- within Energy and Natural Resources topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- in United States

- with readers working within the Accounting & Consultancy, Oil & Gas and Law Firm industries

- within Energy and Natural Resources topic(s)

- in United States

- with readers working within the Oil & Gas industries

- within Energy and Natural Resources, Criminal Law and Finance and Banking topic(s)

Introduction

The Nigerian Upstream Petroleum Regulatory Commission (the "NUPRC" or the "Commission") has announced the 2025 Oil Licensing Round will commence 1 December 2025. This will be the second bid round since the enactment of the Petroleum Industry Act ("PIA") in 2021, and will focus on discovered but undeveloped fields, assets that have been left fallow, and gas-rich prospects.

One of the positive outcomes from the last bid round was TotalEnergies and South Atlantic Petroleum signing a Production Sharing Contract for PPLs 2000 and 2001 with the National Oil Company, NNPC Limited, earlier this year. TEMPLARS advised on this transaction.

Below, we outline key issues for prospective bidders to participate in this bid round.

Regulatory & Policy Context

- Legal framework: The 2025 licensing round will be governed by the PIA1 and the Petroleum Licensing Round Regulations2 , which together provide the statutory framework and standing rules for competitive bid rounds for Petroleum Prospecting Licences ("PPL") and Petroleum Mining Leases ("PML"). The PIA expressly empowers the NUPRC to issue Licensing Round Guidelines for each round3 and we the publication of the 2025 Guidelines on or before 1 December 2025.

- Annual rounds: This is the second bidding since the PIA regime. The previous bid round (in May 2024) offered 12 marginal field blocks and 7 deep offshore licences4 . This year's bid round is focused on discovered but undeveloped fields, fallow assets and natural gas development.5

- Shared Infrastructure: To accelerate deep and shallow-water projects, the NUPRC has introduced a cluster development model.6 This encourages operators of nearby fields to share platforms, pipelines and facilities. For bidders, this means that blocks may be framed for joint development and consortium bids and technology partnerships will be attractive, especially for deepwater.

Strategic Focus: Fallow Fields/Assets and Natural Gas

The 2025 round explicitly targets "discovered but undeveloped fields, fallow assets, and natural gas development". In practical terms:

- Discovered but undeveloped fields: oil and gas deposits already identified by previous operators but not developed to achieving a commercial discovery. They contain proven hydrocarbons, which significantly reduces exploration risk. Under the PIA7 , the Commission is authorized to issue PPLs over previously appraised areas of petroleum prospecting licences or surrendered, relinquished or revoked petroleum mining leases in Nigeria. Successful bidders will therefore inherit these fields with existing geological data and will largely focus on development drilling to bring them onstream.

- Fallow assets: These are fields or discoveries that have been lying fallow without activity for seven years after their discoveries and have now been relinquished to the government under Section 94(4) of the PIA. For bidders, they present near-term opportunities that will require practical, development plans to bring these dormant resources into production.

- Natural Gas: The focus of this year's bid round on natural gas development signals opportunities for gas condensate or pure gas blocks, aligning with Nigeria's energy transition goals of expanding its gas production, reducing gas flaring and attaining net zero by 2060. Prospective bidders with expertise in gas projects or clustering gas fields may find these assets particularly interesting.

Eligibility and Pre-Qualification Requirements

Key requirements to prepare for include:

Legal and Technical Credentials: Applicants should have proven oil and gas experience and technical capacity. Prior successful exploration or development projects will strengthen an application. Experience in deepwater or gas development is a plus. Companies will also need to submit financial statements or proof of funding to demonstrate the resources to execute the work program.

- Corporate Structure & Ownership: All domestic and foreign companies are eligible to participate in the Licensing Round, as long as they meet the Prequalification Criteria in the 2025 Guidelines.8 However, the PIA requires that a licence can only be granted to a company incorporated in Nigeria9 , therefore, a foreign company would be required to incorporate a Nigerian subsidiary if successful in this bid round. In practice, international oil companies have participated via local subsidiaries or consortia with Nigerian partners. The PIA and NUPRC rules further require full disclosure of ownership. All bidding entities must complete NUPRC's Beneficial Ownership Declaration Form and submit it with their application.10 A "person with significant control" (≥5% interest or voting rights) must be disclosed.

- Nigerian Content Compliance: Bidders must plan for Nigerian involvement. This means using Nigerian services, suppliers and staff wherever possible. The NUPRC will evaluate local content plans as part of each bid. Note also that awards are typically subject to agreements on community development and local workforce training.

- Financial Obligations: The soon-to-be released Guidelines will specify bid fees, bid bonds and signature bonuses. We will provide an update after the Guidelines are released.

