- within Finance and Banking topic(s)

- with readers working within the Banking & Credit, Media & Information and Pharmaceuticals & BioTech industries

On August 7th, the White House published its Executive Order Guaranteeing Fair Banking For All Americans (https://bit.ly/4mOKLHJ) designed to address the "unlawful debanking" of certain individuals and industries (the "Order").

The Order defines "unlawful debanking" as directly or indirectly adversely restricting access to, or modifying the terms and conditions of, banking products or financial services of any customer or potential customer on the basis of the customer's political or religious beliefs or lawful business activities that the bank disagrees with or disfavors for political reasons.

The Order was issued to ensure banking decisions are made on the basis of "individualized, objective, and risk-based analyses" and not as a "tool to inhibit ... beliefs, affiliations, or political views." Certain business types that have been identified in the "debanking" context include businesses in the firearms, gas and oil, and cryptocurrency industries.1

Content of the order

The Order seeks to establish a comprehensive review of potentially unlawful banking across the financial service industry:

(1) Comprehensive strategy via treasury: The Secretary of the Treasury, in coordination with the Assistant to the President for Economic Policy, must craft a comprehensive strategy, including possible legislative or regulatory measures to combat unlawful debanking.2

(2) Review and enforcement of regulatory violations: Regulators must review institutions' past and present practices that enabled unlawful debanking — and upon finding violations of applicable law, take remedial actions, such as fines, consent decrees, or other disciplinary measures.3

(3) Referral of religious-based debanking to the Department of Justice (DOJ): Regulators must review supervisory and complaint data for debanking based on religion, and if institutions fail to comply under the Equal Credit Opportunity Act, these cases must be referred to the Attorney General for civil enforcement.4

(4) Restoration of services by lenders making Small Business Administration (SBA)-guaranteed loans: The SBA is directed to require lenders subject to its jurisdiction and supervision to identify and reinstate clients (and inform prospective clients) who were previously denied services due to unlawful debanking in violation of Section 7(a) of the Small Business Act authorizing SBA-guaranteed loans to be made by financial institutions to qualifying small businesses (Section 7(a)) and related Standard Operating Procedures (SOPs) and Policy Notices.5

(5) Removal of "reputational risk" from regulatory materials: Federal banking regulators (including the SBA and agencies under the Financial Stability Oversight Council) must expunge references to reputational risk, or similar concepts, from guidance, exam manuals, and other materials, and make the removal of these concepts clear through formal examiner guidance.6 This process was already under way. Federal banking regulators are also directed to consider rescinding or amending existing regulations, as needed, to avoid any potential resulting unlawful debanking.

Federal legislative and regulatory context

To understand the Order, it is beneficial to know its context. The Order follows efforts during President Trump's first Administration to address debanking concerns, specifically, allegations that federal banking agencies were applying supervisory pressure to encourage banks to terminate banking relationships with industries perceived to be disfavored, such as companies in the payday lending, firearms, tobacco and fossil fuels industries.

In January 2021, the Office of the Comptroller of the Currency (OCC) announced its finalization of a fair access rule that would have required a covered national bank to make its product and service offerings available to all persons (both consumer and commercial customers) in a market served by the bank on "proportionally equal terms," to not deny services unless the denial was justified by the person's documented failure to meet quantitative and impartial risk-based standards established by the bank in advance, and to not coordinate with others in denying such services.7

National banks (and Federal savings associations) that had over a $100 billion in total consolidated assets would have been subject to a rebuttable presumption of coverage under the rule, which was scheduled to go into effect on April 1, 2021.8

Shortly after President Biden took office in early 2021, however, the OCC suspended publication of the final rule while reminding banks to avoid refusing to serve categories of customers rather than assessing individual customer risk.9 Allegations of debanking, however, continued, with cryptocurrency companies highlighted as another industry that had been subject to pressure from banking regulators.

After the President Trump issued the August 7, 2025, Order, Comptroller Jonathan Gould issued a statement affirming that banks should provide access to services without consideration of a customer's political or religious beliefs or its lawful business activities.10

The release also noted the OCC had previously taken steps to remove language around reputation risk from its examination documents, would soon propose a rule to remove the references from its regulations, and would begin a review to assess the extent to which institutions have, or are, engaged in unlawful debanking.11

FDIC Acting Chairman Travis Hill issued a similar statement supporting issuance of the Order and indicating the FDIC's plan to initiate rulemaking and undertake reviews to address debanking concerns.12

On September 8, 2025, the OCC announced (http://bit.ly/46wot8D) that it had issued requests for information from the nine largest institutions that it supervises and had updated its website to assist in obtaining information from customers who believe they may have been subject to unlawful debanking.

