- within Employment and HR and Accounting and Audit topic(s)

- with Senior Company Executives, HR and Inhouse Counsel

Foreword

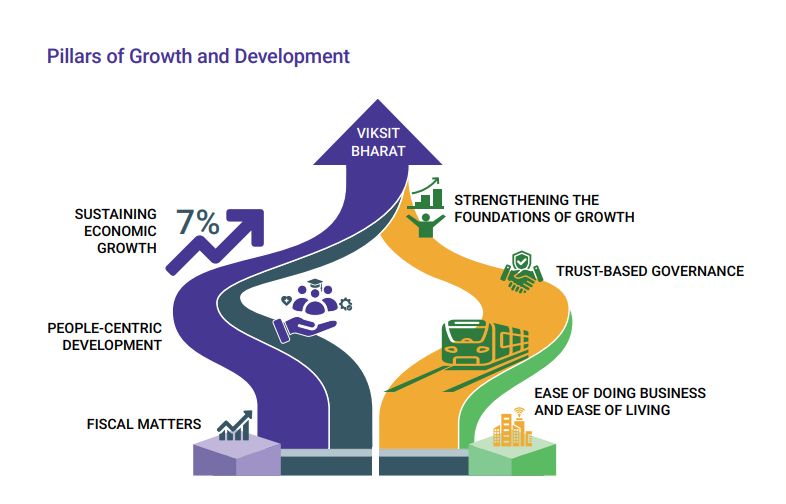

The Union Budget 2026–2027 arrives at a moment when India's long-term ambitions are beginning to shape near-term decisions for policymakers, businesses and investors. Aligned with the broader Viksit Bharat 2047 vision, the budget seeks to strike a careful balance- between growth and resilience, fiscal discipline and flexibility, and policy ambition and the realities faced by individuals and businesses on the ground.

Set against a global economy marked by volatility and recalibration, the Union Budget 2026–2027 signals a continued push to reshape India's economic foundations. Through a focus on reform, performanceled execution, and long-view investments, it outlines priorities that will influence business choices, capital flows, and the trajectory of national progress.

The Government has identified three core Kartavyas or duties to guide this transformation: accelerating and sustaining economic growth, fulfilling the aspirations of our people, and ensuring a vision of Sabka Sath, Sabka Vikas. This strategy is defined by a bold commitment to People Over Populism, Action Over Ambivalence, and Reform Over Rhetoric, prioritizing long-term structural performance over the transient appeal of short-term incentives.

A cornerstone of this budget is the intensification of domestic manufacturing and high-frontier sectors through the “Make in India” momentum. Key initiatives include the India Semiconductor Mission 2.0, the Biopharma SHAKTI program, and the establishment of three dedicated Chemical Parks to enhance production and reduce critical import dependencies.

For the MSME sector, the budget introduces a threepronged approach featuring a dedicated INR 100,000 million SME Growth Fund and a INR 20,000 million top-up to the Self-Reliant India Fund. These measures are paired with strategic custom duty exemptions for components used in aircraft manufacturing and microwave ovens to bolster local assembly and global competitiveness.

Infrastructure development remains a primary catalyst, with public capital expenditure projected to reach INR 17.1 trillion for the fiscal year 2026-2027. This includes transformative projects like seven High-Speed Rail corridors, connecting major hubs such as Mumbai-Pune and Hyderabad-Bengaluru, and the development of the Integrated East Coast Industrial Corridor under the Purvodaya initiative.

Simultaneously, the government's emphasis on investment in people—through the training of 150,000 multiskilled caregivers, the establishment of five University Townships, and the deployment of AVGC Content Creator Labs in 15,000 schools underscores the critical role of human capital in economic transformation.

Beyond physical assets, the budget charts a course for deep institutional and sectoral rejuvenation. The Bharat VISTAAR initiative will integrate AI systems into agricultural practices, while dedicated programs for cashew and cocoa will support rural entrepreneurship.

Financial market reforms are equally significant, featuring a comprehensive review of FEMA rules and a recalibration of the Securities Transaction Tax, with the rate on futures raised to 0.05% and on options premiums to 0.15%. These adjustments are balanced by social welfare priorities, such as full custom duty exemptions for 17 life-saving cancer drugs and the introduction of a one-time, six-month foreign asset disclosure scheme for small taxpayers to promote transparency without undue hardship.

On the fiscal front, the government has struck a compromise between prudent budgetary management and growth aspirations. The fiscal deficit for 2026-2027 is estimated at 4.3% of GDP, with a strategic target to reach a debt-to-GDP ratio of 50±1% by 2030.

Taxation remains a cornerstone of this progress, with reforms aimed at simplification and a Trust-Based Governance approach. This includes automated processes for lower deduction certificates and the decriminalization of technical defaults, such as the nonproduction of books, reflecting a trust first, scrutinize later philosophy that seeks to reduce litigation and enhance the ease of doing business.