- Environmental and Operational Plans: Under the PIA11, each PPL awardee is required to submit a Field Development Plan ("FDP") within 2 years of declaring a commercial discovery. Plans must meet environmental standards (including gas utilization or flaring reduction) and community obligations. Note also that licensees must begin operations promptly or risk revocation. For example, the PIA allows revoking a PML that is not producing "commercial quantities" after 180 days (subject to force majeure).12

Bidding Process & Timeline – Summary Points

Bidding Process & Timeline

As we await the final details in the soon-to-be NUPRC's published guidelines, we expect the process to broadly mirror the 2024 bid round:

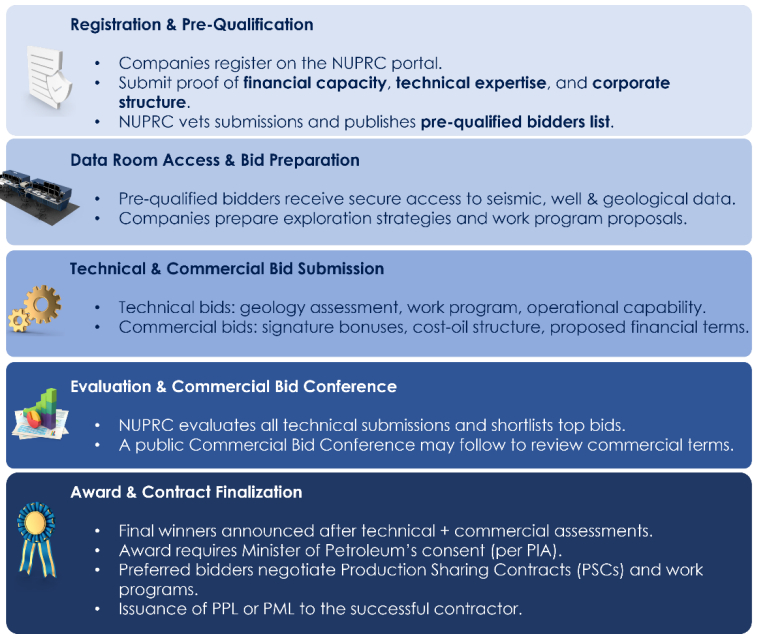

- Registration & Pre-Qualification: Companies register via the NUPRC portal and submit documentation proving financial capacity, technical expertise and corporate structure. (In 2024, this stage included a pre-bid conference for clarifications) NUPRC will vet applications and publish a list of pre-qualified bidders (only those can submit bids). In 2024, the prequalification process took a total of 5 days13. We expect a similar window once the 2025 guidelines are out.

- Data room and bidding: Qualified bidders are granted secure access to seismic, well and geological data for the offered blocks. Companies then prepare detailed exploration and work plans.

- Technical & Commercial Bids: Bidders submit separate technical and commercial proposals. Technical bids typically address geological potential, work programs and operational capability; commercial bids involve bonus payments, cost oil shares or other financial terms. In 2024, the Commission left portal access open for several months (to allow thorough bid preparation).

- Evaluation and Conference: The NUPRC will evaluate technical submissions and shortlist bids. A public "Commercial Bid Conference" may follow to present terms to the Commission.

- Award and Contract: Winning bids are announced after technical and commercial assessment. Per the PIA, final awards require the consent of the Minister of Petroleum's. The preferred bidder(s) then negotiate a Production Sharing Contract and work programs with the NUPRC. Thereafter, the relevant PPL or PML will be issued to the contractor.

Strategic Considerations

- Collaboration: Given the emphasis on shared infrastructure and the size of opportunities, consortium bids are encouraged. A mix of international technology/capital and local partners (who can fulfill content rules and community relations) is likely optimal. The NUPRC itself has organized forums to connect oil companies, banks and service providers, reflecting a collaborative stance.

- Market Context: Nigeria's goal is to increase oil output and gas flaring is being penalized. Licensees should factor in plans for associated gas utilization or LNG offtake. Nigeria has launched a seven-pillar decarbonization framework with strict flaring and methane rules, so bidders should align with those policies to boost sustainability credentials.

- Execution Risks: Companies must be aware that winning a license entails binding obligations. Failure to meet work commitments can lead to relinquishment or revocation.

Footnotes

1 Section 7(t) of the Petroleum Industry Act, 2021

2 Section 1 and 2 of the Petroleum Licensing Rounds Regulations (2022)

3 Section 73(1)(b) of the Petroleum Industry Act, 2021

4 Newsdesk-Nigeria, "Nigeria to hold 2025 bid round focused on undeveloped blocks " S&P Global (19 December 2024) accessed 20 November 2025

5 Ibid

6 Melisa Cavcic, "220 Blocks up for Grabs in Nigeria's bid round to speed up oil & gas development" Offshore Energy (11 August 2025) accessed 20 November 2025

7 Section 74(1) of the Petroleum Industry Act, 2021.

8 To be released on or before the December 1st Commencement Date

9 Section 70(2) of the Petroleum Industry Act, 2021.

10 Available at: [BENEFICIAL OWNERSHIP INFORMATION – Nigerian Upstream Petroleum Regulatory Commission] accessed 20 Nevember 2025

11 Section 79(1) of the Petroleum Industry Act, 2021.

12 Section 86(7) of the Petroleum Industry Act, 2021

13 28 June 2024 to 2 July 2024

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.