In addition, the OCC issued two separate bulletins that (i) address the OCC's intention to consider unlawful debanking practices, and an institution's policies and procedures to avoid unlawful debanking, in evaluating an institution's licensing applications and in rating its Community Reinvestment Act (CRA) performance (OCC Bulletin 2025-22, http://bit.ly/4gToMhm) and (ii) remind institutions that customer financial records cannot be disclosed unless required by law and that voluntary suspicious activity report (SAR) filings cannot be used to evade nondisclosure requirements (OCC Bulletin 2025-23, http://bit.ly/46Dgnty).13

The SBA also has initiated efforts to execute on its requirements under the Order, issuing a news release on August 26, 2025, indicating it had sent a letter to over 5,000 institutions directing them to end unlawful debanking practices.14 The news release (http://bit.ly/3VJVx6V) stated that the letters require institutions to take specific actions by December 5, 2025.

The required actions align to those set out in the Order and also impose an additional reporting obligation to the SBA. Institutions subject to the SBA's directive are required to:

- identify past or current formal or informal policies or practices requiring, encouraging or influencing the institution to engage in unlawful debanking as outlined in the Order;

- make reasonable efforts to identify and reinstate previous clients of the institution or its subsidiaries that were denied services due to debanking practices in violation of Section 7(a) or requirements under any SOP or Policy Notice and to send notice to any injured client;

- identify potential clients denied access to services provided by the institution or its subsidiaries due to debanking practices in violation of Section 7(a) or requirements under any SOP or Policy Notice and to send notice to an otherwise qualified client advising them of the service denial and the renewed option to receive the denied services;

- identify potential clients denied access to the institution's payment processing services (or those of its subsidiary) due to debanking practices in violation of Section 7(a) or requirements under a SOP or Policy Notice and to send notice to an otherwise qualified client advising them of the service denial and the renewed option to receive the denied services; and

- submit a report to the SBA by January 5, 2026, that addresses and evidences their compliance with the above directives in order to "remain in good standing with the agency and avoid punitive measures."

Efforts have also been introduced on the federal legislative front to address debanking as well. In February 2025, Senator Kevin Cramer (R-ND) and Representative Andy Barr (R-KY) reintroduced the "Fair Access to Banking Act" in their respective legislative bodies.15

These bills would impose requirements similar to those in the OCC's unpublished 2021 Fair Access Rule on institutions with assets in excess of $10 billion, with violations potentially resulting in the denial of the institution's access to the Federal Reserve discount window and the loss of its Federal deposit insurance.16

In addition, companion legislation has been introduced to prohibit banking agencies from regulating, supervising or examining depository institutions for their management of reputation risk.17 None of these bills have become law.

State legislative context

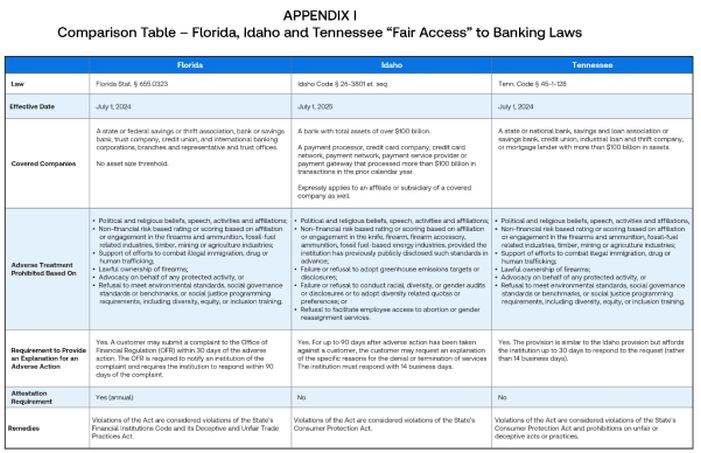

Debanking concerns have also found their way to state legislatures, with state laws having recently been enacted in Florida, Tennessee, and Idaho. These state laws are similar to, but also more expansive than, the prohibitions outlined in the OCC's prior unpublished 2021 rule and statements in proposed federal legislation.

These laws, a comparison of which is set out in more detail at Appendix I, enumerate not only protections for religious and political beliefs and activities, but also incorporate protections for specified ideological views on abortion, gender reassignment, immigration, environmental targets, and diversity, equity and inclusion goals.

They also seek to protect certain industries, such as those related to firearms, fossil-fuels, agriculture, mining and timber. Importantly, these state efforts also add adverse action-like notice requirements, providing customers with the right to request and receive explanations for why a service may have been denied or terminated.

