- with readers working within the Retail & Leisure industries

Destocking is here to stay until supply chains are back in sync—and it could hit weaker suppliers hardest

Ever feel like your inventory has been out of control over the past few years? You're not alone.

The industry has bulked up on production capacity, supplies, and labor as the commercial airliner backlog has flown past 16,000 jets, only to be hamstrung by supply chain and operational challenges that have bloated warehouses and balance sheets.

Warning signs have been building for years. Inventory performance had been deteriorating even before the 737 MAX grounding and the post-pandemic breakdown of global supply chains.

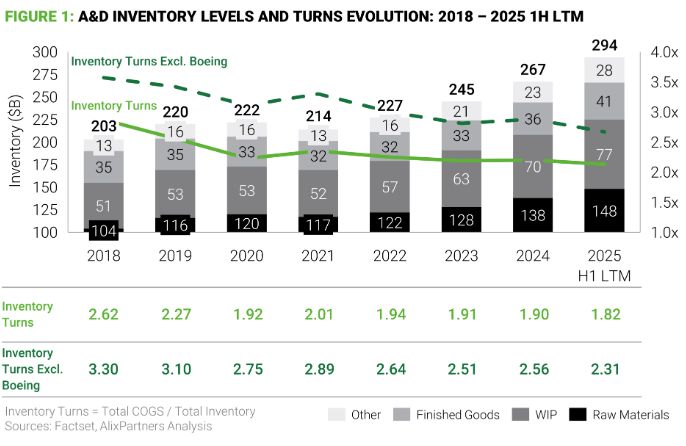

Problems have visibly worsened, from "gliders" waiting for engines to rows of completed fuselages ready to enter final assembly when the parts arrive—and the challenges run deeper than those visible on the tarmac. Data shows escalating levels across raw materials, work-in-process, and finished goods alike.

Misaligned inventory has shifted from being an operating inefficiency to a strategic constraint. The build-up has coincided with stretched lead times and persistent delivery bottlenecks, creating simultaneous gluts and shortages across programs.

Destocking has become a fixture on investor calls and conference agendas this year. With $75 billion of excess inventory sitting in the system, it will remain front and center until supply chains are genuinely back in sync.

The demand whipsaw signals slow program production ramp-ups, inflates working capital needs, and raises the cost of manufacturing across the value chain. An inventory surge in recent years gave weaker suppliers, especially in aerostructures, a temporary cushion. The shift to destocking threatens to hit them hardest. With margins already strained by labor and material inflation, prolonged production at lower rates will compound the stress.

By the numbers

Inventory levels among a sample of 59 aerospace and defense companies surged by a staggering 44%, or almost $90 billion, between 2018 and the second quarter of 2025. On a normalized basis, considering the 2018 inventory turnover performance as a baseline, this translates into $75 billion in excess stock across the industry.

At a conservative 6% financing cost, $75 billion equates to roughly $4.5 billion of annual incremental interest alone. That is capital that could be redeployed to boost capacity, spur innovation, pursue M&A, or be returned to shareholders. For many suppliers, despite the recent rate cuts, the financial strain is becoming unsustainable.

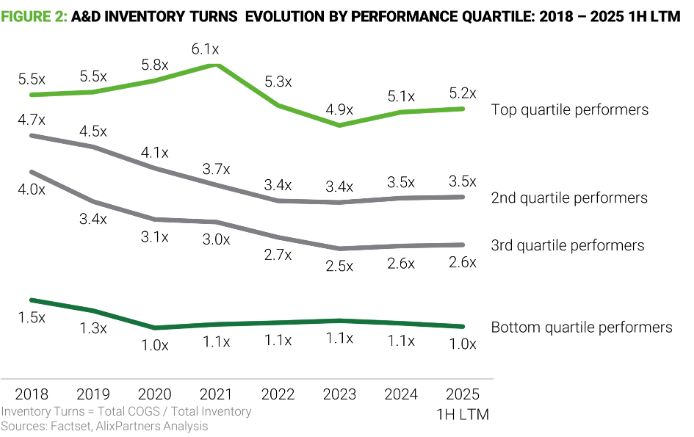

The industry's challenge is that while a few top performers have managed relatively well over the past few years, everyone has still been left struggling. The drop in performance by those in the middle of the pack has been especially striking, with inventory turns dropping to 2.5-3.5x from 4-4.5x consistently across the board. For those in the bottom quartiles, inventory turns are flat at around 1x following the drop from 2018-2020.

