- with readers working within the Banking & Credit, Business & Consumer Services and Securities & Investment industries

- with readers working within the Banking & Credit, Business & Consumer Services and Securities & Investment industries

- within Law Department Performance topic(s)

Introduction: A New Policy Era for Clean Energy

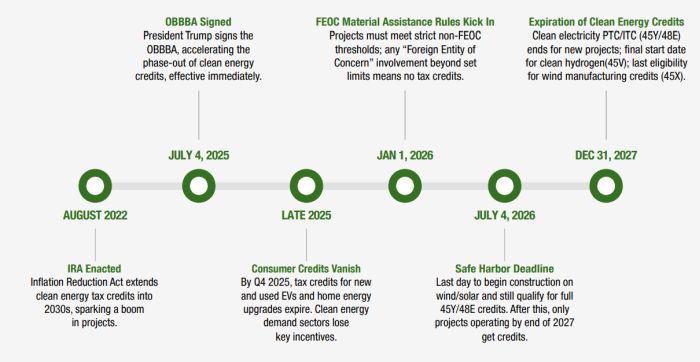

The newly enacted "One BIg Beautiful Bill Act" (OBBBA) has quickly rewritten the script on the US energy tax credited landscape. signed into law on July 4, 2025, the bill introduces broad updates and new eligibility rules for ptoduction tax credits (PTCs), investment tax credits (ITCs), advanced manufacturing, hydrogen, carbon capture, and clean fules.

A key feature of OBBBA is a strong emphasis on US domestic content and supply chain security, including strict limitations on economic relationships with "Foreign Entities of Concern" (FEOCs). With many of the operational rules to be defined by Treasury guidance (with some not required until the end of 2026), a nimble approach will be crucial for navigating the regulatory considerations, including the guidance required via the Executive Order issued on July 7, 2025, which promised guidance on or before August 21, 2025.

The impact is a material and extraordinarily uncertain reconfiguration of the investment landscape. We expect the already anxious capital to flow even more selectively, prioritizing markets with strong state and local-level support, defensible asset portfolios, and robust operating models. Developers, EPC contractors, suppliers, and operators must rethink their strategies through a lens of capital efficiency, operational discipline, long-term value creation, and strategic consolidation. This new era of renewables will require companies to ensure long-term endurance across their business models and operations.

Over the long term, this will lay the foundation for a more resilient industry, accelerating consolidation and improving operational discipline and performance. But, in the short-term, for those who thought the storm clouds were still on the horizon, it's clear that the storm has made landfall.

Strategic Implications by Stakeholder

These sweeping changes in the OBBBA reverberate well beyond project developers and operators. They have direct, material consequences for every member in the clean energy value chain. Many vendors, OEMs, EPC contractors, and service providers must now recalibrate their strategies amid shifting demand, reduced tax credit-fueled spending, and heightened customer risk.

As project economics are reset and the development funnel compresses, vendors will increasingly be evaluated not only on price and technical performance, but on their ability to support customers navigating constrained capital, volatile policy, and increasingly selective investment committees. In this new environment, agility, transparency, and alignment with counterparties will be essential.

- For Developers: The construction commencement deadlines for 45Y/48E credits can introduce enormous pressure on project readiness and pipeline feasibility, while the elimination of 45V (hydrogen) and changes to 45X (domestic manufacturing) reshape the financial viability of some projects.

- For Operators and Asset Owners: They must now deliver consistent performance with fewer and more stringent government subsidies. The compressed economics and restricted liquidity require operators to squeeze more value from operating portfolios, rationalize unnecessary overhead, and reassess O&M scope.

- For Vendors, OEMs, and EPCs Contractors: Supplying clean energy components, such as solar panels, inverters, batteries and electrolyzers, the impact of tax credit rollbacks is both direct and indirect. Reduced visibility in end-market demand may lead to customer renegotiations or project deferrals.

At the same time, these firms must navigate evolving FEOC compliance requirements for both their own 45X tax credits and their customers for the 45Y/48E credits, which are expected to increase costs and administrative burden. This challenge is compounded by a nascent domestic manufacturing ecosystem still finding its footing amid policy and market uncertainty.