Similar laws have been proposed in other states, including in Alabama (HB 418 2025), Arizona (SB 1094 2025), Georgia (SB 341 2025), Indiana (HB 1528 2025), Iowa (HB 922 2025), Kansas (SB 16 2025), Kentucky (HB 314 2025), Louisiana (HB 914 2024), Mississippi (SB 2370 2025), Nebraska (HB 730 2023/2024), North Carolina (HB 919 2025/2026), Oklahoma (SB 1107 2025), South Carolina (HB 3433 2025), South Dakota (HB 1247 2025) and West Virginia (SB 663-2025).

While these bills have died or were postponed (Arizona SB 1094 was vetoed by the Arizona Governor), the prevalence of these bills reflects the support for debanking objectives across the country.

Impact

The Order will have broad applicability. It covers a wide range of banks, credit unions, savings associations, and other nonbank financial institutions. There is no size threshold in the Order and no time limitation on the actions required of financial institutions.

The only immediate action is for those institutions that received the SBA's August 26, 2025, letter and the OCC's information request to conduct the SBA directed lookbacks and comply with the OCC's information requests. The actions that will be required of institutions by other federal banking agencies remains unclear and will likely become more defined as regulators put contours around the Order and engage with the institutions within their supervision.

As a practical matter, institutions also can likely expect requests for information from other regulators who are directed under the Order to conduct their own reviews, as well as increased scrutiny during exams, particularly with respect to institution-specific public allegations of instances of debanking.

This may warrant lookbacks beyond the scope of the SBA-specific lookbacks directed by the Order and the SBA. Institutions may also consider what is reflected in their historical customer complaint data, as the OCC has indicated that data will be a starting point in refining its examination efforts.

Although major financial institutions have repeatedly denied restricting services to customers and potential customers based on their political, religious, or other beliefs, this Order will place pressure on all financial institutions to prove that a denial or withdrawal of services to a customer was not the result of unlawful debanking practices.18

This could prove difficult given the types of records that may be available and the timelines in which to produce them. Complicating matters more, financial institutions may have legitimate reasons to deny their services to a customer or potential customer. Having to provide proof to federal regulators that unlawful debanking did not occur may prove onerous.

Regulators also will have to determine how to carry out the Order's mandates. The Order does not specify how far back federal regulators can search for perceived misconduct. This can raise issues with an institution's retention or other recordkeeping practices. However, the legal authority for regulators to take such actions is unclear.

The Order specifically cites the unfair or deceptive acts or practices (UDAP) provisions of the Federal Trade Commission Act and the unfair, deceptive, or abusive acts or practices (UDAAP) provisions of the Consumer Financial Protection Act, as well as ECOA. While ECOA is focused on anti-discrimination, it does not protect most of the grounds for denying financial services that the Order targets.

Specifically, it does not protect against the Order's coverage of discrimination on the basis of political beliefs or lawful business activities, only against the Order's coverage of discrimination on the basis of religion, and the protections in ECOA are limited to credit transactions, not the decision to provide other banking products, such as a deposit account or payment processing services.

While UDAP and UDAAP may provide a broader basis for liability, the Biden administration was criticized for expanding the application of these prohibitions. While the Order focuses on unlawful debanking and UDAAP/ECOA considerations, the OCC, as noted above, has associated unlawful debanking practices with an evaluation of whether the institution is meeting the credit needs of the communities it serves under the Community Reinvestment Act.

Enforcement efforts may be hamstrung by staffing cuts at both the CFPB and the FTC, the agencies primarily responsible for enforcing those statutes, although issuance of the Order itself reflects the Administration's expectation that agencies prioritize addressing unlawful debanking. In addition to enforcement action considerations, the OCC has announced it will consider unlawful debanking practices in connection with its evaluation of licensing applications.

Agencies had already begun removing references to reputational risk from exam manuals and related materials before the Order and may choose to go further to provide guidance to examiners so that examiners understand how to avoid getting into issues of reputational risk. So, while the Order may present examination challenges for institutions in seeking to justify prior business decisions, it also may present opportunities.

Removing restrictions related to "reputational risk" allows financial institutions freedom to bank customers who may have previously been perceived as too risky to onboard as clients. This could potentially make new industries available as emerging customer markets, allowing financial institutions more freedom to provide services to certain customer bases such as firearm and ammunition entities.

Additionally, removing supervisory focus on "reputational risk" relieves a financial institution of additional drivers that may have historically caused the financial institution to exit a customer relationship. Financial institutions may have more control over the services they are able to provide and maintain with their customers.

However, financial institutions remain subject to anti-money laundering (AML) and countering the financing of terrorism (CFT) obligations and, under the relevant laws and regulations, have to keep suspicious activity reports and other information confidential. Financial institutions have often cited such obligations in responding to concerns of debanking.