As India navigates its economic trajectory, policy clarity and strategic foresight remain crucial. This budget serves as both a reflection of current priorities and a guide for the future, shaping decisions for businesses, investors, and policymakers alike.

This publication examines the Union Budget 2026– 2027 through a closer reading of its key provisions, implications, and emerging opportunities. As the business landscape continues to shift, making sense of these changes becomes central to thoughtful planning and long-term growth.

Economic Overview

Economic Survey 2026: Key Highlights & Insights

The Economic Survey 2026 presents a picture of an Indian economy that is resilient, reform-driven, and structurally stronger in an increasingly fragmented global environment. Amid geopolitical uncertainty, protectionist trade policies, and volatile capital flows, India continues to stand out as the fastest-growing major economy, anchored by strong domestic demand, disciplined macroeconomic management, and sustained public investment.

The Survey highlights how consistent reforms, digital public infrastructure, and infrastructure-led growth have strengthened economic fundamentals, improved financial system resilience, and positioned India for medium-term growth of around 7%. The overview highlights the key economic trends, policy priorities, and structural shifts shaping India's growth trajectory as it moves from recovery to long-term competitiveness.

GDP

As per the Economic Survey 2026, India's real gross domestic product (GDP) growth for FY26 is projected to remain robust at 6.8%–7.2%, supported by strong domestic demand, sustained public capital expenditure, and improving private investment momentum.

- From the aggregate demand perspective, private final consumption expenditure (PFCE) remains the primary growth driver, supported by rising rural incomes, formalization, and steady urban demand.

- PFCE as a share of GDP is expected to remain elevated, reflecting strong household consumption and improving income stability.

- Gross fixed capital formation (GFCF) continues to be a key contributor to growth, supported by public infrastructure spending and gradual crowding-in of private investment.

- On the supply side, gross value added (GVA) growth is projected to remain strong, supported by broadbased sectoral performance.

- The agriculture sector is expected to record stable growth, aided by improved productivity, supply-chain efficiencies, and policy support.

- The industrial sector is projected to grow steadily, supported by expansion in construction, electricity, gas, water supply, and other utility services.

- Growth in the services sector is expected to remain resilient, driven by financial services, real estate, professional services, public administration, defense, and other services.

Fiscal Developments: Anchoring Stability

- The move from a ~5.1–5.2% fiscal deficit in FY25 to a 4.5% target in FY26 signals strong commitment to medium-term fiscal discipline.

- A revenue deficit of ~2.8–3.0% of GDP indicates that borrowing is increasingly directed toward assetcreating expenditure rather than consumption.

- Capex growth of ~10–11% YoY reinforces infrastructure-led growth and helps crowd in private investment, especially in manufacturing and logistics.

- Interest payments absorbing ~40% of revenue receipts highlight limited fiscal headroom and the importance of sustained growth to manage debt dynamics.

- A tax-to-GDP ratio of ~11.7–12% reflects better compliance, formalization, and GST performance, strengthening revenue sustainability without raising rates.

Monetary Management & Financial Intermediation

- With the repo rate at 6.50% and a clear 4% ± 2% inflation mandate, the RBI is prioritizing price stability while allowing room for growth.

- ~15–16% YoY credit growth indicates healthy demand from businesses and households, supporting investment and consumption without signs of systemic stress.

- Gross NPAs at ~2.6–2.8% reflect improved asset quality, better risk management, and successful clean-up of bank balance sheets.

- A CRAR of ~16–17% provides a strong buffer against shocks and enables sustained credit expansion, especially for infrastructure and MSMEs

- Digital payments growth of ~25–30% YoY highlights rapid adoption of digital platforms, improving transaction efficiency, transparency, and financial inclusion.

- The combination of controlled inflation, strong bank balance sheets, and steady credit flow reinforces financial system resilience amid global monetary uncertainty.

Investment and Infrastructure Updates

The Survey infers that sustained government capital expenditure is the primary engine for Capacity and Competitiveness, creating a foundation for long-term private investment.

- Effective Capex Scaling: Central Effective Capex (Budgeted Capex + Grants for Capital Assets) increased from INR 3,270 billion in FY15 to INR 13,300 billion (PA) in FY25.

- Rural Power Sector Transformation: A key metric for rural productivity is the daily power supply; the Survey reports an increase from 12.5 hours in FY14 to 22.1 hours in FY25.

- Renewable Energy Capacity: Generating capacity addition reached 40,938.6 MW (Apr–Nov FY26), a massive jump compared to 15,007.9 MW in the same period for FY25, reflecting an aggressive push toward green energy.

- PPP Pipeline Growth: There is a notable rise in Public-Private Partnership (PPP) activity. The total project cost of approved projects reached INR 1,046.8 billion by November 2025 (up from INR 88.9 billion in FY23).