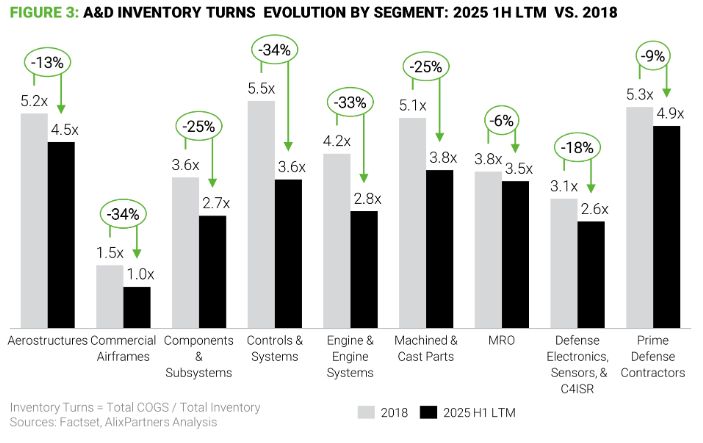

No segment has been immune to inventory performance deterioration, though MRO and defense players have fared significantly better than the commercial aerospace OEMs and their supply chain. Airframers, engine manufacturers, and suppliers of complex systems have suffered drops in inventory turns of 30% or more.

How did we get here?

The A&D supply chain should function like a finely tuned orchestra—each player must remain in perfect sync. As we emerged from the pandemic and the MAX crisis, it became clear that everyone was playing at their own pace.

Certain sectors, such as castings and forgings, struggled to catch up, pacing deliveries and resulting in stockpiles at OEMs and Tier-1 suppliers, leaving these end users with an impossible dilemma. CFOs, horrified by their ballooning working capital, demanded replanning and draconian cuts to the demand signals issued to suppliers. Program managers and supply chain leaders pushed back to protect ramp-ups and their own supply chains. While several cycles of replanning occurred, they were often too little too late, failing to properly address the critical bottlenecks with adequate supplier interventions and worsening whipsaw impacts in the supply chain.

Widespread uncertainty left suppliers across multiple tiers with a sword of Damocles over their heads that created a vicious circle. They started second-guessing OEM demand and often delayed orders for raw materials. That translated into extended lead times, created new bottlenecks, and further worsened whipsaw impacts.

The result: delayed ramp-ups, that $75 billion in excess inventory, and demand signals clouded with uncertainty.

A multifaceted solution

Addressing inventory challenges in the A&D sector requires a multifaceted approach. Uncontrolled destocking risks undermining production ramp-ups and ultimately worsening the problem.

While OEMs play a pivotal role in orchestrating the resynchronization of the supply chain, the entire ecosystem—across every tier—must engage.

Tactical interventions at each level can drive significant improvements.

Step 1: Now

- Manufacturing lead-time reduction: Revisit manufacturing processes to identify bottlenecks and inefficiencies. Use root cause analyses, continuous improvement toolkits, or new equipment to streamline lead times, enhance yields, and optimize lot sizes.

- Lean, agile methodologies: Implement lean principles to optimize inventory flow and minimize waste throughout production. Plan For Every Part (PFEP) and pull/Kanban systems can improve agility and reduce excess inventory.

- Supplier intervention: Deploy multi-functional teams on-site to target the most critical bottlenecks in the supply chain. Anticipate supplier resistance and counter it with accelerated decision-making on waivers, concessions, and nonconformities to keep materials and production flowing.

- Planning parameters (MRP): Reassess batch sizes, minimum order quantities, lead times, safety stock, and reorder points to balance service and excess—and reflect current supplier performance.

Step 2: Next

- SIOP: Align demand, supply, and capacity decisions across the enterprise using a data-driven cadence with clear visibility into risks, mitigations, and accountable action plans.

- Strategic inventory management: Reassess critical component lists and establish strategic stock levels to mitigate risks. Create a supplier watchtower to monitor delivery performance and identify potential risks in the supply chain.

- Supply chain visibility: Better integrate with suppliers down multiple tiers to improve visibility to supply chain performance and gain more advanced notice of potential delays.

- Process overhauls: Undertake comprehensive process reviews to eliminate inefficiencies and prevent dead-stock accumulation. Optimized processes reduce holding costs and ensure appropriate inventory levels.

- AI/ML: Leverage data-driven insights to optimize inventory planning, allocation, and decision-making.

The inventory challenge is more than a financial burden—it's an existential constraint on production ramp-ups, innovation, and competitiveness across the A&D ecosystem. Leading players are already acting to rewrite the playbook on supply chain planning, inventory optimization, and supplier recovery.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.