- For Investors and Tax Equity Holders, expectations must be recalibrated to account for a prolonged market trough. With new restrictions on tax credits and a shrinking pool of eligible projects, the premium once associated with tax-advantaged assets is likely to erode. As a result, underwriting standards will tighten, and capital deployment will become more selective. It also remains to be seen how the tax credit insurance market will view risk relating to begin construction and FEOC under the OBBBA.

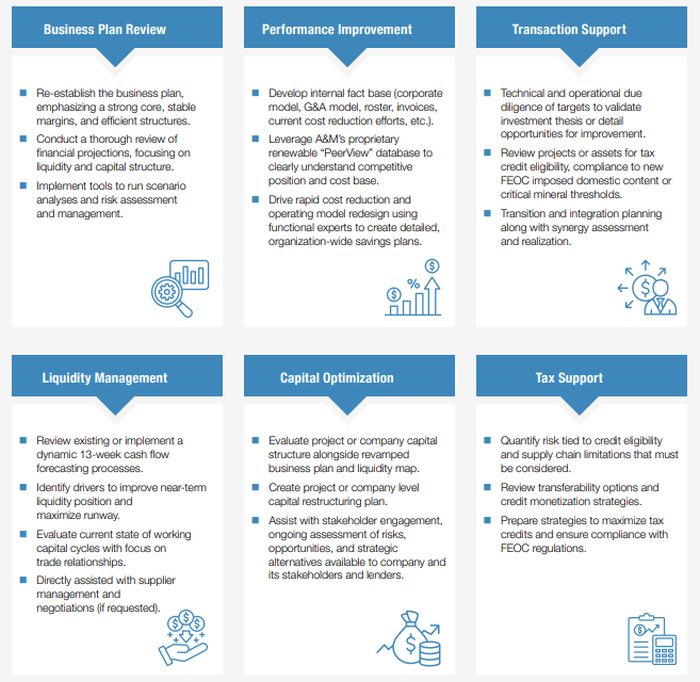

A&M's Role: Strategy, Structure, and Execution

Alvarez & Marsal brings proven expertise across the clean energy ecosystem, offering:

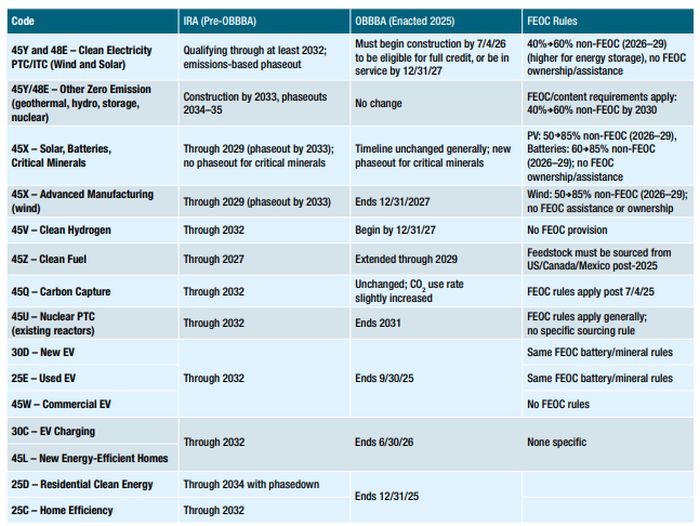

OBBBA Clean Energy Tax Credit Table1

Footnote

1. The information in this table is based on legislative summaries and expert legal interpretations of the House-approved One Big Beautiful Bill Act. Sources include: "The OBBBA Passed...Now What?", Alvarez & Marsal, July 2025, "US Clean Hydrogen Tax Credits Saved from Scrapheap — Temporarily," Hydrogen Insight, July 2025; "One Big Beautiful Bill Explained," Stinson LLP, July 2025; "One Big Beautiful Bill Act Passes Senate," Crux Climate, July 2025; "Tax Credit Implications of the One Big Beautiful Bill Act," Troutman Pepper, July 2025; "Congress Narrows Clean Energy Tax Credits," Davis Wright Tremaine (DWT), July 2025; "House Passes One Big Beautiful Bill: Implications for Clean Energy," Monday, July 2025; "US Throws Lifeline to Green Hydrogen Industry," Financial Times, July 2025; "IRS Issues Final Regulations on Section 45V," King & Spalding, July 2025.

Originally Published 13 August 2025

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]