- National Highway Network Expansion: The length of National Highways has increased from 91,287 km in 2014 to 146,145 km by 2024, representing a 60.1% increase in the total network over the decade.

- High-Speed Corridor Surge: Construction of highspeed corridors has seen an exponential rise, increasing from a mere 353 km in 2014 to 5,435 km in 2024. This represents an increase of 1,439.7% in high-speed corridor length over the same ten-year period.

Regulatory Updates

The financial sector is currently defined by a “double balance sheet advantage,” with both banks and corporates exhibiting unprecedented health and resilience.

- Asset Quality Revolution: Scheduled Commercial Banks (SCBs) have achieved multi-decade highs in stability. As of September 2025, Gross NPA stood at 2.2% and Net NPA at 0.5%.

- Credit Delivery to Growth Engines: Bank credit to Micro and Small Enterprises (MSEs) maintains a strong upward trajectory, supporting the sector's expansion in both industry and services.

- Rise in Premiums: Total premium income (life and non-life) rose from INR 8,300 billion in FY21 to INR 11,900 billion in FY25. Life insurers paid benefits totaling INR 6,300 bn, while net claims incurred in the non-life sector stood at INR 1,900 billion in FY25.

- Banking: The RBI introduced a Framework for Formulations of Regulations to standardize processes and has consolidated over 9,000 existing circulars.

- Securities Market: The Securities Markets Code 2025 was introduced to consolidate major laws (SEBI Act, SCRA, and Depositories Act) into a single framework.

- Insurance: The Sabka Bima Sabki Raksha Act, 2025, was notified to simplify regulations, increase FDI limits, and align governance with digital data protection frameworks.

- AI Integration: The RBI launched free-AI, a structured approach for financial institutions to leverage AI while managing systemic risks.

- PM Mudra Yojana (PMMY): Since inception, the scheme has disbursed over INR 36,180 billion across 554.5 million loan accounts. Notably, women entrepreneurs accessed 69% of these microloans.

- PM SVANidhi: Targeted at street vendors, the scheme has empowered a diverse base where 33% of beneficiaries are women and 64% belong to OBC, SC, and ST categories.

- Socio-Economic Impact: Micro-credit has led to a 20% increase in average annualized business income for SVANidhi borrowers between 2023 and 2025, resulting in significant improvements in housing, healthcare, and education for these households.

Foreign Exchange Reserves

- India's foreign exchange reserves stood at ~USD 701.4 bn as of mid January 2026.

- These reserves provide import cover for about 11 months and cover ~94% of external debt, strengthening resilience against global shocks.

- Robust remittance inflows (India remains the world's largest recipient) contribute to external sector stability and bolster reserves.

- While reserves are strong, the Survey notes that the rupee remains undervalued relative to fundamentals and external vulnerabilities persist due to global conditions.

Foreign Investments

- Despite global investment headwinds, gross FDI inflows reached ~USD 64.7 bn (Apr–Nov 2025), reflecting sustained investor confidence.

- India ranked fourth globally in Greenfield investment announcements in 2024, with over 1,000 new projects, and emerged as a top destination for digital investments between 2020 24.

- Strong FDI performance highlights the effectiveness of reforms, ease of doing business improvements, and sector specific incentives in attracting foreign capital.

- Foreign Portfolio Investment (FPI) flows showed volatility in FY26, with episodes of net outflows, reflecting shifting global investor preferences and risk aversion.

External Debts

- India's external debt stood at ~USD 746 bn as of end September 2025, up from USD 736.3 bn at end March 2025. The rising absolute level reflects ongoing external financing for both corporate and public sector needs.

- The external debt to GDP ratio was ~19.2 percent, indicating that external liabilities remain manageable relative to economic size. External debt accounts for less than 5 percent of India's total debt, underscoring modest reliance on foreign borrowing within the overall debt profile

- India's share in global external debt remains small (~0.69 percent), reflecting a limited global indebtedness footprint despite a large economy.

- Strong foreign exchange reserves (~USD 701.4 bn) cover ~94 percent of external debt and provide a comfortable liquidity cushion against external shocks.

- The Survey highlights that a stable external debt profile, combined with robust export performance and remittance inflows, strengthens external sector resilience.

External Sector: Playing the Long Game

- A CAD of ~1.0–1.2% of GDP is well within sustainable limits, signaling low external vulnerability.

- Services exports are India's key external shock absorber. 11–12% growth in services exports continues to offset pressures from merchandise trade, reinforcing India's comparative advantage in services.

- Annual remittances of USD ~125–130 billion support consumption, external balances, and currency stability.

- While the trade deficit of ~USD 79–80 billion reflects higher imports, it is aligned with investment-led growth rather than demand stress.

- Total exports of USD ~602–605 billion in Apr–Dec FY25 highlight resilience even amid weak global trade conditions.

- The focus is on diversification of exports, servicesled surplus, and stable capital inflows, rather than chasing short-term trade balance correction.

To read this article in full, please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]