The Order directs regulators to consider whether amending or rescinding regulations would avoid debanking decisions, but it remains to be seen how far regulators will carry this directive and whether efforts will emerge to reform AML/CFT regulations. The OCC has already indicated it will evaluate whether its AML supervisory actions may have contributed to unlawful debanking.

Next steps

While it is unclear how this Order will be implemented, there are a number of steps financial institutions can take now to prepare:

- Heightened scrutiny of account closures: Financial institutions should evaluate their policies and procedures regarding client onboarding and account termination to ensure full compliance with risk-based criteria. Policies relying on vague reputational or political considerations may face both state and federal regulatory challenges. The OCC noted in Bulletin 2025-22 that it may evaluate whether an institution's policies and procedures are designed to avoid unlawful debanking when it considers licensing applications.

- Documentation and disclosure: Financial institutions will need to evaluate their process for documenting adverse actions and disclosing the basis for those actions. The requirement for written explanations introduces new documentation and disclosure obligations. This Order may empower customers to challenge closures through regulatory or legal channels, potentially increasing litigation risk if explanations are interpreted as insufficient or arbitrary.

- Regulatory reporting requirements: Institutions will need to organize project management efforts for the development of required regulatory reporting, such as the SBA's requirement that institutions report on their compliance with the SBA's debanking directives by January 5, 2026. Other federal agencies also may adopt similar reporting requirements that, given the potential broader scope of their product coverage, could involve more extensive and detailed reporting regimes.

- State-federal coordination: Financial institutions operating nationally will need to develop a comprehensive strategy that addresses both the requirements of this Order and those of the states that have passed similar legislation. They will also need to keep abreast of state law developments as many states are considering passing similar legislation.

- Compliance strategy: Financial institutions should develop policies and training that integrate federal risk-based compliance frameworks with state-specific fair access mandates to avoid enforcement actions at either level.

- Impact on high-risk and controversial industries: Financial institutions will need to consider how they engage with businesses in sectors like firearms, fossil fuels, cannabis, and others historically deemed to be higher risk. These and other potentially high risk industries would remain subject to AML risks that would continue to raise legitimate concerns.

- Litigation risk: Customers and affected industries may increasingly invoke both state fair access and UDAP laws and federal regulatory guidance in administrative complaints or private litigation, especially if written explanations are insufficient or discriminatory motives are suspected.

Footnotes

1. Michael Stratford, Trump to crack down on banks over alleged political bias, Politico, August 7, 2025, (http://bit.ly/3IpPyRT).

2. Id.

3. Id.

4. Id.

5. Id.

6. Fact Sheet: President Donald J. Trump Guarantees Fair Banking for All Americans, The White House, August 7, 2025, (http://bit.ly/42Wd8wg).

7. Office of the Comptroller of the Currency, News Release 2021-8, OCC Finalizes Rule Requiring Large Banks to Provide Fair Access to Bank Services, Capital, and Credit (January 14, 2021).

8. Id.

9. Office of the Comptroller of the Currency, News Release 2021-14, OCC Puts Hold on Fair Access Rule (January 28, 2021).

10. Office of the Comptroller of the Currency, News Release 2025-78, Comptroller Gould Issues statement on Executive Order "Guaranteeing Fair Banking for All Americans" (August 7, 2025).

11. Id.

12. Federal Deposit Insurance Corporation, Press Release, Statement from Acting Chairman Travis Hill on Executive Order Titled "Guaranteeing Fair Banking for All Americans (August 8, 2025).

13. Office of the Comptroller of the Currency, News Release 2025-84, OCC Announces Actions to Depoliticize the Federal Banking System (September 8,2025).

14. U.S. Small Business Administration, News Release 25-74, SBA Orders Lenders to End Practice of Debanking (August 26, 2025).

15. Kevin Cramer, U.S. Senator, Press Release: Cramer Reintroduces Fair Access to Banking Act to Protect Legal Industries from Debanking (February 5, 2025) (http://bit.ly/4gTGr8H).

16. See S. 401 (the "Fair Access to Banking Act"), 119th Cong. (2025); H.R. 987 (the "Fair Access to Banking Act"), 119th Cong. (2025).

17. See S. 875 (the "Financial Integrity and Regulation Management Act," http://bit.ly/46wdHiJ), 119th Cong. (2025); H.R. 2702 (the "Financial Integrity and Regulation Management Act"), 119th Cong. (2025).

18. Dylan Tokar & Alexander Saeedy, White House Preps Order to Punish Banks That Discriminate Against Conservatives, The Wall Street Journal (August 5, 2025).

Originally published by WestLaw Today.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]