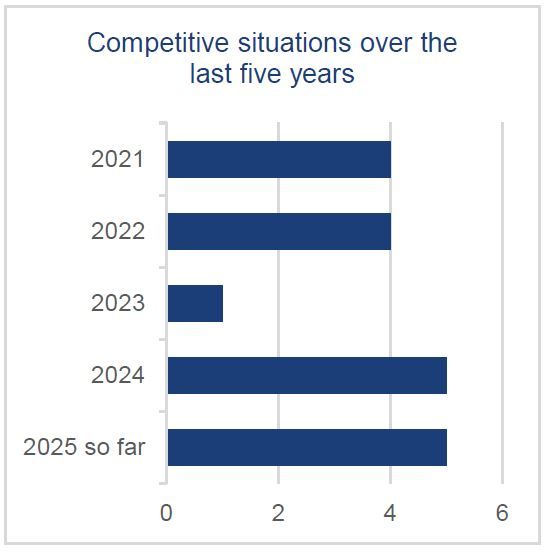

August marks the quietest month for 2025 for public M&A deal activity, with just three firm offers and one possible offer announced. Overall, the number of firm offers match the number of firm offers seen in August 2024 and 2023. There has been a decrease in possible offers from August 2024. This slowdown is not entirely unexpected. This continues a trend of declining August deal volumes, likely reflecting seasonal slowdowns as market participants pause during the summer period.

Another auction procedure was announced (and then cancelled) in August – continuing the trend of competitive situations we have seen this year. Both Blackstone and Tritax Big Box (BBox) made offers for Warehouse REIT in June. As neither had declared their offer final ahead of Day 46 of the offer timetable, the Takeover Panel announced that an auction procedure would be used to resolve the situation (using the default procedure in Appendix 8 of the Takeover Code as the parties had not agreed an alternative). However, before the auction commenced, BBox announced that it would not be increasing its offer and so the auction was cancelled. The same happened on the bids for Harmony Energy Income Trust, where an auction procedure was announced and then cancelled in May this year. We discussed competitive bids and auction procedures in Episode 23 and Episode 34 of our UK public M&A podcast series.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.